Ethereum

Bitcoin And Ethereum Defy Price Slump With Strong Exchange Outflows

Credit : www.newsbtc.com

The cryptomarkt has been confronted in current months as a result of each Bitcoin and Ethereum broke underneath essential assist ranges. Bitcoin broke underneath $ 110,000, whereas Ethereum additionally fell under $ 4,000. This decline led to billions of liquidations And pushed the worry and greed index In nervousness space.

Nonetheless, knowledge from On-Chain Analytics Platform Sentora (previously IntotheBlock) reveals that accumulation is quietly happening. Regardless of the value decreases, the outflows of the change for each property have remained strongly adverse.

Associated lecture

Key weekly statistics

A protracted -term lower from final week noticed the Bitcoin value fall underneath $ 110,000 With rising gross sales stress and liquidations of lifting tree positions. Regardless of this sharp motion to the drawback, knowledge on the chain illustrates an attention-grabbing completely different pattern that happens underneath the floor of volatility. In accordance with to numbers supplied by The on-chain analytics platform Sentora, greater than $ 5.75 billion in BTC flowed from centralized festivals through the week.

This outflow, though small in comparison with intervals of robust bullish motion, reveals a seamless investor order, Particularly with some buyers who might profit and purchase the dip.

Ethereum’s value motion in the identical interval was much more pronounced Then that of Bitcoin. Within the value crash, the main Altcoin broke underneath the psychologically vital assist degree of $ 4,000 and an excessive amount of decrease zones to check round $ 3,850. Regardless of the depth of this lower, the change present knowledge makes it clear that the Bearish value motion has not succeeded in deteriorating the buildup exercise within the community.

Greater than $ 3.08 billion in ETH left scholarships through the week, which serves as proof of a steady willingness amongst buyers to gather Ethereum steadily, even within the mild of brief -term losses and market stress.

Regardless of adverse value efficiency, the outflow of the change remained robust for each ETH and BTC, indicating that accumulation is indicated available on the market pic.twitter.com/eaqztk6VOF

– Sentora (previously Intotheblock) (@Sentorahq) September 26, 2025

Outflows Stimulate change balances to multi -year lows

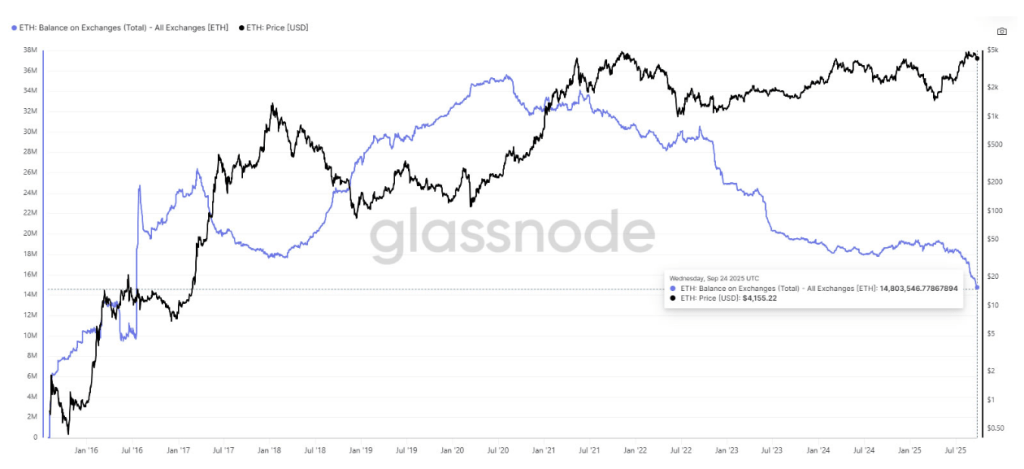

Curiously, Ethereum connects final week’s outflow with a exceptional pattern that has developed in current months. Information reveals that Ethereum’s Whole supply on exchanges Has fallen to only 14.8 million ETH, the bottom degree since 2016. A lot of this inventory has been diverted, long-term chilly storage and Defi protocols, all of which led to a drastic lower in ETH on buying and selling platforms.

ETH balance on exchanges. Source: Glassnode

Information from a cryptoquant quicktake message from worker Cryptooonchain additionally entertain weight to this pattern of heavy outflows. Between August and September 2025, the 50 -day easy advancing common (SMA) Netflow from Ethereum underneath -40,000 ETH per day, the bottom degree that has been seen since February 2023. This persistent adverse Netflow reveals that buyers have steadily shifted their ETH from exchanges and putting the use, chilly storage or different lengthy -term holding. “Decrease change calendaries said analyst said.

Associated lecture

On the time of writing, Bitcoin acted at $ 109,585, whereas Ethereum traded at $ 4,011.

Featured picture of Unsplash, graph of TradingView

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024