Bitcoin

Bitcoin – THIS key signal suggests BTC’s next ATH will be in November

Credit : ambcrypto.com

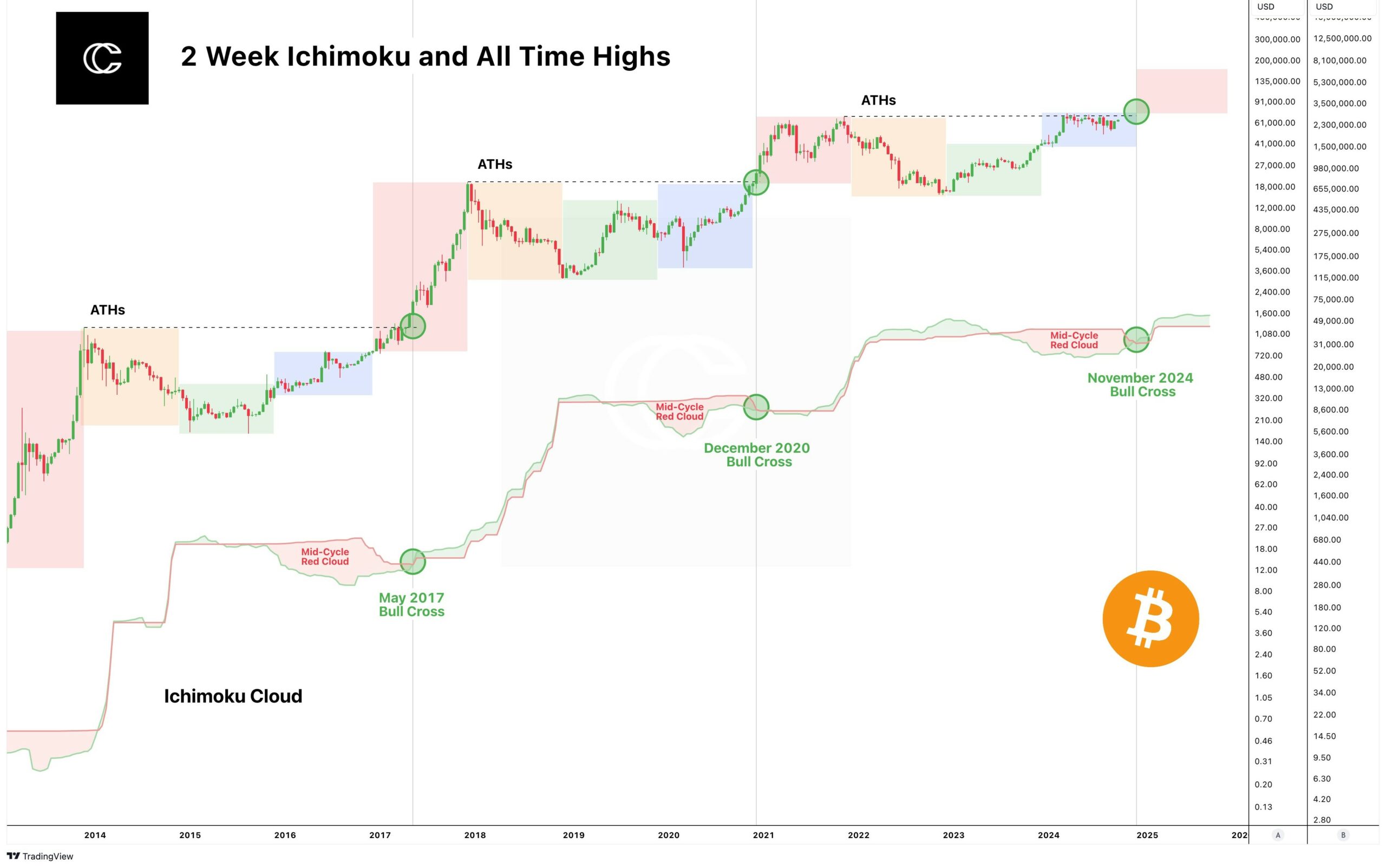

