Bitcoin

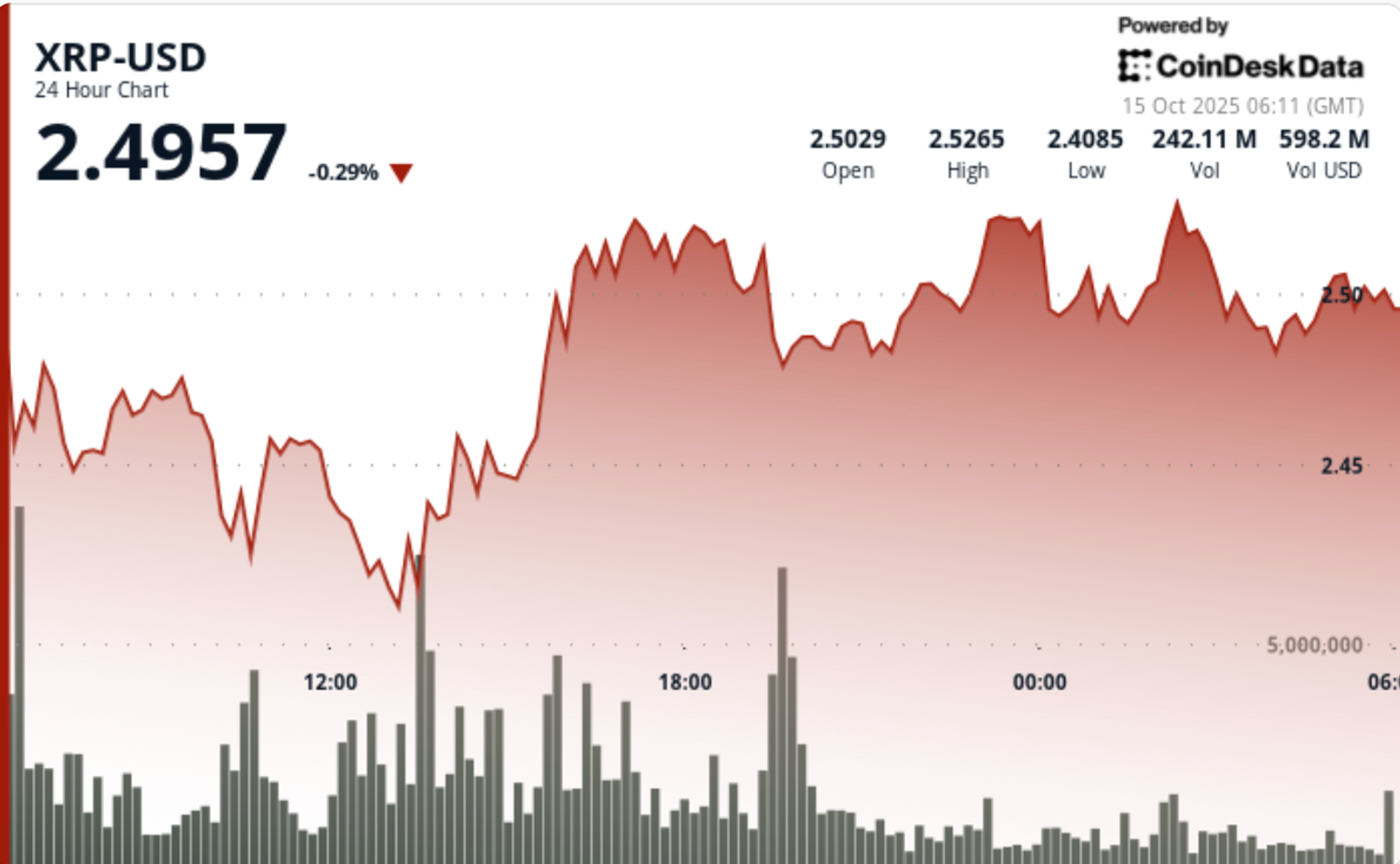

Tests $2.40 Base After 6% Swing; Eyes $2.65 Breakout Level

Credit : www.coindesk.com

Heavy deleveraging in derivatives markets sends XRP decrease earlier than patrons defend the $2.40 zone, organising a key retest of help heading into buying and selling in Asia.

Information Background

- XRP traded sharply decrease in the course of the October 14-15 session as macro pressures and broad crypto unwinding pushed open curiosity down 50% to $4.22 billion.

- Regardless of the outbreak, spot volumes rose 40%, signaling an institutional return.

- Ripple’s just lately introduced partnership with Immunefi – a $200,000 XRP Ledger safety trial operating from October 27 by November. 24 – helped anchor sentiment after a dip early within the session.

Abstract of Worth Actions

- XRP fell 1.97%, falling from $2.54 to $2.49, whereas swinging by a spread of $0.16 ($2.55-$2.39) – about 6% intraday volatility.

- Consumers repeatedly entered between $2.40 and $2.42, defending key help after a day capitulation.

- Quantity exploded to 179.4M at 1:00 PM, virtually double the 24-hour common, confirming accumulation at a low level.

- Sellers closed out the rebounds round $2.53, with constant near-term distribution offering a ceiling.

- In late session buying and selling, XRP recovered modestly to $2.50 as order books stabilized on dip shopping for.

Technical evaluation

- The world between $2.40 and $2.42 stays the essential pivot level for bulls. A number of rebounds verify institutional defenses, however momentum stays susceptible beneath the $2.53-$2.55 resistance cluster.

- A sustained break beneath $2.40 would open draw back targets at $2.33 and $2.25, whereas regaining $2.53 may set off one other advance in direction of the broader $2.65 breakout line.

- Quantity-weighted figures level to accumulation amid compelled deleveraging – a basic near-term base-building part as financing normalizes.

What merchants have a look at

- Whether or not the $2.40 will maintain throughout Monday’s Asia open.

- Utilizing indicators once more after the open curiosity on derivatives exchanges was halved.

- Quantity follow-up above $2.50 confirms accumulation.

- Macro information is linked to commerce warfare rhetoric and Fed coverage as drivers of volatility.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024