Policy & Regulation

New Japan PM may boost crypto economy, ‘refine’ blockchain regulations

Credit : cryptonews.net

Japan’s newly elected Prime Minister Sanae Takaichi might open the door for extra “refined” rules to spice up the nation’s cryptocurrency financial system, which might develop into the subsequent international hub for crypto firms.

Takaichi was elected chief of the Liberal Democratic Celebration (LDP) on Saturday and can grow to be Japan’s first feminine prime minister when she takes workplace on October 15.

Specialists say her management might introduce a extra open angle towards technological experimentation, together with blockchain innovation, whereas sustaining Japan’s strict regulatory requirements.

Takaichi’s election might have a “materials affect on the notion and governance of digital property within the nation,” mentioned Elisenda Fabrega, basic counsel at tokenization platform Brickken.

In earlier public positions, Takichi has expressed assist for “technological sovereignty,” together with the “strategic improvement of digital infrastructure, together with blockchain know-how,” Fabrega instructed Cointelegraph. “From a authorized perspective, this implies that her authorities might undertake a stance that’s not solely permissive but in addition probably proactive in advancing the digital financial system.”

Fabrega added that Takaichi’s political positioning might strengthen “Japan’s dedication to authorized certainty within the crypto house” and renew curiosity within the nation as an innovation-friendly crypto hub.

Sanae Takaichi. Supply: The Japan Information

The Japanese authorities acknowledges blockchain as a “pillar of its digital transformation technique,” mentioned Maarten Henskens, Chief Working Officer at Startale Group and head of the Astar Basis.

“A looser financial view underneath the brand new management might assist liquidity and gas investor curiosity in different property, together with cryptocurrencies,” Henskens instructed Cointelegraph.

“At Startale and Astar, we see this as a robust setting to additional develop Japan’s Web3 ecosystem,” he added.

Associated: Stimulus speak meets shutdown: what rate-funded controls might imply for crypto

Through the elections, Takaichi was the one candidate who proposed each a big spending bundle and a looser financial coverage. Her place has been effectively obtained by voters dealing with a weakening Japanese yen.

Japan’s Nikkei index rose to a brand new file excessive of 47,734.04 on Monday, up 4.75% after information of her election.

Takaichi can ‘refine’ present token definitions and crypto regulatory frameworks

Specialists say Takaichi’s authorities might convey extra readability to token classifications underneath Japan’s Monetary Providers Company. The FSA at the moment distinguishes between fee tokens, securities and utility tokens, every with completely different regulatory necessities.

Takaichi’s management will seemingly give attention to the “refinement and growth” of present classes, notably associated to custody, tokenized monetary devices and investor safety requirements, Fabrega mentioned.

“We might see the consolidation of supervisory instruments associated to anti-money laundering, the implementation of stricter disclosure necessities for public choices involving digital property, and a extra structured framework for the authorization of platforms engaged within the issuance or buying and selling of tokens.”

Japan has embraced crypto regulation for the reason that Mount Gox collapse

Japan has been growing its cryptocurrency regulatory framework since at the least 2016, when the FSA amended the Cost Providers Act (PSA) to determine a regulatory regime that imposed the primary registration necessities for cryptocurrency exchanges.

This got here in response to the Mount Gox collapse, which uncovered urgent regulatory gaps within the nation.

In April 2017, the brand new modifications got here into impact, requiring exchanges to register with the FSA and adjust to anti-money laundering and Know Your Buyer requirements.

In April 2018, crypto exchanges got here collectively to type the Japan Digital Forex Change Affiliation (JVCEA), earlier than the FSA granted JVCEA self-regulatory standing in October 2018.

In June 2022, Japan’s parliament launched new rules permitting licensed monetary establishments to situation fiat-backed stablecoins, requiring issuers to totally again stablecoins with domestically held yen reserves.

In April 2023, Japan’s LDP launched a white paper outlining methods for Web3 and blockchain adoption, recommending changes to tax coverage and approval frameworks for exchange-traded fund (ETF).

In June, the FSA proposed reclassifying crypto property as conventional monetary merchandise. That is anticipated to come back into impact from 2026 and topic cryptocurrencies to a brand new tax regime.

Associated: Ageing boomers and international wealth have boosted cryptocurrencies by 2100

Japan’s evolving rules might make the nation a extra enticing vacation spot for cryptocurrency firms.

