Altcoin

Injective Gives Bullish Signals – How Much Can INJ Gain?

Credit : ambcrypto.com

- INJ is up 10.99% within the final 24 hours.

- Injective is experiencing robust optimistic market sentiment, pointing to additional good points.

Because the Fed’s charge cuts per week in the past, crypto markets have posted important good points. Because the market reawakens, Bitcoin [BTC] has proven the way in which.

Usually, Bitcoin’s restoration means earnings for the altcoins. That is why altcoins have seen important good points, with AI-themed cash seeing an enormous revival.

Amid this resurgence of AI cash, injective [INJ] has proven monumental resilience.

The truth is, on the time of writing, INJ was buying and selling at $23.23. This represented a rise of 10.99% in comparison with yesterday.

Throughout the identical interval, Injective’s buying and selling quantity elevated by 45.27% to $174.4 million. Additionally, the altcoin’s market capitalization elevated by 10.74% to $2.3 billion.

This development continued all through the month. As such, the INJ has risen 13.55% over the previous week, finishing an uptrend of a protracted month, with a rise of 13.14% on the month-to-month charts.

What INJ’s chart says

In keeping with AMBCrypto’s evaluation, INJ was experiencing continued upward momentum on the time of writing.

Since hitting a month-to-month native low of $15.56, Injective has warned towards breaking away from a months-long consolidation. This upward development reveals a continued change in market sentiment and investor desire.

These prevailing market circumstances may due to this fact see INJ making additional good points on its value charts.

Supply: TradingView

For instance, Injective’s Relative Energy Index (RSI) has remained steady over the previous two weeks, rising from 47 to 68 on the time of writing.

This reveals that demand for the altcoin has elevated, which is additional defined by a beforehand noticed improve in buying and selling quantity. INJ due to this fact skilled stronger shopping for stress than promoting.

