Policy & Regulation

DoubleZero Receives No-Action Letter for 2Z Token from SEC

Credit : cryptonews.net

Essential highlights

- US Sec has a “no-action letter” issued to Doublezero for his token ‘2z’

- The letter implies that the SEC doesn’t go for enforcement motion, and the challenge doesn’t should register as a category of ‘inventory results’.

- This resolution reveals a optimistic American regulatory surroundings that may encourage extra infrastructure and at utilities

The Securities and Alternate Fee (SEC), a big American monetary regulator, has given a big challenge a inexperienced mild and explains that her digital token isn’t safety.

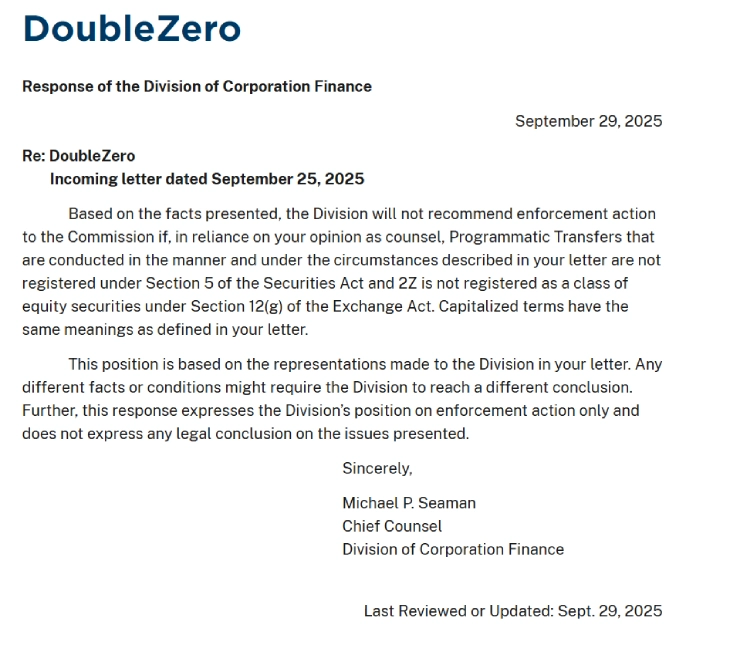

(Supply: sec.gov)

The challenge, referred to as Doublezero, acquired a “no-action letter” from the Securities and Alternate Fee (SEC). This letter is a significant achievement for the challenge.

In a thread on X, Doublezero defined that: “A no-action letter implies that the @Secgov’s Division of Company finance has assessed how the programmatic advantages of the 2Z token work labored and concluded that: Based mostly on the info offered, the Division motion is not going to be enforcement motion.”

Proud to share that the @secgov @doublezero has revealed a no-action letter for 2Z. 🦅🇺🇸

The primary no-action letter of its variety offers us confidence that 2Z doesn’t should register as a category of “Fairness results” and that programmatic streams of 2Z on the double zero community are … pic.twitter.com/gsgin6tpqj

– Doublezero IBRL/ACC (@Doublezero) September 29, 2025

This inexperienced sign can supply the a lot wanted readability and might open the door for a brand new wave of aid-based crypto tasks.

This resolution is a significant drawback, as a result of for years crypto corporations with uncertainty have operated in a grey space, by no means positive if their tokens can be thought of unlawful results by the SEC. This assertion offers a transparent instance of what a authorized token, aimed toward utility, seems to be like.

What’s Doublezero?

Doublezero is a challenge that’s designed to enhance blockchain communication -efficiency by seting up a worldwide community that makes use of beneath -utilized submarine and terrestrial fiber optic cables.

The token, referred to as 2Z, is the gas for this community. It features as a instrument -mechanism inside this ecosystem. It’s utilized by community members, referred to as validators, to realize entry to bandwidth and receiving rewards for his or her providers.

In his letter to the SEC, Doublezero efficiently led individuals to make use of 2Z due to his place, not as a result of they count on the managers of the corporate to make them wealthy.

SEC makes use of the versatile method to take care of a crypto sector

This resolution is one other huge win for your complete cryptocurrency market after the authorized battle of Ripple with the SEC. It builds straight on a well-known authorized battle from 2020 between the SEC and an organization referred to as Ripple Labs.

On the time, the SEC Ripple complained and claimed that his XRP -token was a non -registered safety. After a protracted judicial struggle, a federal decide made an important distinction. She dominated that then Ripple XRP bought on to giant buyers, it was as a safety. However when extraordinary individuals traded XRP at public gala’s, this was not safety.

This was a milestone second within the historical past of cryptocurrency. It has not directly established {that a} token itself isn’t inherent in a safety. This additionally defines the class of those tokens primarily based on how it’s bought and used. The Doublezero assertion takes this concept a step ahead, which supplies a challenge prematurely approval earlier than it even launches its community.

The letter from the SEC to Doublezero is a sign. It reveals that American regulators are beginning to distinguish between tokens which might be purely for hypothesis and who do with an actual, useful activity.

This readability is precisely what giant buyers and technical builders have requested. It reduces the authorized danger to launch new tasks in america. It will ultimately encourage innovation to remain within the nation as an alternative of transferring overseas.

“At this time’s sec no-action letter is a monumental milestone, not only for @DoublezeroHowever for your complete crypto trade. It’s time to have a good time the 2Z mannequin, and that conforming innovation can thrive within the US and for contributors which means that they will take part with confidence, relieved of regulatory uncertainty, ”acknowledged in a submit on X.

The choice comes within the midst of a bigger push in Washington for clear crypto guidelines. A proposed legislation referred to as the Readability Act is presently being mentioned within the Senate. This new rule is predicted to jot down these sorts of distinctions in everlasting laws.

For now, the Double Zero pronunciation is a robust precedent. It tells the crypto world that for those who construct a challenge with actual usefulness, and never solely as an funding schedule, the way in which to approval of laws within the US turns into clearer. It’s a signal that the market grows up and overries from pure hypothesis to constructing helpful expertise.

That is among the many steady legislative efforts to arrange a transparent regulatory framework for the cryptocurrency market beneath the pro-Crypto administration of the US President Donald Trump. SEC and CFTC work collectively to convey readability within the digital belongings sector and withdrawal Improvements. At this time, SEC chairman Paul Atkins stated that crypto is now his “primary” precedence.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024