Altcoin

Analyst Says: Check Out These Key Charts

Credit : www.newsbtc.com

An analyst has revealed the highest Bitcoin charts to keep watch over as Bitcoin slowly recovers from its final crash.

These Bitcoin charts could possibly be fascinating to keep watch over

In a shock to the market, Bitcoin ended final week with a steep crash, from above $122,000 to beneath $110,000. The foreign money managed to recuperate considerably on Sunday, and that restoration continued nicely into Monday.

Associated studying

Whereas BTC seems to be rebuilding its construction, its route stays unclear, as famous by CryptoQuant neighborhood analyst Maartunn in an wire. Maartunn shared some key charts that might decide whether or not the restoration lasts or fades.

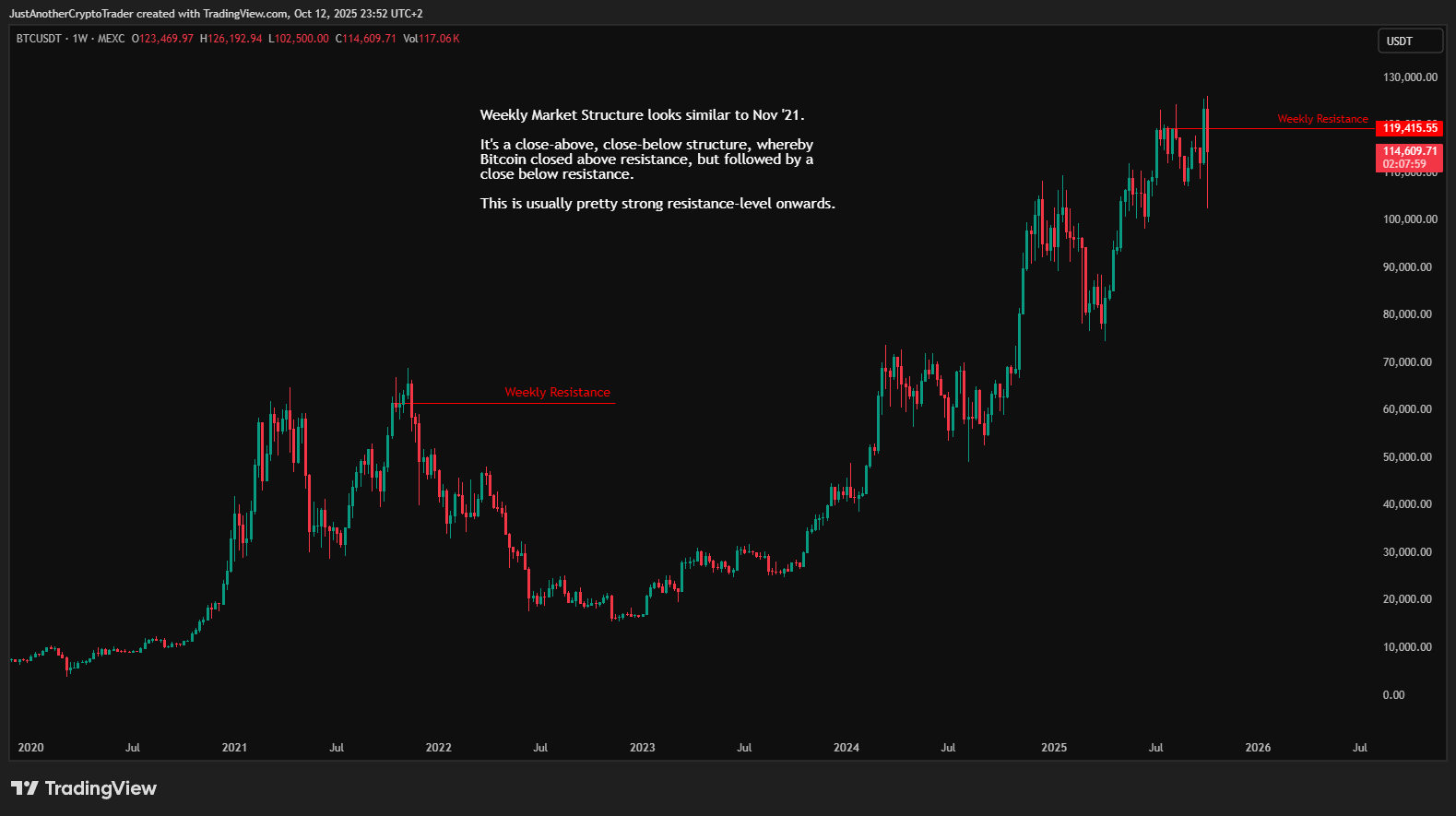

First, the analyst revealed a chart that factors to a similarity between the current Bitcoin value motion and the November 2021 bull market prime.

As proven within the chart above, BTC broke above its weekly resistance in the course of the current value rally, however instantly fell beneath the road after the crash. An identical failed outbreak additionally occurred in November 2021. In accordance with Maartunn, such a development often signifies exhaustion.

