Altcoin

‘Every time this happened, the price became vertical’

Credit : www.newsbtc.com

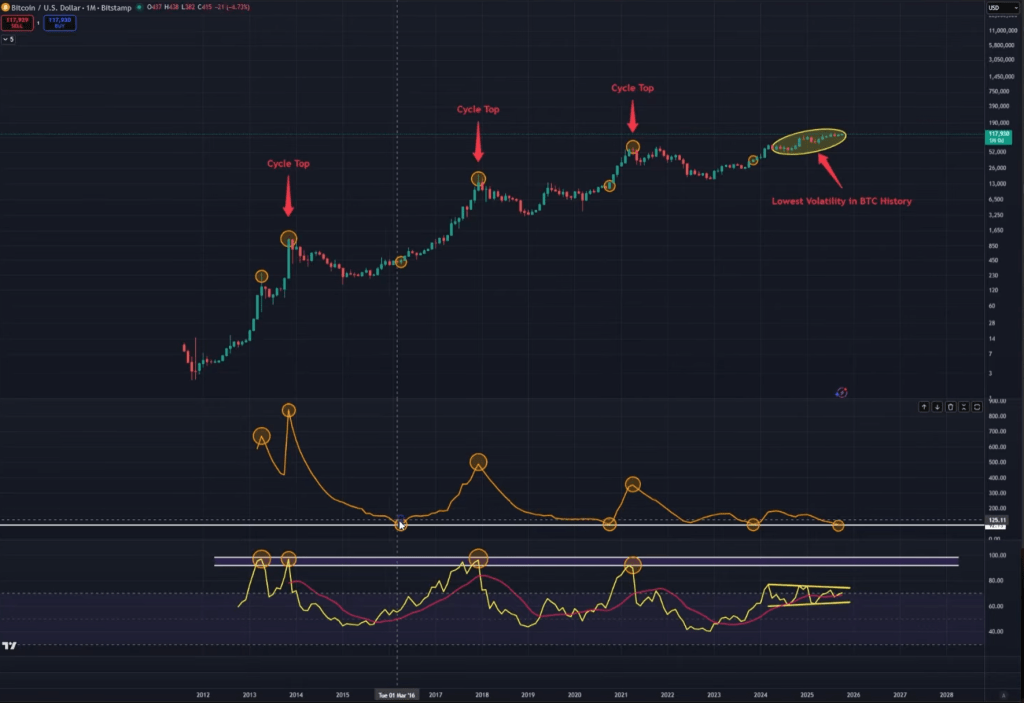

Bitcoin is on the “lowest quantity of volatility of all time” on the month-to-month graph, and that’s traditionally previous essentially the most highly effective on his head of the cycle, based on Crypto analyst Kevin (KEV Capital TA). In a video evaluation of 1 October, Kevin connected a low level within the Bollinger Bandswidte (BBW) to a long-term sample in earlier cycles and argued that the setup in This autumn “no apologies” leaves for the market to not push greater if Key Helps Maintain stays good-natured.

Kevin builds his enterprise on roughly two greater time indicators: the month-to-month BBW and the month-to-month RSI. BBW follows the gap between the Bollinger tires as a substitute of ploting the tires themselves; Compressed width indicators traditionally low realized volatility and the potential for sharp growth. “We’re on the lowest Bollinger tire width the place we have now ever been to Bitcoin’s historical past,” he mentioned, and known as it a bending that’s repeatedly tailor-made to massive pattern actions.

He combines that with a month-to-month RSI that’s on the high in earlier blow-off phases and presently consolidates in what he describes as a bull construction. “Each time the Bollinger is as little as it’s now … Each time in historical past within the month-to-month interval, we have now skilled enormous actions greater available in the market,” he argued.

As an instance the cycle rhyme, Kevin identified on the finish of 2013 and 2017, when the month-to-month RSI peaked round 96 and 95 respectively, whereas BBW expanded to cycle tops after earlier trogs in volatility. Within the subsequent base phases of the Berenmarkt, he says that BBW fell to cycle lows earlier than new extensions began. In the newest cycle run, he characterizes This autumn 2023 because the ‘actual rally’ in March 2024, and famous that RSI is roofed close to 76 and has since been coiling with “decrease highlights and better lows on the month-to-month RSI … complete, very stunning.”

