Policy & Regulation

Crypto Firms Push Trump to Direct Agencies on Stalled Regulatory Guidance

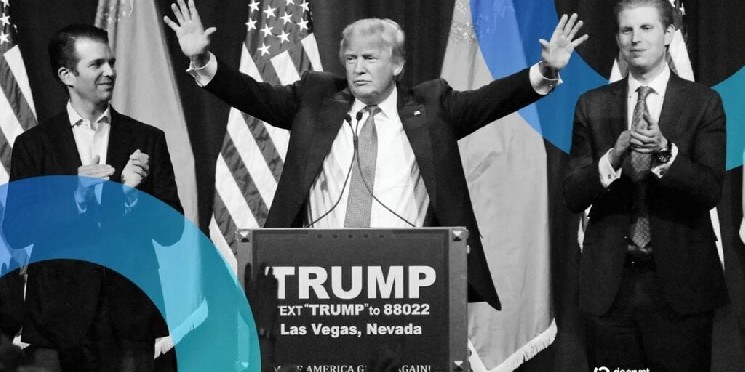

Credit : cryptonews.net

Greater than 65 crypto organizations are calling on President Donald Trump to bypass Congress and order federal companies to instantly make clear digital asset laws, amid rising impatience over the tempo of regulatory reforms.

In a single letter despatched to the White Home, main business gamers together with Coinbase, Uniswap Labs, the Blockchain Affiliation and the Solana Basis outlined particular actions the Securities and Alternate Fee, the Commodity Futures Buying and selling Fee, the Treasury Division and the Justice Division can take with out new laws.

The coordinated push goals to reverse Trump’s pro-crypto stance in concrete company motionutilizing government energy to result in probably the most sweeping adjustments in crypto coverage to this point.

The letter acknowledges the Trump administration’s victories, together with the nullification of the IRS Dealer Rule And passage of the GENIUS Acta regulatory framework for it steady cash.

Regardless of these steps, the letter says extra will be completed by way of government motion to make America “the crypto capital of the world.”

By way of tax coverage, the letter urges the Treasury Division to problem steerage treating staking and mining rewards as “self-created property taxable upon disposal” quite than quick taxable revenue.

It additionally requires clarification that bridge, wrap and cross-chain transactions are non-taxable occasions and seeks de minimis tax guidelines that exclude earnings on purchases as much as $600.

For regulatory readability, signatories need the SEC’s Crypto Process Pressure to problem interim steerage clarifying that builders of “source-available, permissionless protocols” might be shielded from enforcement throughout rulemaking.

On DeFi safety, the business is asking for up to date FinCEN steerage confirming that the Financial institution Secrecy Act doesn’t apply to non-custodial blockchain software program, according to the company’s 2019 place on digital currencies.

Notably, the letter urges the Justice Division to dismiss prices towards the developer of the Twister Money coin blender, Roman Storm. discovered responsible of conspiring to function an unlicensed cash transmitter in August, “recognizing that Storm’s work on Twister Money represents the publication of open supply software program – and never a monetary crime.”

The decision comes because the crypto group faces related issues about Samourai Pockets builders, which just lately have been sentenced to jail for his or her work on privacy-focused software program.

Daniel Liu, CEO of Republic Applied sciences, shared Declutter he helps the decision for readability, however warned that “it’s way more necessary that regulators transfer methodically and get it proper, quite than transfer too shortly and danger creating extra confusion.”

“So long as the actions taken by any company are clearly outlined, I’d not count on particular person states to problem or fragment the framework,” he added.

The letter arrives as Trump’s CFTC nominee, Mike Selig, heads towards Senate affirmation following Wednesday’s affirmation listening to by which he declined to decide to increasing the company’s assets regardless of anticipated tasks for overseeing cryptocurrency.

The push for administrative motion gained momentum on Monday when proposed Treasury Division guidelines relating to worldwide crypto tax reporting reached the White Home for overview.

The foundations would permit the IRS to do this acquire data about Individuals’ overseas crypto accounts by becoming a member of the Crypto-Asset Reporting Framework, a world settlement beneath which nations robotically share details about residents’ crypto holdings to fight tax evasion.

Consumer sentiment on Myriad Markets signifies weak approval for Trump’s efficiency because the forty fifth president, with solely 44% of merchants betting he’ll do properly.

Myriad is owned by Decrypt’s guardian firm, Dastan.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?