Policy & Regulation

US Senate passes GAIN Act, prioritizing domestic AI and HPC chip sales

Credit : cryptonews.net

The US Senate has developed sweeping AI laws beneath the Nationwide Protection Authorization Act, forcing chip makers to serve US prospects first earlier than exporting superior processors overseas.

On Thursday, senators handed the Guaranteeing Entry and Innovation for Nationwide Synthetic Intelligence Act of 2026, or GAIN Act, as an modification to the Nationwide Protection Authorization Act, which requires AI and high-performance chipmakers to prioritize home orders earlier than exporting their merchandise.

The GAIN Act additionally provides Congress the precise to disclaim export licenses for probably the most superior AI processors and mandates export licenses for all merchandise containing an “superior built-in circuit.”

“In recent times, U.S. corporations have repeatedly confronted backlogs in chip purchases. By the tip of 2024, Nvidia’s Blackwell line was totally booked about 12 months upfront,” based on the coverage advocacy group “People for Accountable Innovation.”

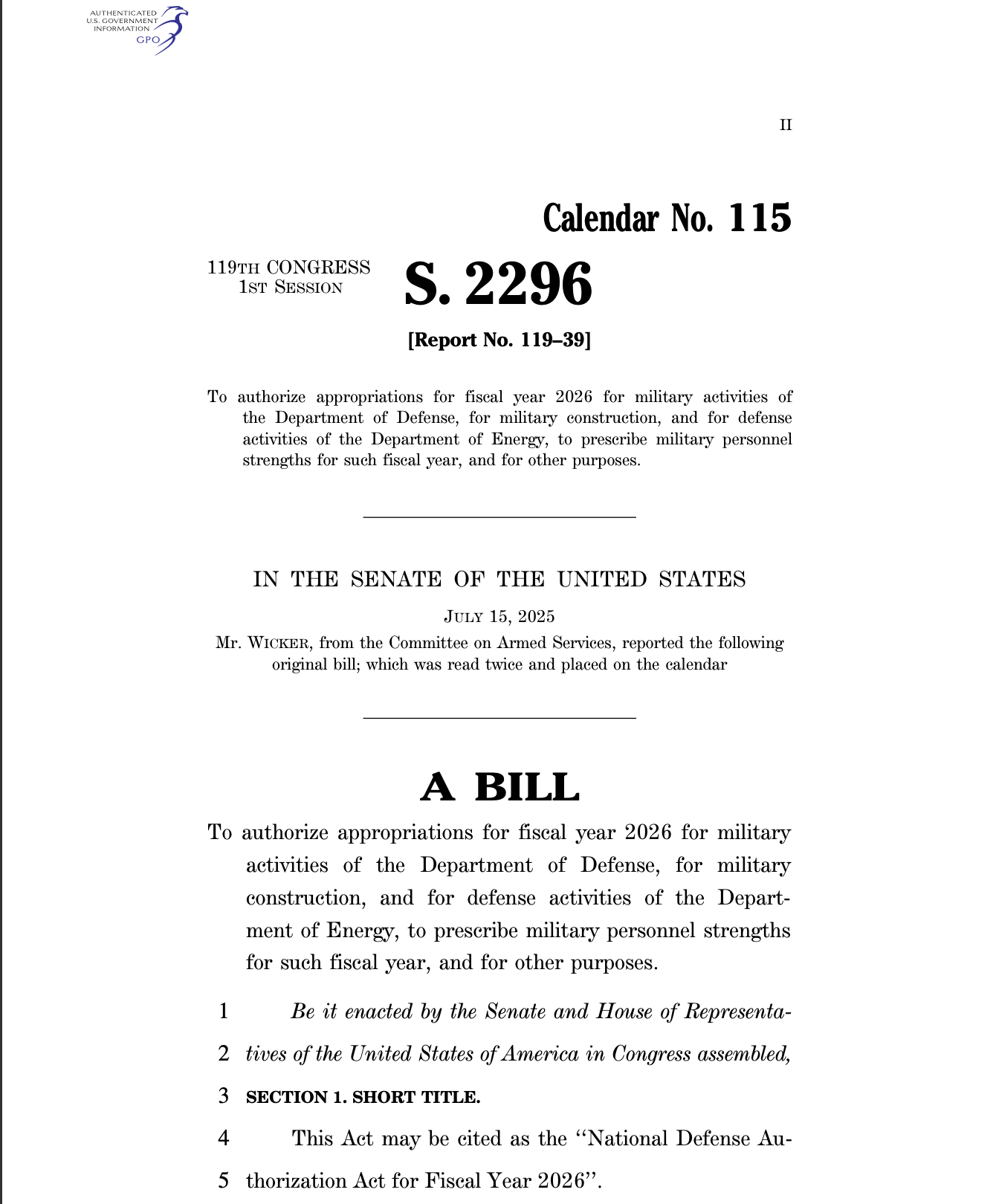

The primary web page of the 2026 NDAA. Supply: American Congress

Candidates should reveal that every one U.S. orders have been fulfilled earlier than export authorization beneath the NDAA for fiscal 12 months 2026 is granted.

