Altcoin

Loss could result in a $100,000 retest

Credit : www.newsbtc.com

Bitcoin is as soon as once more beneath heavy stress, sliding in direction of the $103,000 stage because the broader crypto market suffers a pointy downturn. After days of volatility and failed restoration makes an attempt, BTC has misplaced key assist, sparking renewed worry and accelerating the altcoin sell-off. Most main property are displaying massive losses, with merchants and traders now questioning if the market has entered a deeper correction section.

Associated studying

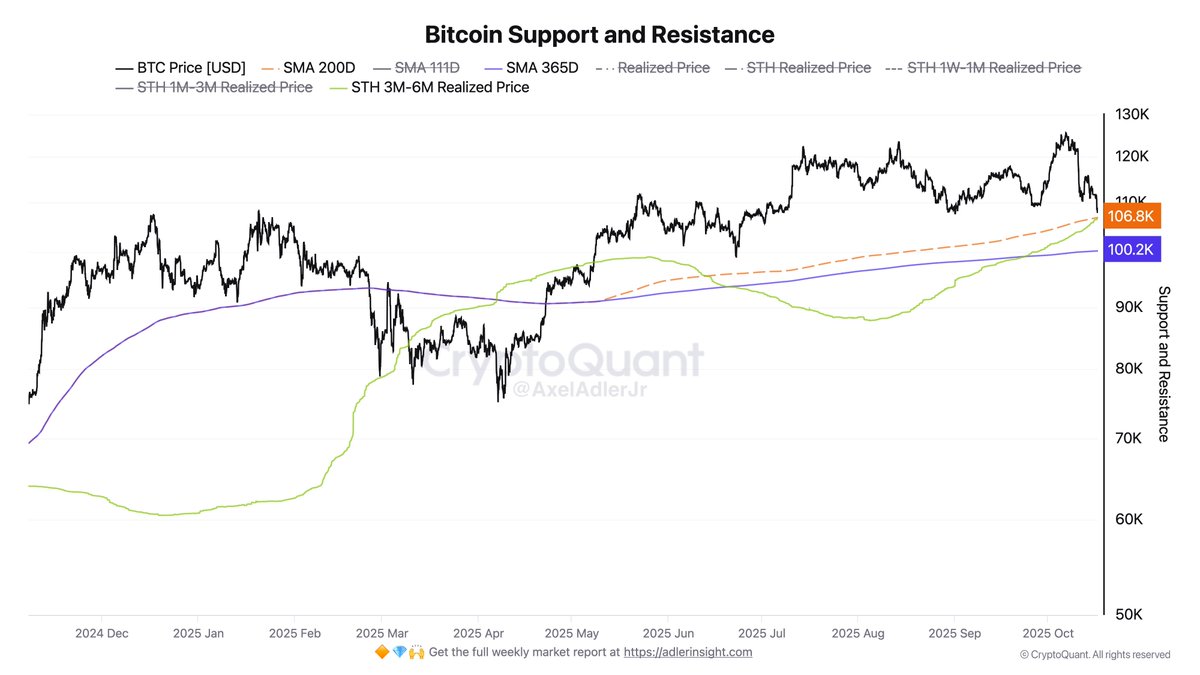

In keeping with high analyst Axel Adler, Bitcoin’s most important assist zone is between $106,000 and $107,000, a variety outlined by the Quick-Time period Holder (STH) 1M–3M Realized Worth and the 200-day easy transferring common (SMA 200D). This essential space represents a confluence of ranges of each on-chain and technical assist, the place earlier corrections have traditionally discovered equilibrium.

Nonetheless, present momentum exhibits rising weak point. As panic spreads and liquidity dries up, all eyes at the moment are on the $106,000 – 107,000 vary – a decisive battleground that might decide Bitcoin’s short-term trajectory and set the tone for the remainder of the crypto market.

Bitcoin’s market construction faces an important take a look at

Adler emphasizes {that a} loss from the $106,000 stage would seemingly result in a transfer in direction of $100,000, the place the annual transferring common (SMA 365D) presently aligns – a stage that has traditionally served as a springboard for main reversals throughout earlier market cycles.

Regardless of the rising fears, Adler notes that the macro construction stays bullish so long as the $100K base holds. This area represents long-term purchaser curiosity, and defending it may restore overheated debt and pave the best way for a extra steady restoration. Nonetheless, Bitcoin is already buying and selling under the $106,000 mark, elevating considerations that the market may very well be making ready for a deeper take a look at of this essential backside.

Analysts throughout the house at the moment are intently watching the shut of the day by day candle, which is able to decide whether or not the transfer under assist is only a liquidity clearing or affirmation of bearish continuation. If Bitcoin fails to shortly reclaim the $107,000 stage, a broader shift in sentiment may happen – one that might prolong the consolidation section and take a look at traders’ conviction.

In distinction, a powerful restoration from the $100,000 zone would strengthen the argument that the correction is a part of a wholesome reset inside an ongoing bull market. The approaching days will subsequently be decisive: both Bitcoin holds this base and rebuilds momentum, or it breaks decrease, indicating that probably the most aggressive section of volatility of the present cycle is much from over.

Associated studying

Bitcoin Checks Help Zone Amid Continued Weak spot

Bitcoin continues to fall, with the newest chart displaying worth motion hovering round $106,000, now testing some of the essential assist zones in months. After failing to reclaim the $115,000 and $117,500 resistance ranges earlier this week, BTC prolonged its losses and reached an intraday low close to $103,500 earlier than recovering considerably. The market stays tense as merchants watch whether or not the 200-day transferring common (SMA 200D) – presently round $107,500 – will maintain.

This stage represents the realized worth area of the Quick-Time period Holder (STH) and coincides with the world recognized by analysts as a key structural base. A confirmed break under may open the door to a take a look at of $100,000, the place the annual transferring common (SMA 365D) aligns and serves as the subsequent main assist.

Associated studying

Momentum indicators point out that BTC continues to be beneath sturdy bearish stress. The 50- and 100-day transferring averages are trending downward, indicating a lack of momentum within the close to time period. Until Bitcoin can shut the day by day candles above $107,000 once more, market sentiment is prone to stay cautious.

Featured picture of ChatGPT, chart from TradingView.com

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024