Bitcoin

Strategy Is Aggressively Buying The $94k Bitcoin Cra

Credit : bitcoinmagazine.com

Amid a wave of panic within the crypto markets, rumors surfaced on Friday that Technique (MSTR) was promoting its bitcoin holdings, as each BTC and MSTR shares plummeted.

Govt Chairman Michael Saylor shortly dismissed the chatter: narrate CNBC: “We’re shopping for bitcoin,” promising the corporate’s subsequent purchases shall be reported on Monday. He added that the technique is “accelerating [its] purchases” and advised that traders might be “pleasantly stunned” by the latest exercise.

The rumors stemmed from on-chain strikes that confirmed BTC leaving company-controlled portfolios, coinciding with bitcoin’s transient dip under $95,000, its lowest stage in about six months.

Nevertheless, Saylor maintained confidence and mentioned: “There isn’t a fact to this rumor.”

MSTR shares fell under $200 in pre-market and early buying and selling, down practically 35% for the reason that begin of the yr, elevating issues that the corporate may liquidate bitcoin to stabilize its steadiness sheet.

Saylor suggested traders to maintain perspective regardless of the volatility. “Zoom out,” he mentioned, noting that bitcoin was buying and selling between $55,000 and $65,000 simply over a yr in the past. Even after latest declines, BTC remains to be displaying fairly good returns at $95,000.

He added that Technique “has created a reasonably robust base of assist right here” and expressed consolation that bitcoin may get well from present ranges.

Technique now owns over 641,000 BTC, price roughly $22.5 billion, with a mean buy value of roughly $74,000 per coin. The corporate’s market capitalization has fallen under the worth of its bitcoin holdings, pushing its market-to-net asset worth (mNAV) under 1, a measure typically cited as proof that the inventory could also be undervalued.

Regardless of these figures, Saylor emphasised that Technique’s steadiness sheet is “fairly steady” and solely fractionally funded, with no looming debt triggers.

Bitcoin is all the time funding

As for the long-term prospects, Saylor remained optimistic, stating: “Bitcoin is all the time funding,” offered traders are ready for volatility and keep a time horizon of no less than 4 years.

Evaluating BTC’s efficiency to conventional belongings, he famous that Bitcoin has averaged annual development of about 50% over the previous 5 years, outperforming gold and the S&P.

He additionally contrasted funding approaches, suggesting that these in search of publicity to digital credit score devices would possibly want different merchandise, whereas traders in search of long-term possession of ‘digital capital’ ought to give attention to bitcoin.

At the same time as market jitters proceed and institutional outflows influence costs, the technique is doubling down. “We’re all the time shopping for,” Saylor mentioned, indicating the corporate plans to make use of market dips to develop its bitcoin holdings slightly than promote.

Saylor: Trillions in Bitcoin

In an in depth interview with Bitcoin Journal Earlier this yr, Saylor outlined an bold imaginative and prescient to construct a trillion-dollar Bitcoin steadiness sheet, and use it as a basis to reshape international finance.

He envisions accumulating $1 trillion in Bitcoin and rising it at 20 to 30% yearly, leveraging long-term appreciation to create an enormous inventory of digital collateral.

From this basis, Saylor plans to concern Bitcoin-backed credit score at yields considerably larger than conventional fiat methods, doubtlessly 2 to 4% above company or sovereign debt, providing safer, over-leveraged alternate options.

He expects this might revive credit score markets, inventory indexes and company steadiness sheets whereas creating new monetary merchandise, together with higher-yield financial savings accounts, cash market funds and insurance coverage companies in Bitcoin.

Earlier this week, Technique purchased 487 BTC for roughly $49.9 million. On the time of announcement, Bitcoin’s value was virtually $106,000. The purchases, made between November 3 and 9 at a mean of $102,557 per BTC, convey Technique’s whole holdings to 641,692 BTC, acquired for roughly $47.54 billion at a mean value of $74,079 every, underscoring the corporate’s continued dedication to its Bitcoin treasury technique.

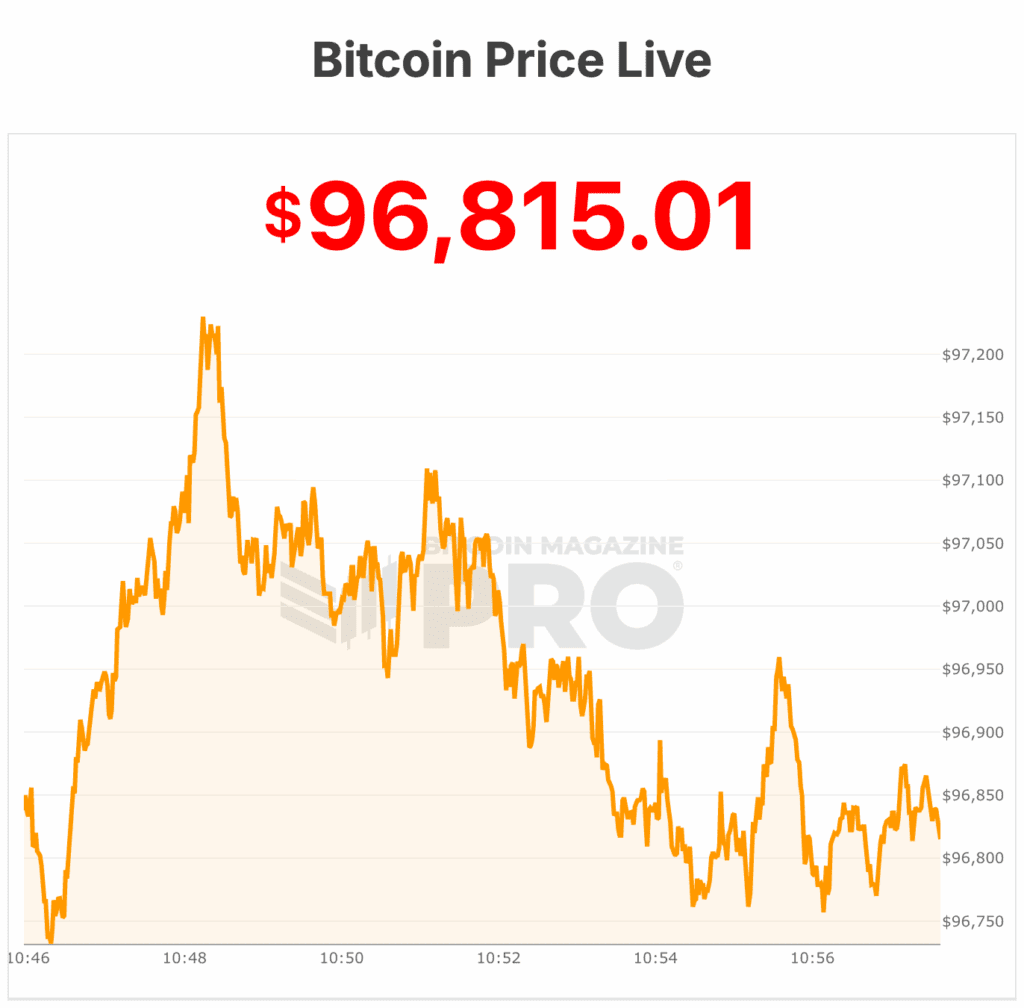

On the time of writing, Bitcoin is buying and selling at $96,815, with lows close to $94,000.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September