Blockchain

Alliance DAO Partner QwQiao Questions Long-term Value of L1 Tokens

Credit : cryptonews.net

Key highlights

- QwQiao argues that giant L1 networks and tokens lack lasting aggressive benefits, generally known as a moat, making them susceptible

- He believes the most important drawback is that it’s now too simple for customers and builders to modify between totally different blockchains, which drives down the long-term worth of their tokens.

- Proposing an answer, he mentioned blockchains ought to construct apps and providers straight on their networks

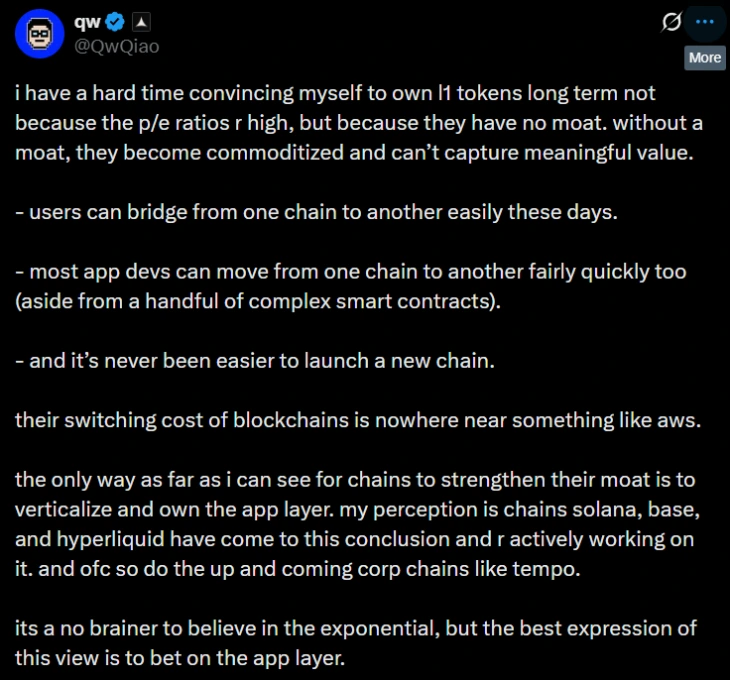

On November 27, QwQiao, a companion on the Alliance DAO, shared a tweet questioning the long-term worth of L1 tokens.

(Supply: QwQiao on X)

Within the final submit on “onerous to persuade” to carry Layer 1 (L1) blockchain tokens for the long run. His concern was not in regards to the present excessive costs. As an alternative, he questioned their core construction by arguing that L1 networks haven’t any ‘moat’.

With out this much-needed safety, he believes these infrastructure chains will change into easy commodities, like electrical energy or water. Because of this, it will be unable to seize nice worth over time.

L1 tokens haven’t any moat: QwQiao

The primary level of QwQiao’s argument could be very easy. He mentioned that in at this time’s crypto sector, there may be nearly no friction to forestall customers, builders or capital tied to the blockchain from leaving one blockchain for one more.

In line with QwQiao, it solely takes a couple of minutes to maneuver digital property between totally different blockchains, due to superior bridge applied sciences resembling Wormhole and LayerZero. The entire quantity of those cross-chain transfers will already exceed billions of {dollars} by 2025.

For builders, the method of shifting an software can also be easy. Most can switch their code to suitable chains inside just a few days. Actually, the emergence of easy-to-use improvement instruments has simplified the method of shifting to non-compliant networks.

Other than this, it solely takes weeks to launch a model new blockchain or application-based bundle, and never years, utilizing available kits.

This infrastructure makes the price of switching blockchains low in comparison with the issue of shifting an organization’s knowledge from a cloud service supplier like Amazon Internet Providers (AWS).

Qw said that “It is a no-brainer to imagine within the exponential, however the very best expression of this imaginative and prescient is to guess on the app layer.”

QW is a companion of Alliance DAO, a company generally known as one of the profitable DAOs within the cryptocurrency house. It is usually generally known as the DeFi Alliance. This group has helped launch main tasks resembling Pump.enjoyable and Fantasy High.

It has raised $50 million in fundraising spherical from main funding corporations resembling Sequoia and Paradigm.

Earlier than, Qw has additionally beforehand warned about dangers in retail ETFs in 2025, and AI tokens have been confirmed appropriate. Now, his views on L1 tokens have change into a subject of debate throughout the crypto neighborhood.

QwQiao thinks vertical integration is an answer

QwQiao additionally shared its resolution for L1 community survival. He argues that they need to cease appearing as pure infrastructure and as a substitute take full possession of the applying layer constructed on high of them.

“the one means chains, so far as I can see, can strengthen their moat is by verticalizing and proudly owning the app layer. my notion is that the Solana, Base and Hyperliquid chains have come to this conclusion and are actively engaged on it. and that features the rising corp chains like tempo,” he mentioned.

For example, he talked about Base, an L2 community from Coinbase. It’s rapidly attracting a big consumer base of recent DeFi actions. He additionally talked about Hyperliquid, a decentralized alternate (DEX) constructed by itself highly effective Layer 1 blockchain.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now