Altcoin

Fed Rate Cuts Boost Bitcoin Buying Wave of $1.6 Billion Among Whales, Can BTC Reach $70,000?

Credit : www.newsbtc.com

This text is offered in Spanish.

The Fed’s rate of interest cuts have boosted Bitcoin investor confidence, with whales buying as much as 1.6 billion BTC for the reason that macro choice. With such a bullish outlook, there’s a chance that the flagship crypto might soon reaching $70,000.

Fed price cuts spark shopping for frenzy amongst Bitcoin whales

The Fed’s rate of interest cuts have led to a shopping for wave Bitcoin whales. These buyers purchased greater than 1.6 billion value of Bitcoin after the macro choice of September 18. Knowledge from the market info platform InTheBlok exhibits that these whales have bought 25,510 BTC since September 19.

Associated studying

This accumulation trend isn’t a surprise because the 50 foundation level price reduce has offered a bullish outlook for dangerous belongings together with Bitcoin. The flagship crypto is predicted to see a major worth enhance as extra liquidity flows into its ecosystem as buyers achieve entry to extra money following the Federal Reserve’s quantitative easing (QE).

With Bitcoin anticipated to make large upside strikes, an increase to $70,000 is feasible quickly sufficient. Already the flagship crypto reversed the $60,000 price level as assist after the Fed’s rate of interest cuts and stays properly above that degree. As anticipated, extra liquidity is already flowing into the BTC ecosystem, as evidenced by the $1.6 billion buy by these whales.

Due to this fact, it shouldn’t take lengthy sufficient for the crypto to achieve the $70,000 worth degree. It will be important that Bitcoin reaches this degree as a result of it might pave the way in which for BTC to achieve some extent new all-time record (ATH). The $70,000 worth degree has acted as sturdy resistance for the reason that crypto fell under this degree after rising to its present ATH of $73,000 earlier in March.

Nonetheless, Bitcoin might simply break above this resistance this time because it has extra bullish momentum because of the Fed’s price cuts.

Historical past might repeat itself

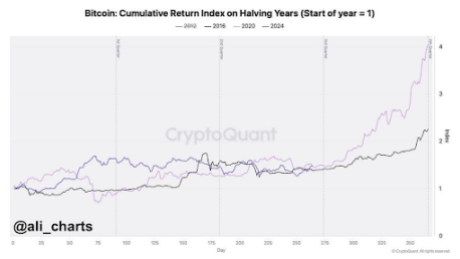

Along with the Fed’s price cuts, Bitcoin’s historic development offers a bullish outlook for the flagship crypto and suggests an increase to $70,000 ought to occur quickly sufficient. Crypto analyst Ali Martinez not too long ago famous that Bitcoin noticed a 61% and 171% worth enhance in 2016 and 2020, respectively. These years have been each halving of years.

Associated studying

The analyst additional revealed that Bitcoin’s worth motion this 12 months is reflective of 2016 and 2020. As such, historical past might repeat itself, and the flagship crypto might see beneficial properties on par with earlier years.

Furthermore, This fall of yearly Traditionally, that is the time when Bitcoin achieves the best returns. Due to this fact, BTC ought to see important worth beneficial properties within the final quarter of this 12 months. Within the meantime, the rally after the halving can also be imminent, which might give rise to this price increase to $70,000.

On the time of writing, Bitcoin is buying and selling round $63,900, up greater than 1% up to now 24 hours. facts from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024