NFT

NFT markets rebound after $1.2B wipeout in Friday’s crypto crash

Credit : cryptonews.net

The non-fungible token (NFT) market confirmed the primary indicators of restoration after a steep sell-off throughout Friday’s crypto market crash worn out about $1.2 billion in market capitalization.

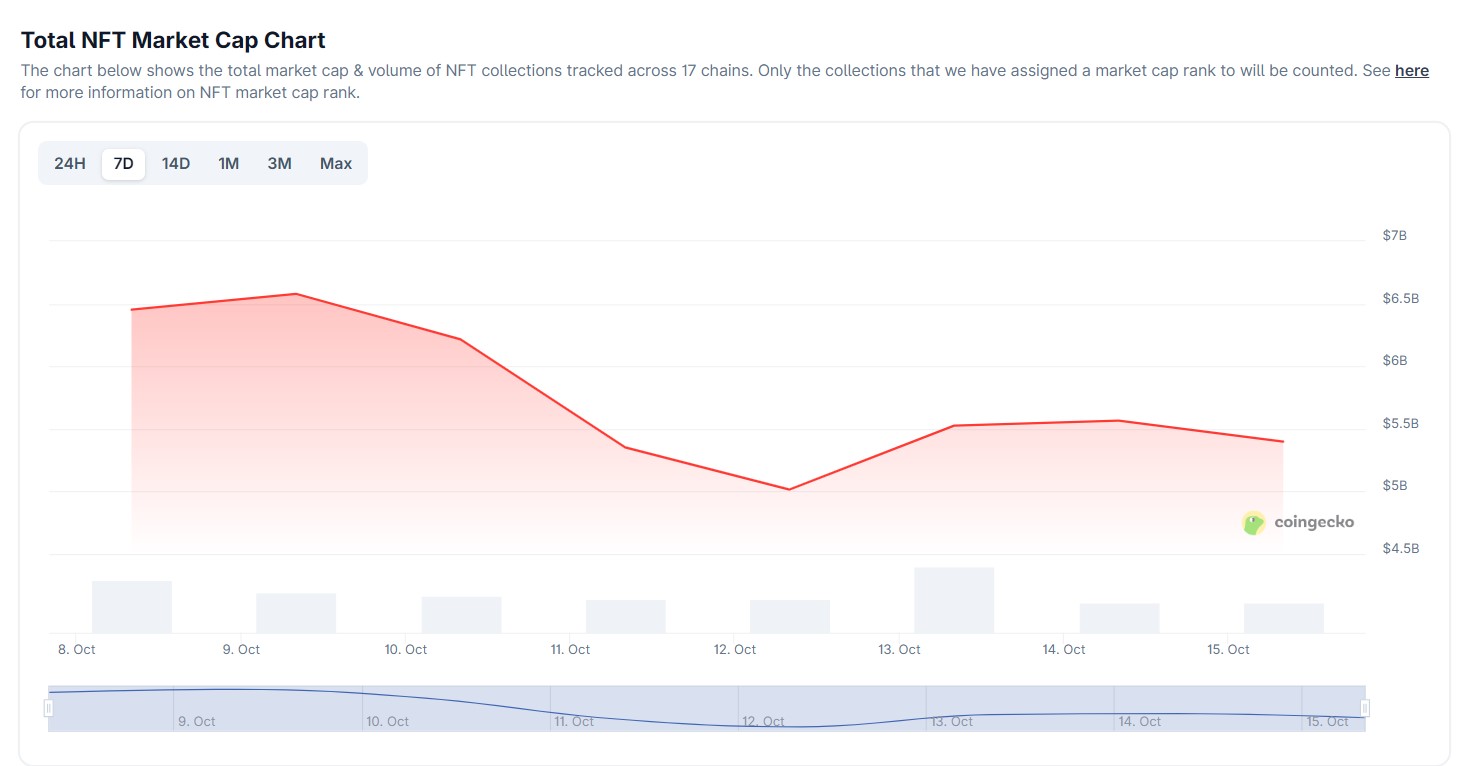

In response to knowledge from CoinGecko, the sector’s complete valuation fell from $6.2 billion on Friday to $5 billion on Saturday. This worn out practically 20%, or about $1.2 billion, of market capitalization for digital collectibles throughout all blockchain networks.

The sector noticed a fast restoration because the crypto markets recovered. On Sunday, NFTs reached $5.5 billion, a ten% acquire after the crash. On the time of writing, the entire market capitalization was nearly $5.4 billion.

The sell-off underscores the NFT sector’s sensitivity to broader crypto volatility. When the market fell sharply on Friday, NFT all-time low costs adopted swimsuit as liquidity dried up and speculative demand fell.

