Analysis

Bitcoin Holds Steady Ahead of FOMC Decision—Will BTC Price Ignite a Major Rally Next?

Credit : coinpedia.org

It is one other FOMC day and as soon as once more Bitcoin costs are beginning to consolidate forward of the assembly, reflecting the prevailing uncertainty within the markets. Promoting strain has elevated over the previous buying and selling day, pushing ranges near $112,000 from intraday highs above $116,000. Though the bears haven’t had a agency grip on the rally, the Fed chairman’s hawkish stance may weaken the bulls. This might do much more injury to BTC’s worth appreciation within the quick time period.

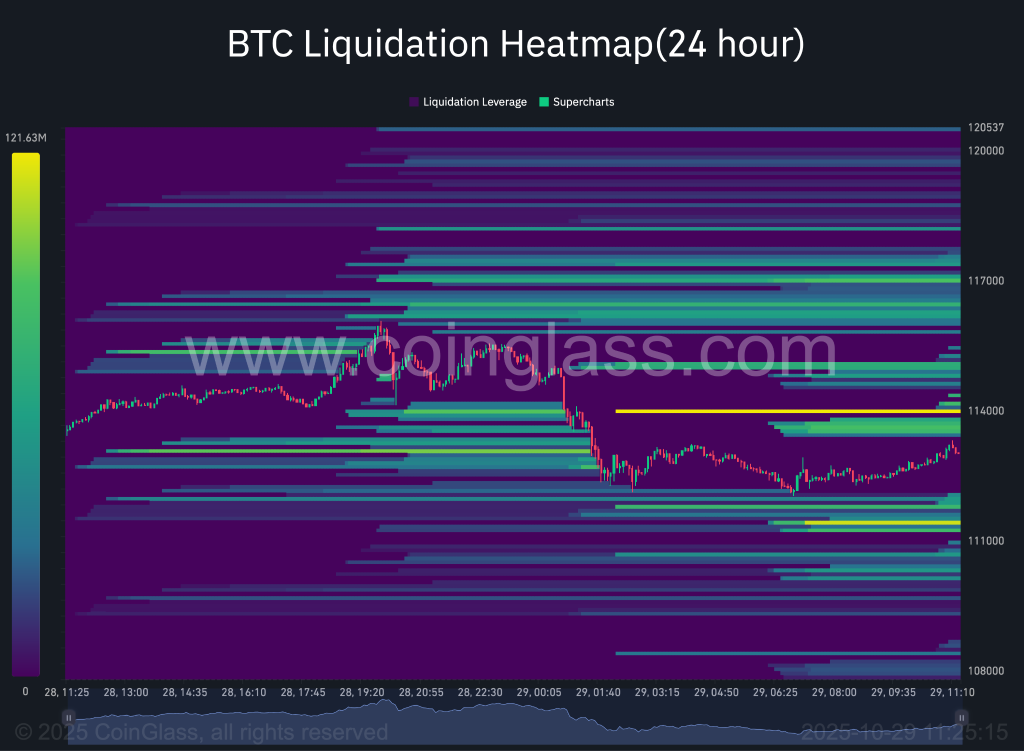

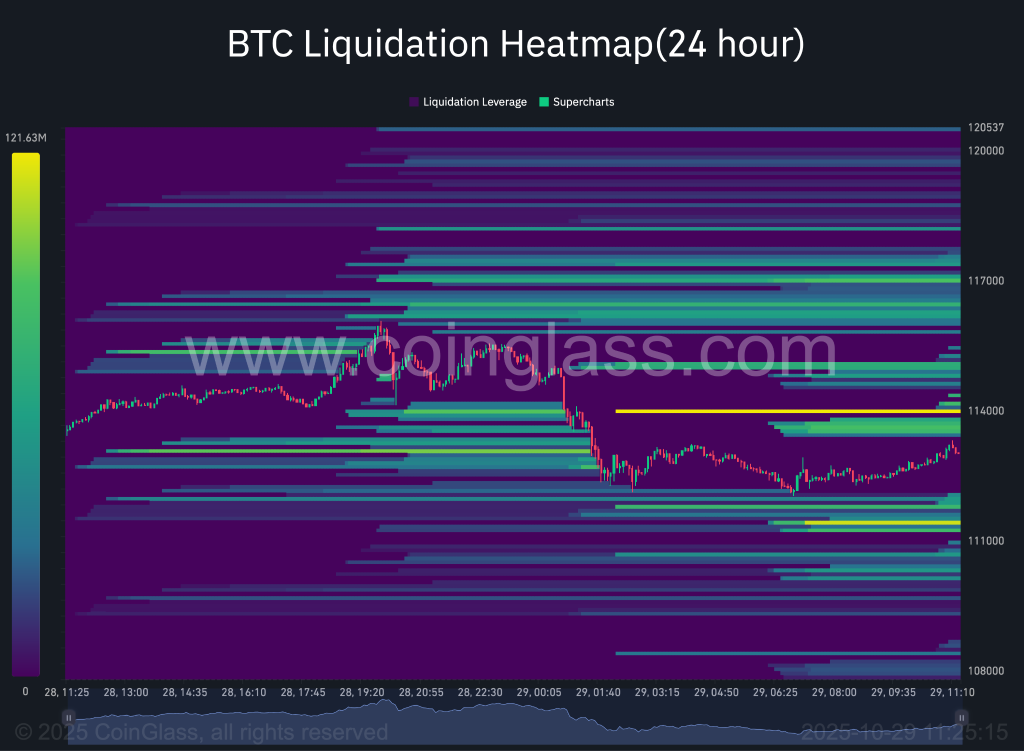

Bitcoin worth has bounced again barely forward of a lot of the FOMC assembly, largely leading to a robust breakout. The token not too long ago rallied earlier than hitting the decrease liquidity ranges round $111,000, the place greater than $100 million price of longs have been piled up. The commerce remains to be energetic, indicating that merchants are nonetheless on the lookout for an entry level at this level, whereas being unsure above $114,000, as greater than $121 million in shorts has already collected round this vary.

The liquidity ranges point out indecision amongst merchants as the worth stays consolidated between the stacked longs and shorts. So on this case, the FOMC may affect the prevailing accumulation, as an increase above $114,000 may set off shorts, whereas a fall beneath $111,000 may liquidate the longs.

The place will the worth of Bitcoin (BTC) go subsequent?

No matter FOMC volatility, BTC worth stays largely inside a bullish construction, an ascending parallel channel. The decrease timeframe chart reveals a robust restoration from help after a pullback. Nevertheless, the result of the upcoming FOMC assembly may have a big affect on the rally, which may both transfer above the parallel channel common zone or break help.

Bitcoin is exhibiting great power on the hourly chart, confirmed by the current rebound, which was effectively above the essential help zone round $110,000. We had some quantity spikes, however extra importantly, the hourly MACD is about to show bullish. This implies that purchasing quantity is slowly crowding out the bears. Then again, the stochastic RSI simply recovered from the oversold zone, indicating a continued rise for the brand new hours.

Closing Conclusion: Will FOMC Push Bitcoin Value Above $115,000?

Bitcoin seems to be consolidating inside an ascending channel, with worth motion presently testing mid-range help close to $112,500. The chart highlights a possible bounce in the direction of the $115,000-$117,000 zone if the bulls maintain this degree, which additionally ties in with the Fibonacci retracement within the mid-channel. Nevertheless, the lack to defend the help trendline and the close by CME hole may result in a pointy decline in the direction of $108,000-$106,000, which might sign a deeper correction. The upcoming FOMC choice will seemingly decide which state of affairs unfolds.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We attempt to offer well timed updates on every little thing crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market situations. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts duty on your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks might seem on our website. Advertisements are clearly marked and our editorial content material stays utterly unbiased from our promoting companions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024