Analysis

How Low Can XRP Price Go In This Crash?

Credit : coinpedia.org

The XRP value has entered a turbulent section in October, falling sharply after a dramatic intraday crash of 44% on October 10. Following President Trump’s menace of 100% tariffs on China, the broader crypto and fairness markets skilled a fast threat response.

About $19 billion value of leveraged positions had been liquidated through the inventory market sell-off, based on Binance information. The XRP value at the moment is round $2.49, recovering from this week’s low, however nonetheless reflecting fragile sentiment.

The inflow of whales signifies cautious positioning

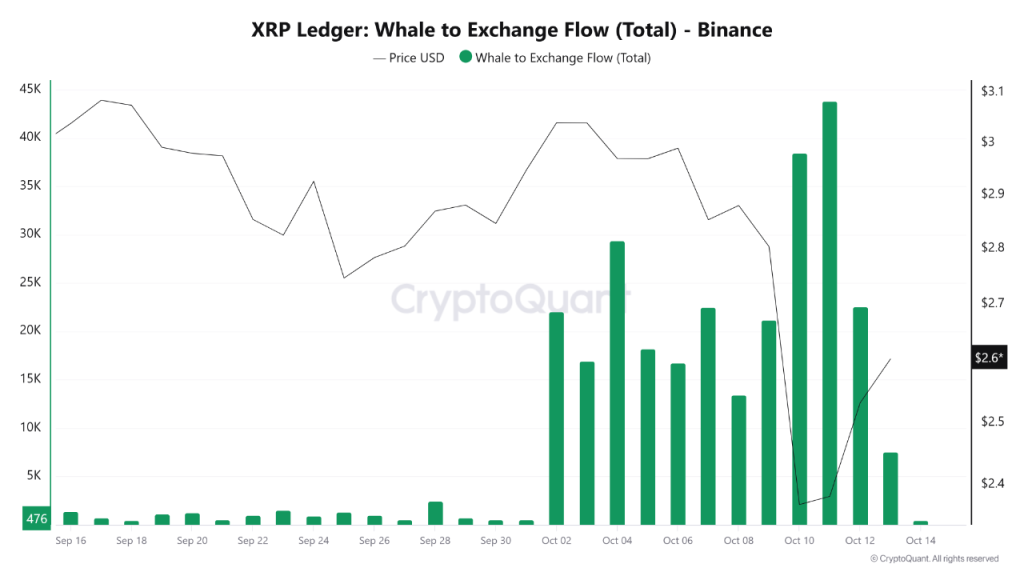

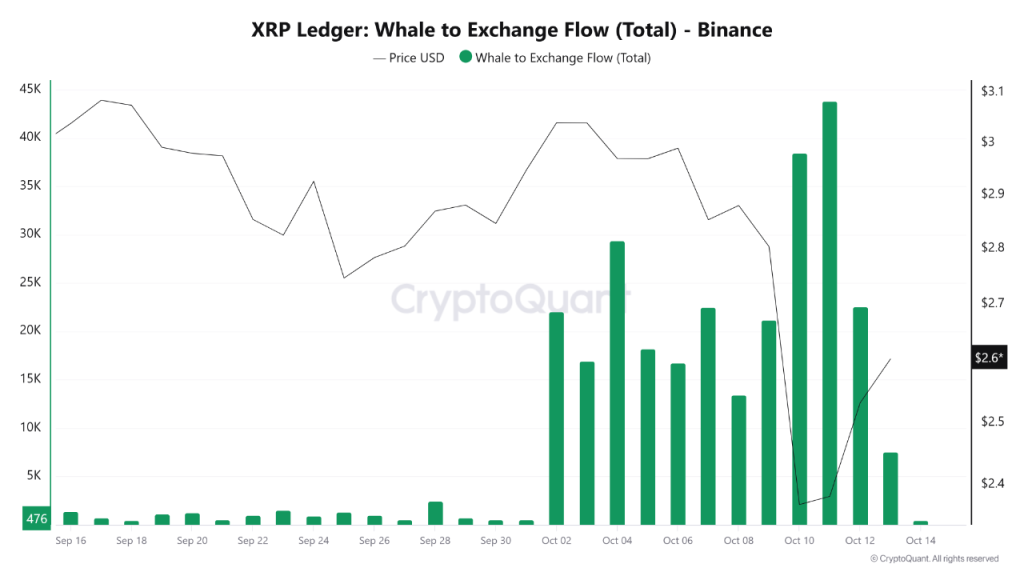

New information from Binance, the biggest trade by buying and selling quantity, reveals a major improve in whale transfers of XRP crypto within the first half of October. This sample marks a transparent behavioral shift from the quiet section of September to lively promoting or hedging by massive traders.

Between October 10 and 12 whale influx peaked proper when the XRP value USD dropped. Traditionally, massive inflows to centralized exchanges point out an intention to promote, particularly when accompanied by falling costs.

Every wave of inflows is correlated with a steep correction, confirming that whales affect the present path of the XRP value chart.

Nonetheless, after the influx peak on October 11, switch exercise started to decelerate. The worth has since stabilized close to $2.60 to $2.40, indicating that probably the most aggressive promoting section might have subsided. This stabilization may point out a short lived market equilibrium as liquidity disappears and merchants wait for brand new catalysts.

Macro and regulatory elements improve volatility

Nonetheless, macroeconomic tensions nonetheless stay a major driver of volatility. The US-China tariff difficulty has elevated world uncertainty, immediately impacting dangerous property like XRP and different altcoins.

Additionally, ETF tracker highlights that there are solely 6 XRP ETF merchandise reside, whereas many XRP ETF are nonetheless up within the air for approval. The delay within the US SEC’s determination on the extremely anticipated XRP ETF is because of the authorities shutdown, which has dampened investor confidence. This confidence had beforehand supported a bullish XRP value forecast for October and was even themed ‘Uptober’, which does not keep on with its nickname.

- Additionally learn:

- Volatility inventory shares for 5x Leveraged XRP ETF

- ,

With out well timed regulatory progress, institutional participation may stagnate, hindering restoration. In the meantime, the escalating commerce warfare can be essential, in any other case an extra macroeconomic deterioration may push threat sentiment even deeper, weighing on altcoins like XRP, XLM, ADA, LINK and plenty of different altcoins, particularly people who lack Bitcoin’s store-of-value attraction.

How Low Can XRP Go?

From a technical perspective, the XRP value forecast identifies $2.30 as a vital near-term help zone. Dropping this degree may see $1.60 as the following check. Ought to promoting intensify amid persistent macroeconomic headwinds, structural help lies between $1.15 and $1.05, a zone that represents each psychological and historic stability.

Nonetheless, continued institutional accumulation, advances in ETFs or renewed risk-weighted property may assist take in promoting strain. Because the broader crypto market recalibrates, XRP crypto appears to be like to consolidate for its subsequent decisive transfer, both to reclaim the $3.00 vary or revisit deeper lows close to $1.20.

Regularly requested questions

Analysts and AI predict that XRP may attain $5.05 by the tip of 2025, pushed by ETF approvals, partnerships, and regulatory readability.

Primarily based on compound progress and adoption, projections estimate that XRP may commerce round $26.50 by 2030, with averages round $19.75.

XRP is taken into account a powerful funding as a result of its institutional adoption, regulatory developments, and position in cross-border funds. Nonetheless, it comes with volatility dangers, like all cryptocurrencies.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We goal to offer well timed updates on all the things crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market situations. Please do your individual analysis earlier than making any funding selections. Neither the author nor the publication accepts duty to your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our web site. Adverts are clearly marked and our editorial content material stays utterly unbiased from our promoting companions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024