The worth of Bitcoin (BTC) noticed a fast sell-off on Tuesday after hitting its all-time excessive (ATH) of over $126,000 on Monday. The flagship coin fell greater than 3% over the previous 24 hours, hitting a low of round $120,681 earlier than recovering to commerce round $122,000 on the time of writing.

The broader altcoin market – excluding Binance Coin (BNB), PancakeSwap (CAKE) and some different altcoins – fell together with Bitcoin. As such, the full cryptocurrency market cap was down 3.5% to round $4.16 trillion on the time of writing.

Main Causes Why Bitcoin Worth Dropped Right this moment

Excessive leverage flush

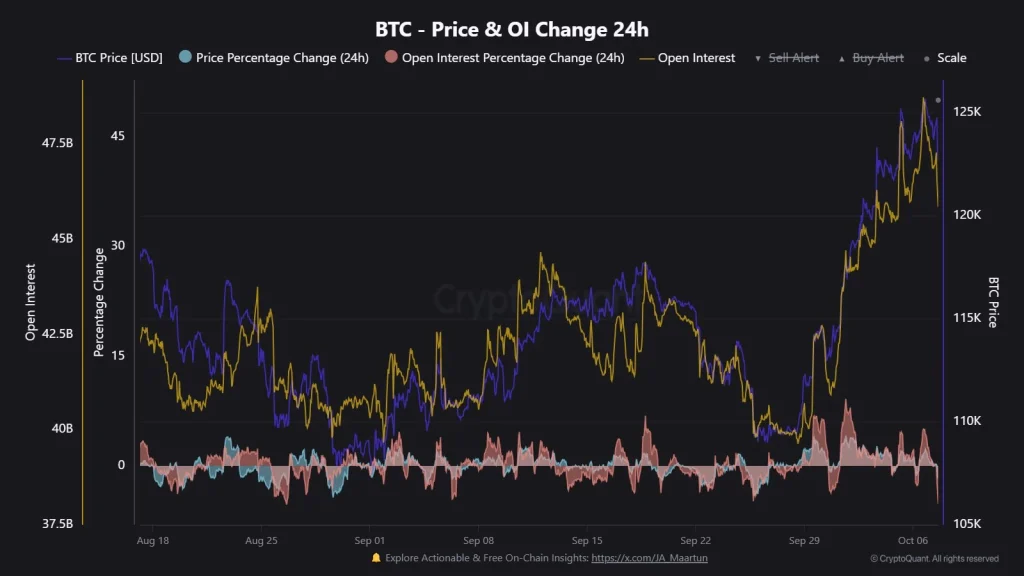

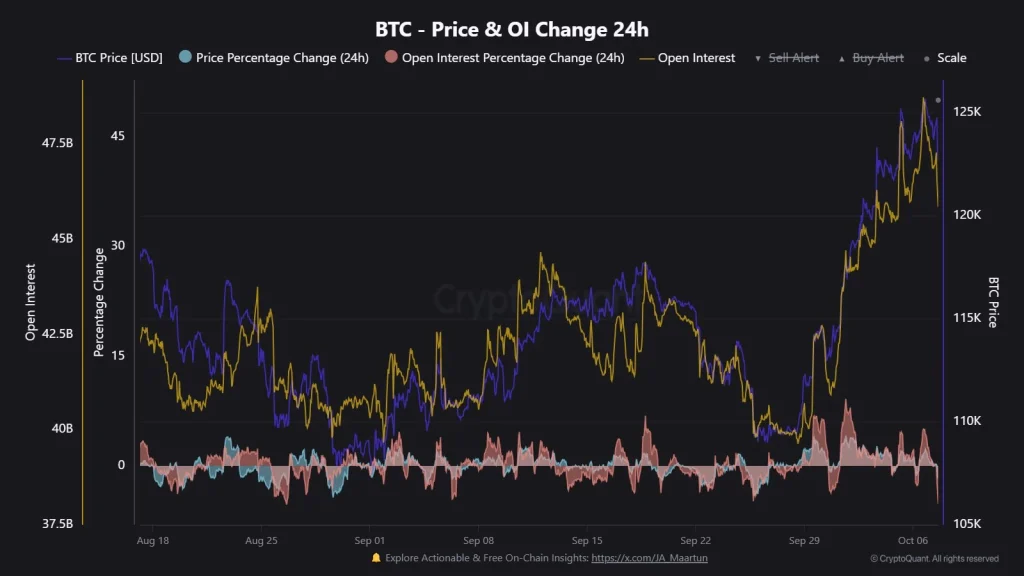

Following the cryptocurrency’s sudden drop on Tuesday, greater than $625 million was liquidated by leveraged merchants, the vast majority of which have been lengthy merchants. Based on market information evaluation from CryptoQuant, Bitcoin Open Pursuits (OI) fell by greater than 5%, the most important single-day drop in six weeks.