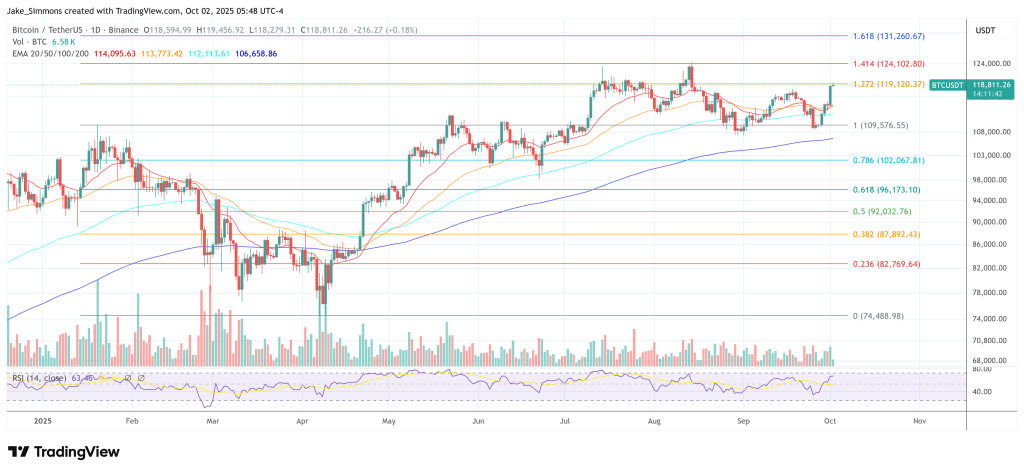

Associated lecture

The analyst underlined an vital conditional one: the technical construction solely dissolves Bullish If Bitcoin retains help with a better time. He mentions the weekly “Bull Market Help Band” and within the neighborhood horizontal ranges like the road within the sand. “So long as Bitcoin can have vital ranges, it’s the weekly Bull Market Help Band, which is presently at 109.2K, [and] The extent of 106.8k, then there are not any apologies why Bitcoin shouldn’t be capable of press 4 in quarter, “he mentioned.

What to view now for Bitcoin

Along with the map construction, Kevin put in macro and on-chain context because the affirmative, not main, proof. On Macro is his basicase that the coverage setting is supporting: “We’ve got secure inflation, just about flatlined … a weakening job market, however not kriquen … a gentle GDP progress, and we have now a Fed in search of assuaging.”

Referring to weaker then anticipated ADP workshop knowledge and up to date FOMC signaling, he added: “We’ve got projected a price discount for October … for December … and [possibly] January, “and advised that the quantitative tightening of the Fed may method an finish if sharpening financial institution reserves. He was specific that the trail relies on these circumstances that persist: ‘So long as our macro -economic panorama stays favorable right here within the US … The trail has been laid for crypto to go greater in This autumn. ‘

About appreciation and positioning, Kevin turned to a logarithmic regression mannequin of the overall crypto market capitalization and a “Bitcoin risicometric”. He mentioned that the overall market capitalization has not but surpassed this cycle of the trendline of its mannequin, this cycle-it-all inserting the actual worth at round $ 4.38 trillion versus about $ 4 trillion for the present lecture in his framework and argued that earlier cycle-off-offs have solely begun above the actual worth.

Associated lecture

“Each time … we lastly broke previous the logarithmic regressee line of the actual worth, you have seen your greatest actions of the cycle,” he mentioned. His danger triek, color-coded from low to excessive, is presently close to 0.49-0.50 due to his depend, nicely beneath 0.8-0.9 “crimson” zone that he associates with sustainable tops. “Not as quickly as this whole cycle Bitcoin has grow to be the crimson degree degree in precept,” he famous, including that month-to-month RSI sees close to the high-60s/low-70s “doesn’t see a parabolic value motion … no insane euphoria.”

Change conduct is one other pillar of his non-deputy. In earlier cycles, he mentioned, web streams of BTC to change which have risen as members prepared to promote. “Not solely is that not occurring, however web streams go from exchanges,” he mentioned. “That isn’t a cycle of high conduct. That’s accumulation conduct.” The mixture-compressive month-to-month volatility, consolidating momentum, sub-threshold danger and outflow leads him to a single conclusion: “There shall be nice volatility. If there’s something, it begins now.”

Kevin additionally acknowledged uncertainties surrounding the US financial prints and even authorities actions, however he returned to the core of his technique: synthesizing macro, technicalities and on-chain in a uniform cycle show. “We do not lean in a single course … we put all of it collectively,” he mentioned. Beneath that combined framework, he claims, he would name a cycle high on the present ranges “to go towards every bit of knowledge that we have now ever used previously to find out Cyclus tops,” and would solely forcing a reconsideration of the mannequin if the market proves the improper method.

The fight strains are clear in his inform. Hold the weekly bands about $ 109.2k and $ 106.8k, hold the macro trajectory supporting and resolves the historic sample of BBW compression in a strong, final upward leg would play as This autumn progresses. Or, as Kevin put it in line that outlined his place: “Each time this occurred, the worth turned vertical.”

On the time of the press, BTC traded at $ 118,811.

Featured picture made with dall.e, graph of tradingview.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024