Altcoin

Bitcoin speculation muted: Glassnode analyst calls perpetrators a ‘ghost town’

Credit : www.newsbtc.com

Glassnode’s senior researcher has identified that the Bitcoin perpetual futures market appears to be like like a ‘ghost city’, with Open Curiosity nonetheless at muted ranges.

Open curiosity on Bitcoin Futures has remained low because the reset in October

In a brand new after on The “Open Curiosity” refers to an indicator that measures the entire variety of positions associated to the asset which are at the moment open on all centralized derivatives platforms.

When the worth of the measure will increase, it signifies that the traders are opening new positions associated to the asset. Normally, new positions carry new leverage to the sector, so the cryptocurrency’s value can turn into extra unstable following an increase in Open Curiosity.

However, the bearish indicator signifies that perpetual futures merchants are both closing their positions on their very own accord or being forcibly liquidated by their platform. Such a pattern might result in extra steady value motion for BTC as a consequence of leverage clearing.

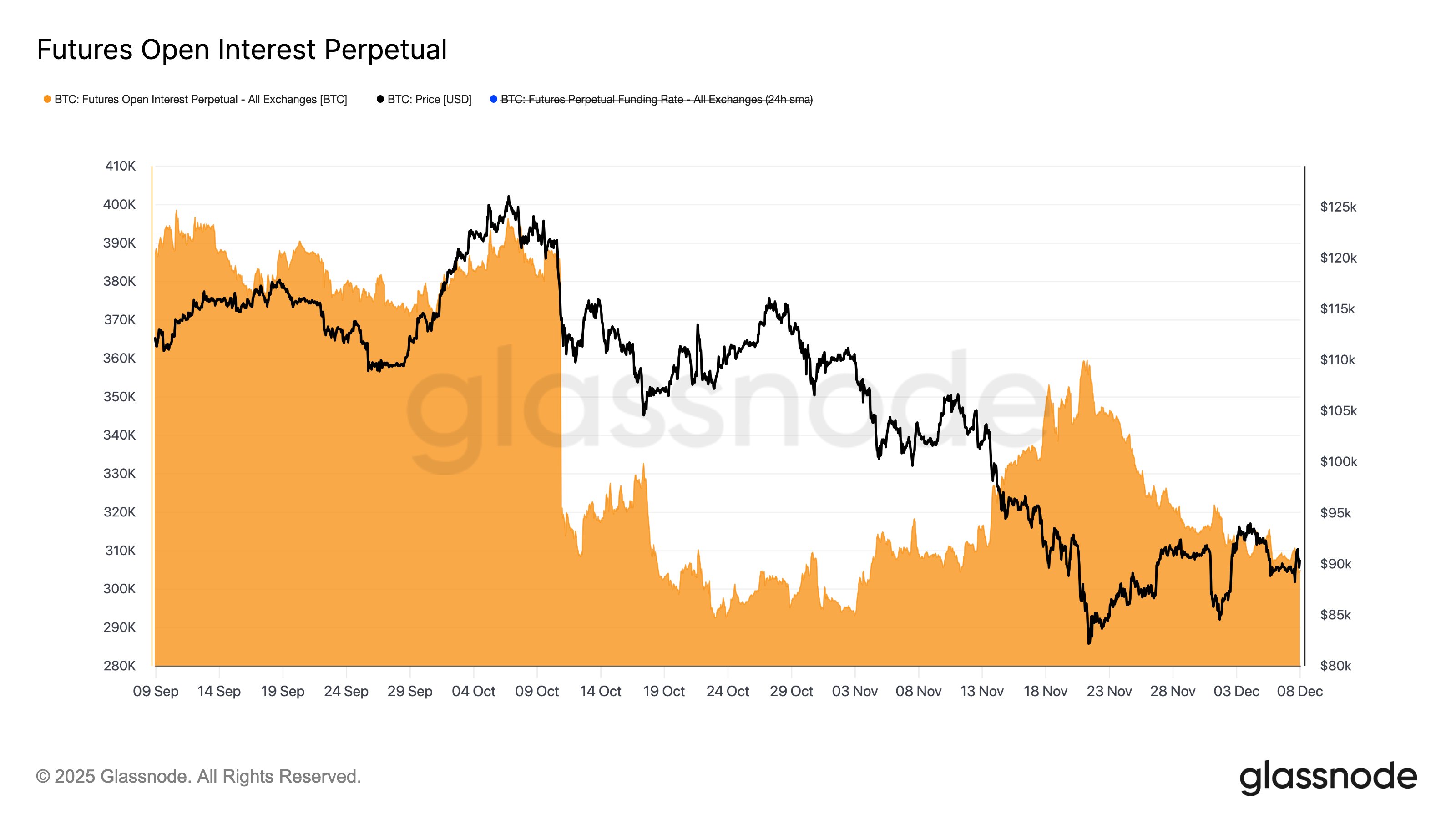

Right here is the chart shared by CryptoVizArt.₿ exhibiting the pattern in Bitcoin perpetual futures Open Curiosity (in BTC phrases) over the previous few months:

As proven within the chart above, BTC-denominated Bitcoin perpetual futures Open Curiosity noticed a pointy decline in October as a result of crash within the cryptocurrency’s value.

After the leverage flush, the indicator moved sideways round its lows, however in mid-November hypothesis famous a rebound because the asset decline continued, with the measure’s worth peaking subsequent to the extent that had hitherto acted as a flooring.

Nonetheless, since this excessive, the indicator has cooled once more and has reached the identical lows because the lows that adopted the large liquidation in October. So now that Open Curiosity is again beneath 310,000 BTC, it seems that speculative curiosity available in the market has weakened as soon as once more.

The latest decline in speculative participation has been accompanied by a decline within the perpetual futures Funding Charge, a measure that tracks the quantity of periodic charges exchanged between brief and lengthy traders.

The chart reveals that the funding charge for Bitcoin perpetual futures has been declining for a while. “This continued decline displays a decline in lengthy leveraged beliefs, with merchants unwilling to pay a premium to keep up upside publicity,” the Glassnode researcher stated.

Primarily based on the latest developments, CryptoVizArt.₿ has referred to as the perpetual futures market a “ghost city.”

BTC value

On the time of writing, Bitcoin is hovering round $90,500, up almost 6% up to now seven days.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now