The on-chain exercise of Bitcoin has led to a brand new debate, as a result of a pointy rise within the actions of enormous wallets signifies a doable shift available in the market positioning. Numerous high-quality Bitcoin transactions have been registered for the previous 24 hours. This means that whales both retain their income, or redistribute capital pending a broader market trotation. This sudden improve in BTC transfers typically precedes volatility phases, as a result of merchants assess whether or not the motion signifies institutional revenue realization or strategic positioning for the subsequent bullish stage.

Now that the liquidity on the big inventory markets is impressed, within the coming days it may present whether or not these actions begin the beginning of a consolidation part – or a preparation for a renewed up momentum.

Moved greater than $ 4 billion in Bitcoin

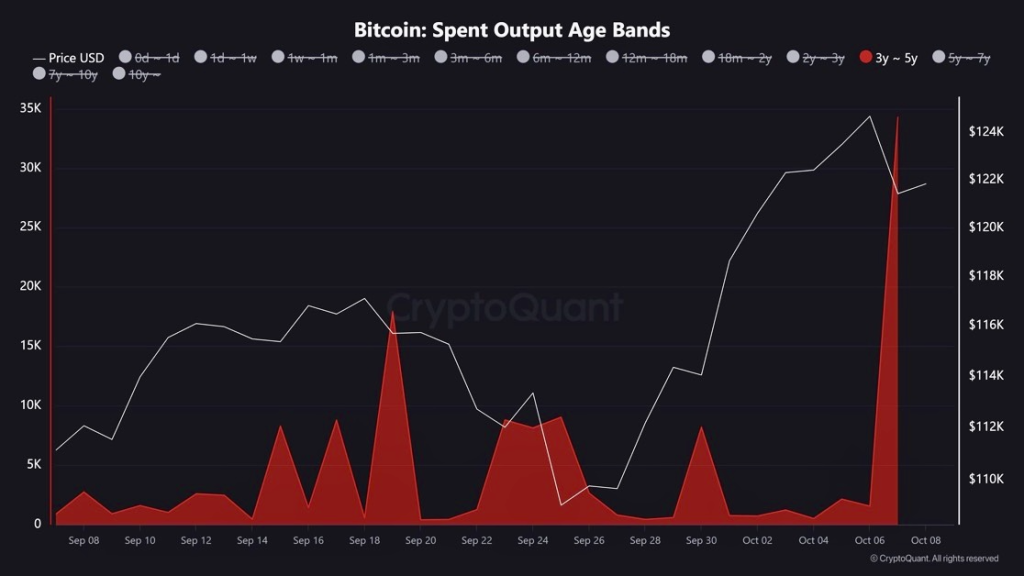

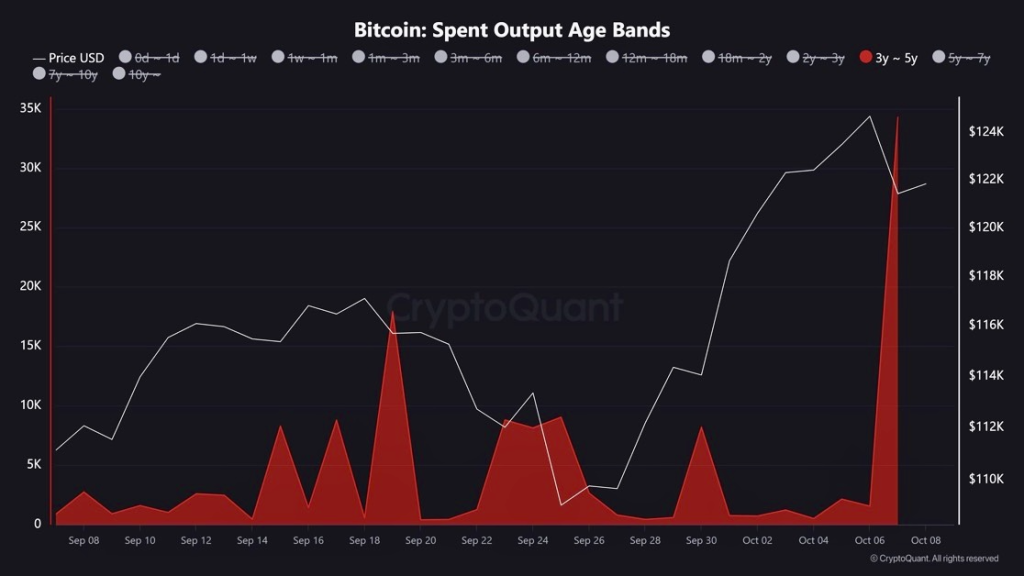

The newest on-chain information from Cryptoquant emphasizes a pointy rise within the Bitcoin age classes (3-5 years), which reveals that long-term holders are more and more shifting their sleeping cash. Such actions typically happen throughout vital market phases, which signifies shifts within the investor sentiment. Now that Bitcoin just lately floated close to native highlights, this peak suggests within the exercise of outdated cash that early buyers might put together for revenue realization or a strategic repeat whereas the market is bracing its subsequent route change.

The graph reveals a major improve in spending three to five-year-old Bitcoin, which coincided with a worth drop from the $ 124,000 area. This sample signifies that lengthy -term homeowners – who’ve piled up throughout earlier cycles – grow to be lively, which is commonly a harbinger of accelerating volatility within the brief time period. If these transactions are representing gross sales, a brief -term correction may observe because the revenue ceremonies improve. Nonetheless, if the cash are moved for repositioning or shifts in custody, this could mark capital rotation as a substitute, which prepares the subsequent market accumulation part.

- Additionally learn:

- Binancecoin worth forecast: Can the BNB worth attain $ 2000 in 2025?

- ,, “

What’s the following? Will this decrease the Bitcoin worth?

Simply earlier than the month-to-month closing, the Bitcoin bulls brought about a powerful revival and lifted the degrees above the Bearish affect. This led the rally to a brand new ATH of round $ 126.199, adopted by a interval of consolidation. Sadly, this consolidation resulted in a substantial relapse, which meant a low level in the course of the day of round $ 120,574. Nonetheless, the bulls appear to have began a restoration, however the query arises as as to if token is in a state of restoration or whether or not it’s a brief -term improve.

As could be seen within the every day graph, the Bitcoin worth stays inside a rising parallel channel. That’s the reason the present relapse could possibly be a brand new probability for the bulls to enter the lows and push the rally increased. Given the buildup/distribution, this implies that the value has once more began an accumulation part, because the indicator has proven a bullish divergence. Within the meantime, the RSI has additionally proven an analogous motion, which confirms the bullish declare.

Now that volatility will rise, the common vary of the $ 118,600 channel can act as a powerful help for the Bitcoin (BTC) worth to realize the interim objective of $ 128,000.

Ceaselessly requested questions

A rise within the variety of massive Bitcoin transactions means that long-term homeowners might take a revenue or reposition their portfolios, which is commonly an indication of a coming interval of market volatility.

Analysts counsel an vital stage of help of $ 118,600. If that is so, Bitcoin may concentrate on $ 128,000. The present relapse may supply a brand new accumulation choice for bulls.

The present relapse to vital help ranges, mixed with bullish divergences in indicators such because the RSI, may supply a possible shopping for second for lengthy -term buyers.