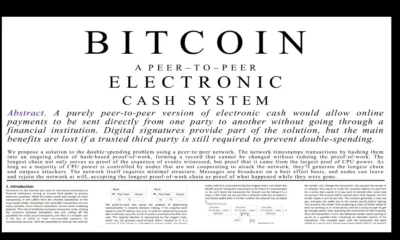

Bitcoin

Strategy (MSTR) Reports $2.8B Q3 Income, Bitcoin Gains Soar

Credit : bitcoinmagazine.com

Michael Saylor’s Technique (NASDAQ: MSTR) reported its third-quarter outcomes after market shut on October 30, with internet earnings of $2.8 billion.

Diluted earnings per share (EPS) got here in at $8.42, surpassing analyst expectations of $8.15. As of October 26, 2025, Technique owned 640,808 BTC, acquired for a complete of $47.44 billion at a mean worth of $74,032 per coin.

The corporate reported a year-to-date Bitcoin return of 26%, producing $12.9 billion in earnings amid the continuing crypto bull market in 2025.

Trying forward, Technique expects full-year 2025 working earnings of $34 billion and internet earnings of $24 billion, or $80 per share. This underlines the transformation from a enterprise intelligence firm to a de facto company Bitcoin funding automobile.

Complete income for the third quarter was $128.7 million, up 10.9% 12 months over 12 months and forward of the $118.43 million analysts had forecast.

The corporate’s Bitcoin holdings have already generated a revenue of 116,555 BTC in 2025, which interprets to $12.9 billion in {dollars}, based mostly on a mean BTC worth of about $110,600 on October 24, which is near the $20 billion goal for the complete 12 months.

Michael Saylor is the epitome of a bitcoin bull

Michael Saylor lately mentioned on Cash 20/20: “By the point the bankers let you know it is a good suggestion, it would value $10 million per Bitcoin.” He added that Bitcoin is presently at a “99%” low cost.

And Saylor’s public discourse on bitcoin helps this perception. Saylor reiterated his bullish view on Bitcoin, anticipating $150,000 by the top of 2025 and $1 million inside 4 to eight years.

He cited rising institutional adoption, pushed by trade shifts, new funding merchandise and Technique’s current B-minus credit standing, as key catalysts.

Saylor highlighted Technique’s digital credit score devices that supply yields of 8-12.5%, tax-efficient returns and customised threat profiles. He famous the growing adoption of Bitcoin by main US banks and praised supportive regulatory insurance policies.

Technique with a trillion-dollar Bitcoin stability sheet

In a current interview with Bitcoin Journal, Michael Saylor outlined his bold imaginative and prescient for technique: constructing a trillion-dollar Bitcoin stability sheet to remodel international finance.

Saylor sees his firm – and presumably different Bitcoin Treasury firms – constructing large Bitcoin holdings, utilizing the cryptocurrency’s historic 21% annual appreciation to gasoline capital progress.

Central to his plan is the creation of Bitcoin-backed credit score markets that supply considerably larger returns than conventional fiat debt. By over-collateralizing the capital, Saylor argues that the system may very well be safer than AAA company bonds, whereas on the similar time delivering more healthy returns for traders.

This strategy, he mentioned, may revive international credit score markets and supply options to low-yield bonds that dominate Europe and Japan.

Saylor additionally foresees Bitcoin changing into embedded within the stability sheets of firms, banks and governments, step by step turning conventional inventory indexes into oblique Bitcoin autos.

This integration may enhance public firms, redefine financial savings accounts and cash market funds, and permit tech giants like Apple and Google to inject lots of of hundreds of thousands into the digital financial system.

Those that wish to know extra about Technique’s earnings report can test it out in full particulars here.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now