Analysis

On-Chain Activity Hints ETH Eyeing $5,600

Credit : coinpedia.org

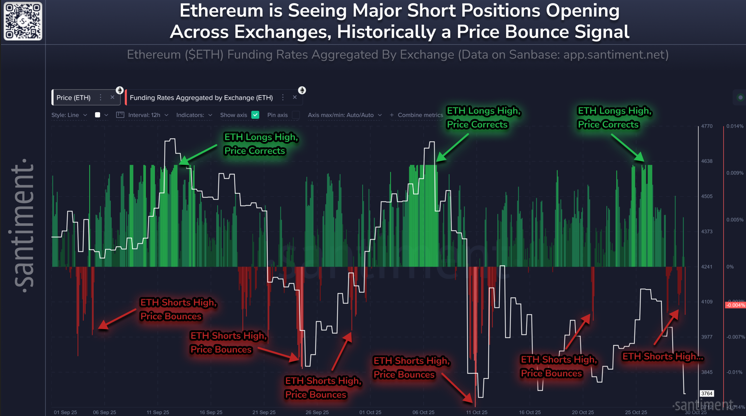

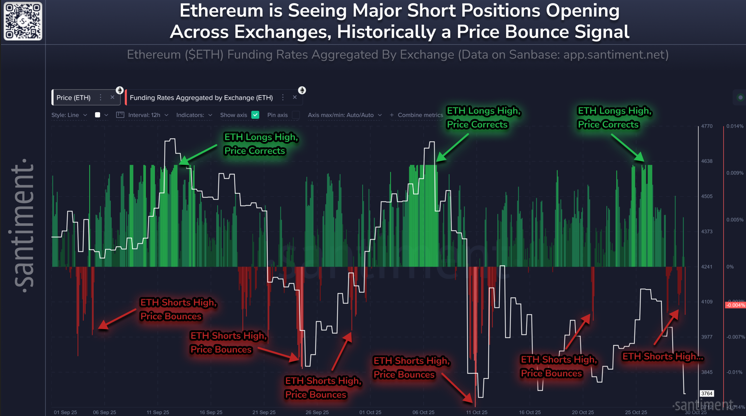

The Ethereum value prediction story for 2025 is heating up once more because the second-best cryptocurrency faces intense shorting. On-chain analysts recommend this shorting is rising concern available in the market. This setup is clear because it creates alternatives for upside because the market does the other of what bearish expectations would recommend.

That is clearly seen traditionally within the finance charge graph. Related setups previously have preceded main ETH value will increase. The Ethereum value is hovering round $3,850 right now. Each on-chain and technical information point out a rising bullish divergence. This distinction might set off an explosive restoration rally.

Quick Squeeze Setup: Funding Charges Point out Panic Amongst Merchants

In response to Santiment Insights over the previous two months factsFunding charge has turn into a vital indicator for predicting the following path of Ethereum value USD on exchanges.

Traditionally, corrections happen when the market leans too closely towards lengthy positions. Conversely, when shorts dominate, costs usually stage a restoration. This appears to be occurring recently.

Presently, Ethereum is witnessing an increase in brief positions on main exchanges, indicating merchants are betting on much more draw back.

Nonetheless, such intervals of utmost bearish sentiment usually mark the tip of corrections and the start of restoration. The Ethereum value chart reveals this ETH The value is consolidating round $3,850 after a decline from current highs, whereas financing charges level to an rising chance of quick liquidations, which could possibly be a traditional harbinger of a aid rally.

This setup has positioned Ethereum crypto for what some are calling a “historic bounce sign” as exchanges stay poised to liquidate extreme bearish bets, doubtlessly triggering a speedy transfer to the upside.

On-chain divergence: Strikers present energy amid market volatility

On-chain information from CryptoQuant analysts additional strengthens the bullish outlook for Ethereum’s 2025 value forecast. In response to current statistics, a distinction has emerged available in the market worth to realized worth (MVRV) ratio between staked ETH and circulating ETH.

In response to the analyst survey performed this week, the MVRV for the circulating provide was at 1.5, whereas the ETH stake was barely larger at 1.7, indicating round 20% higher unrealized earnings for the stake holders. This mirrored that stronger conviction amongst validators, who’re much less more likely to promote and extra more likely to maintain via volatility.

The analyst mentions that at present 36.1 million ETH have been staked out of the 121.12 million ETH in circulation. This regular enhance within the variety of cash staked underlines a mature community basis. In the meantime, Ethereum’s burn mechanism continues to offset inflation, balancing provide and demand dynamics.

This hole in MVRV highlights a “wholesome” market construction, as long-term strikers guarantee ecosystem stability, whereas liquid ETH maintains average revenue zones that stop speculative overheating.

Technical Outlook: Key help might gas a rally to $5,600

From a technical perspective, Ethereum’s value forecast suggests ETH is testing an important weekly help zone that would function a springboard for a year-end rally.

If this degree holds, the following potential upside goal is close to $5,600, in keeping with each structural resistance and historic rebound patterns.

If that occurs, the closest goal appears probably to be reached earlier than the tip of the 12 months, which additionally coincides with the higher restrict of an ascending parallel channel.

The rising hole between short-term concern and long-term conviction paints a compelling image for the months forward.

Ought to market sentiment change and quick positions start to decrease, Ethereum value USD might see an accelerated breakout to larger ranges as liquidity flows again in.

In abstract, the present mixture of quick positioning, on-chain stability and technical resilience creates a good setting for Ethereum’s subsequent huge transfer, reinforcing the optimism within the 2025 Ethereum value forecast.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We purpose to offer well timed updates on every little thing crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts duty on your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our web site. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now