Blockchain

Chintai and Splyce target retail access to tokenized securities on Solana

Credit : cryptonews.net

Actual-World Asset (RWA) Protocols Splyce and Chintai have launched a brand new product on Solana designed to present retail customers entry to tokenized results of institutional quality-a motion that would broaden the attraction of RWA-Tokenization on one of many world’s largest blockchains.

The product is powered by technique chists, or S tokens, which provide retail customers publicity to yields generated by Chintai. Whereas customers by no means instantly have the tokenized results of Chintai, S-Tokens act as a “mirror” via a mortgage construction that’s supported by the underlying belongings.

S-tokens are designed to extend entry to RWA yields that transcend institutional buyers. These days, most institutional RWA merchandise work akin to ‘walled gardens’ with strict capital necessities and compliance nuisances, which restrict the participation of the retail commerce, the businesses advised Cointelegraph.

The S-Token mannequin is meant to bridge this hole, and provides retail customers entry to institutional high quality yields, whereas emitting persons are in a position to stay compliant.

With SPLYCE, customers can deal with these belongings immediately with these belongings through their current Web3 portfolios, which maintains the permissionless expertise that normally defines Defi.

“There are not any jurisdiction restrictions on the place s -tokes will be supplied – they’re as permissionless as USDC or USDT,” Ross Blyth, Chief Advertising Officer of SPLYCE, advised Cointelegraph. “That mentioned, deposits are nonetheless topic to plain KYC/AML monitoring to make sure compliance with anti-money laundering practices.”

Within the first iteration of S-Toks, the Kin Fund, a tokenized actual property fund, was launched by Kin Capital on the Chintai community.