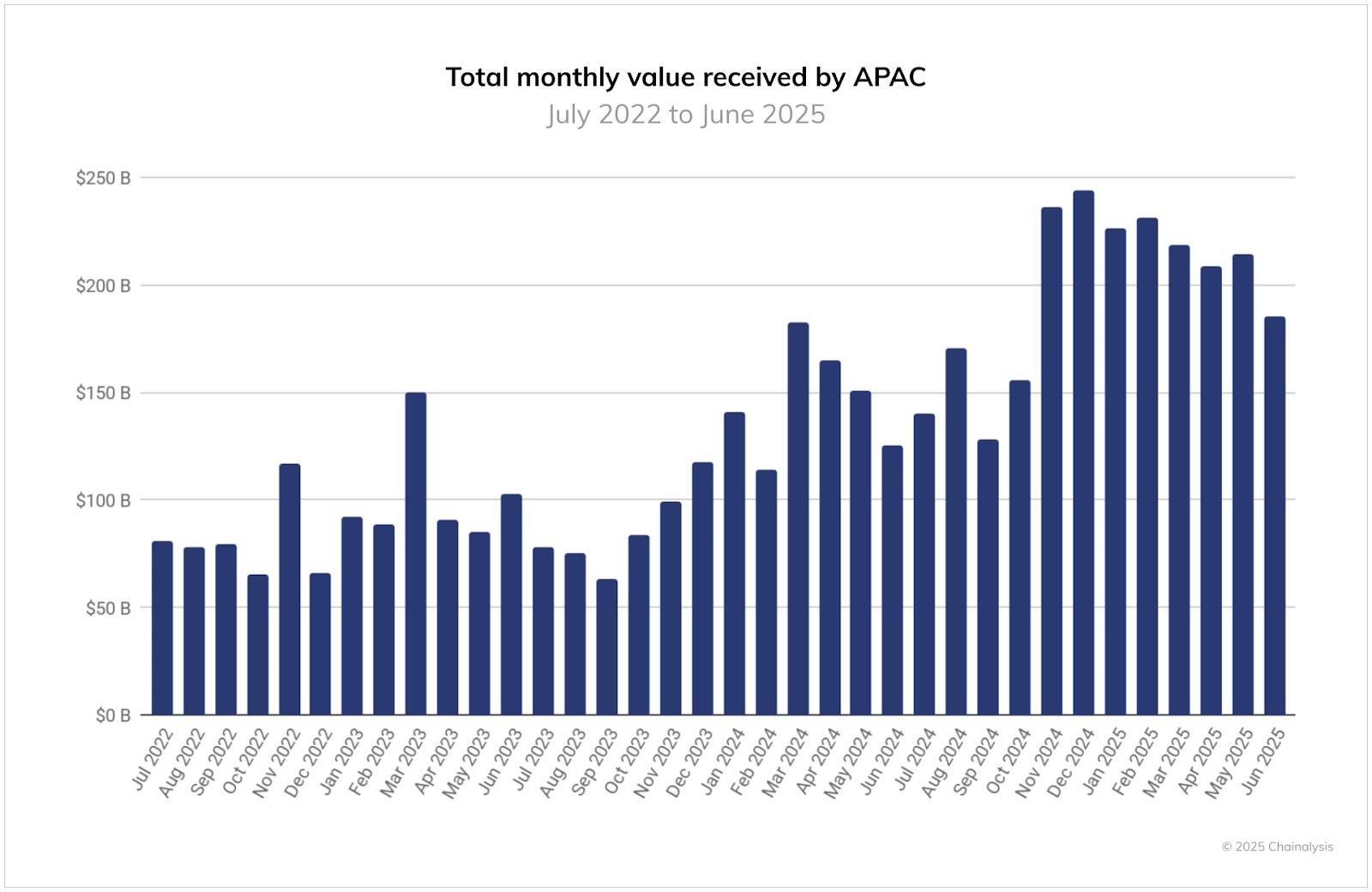

The worth of month-to-month crypto obtained in APAC reveals a rise in November 2024, coinciding with rising crypto costs following US President Donald Trump’s election victory. Supply: Chain evaluation

Japan’s coverage shift has already helped the nation double its crypto adoption within the 12 months main as much as September, in response to Chengyi Ong, head of APAC coverage at Chainalysis.

Japan noticed the strongest development among the many 5 main markets within the Asia-Pacific area, with onchain worth rising greater than 120% year-on-year within the 12 months to June 2025, in response to an excerpt from Chainalysis’ 2025 Geography of Cryptocurrency Report.

Journal: Hong Kong will not be the loophole that Chinese language crypto firms assume it’s

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024