Policy & Regulation

UK tax authority doubles crypto warning letters in crackdown on unpaid gains

Credit : cryptonews.net

Britain’s tax authorities have stepped up their scrutiny of crypto buyers, doubling the variety of warning letters despatched to these suspected of under-reporting or evading taxes on digital asset earnings.

HM Income & Customs (HMRC) despatched out virtually 65,000 letters within the 2024-2025 tax 12 months, in comparison with 27,700 the 12 months earlier than, the Monetary Occasions reported on Friday, primarily based on information obtained underneath the Freedom of Data Act.

The letters, referred to as “nudge letters,” are meant to immediate buyers to voluntarily appropriate their tax returns earlier than formal investigations are initiated.

The sharp enhance displays HMRC’s rising deal with crypto-related tax compliance. Over the previous 4 years, the company has despatched out greater than 100,000 such letters, with exercise accelerating as cryptocurrency adoption and asset costs soared.

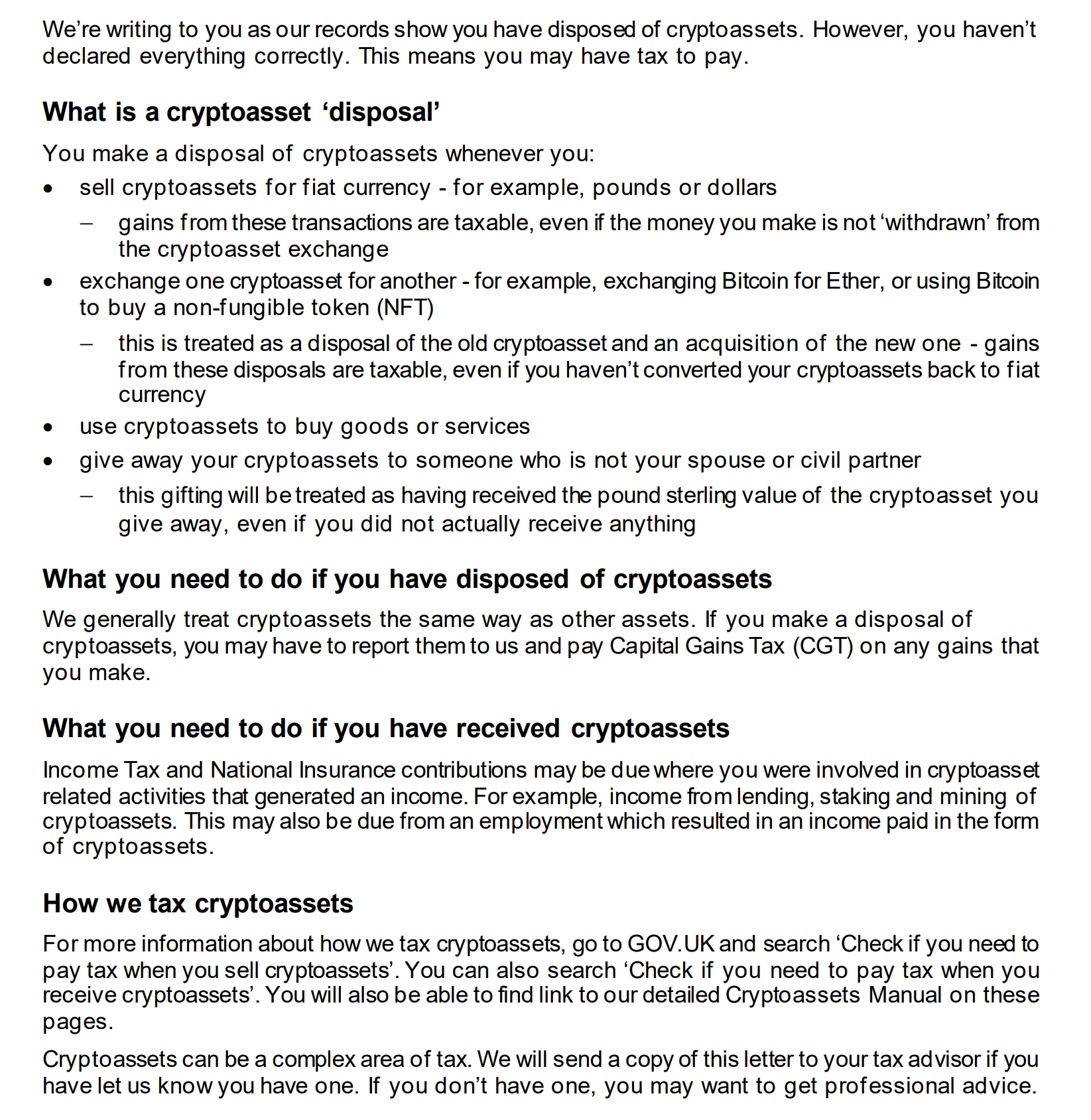

Instance of an earlier nudge letter from 2024. Supply: kc person content material

Associated: Tips on how to File Crypto Taxes in 2025 (Information for US, UK, Germany)

7 million UK adults personal crypto

The Monetary Conduct Authority estimates that seven million UK adults now personal crypto, up from round 10% (5 million) in 2022 or 4.4% (2.2 million) in 2021, demonstrating the rising curiosity.

“The tax guidelines round crypto are fairly advanced and there at the moment are numerous individuals buying and selling crypto who do not perceive that even when they change from one foreign money to a different, it’s going to set off a capital positive aspects tax,” Neela Chauhan, a accomplice at UHY Hacker Younger, which made the FOI request, advised the FT.

HMRC’s visibility available in the market has improved dramatically. The company now receives transaction information straight from main crypto exchanges and can routinely entry international alternate information from 2026 underneath the Group for Financial Co-operation and Growth (OECD) Crypto-Belongings Reporting Framework (CARF).

Associated: New York State Senator Proposes Tax on Crypto Mining Power Consumption

US lawmakers are weighing crypto tax exemptions

US senators are exploring updates to crypto tax coverage, together with exempting small transactions from tax and clarifying how staking rewards are handled.

Throughout a Senate Finance Committee listening to earlier this month, lawmakers debated whether or not every day crypto funds ought to appeal to a capital positive aspects tax and tips on how to pretty classify revenue from staking providers. Coinbase’s vice chairman of tax affairs, Lawrence Zlatkin, urged Congress to move a de minimis exemption for crypto transactions underneath $300.

In the meantime, South Korea’s Nationwide Tax Administration (NTS) has additionally intensified its crackdown on crypto tax evasion, warning that even belongings saved in chilly wallets might be seized if they’re linked to unpaid taxes.

Journal: Again to Ethereum – How Synthetix, Ronin and Celo had been born

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024