Adoption

Will Bitcoin be replaced too?

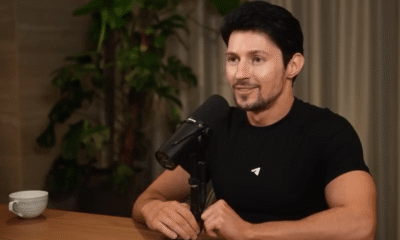

Credit : cryptoslate.com

AOL stopped yesterday, September 30, 2025, the entry service, whereas AOL-E-mail and different merchandise proceed to terminate.

In keeping with AolThe AOL -Dialer and AOL -Schild are actually retired, with directions for customers to modify legacy connections that are actually being positioned for help reference.

The closure influences a small a part of the American households and arrives when cryptom markets develop up by new entry channels that attain the way in which wherein traders attain Bitcoin, change with out altering what Bitcoin is.

The dial-up analogy comes up when markets rotate or infrastructure sunsets, however the dial-up was an entry modality for a community, not the community itself.

So in brief, NoBitcoin is not going to get replaced as dial-up has been.

Nevertheless, let’s dive into why and the place the precise comparability between the web and Bitcoin acceptance stays legitimate.

Bitcoin is a financial lively and a fundamental settlement protocol.

If there’s a parallel with AOL in Crypto, that is the set of the entrance of custody, trade charge, and second-layer consumer experiences that rotate as expertise and regulatory motion.

The community that was related within the web continued to exist and scaled over broadband and cell generations.

In keeping with the International telecommunications -UnionAbout 5.5 billion individuals, about 68 % of the world, had been on-line in 2024, a reminiscence that networks increase whereas entry to entry is altering.

The right crypto-mapping offers with ETFs, stablecoins and layer-2s as entry rails that may broaden participation, not as replacements for the essential financial layer.

The remaining footprint of dial-up affords a perspective on sundown dynamics.

The 2023 American Group Survey had roughly 163,401 American households who solely reported in Dialup, a closely rural paste that remained as a result of last-mile limitations and value sensitivity.

In keeping with the US Census BureauAlong with a lot bigger shares on cell broadband and stuck broadband, these households are underlined that the lengthy tail of a community of Legacy entry can exist subsequent to new rails earlier than they lastly retire.

Cryptos Entry Combine appears to be in precept comparable, with direct self-herb, trade charge, programmatic publicity by ETFs and rising account abstraction fashions that every one function the identical financial protocol.

Capital entry has shifted the quickest.

Spot Bitcoin ETFs in the USA have created a broadband driveway for establishments and advisors, which convert operational obstacles into Ticker publicity to brokerage accounts.

Per Distant investors‘Reside tracker, cumulative internet entry since January 2024 has now been north of $ 60 billion, with streams that pulsate subsequent to macro and positioning as a substitute of disappearing when the volatility fades.

Coinshares’ recently Weekly notes till September reported steady influx into Bitcoin and Ethereum merchandise, which reversed the chance of and off wake to week whereas sustaining a sustainable foundation of property in management.

Bitcoin doesn’t exchange the ETF channel; It replaces operational friction in the way in which to get in the way in which as soon as made means for cable, fiber and 4G, all of which function the identical web.

Macro affords the background of the cycle. On September 17, the Federal Reserve lowered the goal vary by 25 fundamental factors to 4.00 to 4.25 %, with officers emphasize a cautious path that leaves the optionality when inflation is the goal of the goal.

In keeping with the FEDs Implementation commentThe standing repo facility and managed charges had been adjusted to agree with the brand new vary, making the Sanitary cash market in accordance with coverage intention.

The influx into listed merchandise tends to construct when actual yields are stabilized and credit score spreads stay organized, so allocation channels as a substitute of fundamental layer throughput usually established the incremental marginal copper for Bitcoin on this part of the cycle.

Adoption knowledge retains the framing sincere.

