Ethereum

Is Ethereum set for a breakout? 2 factors hold the key

Credit : ambcrypto.com

- Whale exercise and a 79% enhance in quantity indicated potential bullish momentum for Ethereum.

- The on-chain metrics remained combined, however the bulls had a slight edge within the Lengthy/Brief ratio.

A Ethereum [ETH] The ICO participant, who initially earned 150,000 ETH (now valued at $389.7 million), made a significant transfer by depositing 3,510 ETH ($9.12 million) into Kraken after remaining inactive for greater than two years.

This huge-scale transaction suggests rising confidence in Ethereum’s future. With Ethereum buying and selling at $2,656.39, up 3.02% on the time of writing, the market is now specializing in whether or not this whale transfer will create bullish momentum.

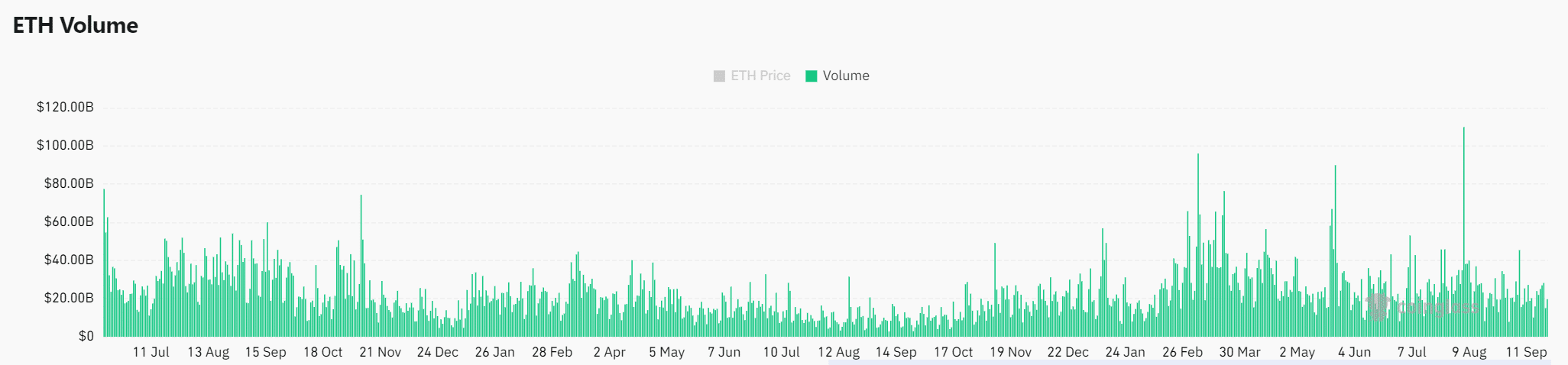

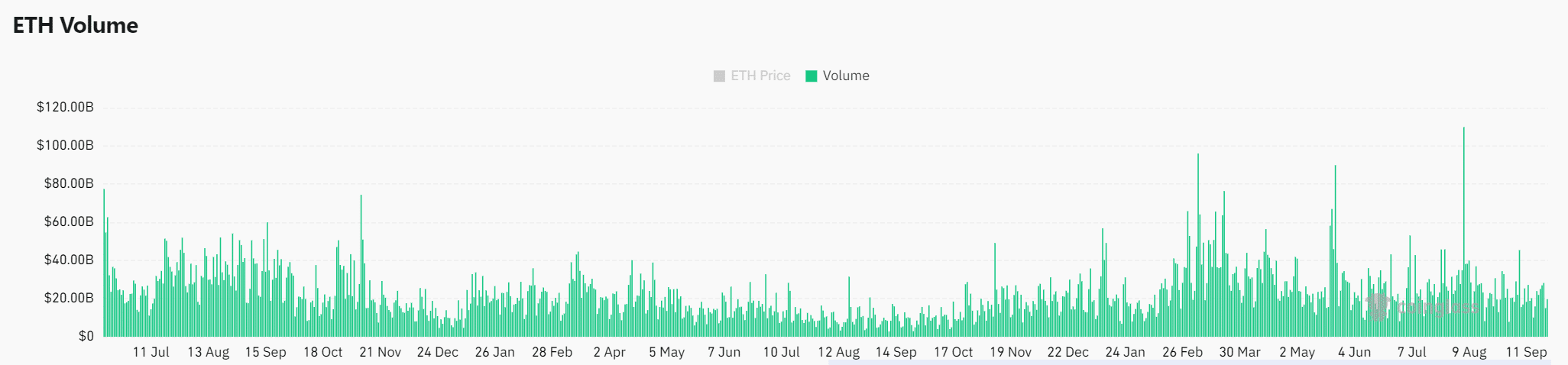

Ethereum’s Quantity Surge: A Bullish Sign?

Ethereum buying and selling quantity has seen a pointy enhance, rising 79.30% within the final 24 hours to $28.21 billion on the time of writing.

This enhance often signifies a rising urge for food amongst merchants, which frequently results in larger worth volatility.

Due to this fact, elevated quantity might drive the market larger if consumers proceed to dominate. Nevertheless, if quantity decreases with out follow-up purchases, it might point out hesitation, doubtlessly resulting in a worth drop.

