Bitcoin

Bitcoin’s risk dynamics: Safe haven or speculative bet?

Credit : ambcrypto.com

- Analysts gave their opinions on BTC’s sensitivity to world liquidity circumstances.

- BlackRock’s Mitchnick noticed BTC as a threat asset; Alden thought-about it a “threat to gold.”

Bitcoin [BTC] was reportedly extra delicate to world liquidity circumstances than gold and different asset lessons.

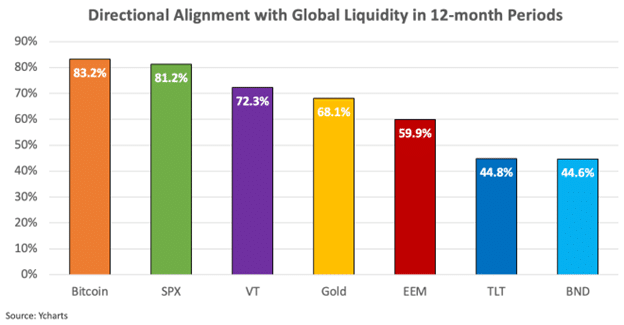

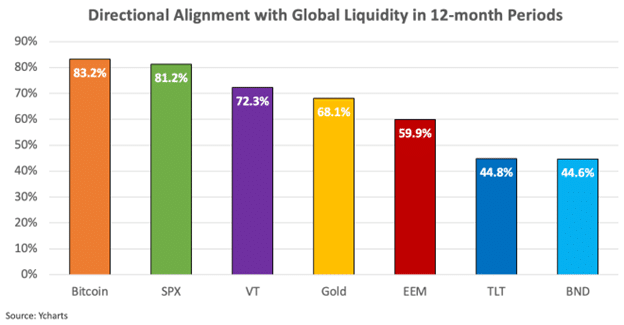

In line with Lyn Alden, a famend macro analyst, BTC responds to world liquidity circumstances 83% of the time greater than every other asset.

“Bitcoin strikes in the direction of world M2 83% of the time; greater than different belongings.”

Supply: Lyn Alden

BTC: a ‘risk-on’ or ‘risk-off’ asset?

US shares, as denoted by SPX, are the second most responsive belongings to world liquidity circumstances, whereas gold got here in fourth.

This indicated that BTC was extra of a ‘risk-on’ asset that carried out higher when charges had been low or throughout quantitative easing cycles.

That additionally means that BTC is much less of a relative hedging asset than gold. In line with Alden, BTC is “threat on gold” as a result of it’s new, sound cash, however some capital allocators have a restricted understanding of it and deal with it as a “threat on asset.”

She added that the correlation can final one other 5 to 10 years earlier than BTC begins behaving like gold.

“If it will get actually massive, it might change extra to a gold-like correlation, which is not that far off.”

Nevertheless, BlackRock’s Head of Digital Belongings Robbie Mitchnick views BTC as a risk-off and hedging asset. For context, risk-off belongings are inclined to carry out effectively during times of uncertainty and turmoil.

