Bitcoin

Bitcoin’s bull run: Will ‘Uptober’ turn things around for BTC?

Credit : ambcrypto.com

- BTC bulls are concentrating on $64K and see $68K as the subsequent resistance degree.

- Can they overcome 4 days of failed makes an attempt to push BTC above this main goal?

Bitcoin [BTC] Bulls are concentrating on the $64,000 mark, a key degree final reached in the course of the late August rally, making this an important turning level.

To keep away from repeating previous downturns, bulls should counter any bearish stress. If profitable, the subsequent resistance might emerge round $68,000.

Bitcoin: Bull run relies on $64K

Supply: Coinalyse

The present cycle is similar to the pattern from early August, which noticed BTC rise to $64,000 after returning under $55,000. Nevertheless, the 18-day rise was then marked by inconsistent bearish stress.

In distinction, whereas this cycle reveals extra constant inexperienced candles, the expansion fee is much less steady, inflicting volatility amongst stakeholders.

In consequence, as a substitute of fee cuts fueling bullish sentiment, continued volatility has prevented BTC from retesting $64K and is at the moment buying and selling at $63,543 – marking the fourth day in a row under this benchmark.

Moreover, this benchmark has been examined 5 instances since March, when BTC reached its ATH of $73K. Apparently, it wasn’t till July that the bulls prevented a pullback, sending BTC hovering to $68K.

Merely put, the $64,000 mark has been an important turning level for Bitcoin.

Whereas quantity indicators level to a bullish pattern, the actual problem is whether or not different buyers will assist a breakout or whether or not bears will as soon as once more block BTC’s rise.