Supply: Coinglass

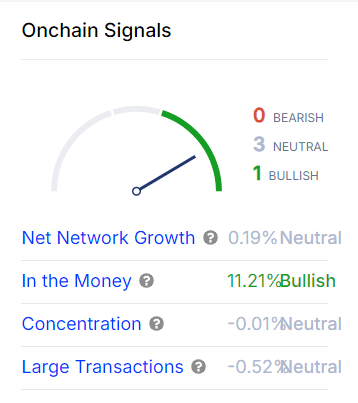

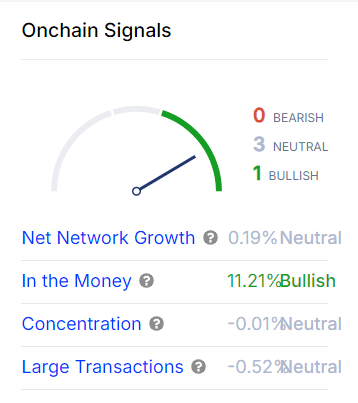

On-chain metrics: combined indicators for Ethereum

Wanting on the on-chain metrics, AMBCrypto discovered a mixture of indicators.

Ethereum’s web community development stays impartial at 0.19%, displaying no important inflow of latest customers.

Nevertheless, the Within the Cash metric, a key indicator of how a lot traders are at present making income, exhibits a bullish determine of 11.21%.

This implies that a good portion of Ethereum holders are nonetheless in a revenue place, which might scale back promoting stress and help worth stability.

Alternatively, measures akin to Focus and Giant Transactions additionally present impartial traits, with no important adjustments in whale accumulation.

Whereas the Kraken whale deposit indicators renewed market exercise, it has not but led to an enormous shift in Ethereum’s on-chain dynamics.

Supply: IntoTheBlock

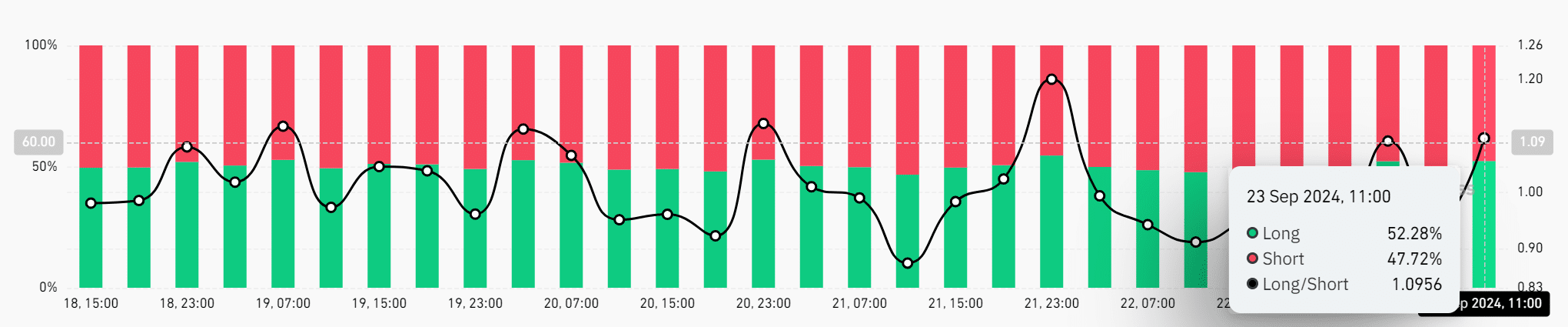

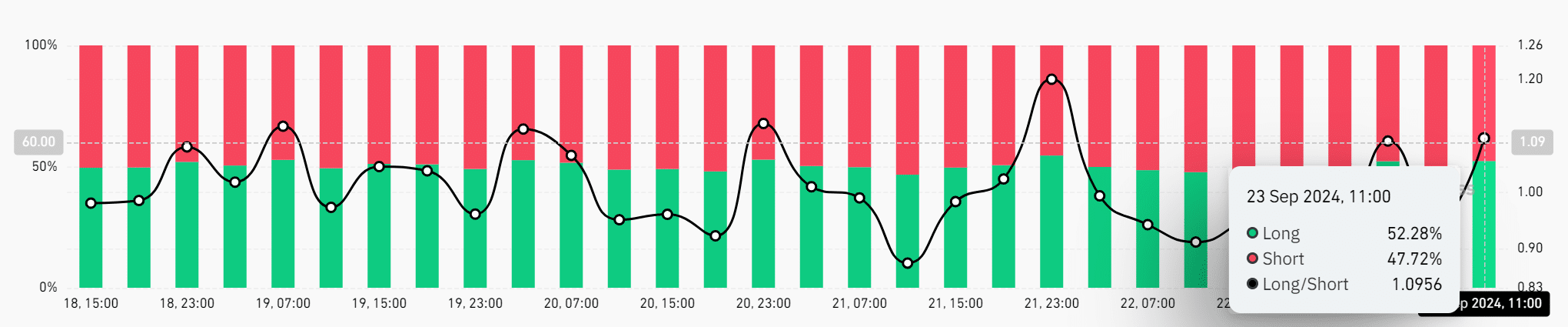

Taurus have an edge

The Lengthy/Brief ratio barely favors bulls. As of September 23, 52.28% of merchants had lengthy positions, whereas 47.72% had been quick the market.

This small majority signifies that merchants are leaning in the direction of an additional enhance within the worth of Ethereum. If the ratio continues to favor the bulls, Ethereum might preserve its upward momentum.

Supply: Coinglass

Learn Ethereum’s [ETH] Worth forecast 2024-25

The latest whale exercise in Ethereum and the sharp enhance in buying and selling quantity recommend bullish potential. Nevertheless, combined on-chain metrics present that the market stays cautious.

The Lengthy/Brief ratio provides bulls a slight edge, however broader market dynamics will in the end decide the route.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024