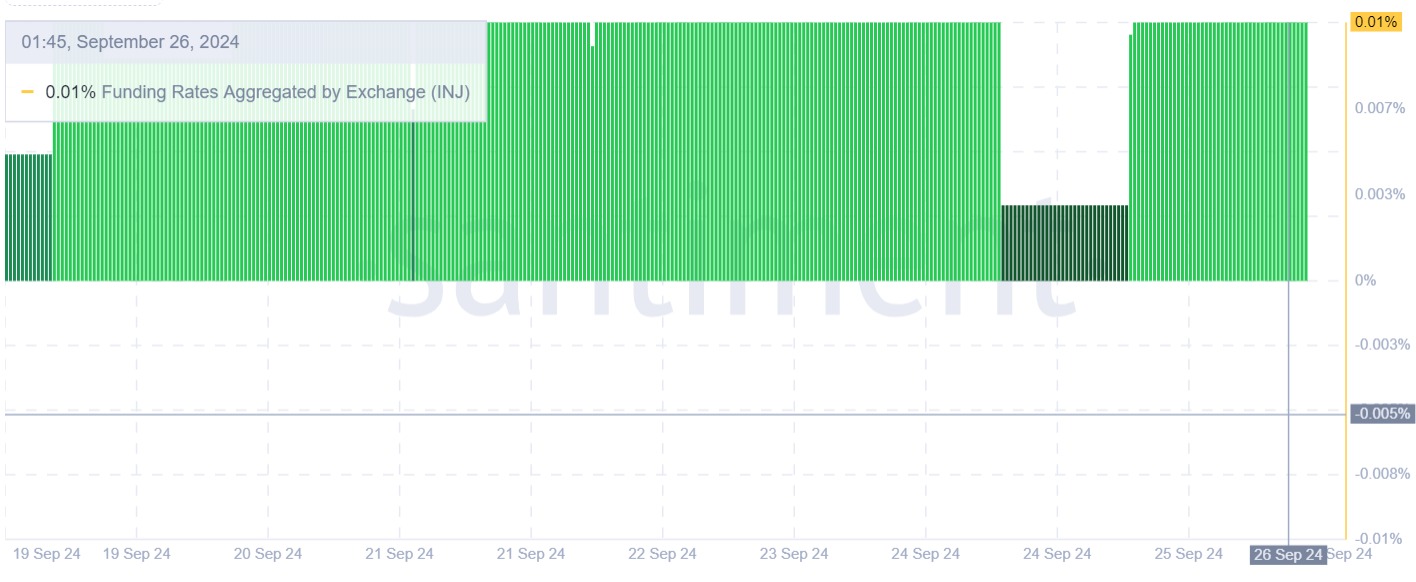

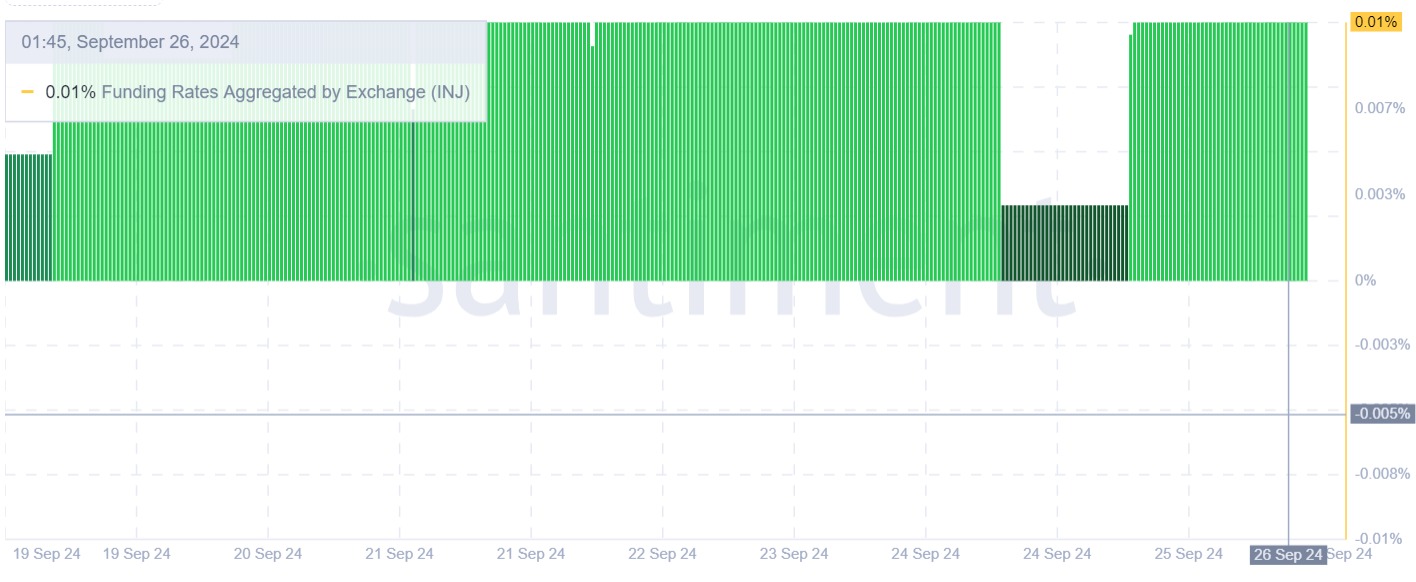

Supply: Santiment

Moreover, Injective’s funding charge aggregated by Trade has remained optimistic over the previous week.

Sometimes, a optimistic funding charge, aggregated by alternate charge, signifies that lengthy positions are paying quick positions. This means that almost all buyers are bullish and count on costs to rise.