Complete NFT Market Cap Chart. Supply: CoinGecko

High NFT collections stay within the crimson

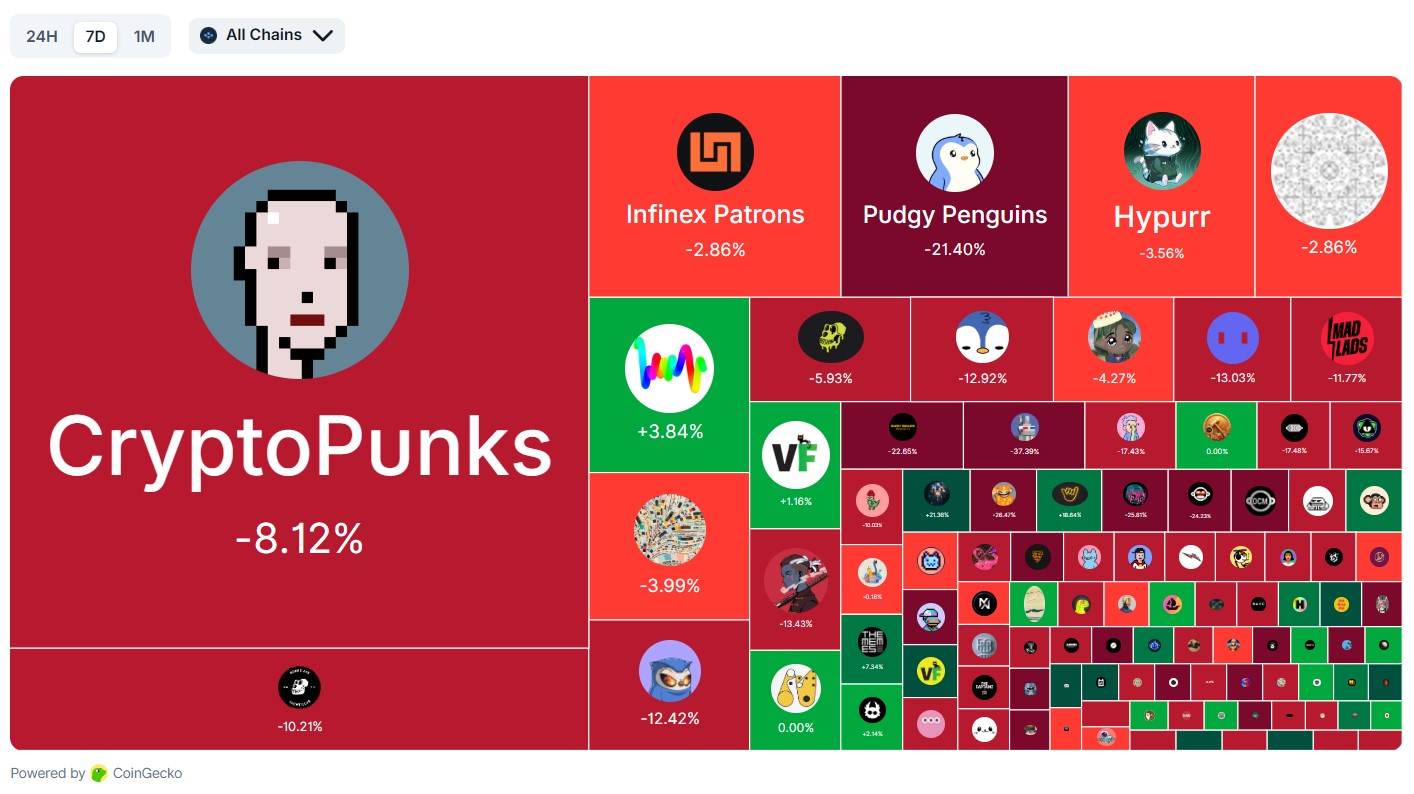

Regardless of the partial restoration, many prime NFT collections have fallen over durations of seven to 30 days.

High Ethereum-based initiatives, similar to Bored Ape Yacht Membership (BAYC) and Pudgy Penguins, are nonetheless down 10.2% and 21.4% respectively over the previous week. Collections like Infinex Patrons and Tyler Hobbs’ Fidenza posted double-digit losses on the month-to-month charts.

CryptoPunks, the highest NFT assortment by market cap, is down 8% on the weekly charts and practically 5% on the 30-day NFT efficiency chart.

Whereas many of the prime 10 NFTs have fallen, some collections confirmed a slight restoration on the 24-hour charts. This consists of Hyperliquid’s Hypurr NFTs, which gained 2.8% previously 24 hours, and the Mutant Ape Yacht Membership (MAYC) assortment, which gained 1.5%.

The slight restoration means that consumers could also be selectively returning to the market regardless of the crash.

Seven-day NFT assortment heatmap. Supply: CoinGecko

Associated: Decide information lawsuit towards Yuga Labs for failing to go Howey check

Crypto merchandise are rebounding after Friday’s market crash

On Friday, Bitcoin plummeted to $102,000 within the Binance perpetual futures pair as US President Donald Trump introduced a 100% tariff on China because the nation tried to impose export restrictions on uncommon earth minerals.

When markets crashed, the business noticed liquidations of as much as $20 billion, surpassing earlier crypto market crashes together with the FTX collapse.

Knowledge from CoinGecko confirmed that the entire crypto market capitalization fell from $4.24 trillion on Friday to $3.78 trillion on Sunday, an almost $460 billion loss in two days.

The market rebounded to a $4 trillion valuation on Monday. On the time of writing, the crypto markets are valued at $3.94 trillion.

Regardless of the market crash, crypto funding merchandise attracted billions in inflows.

On Monday, CoinShares reported that crypto exchange-traded merchandise (ETPs) noticed inflows of $3.17 billion final week, regardless of Friday’s flash crash. This highlights the resilience of the funds towards market panic brought on by the liquidations and sell-offs.

Journal: Digital artwork will ‘age like fantastic wine’: inside Flamingo DAO’s 9-digit NFT assortment

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024