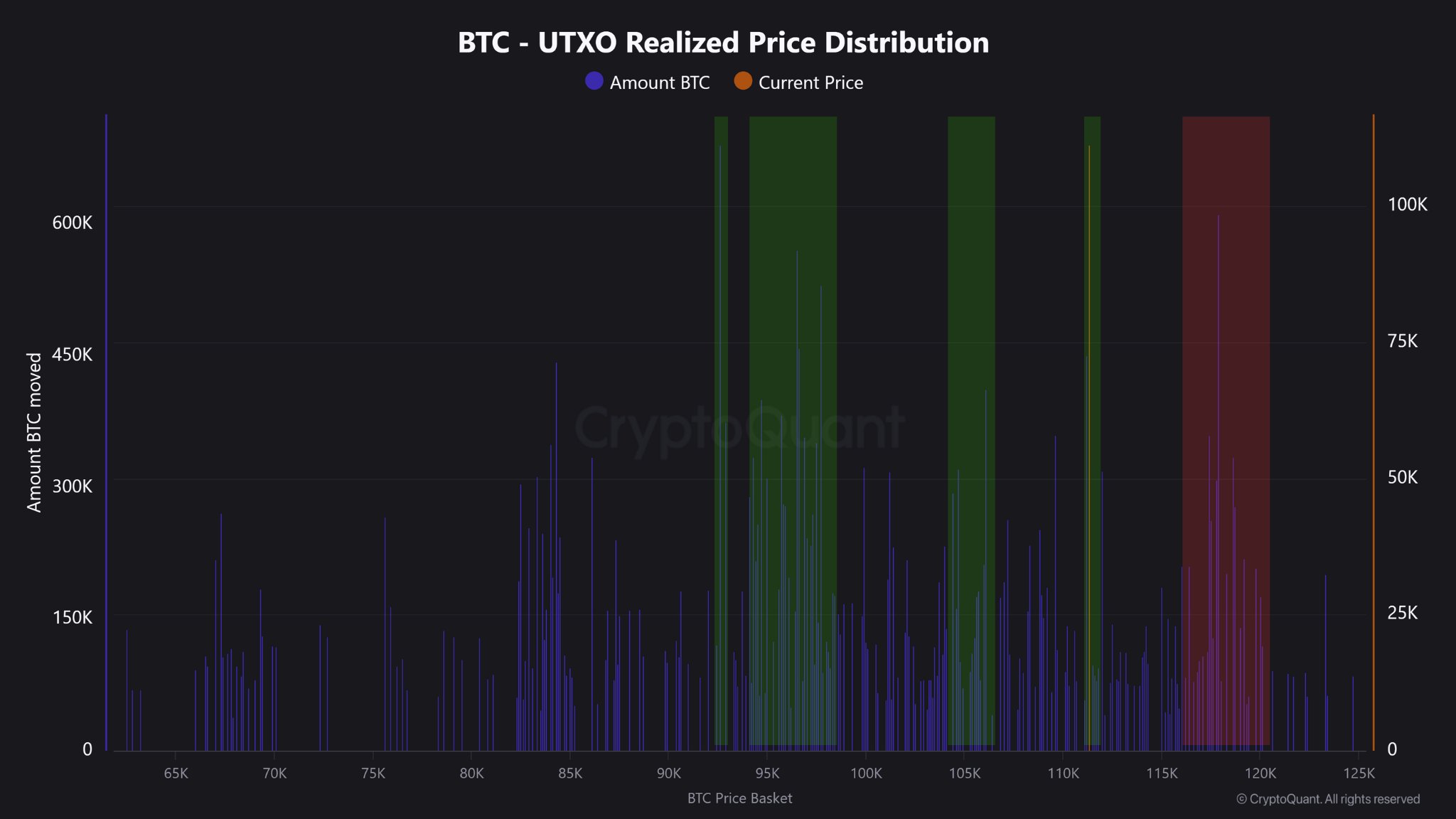

On-chain information additionally means that the cryptocurrency is presently beneath a notable resistance stage, because the chart for the UPRD reveals.

The UTXO Realized Worth Distribution (URPD) right here is an indicator that tells us concerning the quantity of Bitcoin final bought/transferred on the completely different value ranges the asset has visited in its historical past.

The statistics graph reveals that the associated fee foundation of a good portion of the providing is between $117,500 and $120,000. The holders of those cash would after all be underwater at this level, so there’s a probability that if BTC recovers to their breakeven stage, they are going to panic promote for worry of incurring losses once more.

Given the dimensions of the providing concerned, the sort of promoting stress could possibly be notable in a retest of the vary, doubtlessly making it a key resistance barrier for the asset.

One help stage that could possibly be crucial is the common value foundation or realized value of the short-term holders (STHs).

Traditionally, the road has helped the asset discover a restoration throughout bullish developments, with three cases of this development occurring within the final six weeks alone. Nonetheless, the analyst has warned that perception among the many cohort is fading.

Associated studying

The market worth to realized worth (MVRV) ratio means that profitability amongst Bitcoin STHs is following a chronic decline, retesting the cutoff stage of 1.

“If this stage breaks, anticipate a downtrend. If this holds, it confirms demand, however handle threat accordingly!” Maartunn famous within the thread.

BTC value

On the time of writing, Bitcoin is hovering round $114,100, down over 8% previously seven days.

Featured picture from Dall-E, CryptoQuant.com, charts from TradingView.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024