Analysis

Is IP Crypto’s 75% Fall Setting Up for a Reversal Ahead?

Credit : coinpedia.org

The broader market is intently watching the crash of IP/USD from its peak, and merchants and traders are searching for indicators of reversal, growing curiosity within the Story Protocol 2025 worth forecast. Whereas the Story Protocol worth at the moment displays a lack of momentum, its structural setup, historic patterns, and basic catalysts might decide how IP crypto behaves in 2025.

A historic hunch after a large 375% rally

To grasp the evaluation of the Story Protocol worth forecast for 2025, the Story Protocol worth chart gives essential context. Between March and July, IP crypto shaped a basic falling wedge sample that brought on an explosive transfer from $3 in July to $14.5 in September, delivering a acquire of over 375%.

This upward pattern was not linear; in actual fact it took just a few days, primarily based on particular person intervals. These pauses within the rally shaped a rising wedge, which finally broke down between late September and mid-November.

Since then IP USD worth has corrected greater than 75% from its all-time excessive, with a deeper 60% drop from $7.5 to virtually $3 in simply 30 days. This worth construction is per the cyclical exhaustion following the wedge break, reinforcing that the continuing decline is technically constant relatively than surprising.

Approaching a important accumulation zone

Whereas Story Protocol worth is hovering round $3.01 at the moment, it’s now approaching the June accumulation help vary of $2.00-$2.50. This zone beforehand served because the launchpad for the 375% enhance, making it a key space for the present Story Protocol worth forecast for 2025.

This means {that a} 30% downtrend stays doable earlier than stabilization happens, after which accumulation might strengthen the inspiration for the subsequent bullish try.

Furthermore, a retest of the $4.30 degree stays believable earlier than the tip of the yr, however the chance of a stronger bullish continuation appears greater in early 2026 than in late 2025.

Exercise within the chain is reducing, however is just not a “dying asset”

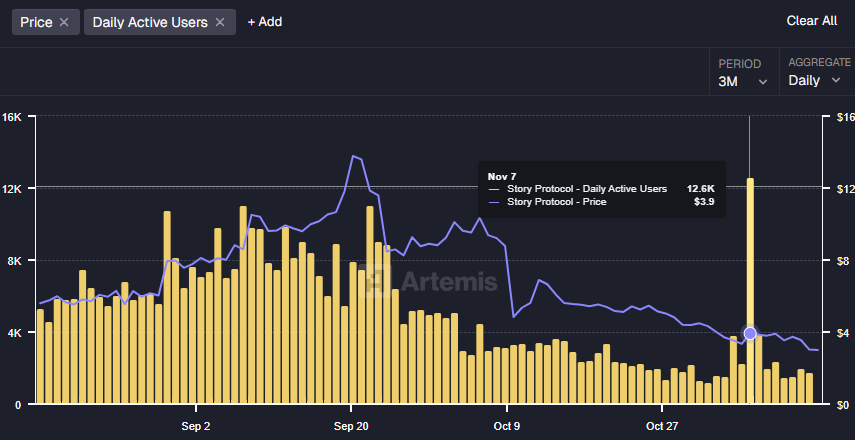

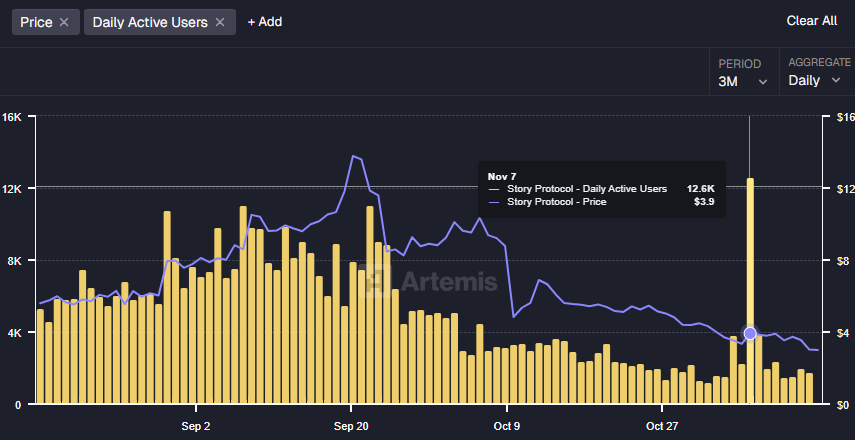

The decline is just not restricted to cost motion. Story Protocol’s on-chain enterprise has additionally taken successful. TVL fell sharply from $45.12 million to $12.07 million, whereas every day energetic customers fell to round 1.8K from 7.5K in September.

Though there was a single peak above 12,000 customers on November 7, which seems to have been brought on by Story working the RWA’s first advertisement in mainland Chinahowever the broader pattern within the every day energetic customers graph remained downward.

But this weak point shouldn’t be confused with ecosystem decline. The introduction of tokenized digital promoting house, a multi-billion greenback business. This means strategic growth and continued growth relatively than everlasting decline.

Buyback program strengthens medium-term prospects

A key catalyst shaping the Story Protocol worth forecast for 2025 is the Basis’s announcement that it has accomplished greater than 60% of its deliberate IP crypto purchases. The buyback program will broaden from $82 million to $100 million, with purchases persevering with by way of February 1, 2026.

This reinforces expectations that whereas the fourth quarter of 2025 could stay subdued, the chance of significant upside momentum will increase considerably within the first quarter of 2026, particularly if the Story Protocol worth chart stabilizes at its historic accumulation zone.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We intention to offer well timed updates on every part crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the writer’s personal views on present market situations. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability in your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our web site. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September