Crypto property worldwide is situated in the course of the hundredths of hundreds of thousands. In keeping with Triple-A’s 2024 reportAbout 562 million individuals held crypto final yr, with nearly 6.8 % penetration, with broad regional dispersion and methodological reservation that differ from counts on the chain.

Crypto.com’s market dimensions Positioned end-2024 possession nearer to 659 million, a reminiscence that top-down survey-based estimates differ and should be handled as reaching as a substitute of sages.

Exercise on the chain usually deviates from value and AUM, wherein Glassnode paperwork that lively adroments stay below 2021 highs, even whereas the entry to capital has been widened by ETFs, a spot that’s in line with a cycle led by financial savings as a substitute of a funds guided by funds.

Lightning community has public capability draver From the tip of 2023 peaks above 5,400 BTC to roughly 4,000 to 4,200 BTC by August 2025, a motion that matches an structure and UX resistance equivalent to storage accounts and various scale decisions soak up some streams; The reside collection stays the proper reference for the present measurements.

The alternative query is best examined as a set of vectors as a substitute of a slogan. One path is financial alternative in funds, wherein stablecoins or future CBDCs dominate transactions, whereas Bitcoin concentrates as a financial savings instrument.

A second is purposeful abstraction, wherein layers and storage accounts masks fundamental layer complexity, identical to broadband masked copper and modems for net customers. A 3rd celebration is competitors from different L1s in cost or calculation of niches, which don’t routinely loosen the position of Bitcoin as institutional rails and treatment for custody.

Every path is perceptible with knowledge, together with ETP flows, pockets counts, stablecoin and low capability. The Capital Rail is the clearest change thus far per far and coinshares.

A small collection of system dangers continues to anchor the ahead view.

Coverage stays the swing issue, together with stablecoin laws, financial institution connectivity and ETP management changes that may delay flows, even when the demand is unbroken.

Macro can rapidly symbolize the allocations if inflation above the objective or accelerating, which might put strain on the Fed’s leisure path and lift the actual yields, an association that traditionally cools the inflow within the lengthy -term danger. Community construction deserves monitoring, particularly polar focus.

In keeping with B10Cs 2025 analysisAbout six mining swimming pools are good for greater than 95 % of latest blocks, which is a pool focus as a substitute of the final word energy possession, however nonetheless related for transaction choice, dynamics for prices and potential MEV care.

Implementation danger seems in lightning help focus and channel administration, which should be assessed along with the expansion of use exterior the channel and custody as a substitute of studying as a single demand meter.

Allocation and penetration situations Body 2026 to 2030 with out resort to cost aims. A conservative path assumes about 0.5 % allocation of world investable property in Bitcoin about ETFs, enterprise treasury and HNW custody, which produces tons of of billions of potential demand for a full cycle, with turbulent stimulation as inflation surprises.

A basicase makes use of a allocation of 1 % that creates a trillion-plus demand capability over time if custody, clearing and advisory work flows proceed to combine bitcoin.

An bold matter within the attain of two to 2 and a half % requires benign macro, scalable market vegetation and clear coverage that might be equal to the capability of a number of trillion {dollars} through the cycle.

On the consumer aspect, sluggish, base and quick tracks differ from about one billion to greater than two billion crypto homeowners by 2030, relying on the integrations of cell pockets, regulatory readability and the division between financial savings and funds.

The ITU-Foundation line helps to place these collection on the adoptive curve, as a result of the web penetration of the world is already close to the higher half of the S curve.

On this means framed, the tip of the dial-up clarifies the controversy.

Entry strokes come and go as distribution, rules and consumer expertise, whereas the community or financial foundation can face up to.

ETFs, Stablecoins and Layer-2s work as a broadband for capital and transactions, increasing the addressable foundation for financial savings and settlement with out requiring a alternative for Bitcoin itself.

Aol’s authentic dial-up service is disabled, however the web has nonetheless began.

State on this article

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024