The present value could also be out of attain

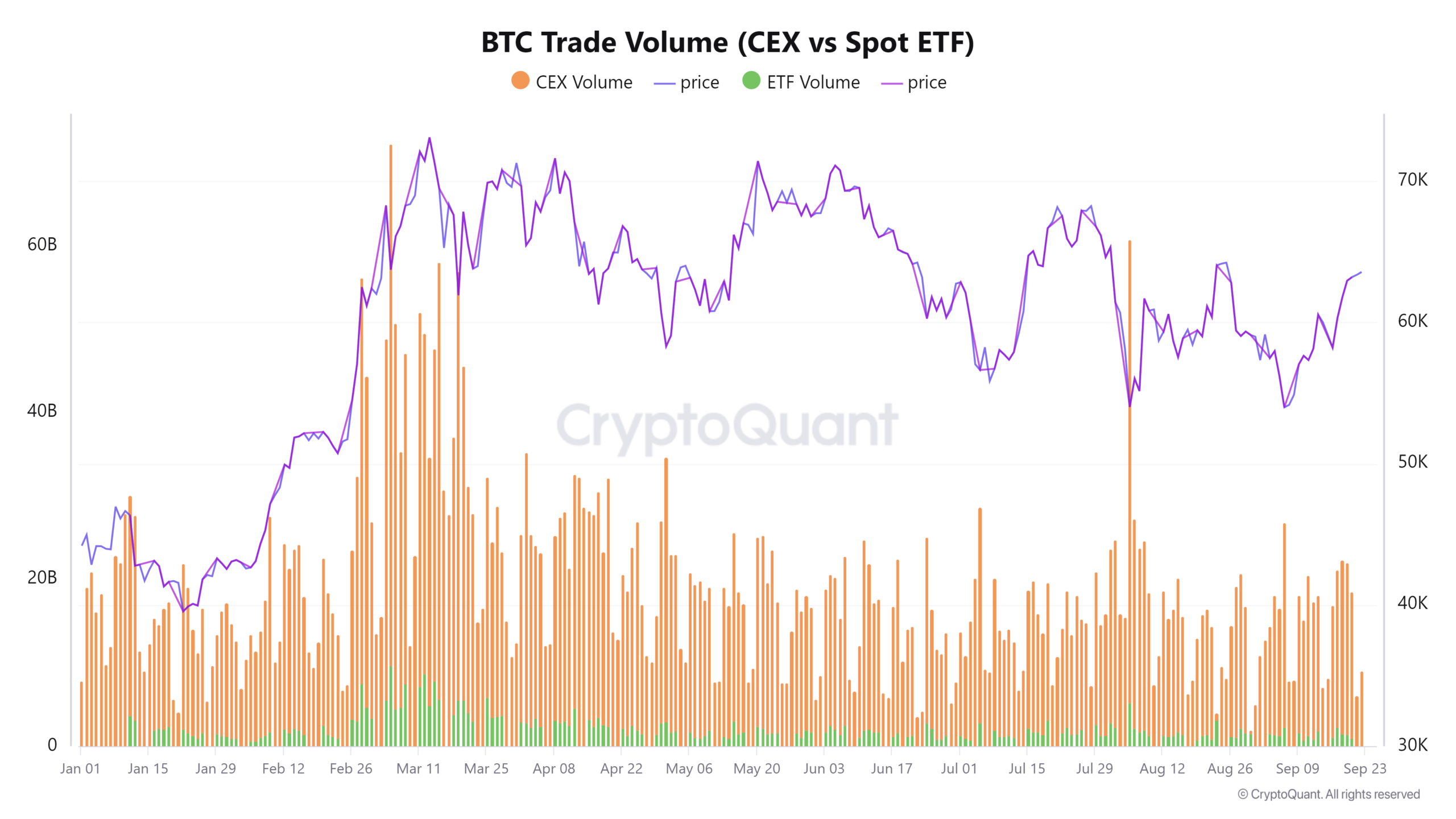

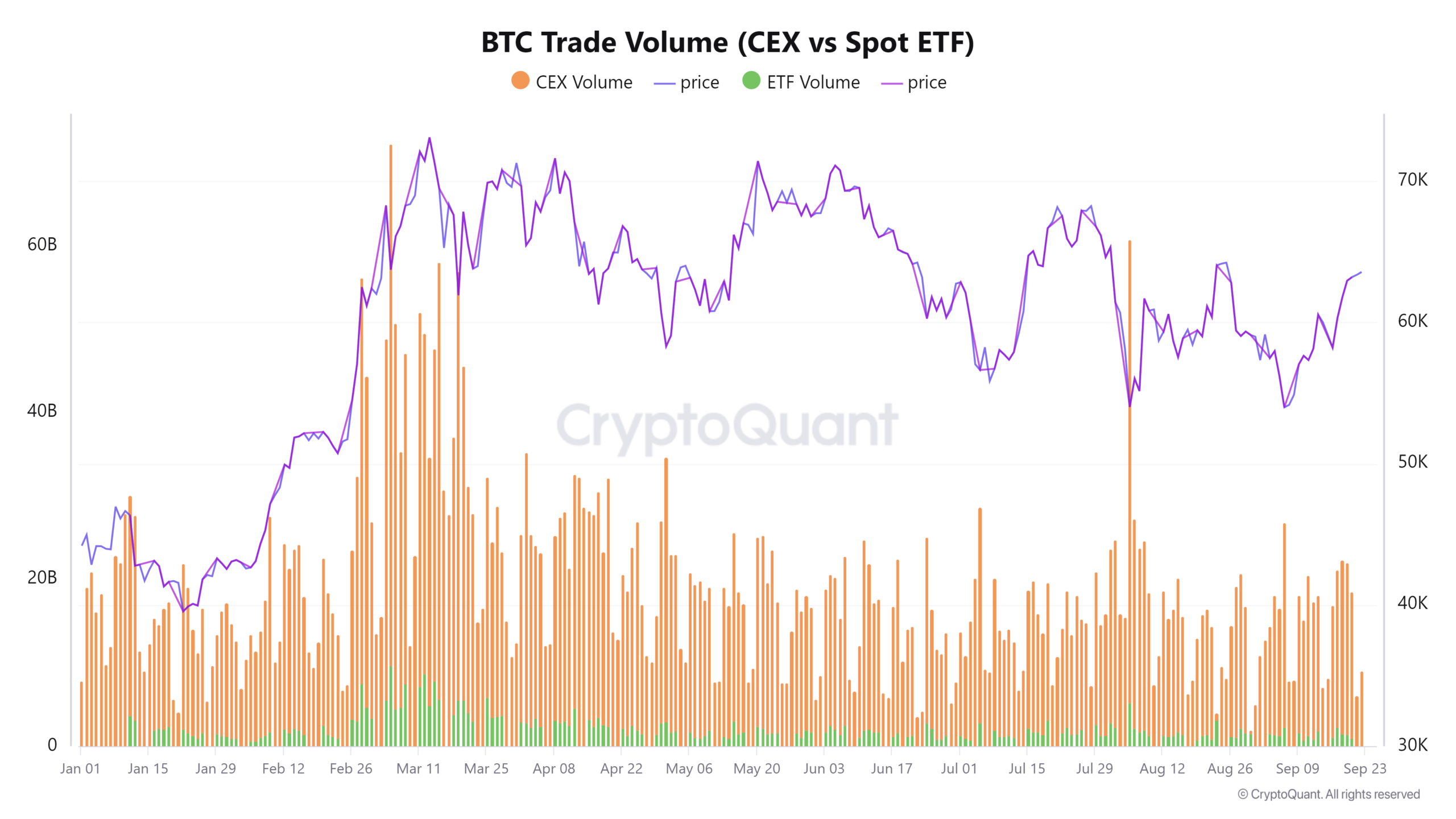

Over the previous two days, BTC buying and selling quantity on CEXs has dropped from $17 billion to $6 billion. This sharp decline might enhance volatility, shaking investor confidence in a attainable pattern reversal.

The chart under could point out a possible market high, which frequently coincides with decreased buying and selling exercise on CEXs.

Conversely, when inventory market volumes spike throughout sharp declines in BTC, it typically supplies a great dip shopping for alternative.

Supply: CryptoQuant

In response to AMBCrypto, the decreased inventory market exercise might counsel two potentialities: both buyers money in on the positive factors from the September cycle, or they look forward to a dip to purchase BTC at a cheaper price.

If this pattern continues, it might actually pave the best way for a resurgence in positions short circuit Bitcoin. Consequently, the possibility of an outbreak could lower. Nevertheless,