Nevertheless, the GAIN AI Act is an modification to the NDAA and each should nonetheless be handed by the Home of Representatives and signed by the President earlier than turning into legislation.

This leaves the ultimate provisions within the NDAA to negotiations in Congress, with no assure that the GAIN Act in its present kind will develop into legislation, if in any respect.

Export restrictions on synthetic intelligence and high-performance laptop chips might negatively affect the crypto mining trade, which is international in scale and already feeling the financial ache from commerce tensions as {hardware} turns into more durable to acquire.

Associated: Bitdeer is doubling down on Bitcoin self-mining as demand for rigs declines

Tariffs and commerce wars have hit the mining trade exhausting

The cross-trade tariffs introduced by US President Donald Trump in April brought on crypto costs to plummet and created more difficult circumstances for the extremely aggressive mining trade.

The manufacturing of crypto mining {hardware} depends on worldwide provide chains that are actually topic to tariffs, rising the price of {hardware} and reducing the profitability of miners.

CleanSpark, a US-based mining firm, confronted $185 million in debt in July after US Customs and Border Safety (CBP) alleged that a few of the mining {hardware} it ordered got here from China.

IREN, one other US crypto miner, confronted a $100 million invoice over claims that its {hardware} was topic to elevated buying and selling duties.

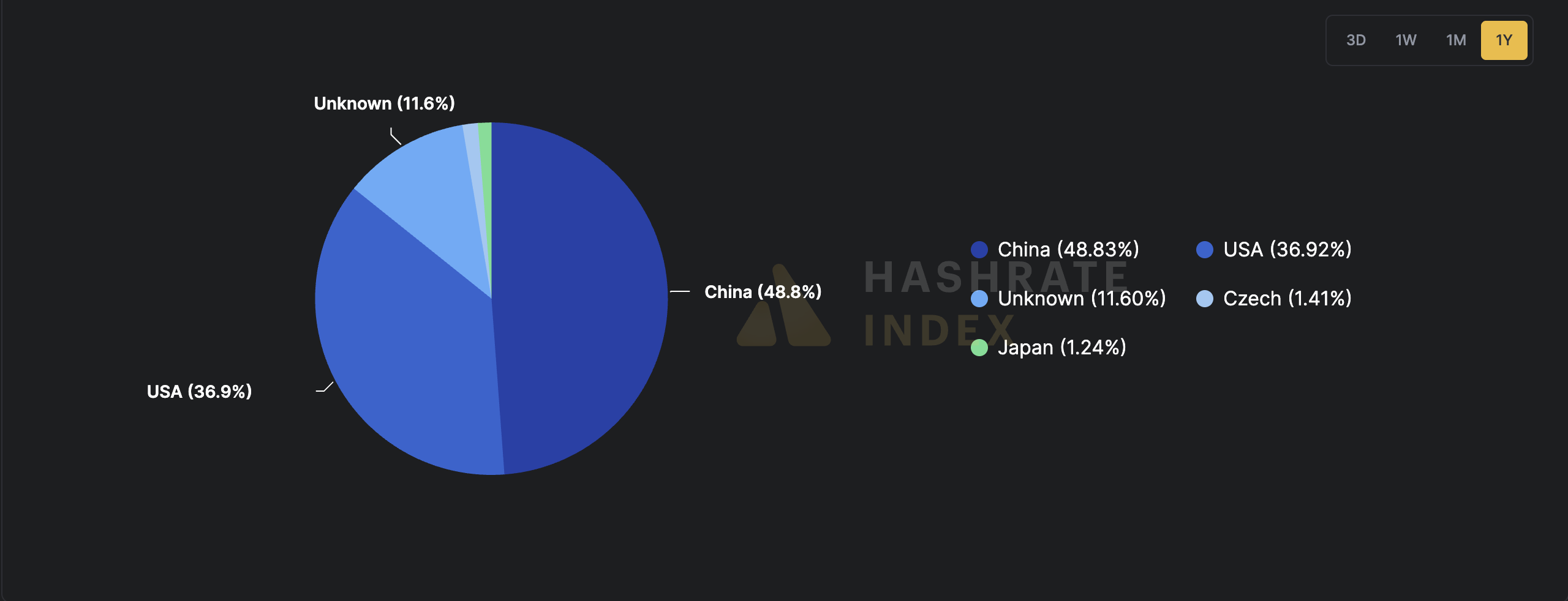

The hashrate breakdown of Bitcoin mining swimming pools by nation. Supply: Hashrate index

The tariffs might additionally decrease costs for mining {hardware} outdoors the US, placing US-based miners at a aggressive drawback and eroding america’ share of the worldwide hashrate, the quantity of computing energy spent on securing crypto networks.

Shedding hash energy would undermine the Trump administration’s acknowledged aim of reworking the US into the crypto capital of the world.

Journal: Bitcoin Mining Business ‘Will Be Lifeless Inside Two Years’: CEO of Bit Digital

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024