NFT

NFTs are coming back but Blue Chip projects are on life support

Credit : cryptonews.net

NFT buying and selling exercise confirmed indicators of life within the third quarter of 2025, breaking an extended interval of decline that outlined the post-hype years.

After two years of downsizing and shifting narratives, on-chain markets discovered new footing, not in high-end collectibles or speculative artwork, however in cheaper rails, loyalty applications, and sports-related property traded extra by utility than standing.

NFT buying and selling quantity elevated within the third quarter of 2025 and gross sales peaked.

The main target shifted to lower-cost rails and utilitarian use instances as Ethereum’s scaling pushed exercise to L2s, Solana leaned on throughput and compression, and Bitcoin inscriptions grew right into a accumulating tradition that waxes and wanes with charge markets.

Value and distribution, not profile footage, now decide the boundaries for progress.

The post-Dencun financial system has reset the map. Ethereum’s EIP-4844 lowered knowledge prices for rollups, pushing L2 transaction charges towards pennies and enabling gasless or sponsored flows for mainstream-focused mints.

L2 charges have fallen by greater than 90 % on account of the improve, a shift that’s already seen in coin habits and Base’s emergence as a distribution rail.

On Solana, compression put mass issuance inside attain for loyalty and entry use instances, with provisioning charges for 10 million compressed NFTs round 7.7 SOL and median transaction charges of just about $0.003, even underneath tax.

Bitcoin inscriptions have blazed a definite path tied to mempool cycles and miner revenues, with over 80 million inscriptions as of February 2025 and a prime three place primarily based on lifetime NFT gross sales.

The demand facet is exhibiting a restoration, with one caveat.

Knowledge from DappRadar exhibits that NFT buying and selling quantity almost doubled quarter-on-quarter to $1.58 billion within the third quarter, whereas gross sales reached 18.1 million, an all-time excessive for the variety of transactions.

Sports activities NFTs stood out, with income up 337 % quarter-over-quarter to $71.1 million, a sector the place plannable utility, entry and loyalty advantages drive spending no matter minimal pricing. Summer season supplied a snapback earlier than a cooldown.

Month-to-month income reached $574 million in July 2025, the second-highest month of the yr, after which fell about 25 % month-on-month in September as broader crypto threat urge for food declined, primarily based on figures from CryptoSlam.

The sample reinforces a decrease common gross sales worth regime and exhibits how GMV follows the crypto beta whilst distinctive customers and utility classes maintain.

Distribution, not simply reimbursement, is doing extra of the work. Wallets with built-in entry keys and sponsored charges take away the entry friction that stalled earlier cycles. Coinbase Good Pockets helps passkeys and gasoline sponsorships in supported apps, and Phantom reported 15 million month-to-month lively customers in January 2025, a base that results in cell and social coin funnels.

These items are achieved in chains the place cultural and social flows come collectively. Primary is an instance of this.

Base overtook Solana in NFT quantity this yr as low-cost mints, Zora’s mass mint cadence, and Farcaster-adjacent funnels piled up. The lean explains why creators weighing the place to go subsequent begin with distribution math after which return to compensation profiles.

Royalties not anchor the income stack.

Creator compensation has collapsed since peaks in 2022 after market wars made royalties elective in a lot of the market. In line with Nansen, royalty revenues hit a two-year low in 2023 and didn’t recuperate to earlier ranges.

The countertrend is the rise of enforcement-oriented areas. Magic Eden and Yuga Labs launched an Ethereum market in late 2023 that enforces creator royalties and builds a protected lane for manufacturers that may management it.

The equilibrium is a divided market, with low take charges and first gross sales, IP offers and retail tie-ups offering essentially the most margins for creators, whereas walled gardens take up premium declines the place enforcement is contractual.

Market share stays fluid, the place incentives drive order circulate. On Solana, Magic Eden and Tensor commerce in a duopoly that alternates between reward schemes and program design, with shares typically starting from round 40 to 60 % for every of the intervals.

That is much less a structural change than a perform of stimulus home windows, which might make inventory charts appear like a regime change that’s later reversed. The message for creators is to barter distribution as a part of launch planning, fairly than limiting themselves to a single location.

The short-term roadmap tells us the place customers really went.

Sports activities, ticketing and loyalty applications are increasing as a result of the advantages are plannable and recurring, and the primitive, token-gated entry on the chain is already embedded within the current ticketing and e-commerce flows.

DappRadar’s Q3 breakouts present sports activities volumes outpacing the market, and that is earlier than season-long or league-wide applications land.

Gaming is quieter. Immutable’s zkEVM stack and reside metrics present regular transaction progress and a security-on-ETH, UX-on-L2 design that aligns with asset custody and recurring fringe charges, Messari mentioned.

IP and licensing are the opposite bridge from JPEGs to client channels. Pudgy Penguins’ enlargement to greater than 3,000 Walmart shops created a reside pipeline from NFTs to bodily retail and licensing money flows.

For creators deciding the place to ship subsequent, the associated fee and UX per chain at the moment are readable. ETH L1 continues to function artwork of top quality and provenance, with variable gasoline costs and elective royalties in most areas.

ETH L2s supply cent-level charges after Dencun, plus sponsored or gasless flows and social funnels on Base and Farcaster.