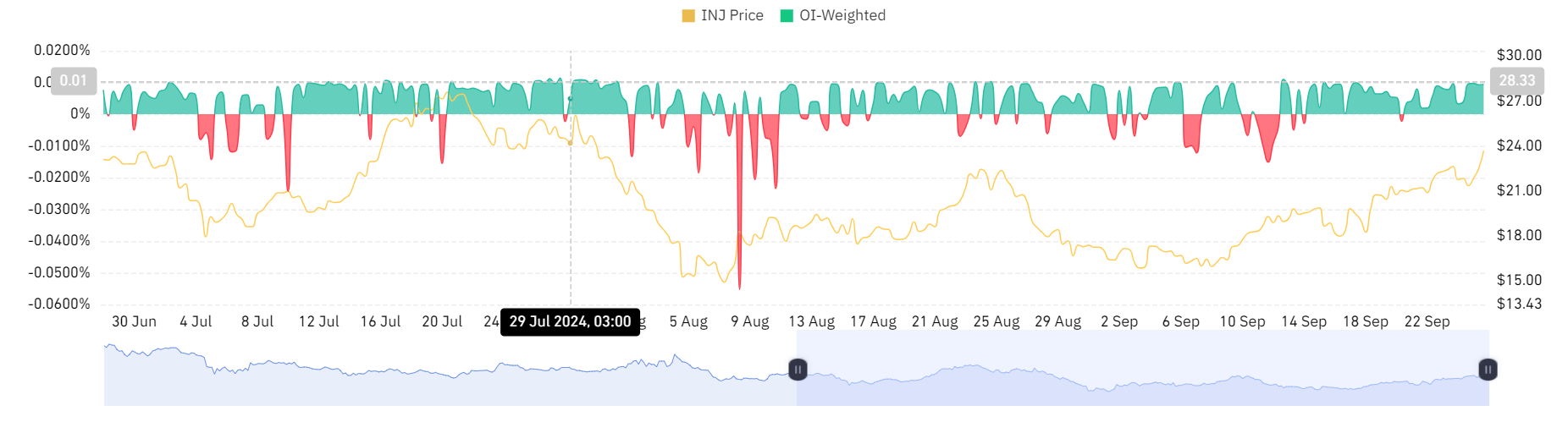

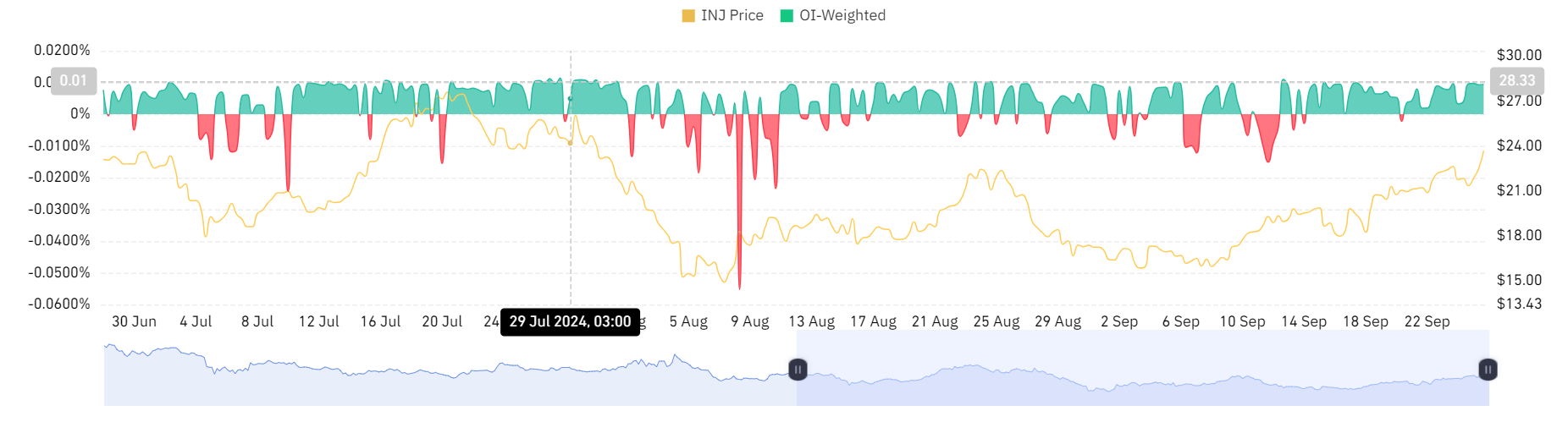

Supply: Santiment

Wanting additional, the Open Curiosity in USD per Trade has been on a sustained upward development over the previous week. As such, it has elevated from $33.4 million to $41.18 million.

Because the value rises as Open Curiosity will increase, this often confirms the power of an uptrend. Which means that merchants take positions within the route of the worth motion, which confirms the credibility of the development.

Supply: Coinglass

Lastly, the demand for lengthy positions is additional strengthened by a optimistic OI-weighted financing charge. This means that lengthy place holders are optimistic about paying a charge to keep up their positions.

Learn Injective [INJ] Worth forecast 2024–2025

Merely put, Injective is at present experiencing upward momentum. Due to optimistic market sentiment, INJ is effectively positioned for additional good points.

So, if prevailing market circumstances persist, INJ will break the subsequent important resistance stage at $25.8. If this stage is damaged, Injective will attain $29.3.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024