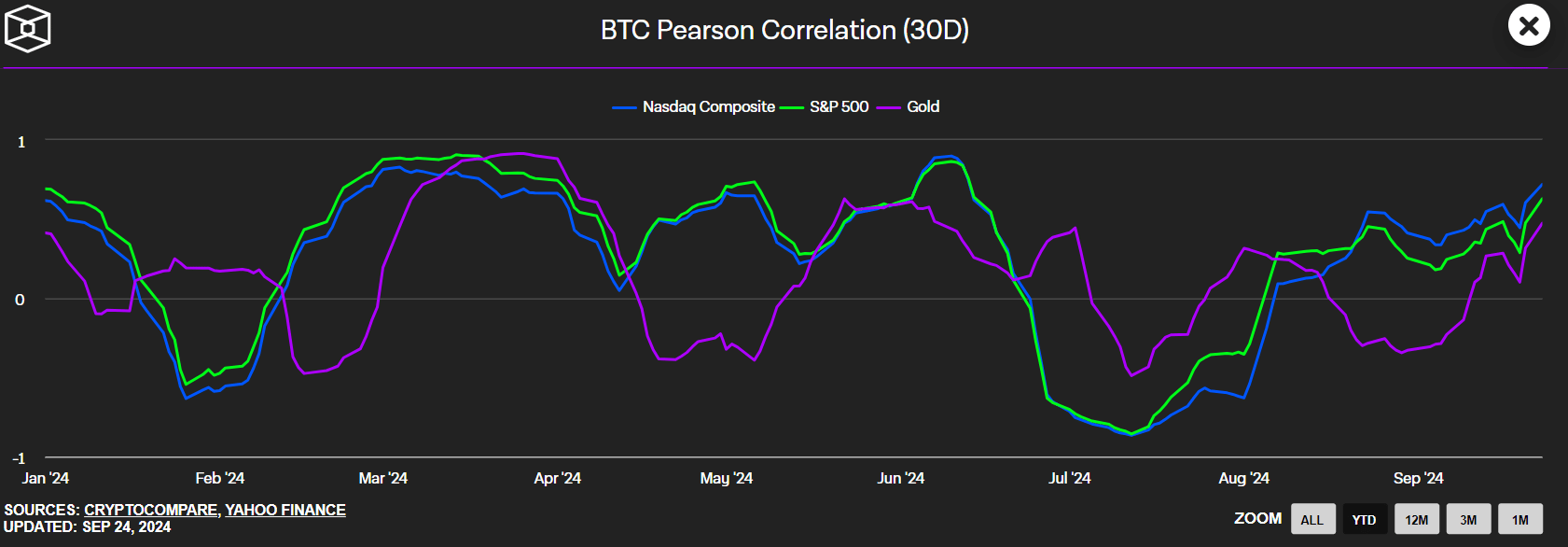

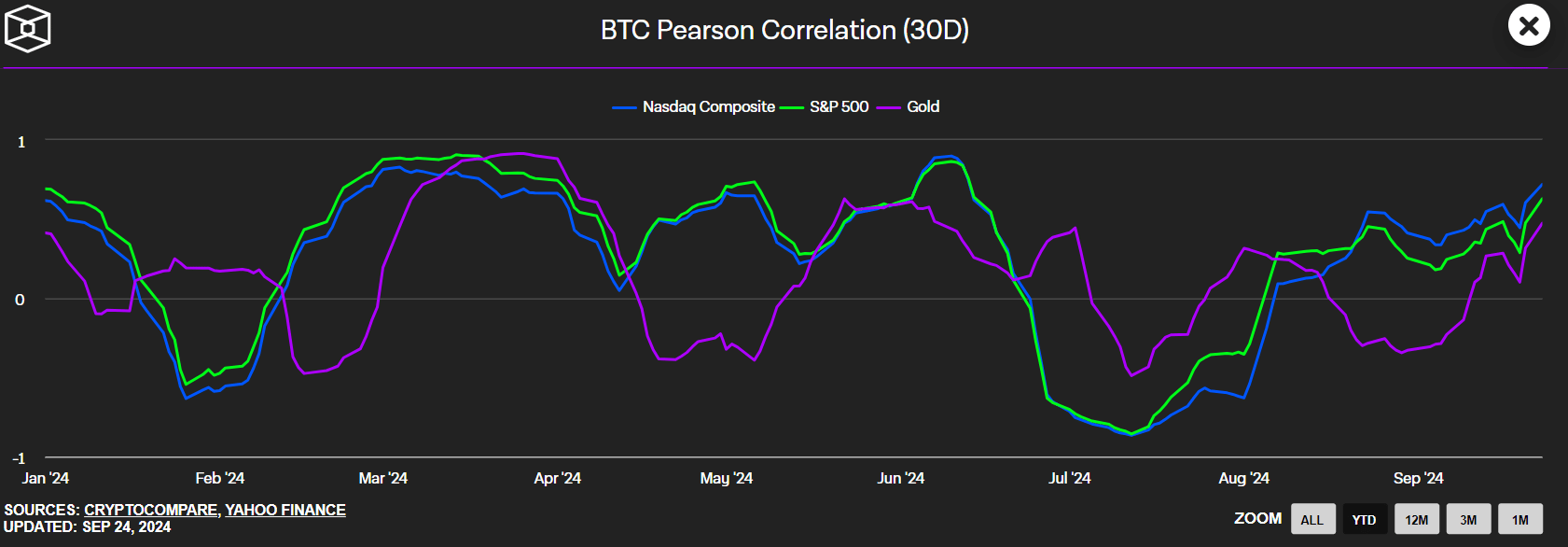

Mitchnick noted that BTC and gold have nearly no long-term correlations with US shares, with occasional and momentary constructive appreciations. He added:

“Once we consider Bitcoin, we first consider an rising world financial various… Scarce, world, decentralized, non-sovereign belongings. And it’s an asset that has no country-specific threat, that has no counterparty threat.”

In line with Mitchnick, rising inflation and investor issues about US political/fiscal sustainability might be key development drivers for BTC, making it a risk-off asset.

That mentioned, there have been ongoing ones debates about whether or not BTC is extra sound cash with further advantages potential in comparison with gold.

Within the quick time period, nonetheless, Alden’s projections appear extra probably. BTC behaves like a ‘risk-on’ asset.

Even based on BTC Pearson Correlationthe cryptocurrency grew to become more and more positively correlated with US equities within the third quarter.

Supply: Het Blok

Put one other manner, BTC’s worth motion could possibly be forward-looking at updates to the US Fed’s financial coverage, quite than near-term crypto-specific occasions.

In brief, the US PCE (private consumption expenditure) knowledge, launched on September 27, will drive BTC volatility.

Furthermore, the latest Chinese language financial stimulus measures and expected The easing cycle may also enhance BTC within the medium time period.

Ergo, monitoring this entrance could be helpful as a part of a macro strategy to threat administration technique for BTC traders and merchants.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024