Policy & Regulation

SEC’s ‘future-proofing’ push to shape how much freedom crypto enjoys after Trump

Credit : cryptonews.net

Paul Atkins desires to strengthen his view on the crypto markets earlier than the political tides flip once more in Washington. As the brand new chairman of the U.S. Securities and Change Fee, he’s shortly transferring to “future-proof” SEC insurance policies, a push that might decide how a lot freedom the crypto trade enjoys after President Donald Trump leaves workplace.

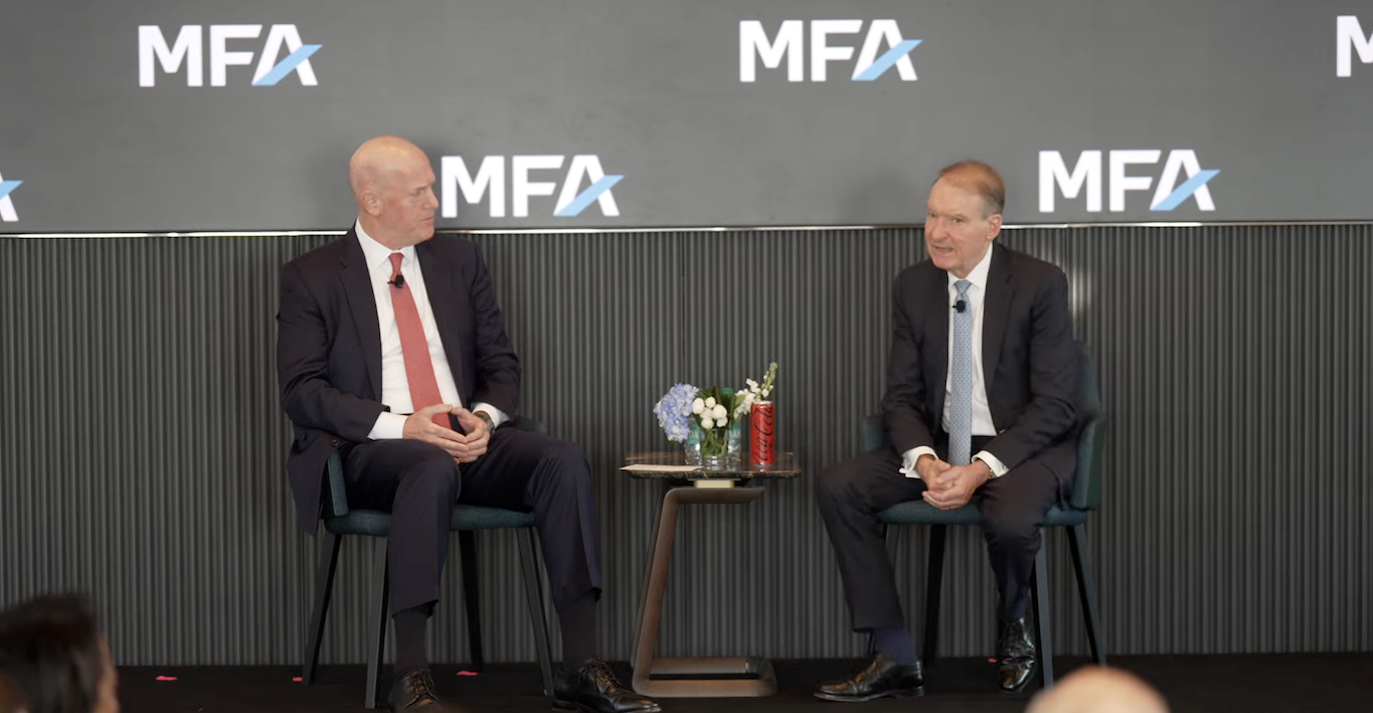

At a convention hosted by the Managed Funds Affiliation in New York on Tuesday, Atkins mentioned the SEC would work shortly to undertake guidelines that might “future-proof” its agenda. He particularly referred to eradicating or weakening laws on private and non-private markets, each of which might influence the cryptocurrency trade after Trump or Atkins depart workplace.

“We’ve, I believe, an incredible alternative to come back collectively and, in a can-do mentality, create one thing that may final,” Atkins mentioned of the collaboration between U.S. regulators. “My largest concern is to future-proof this in opposition to future potential modifications. What we have to do is get issues carried out, attain settlement after which make the market work. […]”

Relating to the partnership with the Commodity Futures Buying and selling Fee (CFTC), the SEC Chairman mentioned:

“As we transfer ahead, particularly with digital means, the one factor I attempt to warn individuals about is that we can’t have two fortresses on both aspect of a no-man’s-land strip, as a result of that no-man’s-land strip is now plagued by the corpses of so-called merchandise which were killed within the crossfire of the 2 businesses through the years.”

