Policy & Regulation

US lawmakers grapple with crypto tax policy amid government shutdown

Credit : cryptonews.net

American legislators debated the tax coverage of the Crypto within the Senate Committee for the Monetary Housing, together with potential tax exemptions for crypto transactions below a sure threshold and the way revenue from setting providers needs to be labeled.

Lawrence Zlatkin, the Vice -President of Tax on Crypto Change Coinbase, insisted on the Senate Fee to think about the minimis tax exemption for cryptocurrency transactions below $ 300 to encourage business use in funds and to make sure innovation inside the US. Zlatkin mentioned:

“The main precept is a straightforward parity with conventional funds. The identical tax guidelines should apply to the identical financial exercise, whether or not it issues uncooked supplies, shares or tokens on a blockchain. In the meanwhile that parity doesn’t exist. The dearth of tailor -made guidelines has actual penalties.”

Lawrence Zlatkin who addresses the Senate on crypto taxes. Supply: American Senate

The legislators additionally struggled with the closing of the annual tax hole of roughly $ 700 billion by imposing tighter reporting necessities for cryptocurrency transactions, minimizing tax exemptions and potential classifying revenue from the institution of providers comparable to earned revenue below the layered revenue taxation system.

Tax coverage is a crucial drawback for cryptocurrency customers, trade managers and firms that stay unsure concerning the implications of their actions and whether or not the Inner Income Service (IRS) will punish them for coming into into the digital economic system.

Associated: US Senate Finance Committee to debate crypto tax issues subsequent week

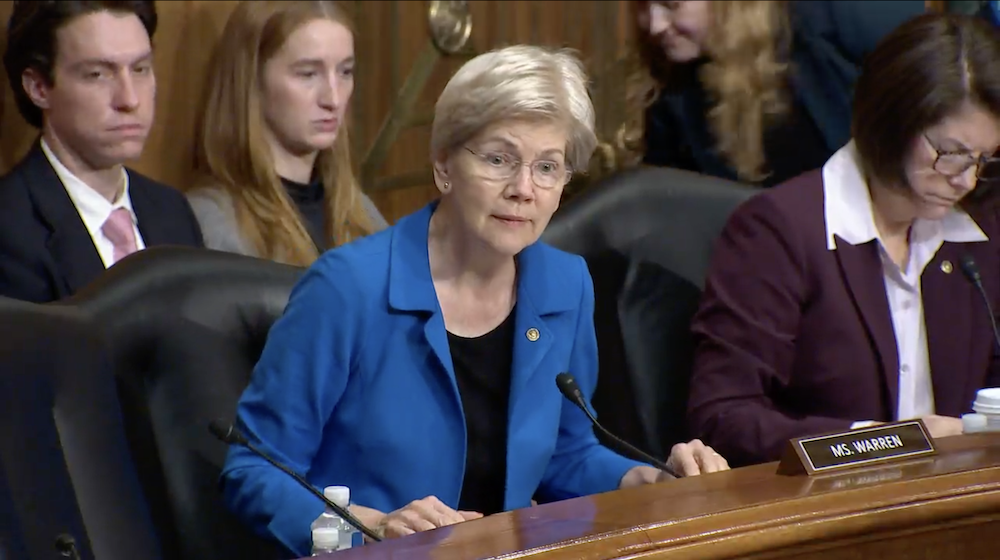

Elizabeth Warren argues and claims looser tax necessities will assist Geldwassers

“Crypto holders don’t pay not less than $ 50 billion a 12 months in taxes they owe,” mentioned Massachusett’s senator Elizabeth Warren in the course of the listening to.

Warren argued that by exercising particular tax exemptions for cryptocurrencies, different activa lessons would endure as a result of traders deserted activa lessons to benefit from the tax financial savings in crypto.

Senator Warren argues in opposition to the granting of particular tax exemptions for smaller crypto transactions. Supply: American Senate

“The blended tax committee estimates that this proposal alone can be a tax reinforcement of $ 5.8 billion for the crypto traders,” Warren added.

Senator Warren made a connection between particular tax exemptions for crypto and cash laundering, with the argument that exemptions would provide protection to keep away from American sanctions and surveillance by way of the Monetary Crimes Enforcement Community (FINCEN).

She concluded by saying that no particular tax exemptions needs to be granted for digital belongings and that every one the cash from crypto transactions have to be taxed below the prevailing coverage framework for securities and uncooked supplies.

Journal: The one factor that these 6 world crypto -hubs all have in widespread …

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024