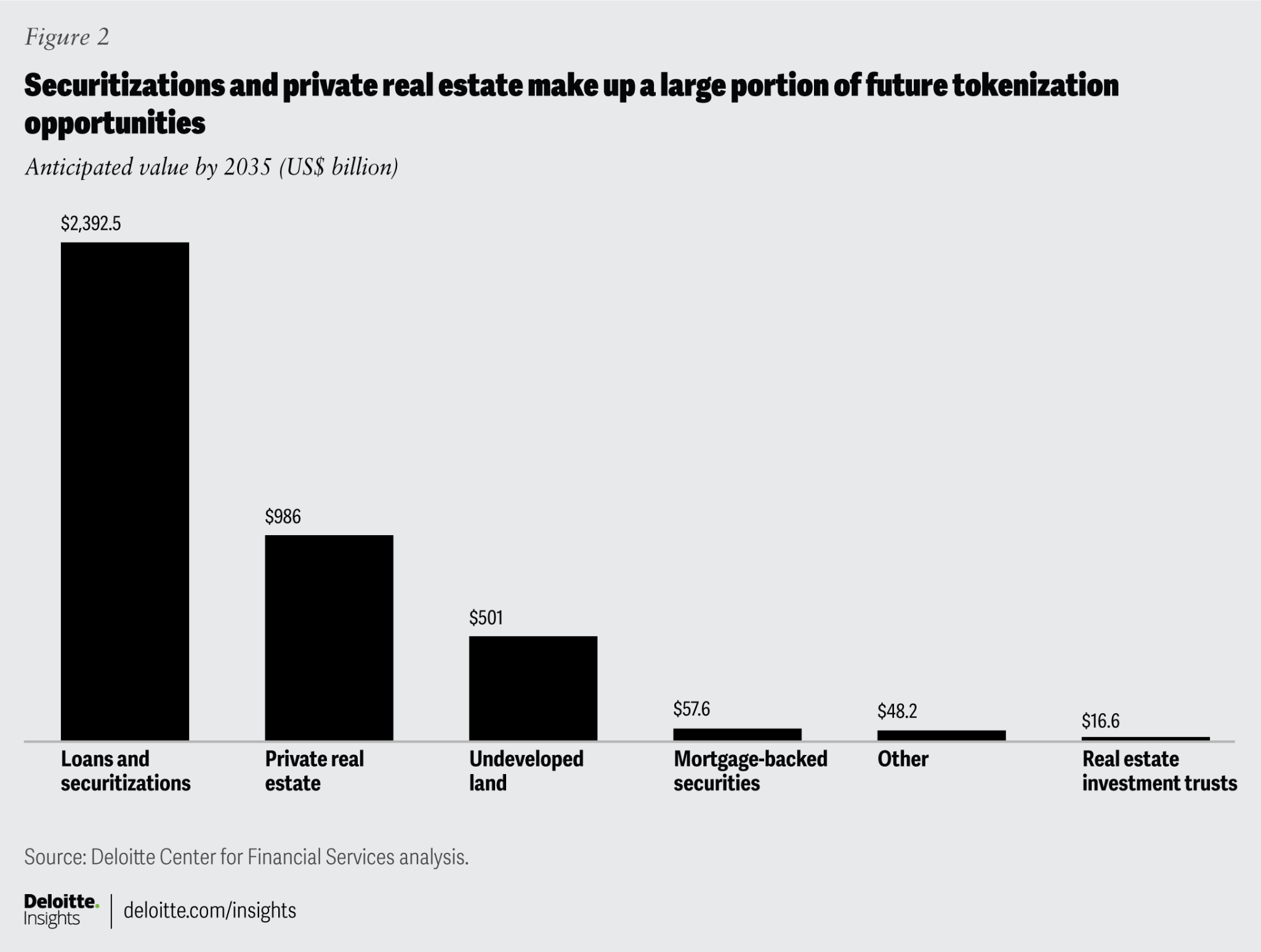

Deloitte recognized loans and securitization and personal actual property as two of the potential largest tokenisation choices of the next decade. Supply: Deloitte

“Distribution and liquidity have all the time been the most important obstacles for RWAS,” Chintai director Josh Gordon advised Cointelegraph. “Quickly belongings of institutional high quality will likely be traded in Solana-decentralized exchanges with the identical ease immediately as tokens.”

Associated: VC Roundup: VCS Gasoline Vitality Tokenization, AI DataChains, Programmable Credit

A possible increase for the RWA momentum of Solana

Solana, identified for its excessive transit, low prices and a powerful ecosystem for builders, has been given a outstanding traction within the Actual-World asset area.

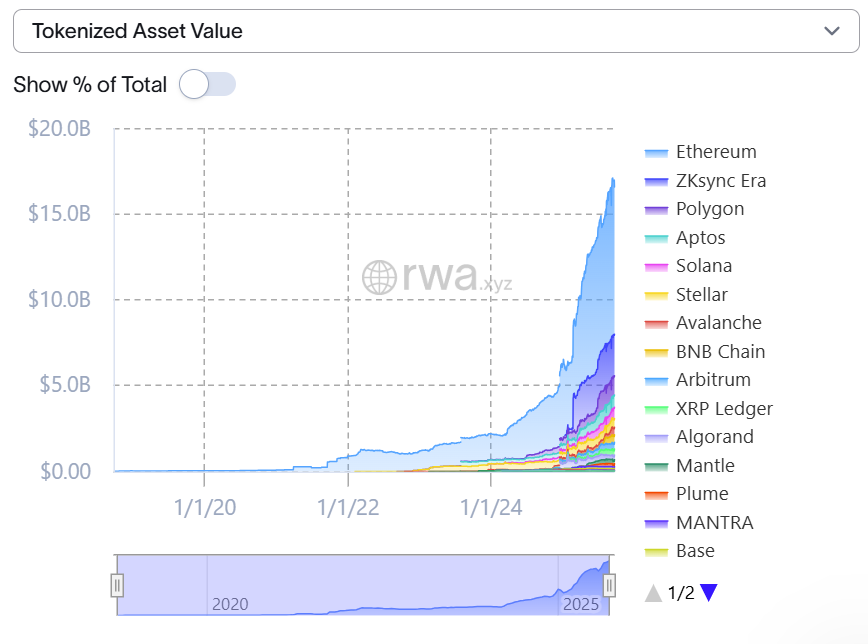

In accordance with knowledge within the business, Tokenized belongings on Solana at the moment are appreciated at greater than $ 656 million. Solely 4 different networks – Ethereum, ZKSync ERA, Polygon and Aptos – are presently supporting greater ranges of Tokenized Activa.

Tokenized belongings values in massive networks. Supply: Rwa.xyz

Because the begin of the yr, the worth of Tokenized belongings on Solana has grown by greater than 260%. The biggest non-stable tokenized merchandise from the community embody the ONDO US Greenback Yield and the ONDO Brief-term US US Bond Fund, which provides tokenized entry to income merchandise akin to US treasurys within the brief time period.

As well as, BlackRock launched its USD Institutional Digital Liquuidity Fund (Buidl) on Solana earlier this yr. Though Buidl shortly has develop into the dominant tokenized US treasury product over block chains, the presence on Solana underlines the rising function of the community within the institutional RWA acceptance.

Though the most important RWA merchandise on Solana are nonetheless primarily geared toward certified institutional consumers or accredited buyers, which limits entry to the retail commerce, options are rising. ONDO Finance has additionally introduced plans to broaden the entry to the retail commerce on Solana via her collaboration with Alchemy Pay.

Within the meantime, Ondo’s Yieldcoin (USDY) is accessible for retail customers on Stellar, in response to Mexc.

These developments come to the fore when Solana emerges as a platform for tokenized shares, with ahead industries-a nasdaq-listed firm and Solana Treasury Holder-Die is planning to make its shares on the blockchain through a partnership with Superstate, a regulated concern platform.

https://www.youtube.com/watch?v=AV4BEOAJDG

Associated: $ 400T Tradfi Market is a large runway for Tokenized Rwas: Animoca

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now