Analysis

Is ICP Aimed for $1 Fall Before a Reversal Ahead?

Credit : coinpedia.org

The dialogue in regards to the value prediction of web computer systems for 2025 has intensified as ICP/USD undergoes a pointy correction, whereas on-chain transactions additionally endure. Nevertheless, adoption statistics nonetheless level to long-term power. Regardless of the latest decline seen on the value chart of Web computer systems, merchants are assessing whether or not the present sell-off will produce an enormous rebound or a deeper collapse.

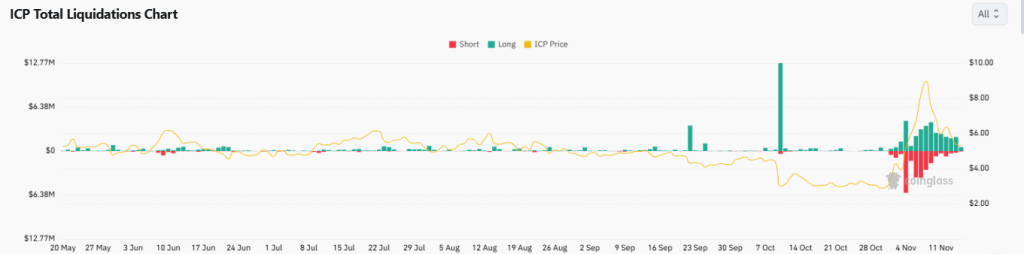

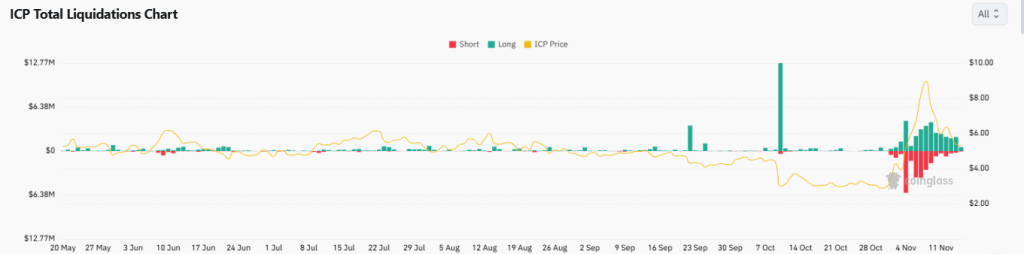

Bearish strain will increase as lengthy liquidations dominate

Bearish sentiment has elevated in latest days, with liquidation charts displaying lengthy positions experiencing constant losses. At the same time as I write this, $1.88 million has been raised within the final 24 hours alone ICP liquidations had been recorded, of which $1.70 million got here solely from lengthy positions.

This imbalance is in keeping with the broader sell-off, as the value of Web computer systems has additionally fallen at present, falling this week from final week’s peak of $9.45 to $5.27, representing a pointy 45% decline.

This rejection occurred proper on a declining trendline originating from the March 2024 swing excessive.

Traditionally, any contact with this line has led to sharp weekly candle-based retracements. That’s the reason, in line with the 2025 value forecast of Web computer systems, it strengthens this technical falling wedge sample in two years and the third contact just lately noticed on the technical construction.

Will the falling wedge push the ICP to a brand new low earlier than restoration?

The longer falling wedge on the Web laptop value chart signifies this ICP/USD might come underneath additional strain if historic habits continues.

A technical extension of this channel into the primary half of 2026 means that the USD ICP value might method the $1 zone, which might mark a brand new low. Such a decline would align with the decrease finish of the sample earlier than any significant restoration.

Nevertheless, if a powerful catalyst emerges within the fourth quarter of 2025, a restoration from the $5 zone might set off a breakout from the higher restrict of the wedge. This state of affairs would pave the way in which for a return to the $15 area earlier than the top of the yr. Though the present likelihood for this transfer appears decrease given the growing volatility and the absence of main catalysts.

