Altcoin

There is something else moving Bitcoin – what the charts reveal

Credit : www.newsbtc.com

Bitcoin’s newest pullback has little to do with crypto-native flows and every thing to do with the greenback, in response to Jamie Coutts, chief crypto analyst at Actual Imaginative and prescient.

Sharing two graphs on X, Coutts argued {that a} restoration within the US Greenback Index (DXY) will briefly tighten international liquidity and put strain on danger property throughout the board. “Bitcoin’s dip is not mysterious – it is macro,” he wrote.

Why has Bitcoin fallen?

“The greenback’s restoration is tightening international liquidity. DXY retests 100-101 – a key resistance and pure mean-reversion zone after one of many sharpest declines in many years within the first half of 25. The positioning had turn out to be on the quick facet, so a rebound was all the time possible. The actual query: is that this the beginning of a brand new greenback cycle or simply the setup for the following leg decrease? Baseline situation: liquidity tailwinds and an enhancing enterprise cycle hold the outlook for dangerous property optimistic till mid-2026,” he added.

Associated studying

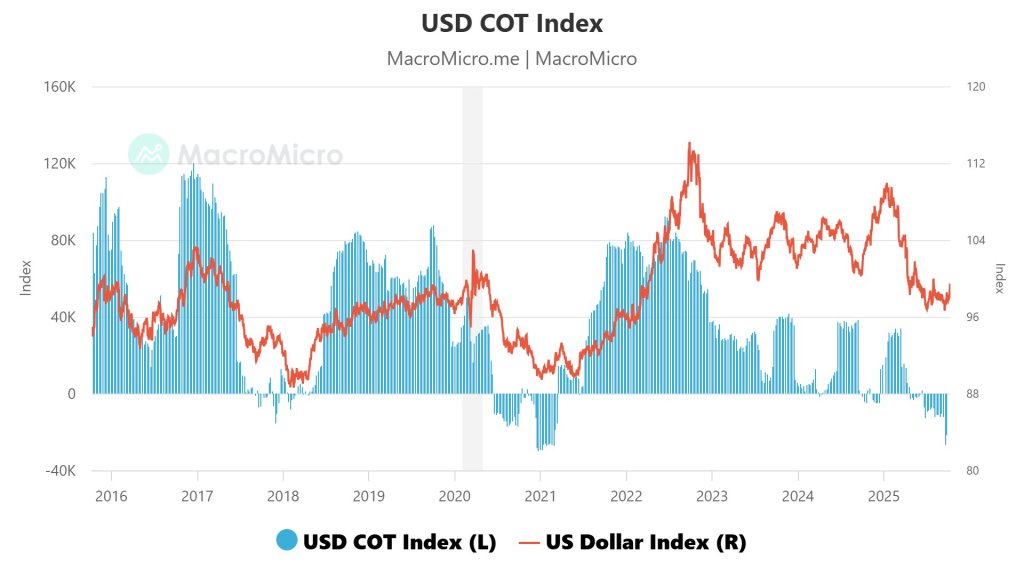

The primary chart he shared places the USD COT index subsequent to the US Greenback index. After a protracted decline within the first half of 2025, speculative positioning reversed aggressively in opposition to the greenback, with the COT index getting into unfavourable territory by mid-2025.

That capitulative perspective created fertile situations for an reverse development. The value panel exhibits DXY retreating in direction of the 100-101 space – a zone according to earlier congestion and the underside of this yr’s stoop – whereas the COT bars stay beneath zero, which is according to short-covering dynamics quite than a completely rebuilt long-dollar consensus.

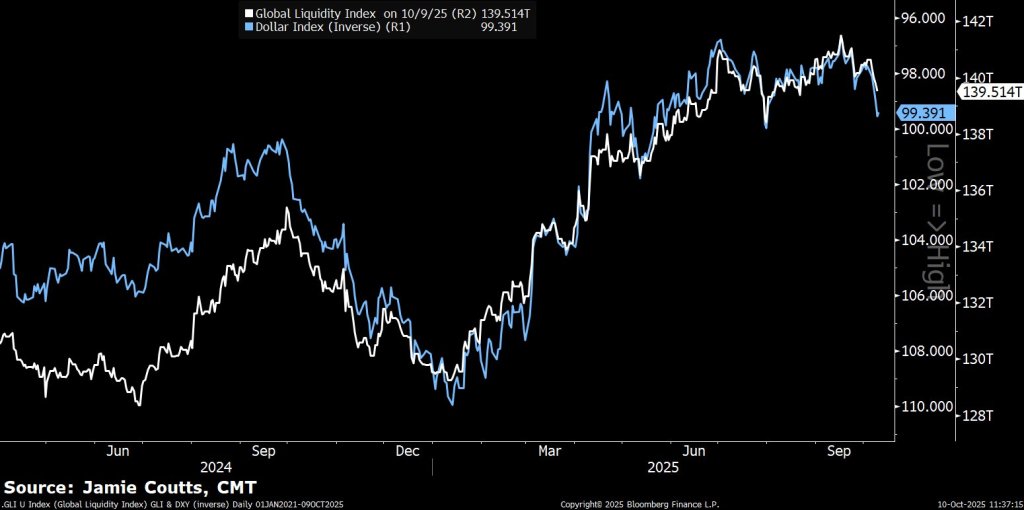

Coutts’ second chart overlaps the World Liquidity Index with the inverse of DXY. The sequence comply with one another carefully: when the greenback weakens (inverse DXY rises), the worldwide liquidity proxy additionally rises, which traditionally coincides with stronger efficiency for duration-sensitive danger property comparable to shares and crypto.

Associated studying

In latest weeks, the white liquidity line has rolled modestly, whereas the blue inverse-DXY line has finished the identical, illustrating the transmission mechanism Coutts highlights: a firmer greenback equates to tighter international greenback liquidity on the margin, which in flip impacts danger urge for food and crypto beta.

What this implies for the BTC value

Formulated this manner, Bitcoin’s slippage is a transparent perform of FX imply reversion and futures positioning, and never a disruption of crypto’s structural flows. The “crowded quick place” in greenback futures left it weak to a rebound, and the mean-reversion goal round 100-101 supplied a logical entry level for that transfer.

If DXY stalls and returns decrease from that vary – according to the broader 2025 downtrend – liquidity situations would possible ease once more, restoring bidding amongst high-beta property. Then again, if the index continues and stays above that zone, Bitcoin would see a extra sustained greenback increase and a slower return of constructive liquidity momentum.

Coutts’ “base case” stays constructive regardless of near-term headwinds: an enhancing international enterprise cycle and protracted liquidity tailwinds by means of mid-2026. In that context, Bitcoin’s declines on greenback power seem cyclical and never secular. The quick pivot level is clearly seen on its charts: the 100–101 retest of the DXY, spawned by stretched speculative shorts and traditional imply reversion, dictates BTC’s temperature in the interim.

On the time of writing, Bitcoin was buying and selling at $121,703.

Featured picture created with DALL.E, chart from TradingView.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024