There should still be hope

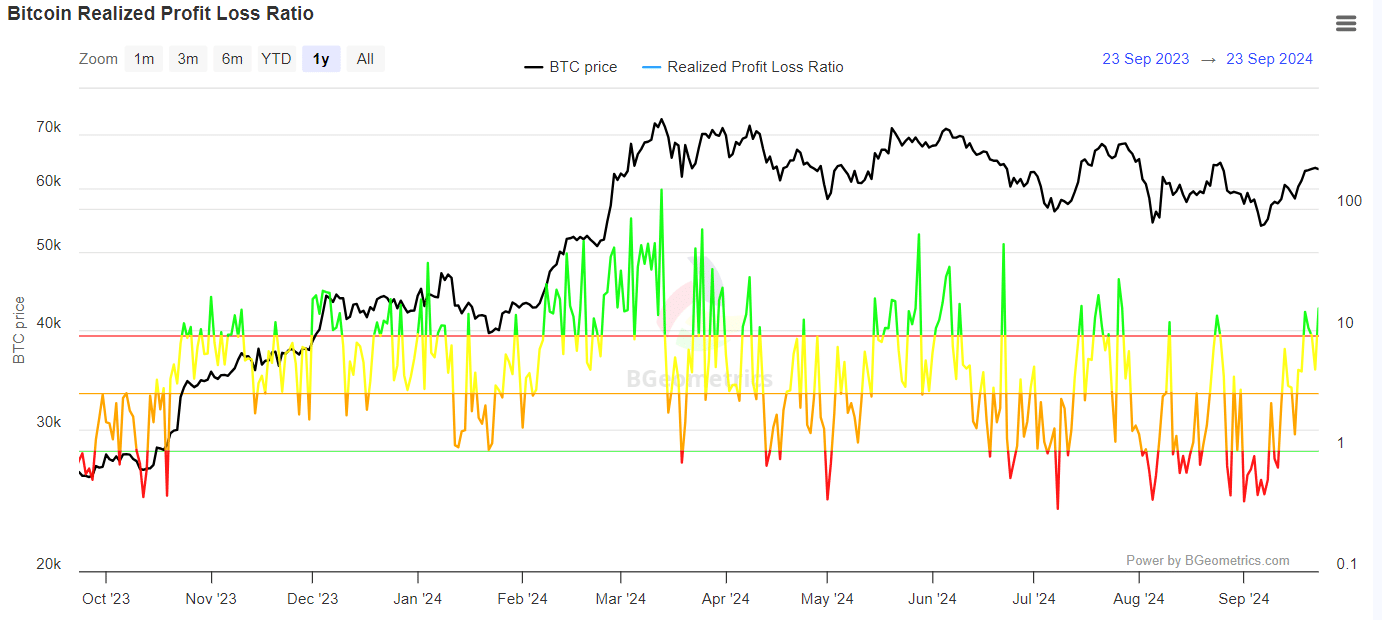

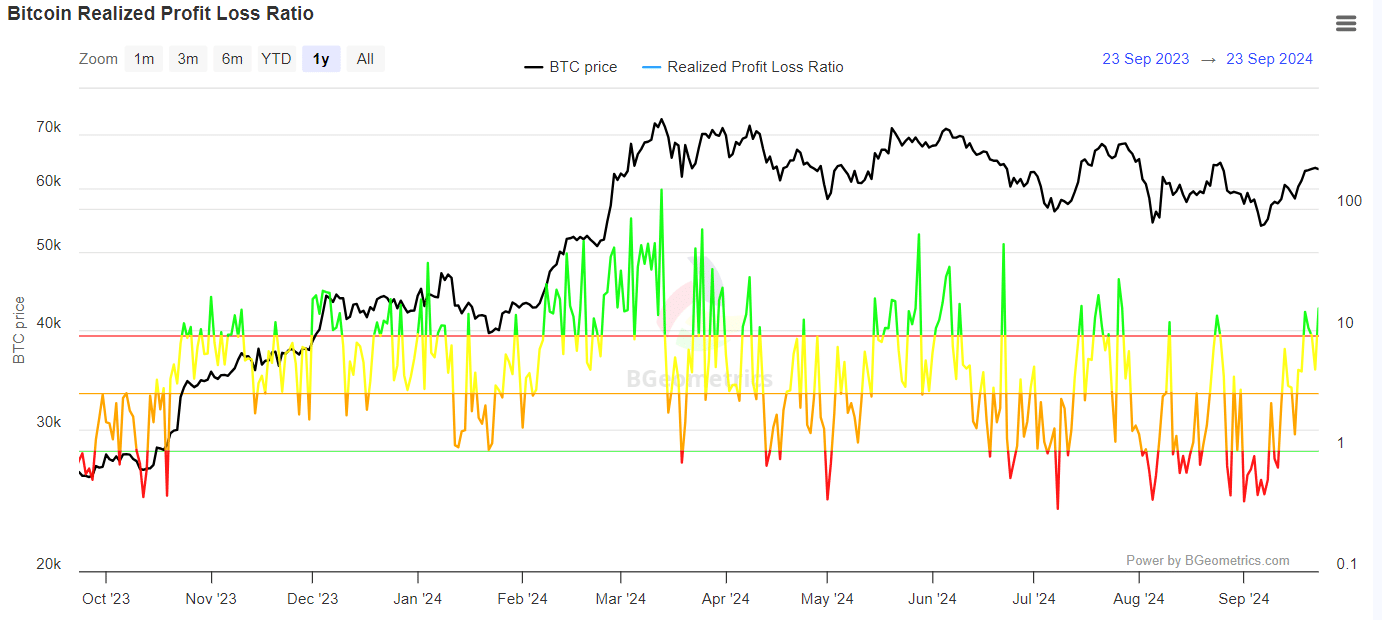

As essentially the most risky month attracts to a detailed, the potential for “Uptober” might mark a bullish turning level for the market, a glimmer of hope illustrated within the chart under.

On the day Bitcoin noticed a small decline of 0.37%, the RPL ratio dropped, indicating losses. Nevertheless, since then nearly all of transactions have occurred above the unique buy value.

Supply: BGeometrics

Along with this evaluation, there are additionally massive transaction volumes rosewith transactions over $100,000 exhibiting vital exercise.

Clearly, bulls are bucking the resistance that has stored Bitcoin under the $64K benchmark. Presently, the sharp decline in CEX quantity is strengthening quick dominance and performing as a barrier.

Learn Bitcoin’s [BTC] Value forecast 2024-25

Nevertheless, if the market stabilizes, as evidenced by sellers making earnings, FOMO might encourage a longer-term dedication.

In the end, monitoring CEX quantity alongside speculative market exercise is important. If their dominance isn’t checked, BTC might fall again under $60,000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024