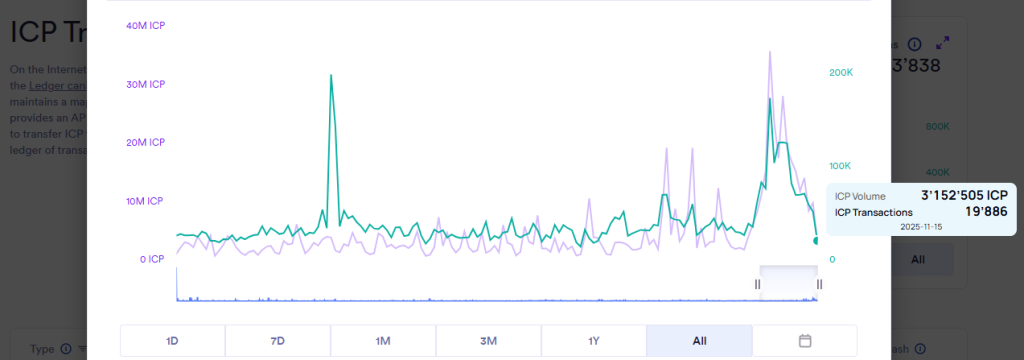

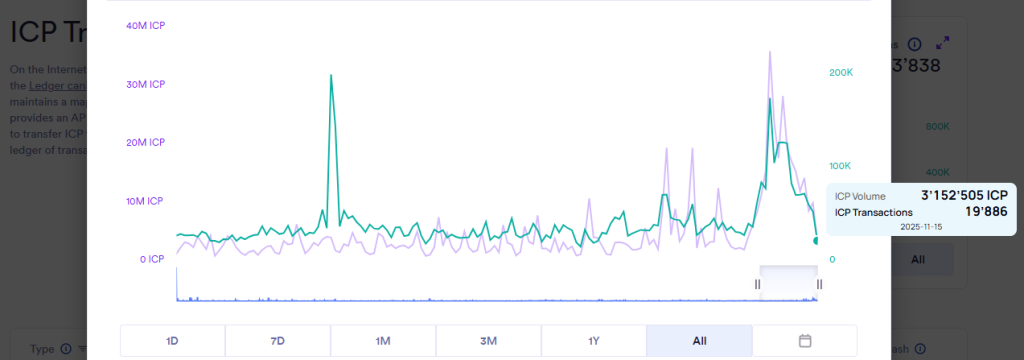

Weak point within the chain confirms short-term downward development

On-chain metrics additional assist the bearish near-term outlook. Transfer volumes and transaction numbers have fallen sharply. On November 4, ICP registered 35.6 million ICP crypto tokens moved via 172,844 transactions.

By mid-November this had dropped to only 3.15 million tokens and 19,886 transactions. It is a dramatic contraction that displays declining person exercise throughout the sale.

This decline displays the risk-off sentiment of the broader market, with near-term uncertainty and aggressive liquidations suppressing momentum.

Lengthy-term fundamentals stay robust regardless of the pullback

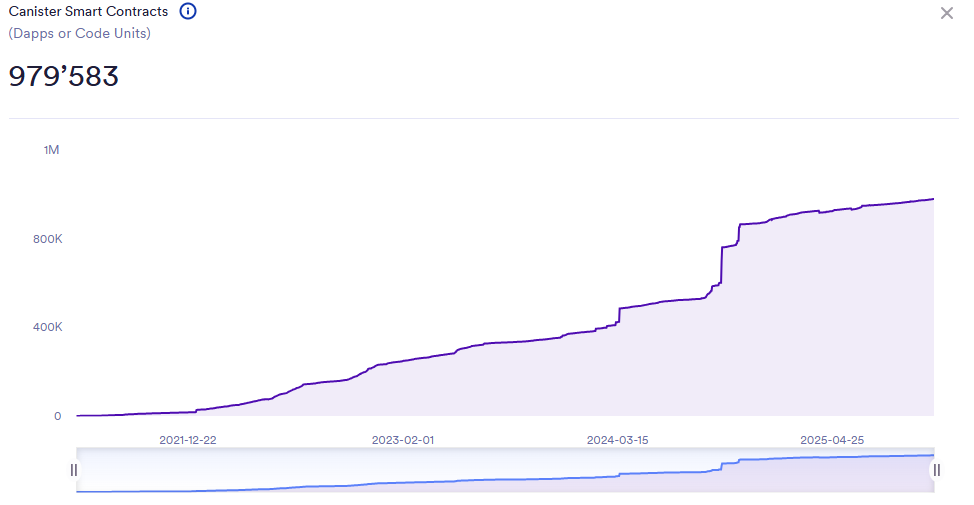

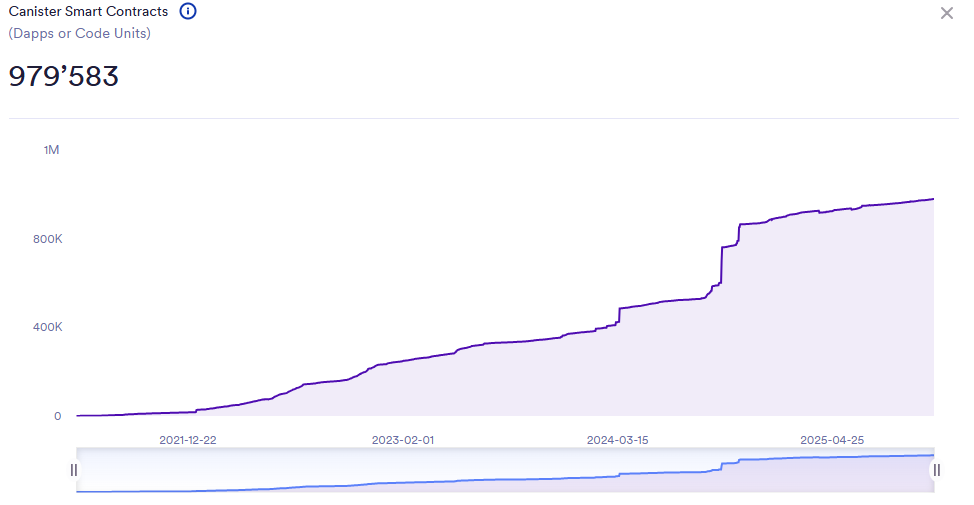

Regardless of the value weak spot, elementary development throughout the ICP ecosystem has continued to develop. The number of registered smart contractswhich could be thought-about one of many core measures for community adoption. In the long run, ICP/USD has continued to develop for a few years.

Furthermore, since January 2024, the quantity has elevated from 372,968 to 979,583 as of the present date. This displays 2.5x development, confirming sustainable adoption, despite the fact that near-term value forecasts for Web computer systems stay unsure.

Whereas value motion signifies restricted upside potential via the fourth quarter of 2025, the buildup of growth milestones positions ICP in a powerful place for potential enlargement in 2026.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We purpose to supply well timed updates on the whole lot crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared symbolize the creator’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts accountability to your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks might seem on our web site. Advertisements are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September