Paul Atkins (proper) speaks in New York on Tuesday. Supply: Affiliation of Managed Funds

Even earlier than the U.S. Senate appointed Atkins chairman of the SEC in April, then-Chairman Mark Uyeda had considerably modified the company’s method to digital belongings, closing a number of investigations and instances in opposition to crypto firms and making a crypto activity power led by Commissioner Hester Peirce.

Below Atkins, the fee modified itemizing requirements for crypto exchange-traded funds (ETFs), reportedly thought of whether or not shares must be allowed to commerce on the blockchain, thought of abandoning the company’s quarterly reporting necessities and held a roundtable with the CFTC to “harmonize” laws.

“[T]The momentum behind digital belongings is troublesome to reverse,” mentioned Andrew Forson, president of Canada-based DeFi Applied sciences, in response to an e mail from Cointelegraph. “U.S. coverage, even amid differing management philosophies, has more and more aligned conventional capital markets with decentralized finance.”

Can a future US president undo all of the SEC’s work with the stroke of a pen?

Whereas Atkins has broad authority to suggest and help laws and insurance policies that profit the crypto trade, he has been in shut contact with the present administration based mostly on public statements. As SEC chairman, he can direct the company to take enforcement actions and set up insurance policies.

Shortly after former SEC Chairman Gary Gensler resigned in January, the company softened its method to crypto enforcement, halting many years-long investigations and instances. Some could wonder if a future US president who might be extra anti-crypto or impartial on the expertise might shortly reverse Atkins’ agenda, because the SEC is doing for a lot of of Gensler’s positions.

“It might be troublesome for a brand new SEC chairman to fully reverse Chairman Atkins’ proposed insurance policies,” Forson informed Cointelegraph. “Nonetheless, a future administration might impose further reporting necessities and compliance burdens, successfully slowing progress and innovation. This may echo the early days of ICOs, when overregulation suppressed professional token provide.”

Forson added:

“If a much less crypto-friendly authorities takes over, current instruments would possible be adopted, however new entrants would face important headwinds. Regulatory modifications could dampen innovation, however they can not dismantle the ecosystem that’s already nicely established.”

Associated: The US authorities shutdown enters day 1: how does the SEC nonetheless operate?

David B. Hoppe, a expertise and media legal professional and founding father of Gamma Regulation, supplied a barely completely different perspective, saying future SEC chairmen can’t unilaterally roll again the company’s guidelines and laws. Nonetheless, they may change the SEC’s “inner priorities” set by Atkins and shift sources again to pursuing enforcement instances and investigations in opposition to crypto firms.

“With a vote of the SEC commissioners, the longer term chairman might additionally reverse the SEC’s official insurance policies introduced underneath Mr. Atkins,” Hoppe informed Cointelegraph. “This might mark a return to the SEC’s earlier place that crypto initiatives presumptively implicate securities legal guidelines. Whereas not binding, SEC coverage statements talk SEC rule interpretations and enforcement priorities and may considerably affect market individuals.”

What concerning the SEC guidelines modified by Congress?

A market construction invoice presently being handed by the U.S. Senate might additionally considerably change SEC laws and, ought to it cross and be signed into regulation, would require one other act of Congress to vary or undo. Nonetheless, Hoppe mentioned some modifications underneath the Market Construction Act would possible face fewer challenges.

“[A]Any laws adopted by the SEC and CFTC to implement the Market Construction Act could be a lot simpler to amend or repeal as a result of they’d solely should undergo the usual discover and remark course of (or different relevant process),” Hoppe informed Cointelegraph. “The SEC or CFTC might determine sooner or later to reinterpret the provisions of the Market Construction Act and revise the laws amend or withdraw accordingly.”

Cointelegraph contacted Atkins for remark however had not obtained a response by time of publication.

On Thursday, the US authorities entered the ninth day of a shutdown attributable to lawmakers’ incapacity to agree on a funding invoice. The SEC continues to function with diminished employees and operations, however Atkins mentioned Tuesday that the company “didn’t decelerate” through the shutdown.

Journal: The SEC’s turnaround on crypto leaves essential questions unanswered

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024