Ethereum

Ethereum (ETH) Set to Hit $3,000, Insights from On-Chain Data

Credit : coinpedia.org

Ethereum (ETH), the world’s second largest cryptocurrency by market cap, appears tremendous bullish and will quickly attain the $3,000 degree. Regardless of the vast majority of main cryptocurrencies, together with Bitcoin (BTC), Solana (SOL) and lots of others, struggling to achieve momentum, ETH has gained greater than 4% of its worth.

Ethereum value momentum

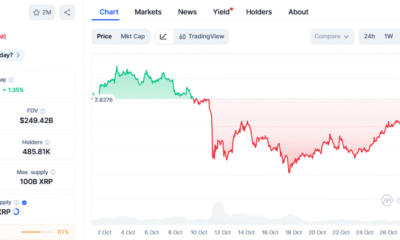

On the time of writing, ETH is buying and selling across the $2,680 degree and has skilled a value improve of over 4.25% within the final 24 hours. Throughout the identical interval, buying and selling quantity has skyrocketed by 65%, indicating higher dealer participation, presumably because of continued value momentum.

Technical evaluation of Ethereum and upcoming ranges

In accordance with skilled technical evaluation, ETH appears bullish and is now heading in direction of the $3,000 resistance degree. After breaking the descending trendline, sentiment has utterly modified and ETH has risen by greater than 15%.

Nonetheless, over the previous two days, ETH has been in a consolidation section between the USD 2,530 and USD 2,600 ranges. On September 23, 2024, it broke out of that zone and staged an upward rally.

Primarily based on the historic value momentum, there’s a excessive chance that ETH value might attain the $2,900 degree, and even larger if sentiment stays constructive. As of now, the value is buying and selling beneath the 200 Exponential Shifting Common (EMA) on a each day timeframe, indicating a downtrend.

ETH’s bullish on-chain metrics

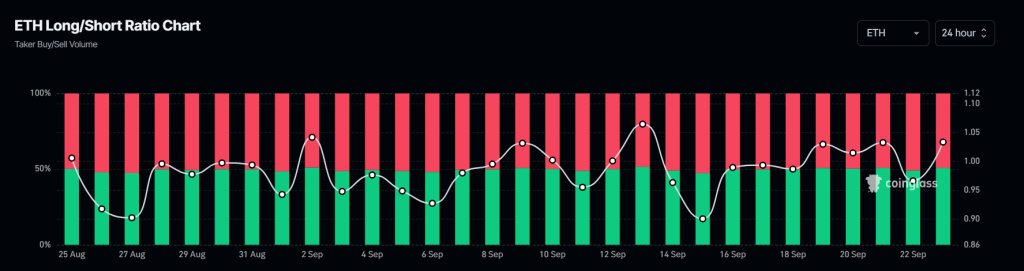

This bullish outlook is additional supported by on-chain metrics that point out market sentiment. In accordance with the on-chain analytics firm Mint glassETH’s lengthy/quick ratio at present stands at 1.033, indicating bullish market sentiment.

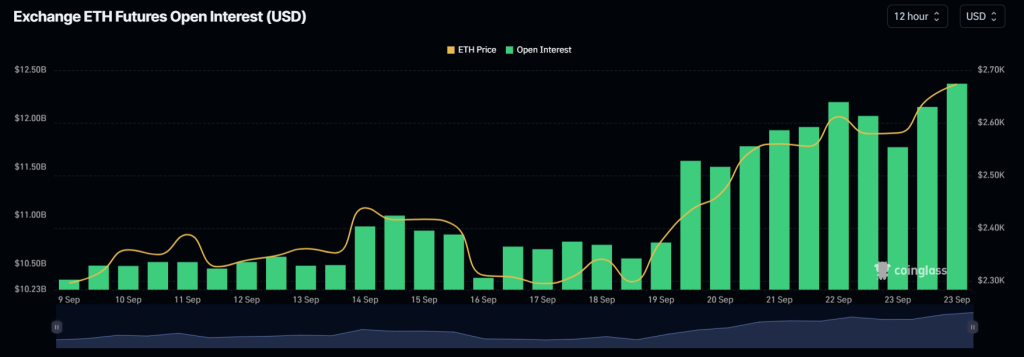

Moreover, future open curiosity has elevated by 4.8% over the previous 24 hours and has been steadily rising since September 9, 2024.

This rising future open curiosity means that bulls are constructing increasingly lengthy positions. Presently, 50.82% of prime merchants have lengthy positions, whereas 49.18% have quick positions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now