Solana’s compression brings hundreds of thousands of mints inside dollar-level budgets with mobile-first pockets attain. Bitcoin inscriptions correspond to scarce collectibles, the place worth spikes are a function and never a bug. The desk under summarizes the present journey from coin to commerce.

The macro combine is additionally altering.

An annualized run fee of $5 to six.5 billion in 2025, with common gross sales values within the $80 to $100 vary within the first half, offers the bottom from which subsequent yr’s eventualities lengthen.

Utilizing CryptoSlam’s month-to-month gross sales as a spine and splitting the DappRadar class by colour, a bear case comes out to $4-5 billion GMV if the crypto beta stalls and common gross sales values decline, with fee-sensitive use instances specializing in Solana and ETH L2s, ETH L1 artwork secure, and inscriptions that the Bitcoin charge cycles comply with.

A base case within the $6-9 billion vary requires built-in wallets and social coin rails to proceed increasing, plus sports activities and reside occasions increasing throughout seasons and types testing royalty-mandated areas for brand new drops.

The $10 to 14 billion bull case would require a step change in cell distribution, with Base and passkeys normalizing coin flows, Phantom month-to-month actives rising above 20 million, ticket pilots transitioning to common applications, and gaming property returning.

In all three bands, the inventory combine tilts towards ETH L2 and Solana, with ETH L1 narrower and Bitcoin secure as a collectibles lane.

Six switches will decide how shortly that present manifests.

- Pockets UX and distribution would be the main indicator, measured by key acceptance, sponsored charges, and MAUs for Phantom and Coinbase Good Pockets.

- The footprint of royalty enforcement issues for bounty declines, together with any OpenSea coverage pivot factors and the well being of creator-affiliated markets on Ethereum.

- Sports activities and ticketing companions transferring from pilots to seasonal applications are changing one-time GMV into schedules.

- Base and Zora’s cadence, seen in month-to-month mints and Base’s share of NFT GMV alongside Farcaster Frames, exhibits whether or not social funnels will maintain up.

- The adoption of Solana compression, tracked by compressed coin counts and value per million property, signifies whether or not loyalty and media applications are transferring from experimentation to requirements.

- Bitcoin charge cycles, and their hyperlink to inscriptions and Runes, will proceed to drive collectibles costs as mempool congestion ebbs and flows.

Two dangers stay fixed. Wash buying and selling and spamminting nonetheless distort GMV and gross sales counts. Due to this fact, it’s safer to take a look at common gross sales values and organically filtered dashboards.

Market stimuli could make inventory charts appear like a regime change on the subject of simply airdrop cycles, particularly within the Solana duopoly, so launch plans want to cost this in from the beginning. The opposite operational constraint is income design.

As a result of royalties in open markets are often elective, major gross sales, IP licensing and retail bear a better share of the burden, whereas compelled areas create a premium lane that some manufacturers can faucet into and most can not.

What seemed like an finish state in 2023 became a migration.

The JPEG growth is over, the rails have gotten cheaper, the use instances now match tickets, sports activities, gaming and IP, and the pockets and distribution stack is beginning to meet customers the place they already are.

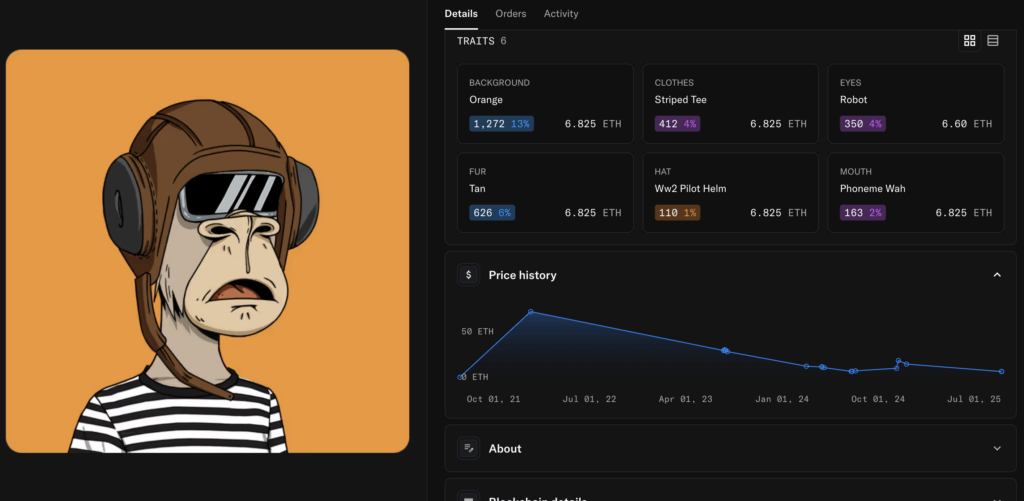

The Blue Chip flagship NFT, Bored Ape Yacht Membership, remains to be in a deadly state for individuals who have invested six figures in AWS-hosted JPEGs. The NFT under bought for over 74 ETH in 2021, however is now price simply 9 ETH, down 87 % in three years.

Hypothesis concerning the non-fungible sector could also be over, however will it lastly permit the underlying expertise to achieve traction in real-world utility functions? Solely time will inform, however the indicators are promising, simply not for the bag holders.

The third quarter ended with $1.58 billion in transactions and 18.1 million gross sales, and the combination is already transferring in that course.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024