Historical whales awaken

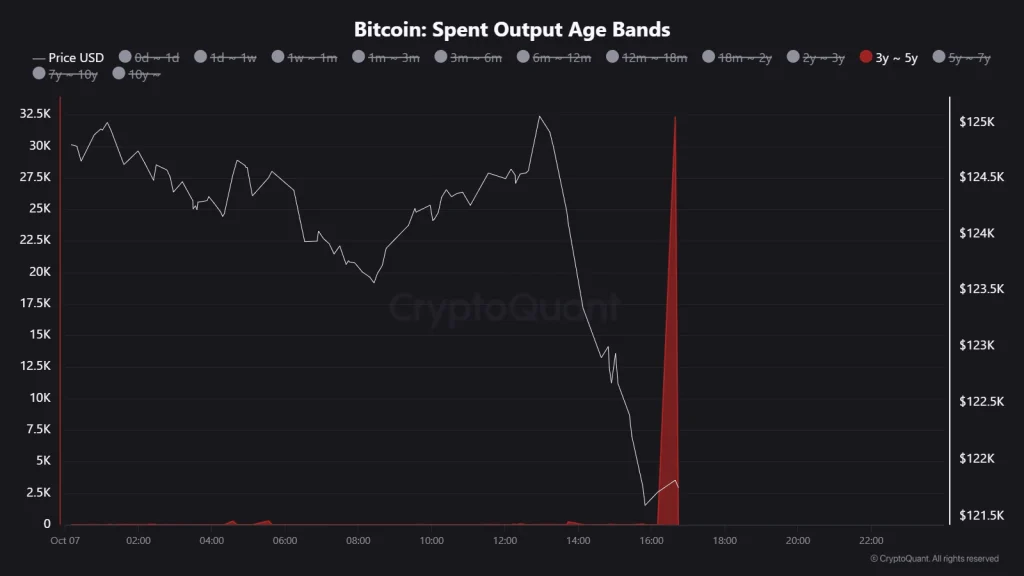

After the BTC worth rose to a brand new ATH on Monday, on-chain information evaluation confirmed a rise in profit-taking. Based on information from CryptoQuant About 15,000 BTC, value nearly $2 billion, was deposited on crypto exchanges previously 24 hours.

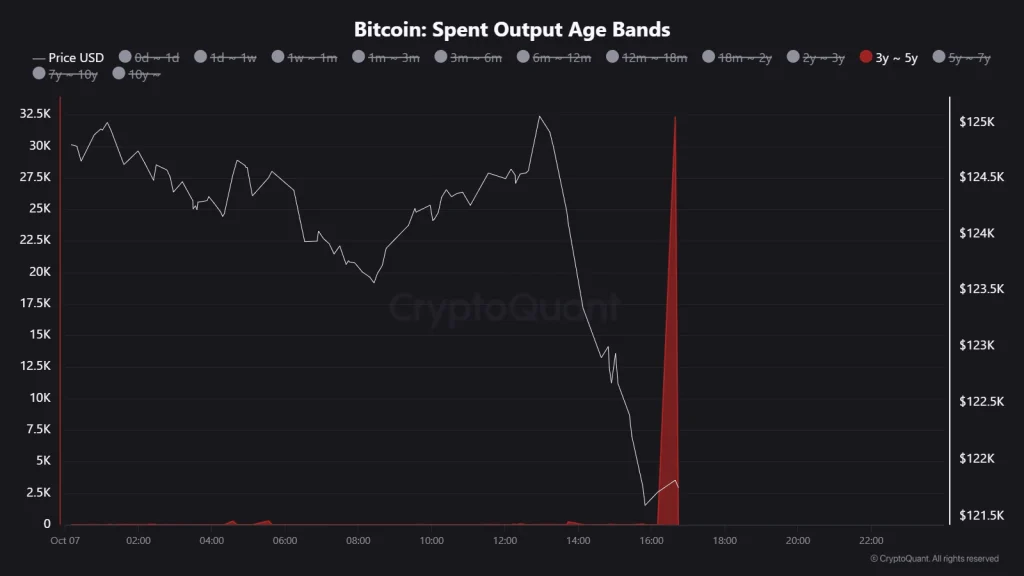

On Tuesday, the most important Bitcoin whale transfer of 2025 was recorded, with wallets that had been inactive for 3 to five years transferring 32,322 BTCs value about $4 billion.

What’s subsequent for the BTC worth?

Bitcoin worth was pushed by sturdy demand from institutional traders, a supportive macroeconomic surroundings and ‘Uptober’ bullish sentiment.

From a technical evaluation perspective, BTC worth is nicely positioned to return to the parabolic section within the coming weeks. Furthermore, the BTC worth is the digital gold, and the gold worth has been in a parabolic rally since mid-August. Furthermore, the worldwide cash provide has regularly elevated within the current previous, which is bullish for Bitcoin and the broader crypto market.