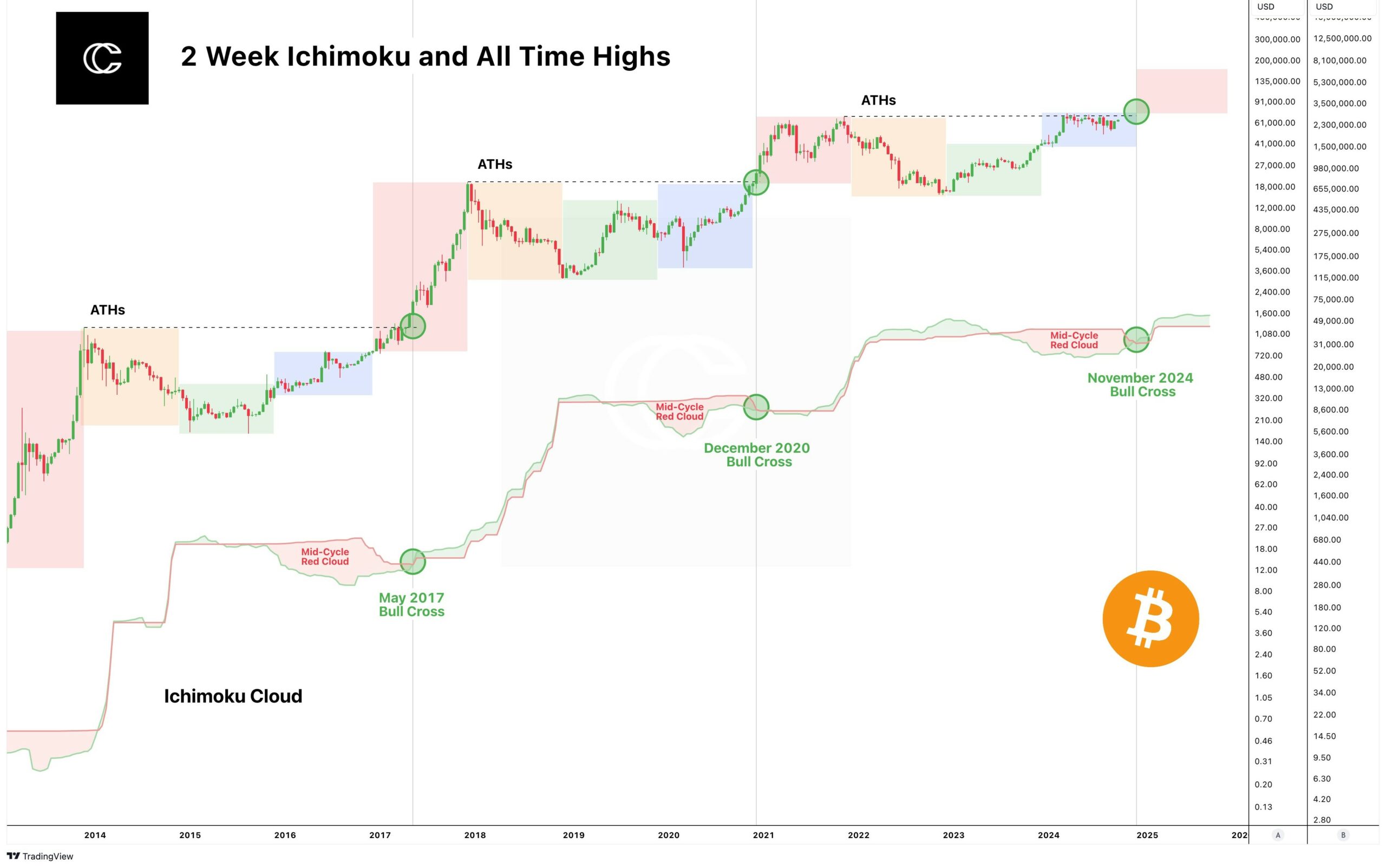

- The 2-week Ichimoku Cloud indicator has predicted potential Bitcoin highs within the fourth quarter

- Establishments and retailers have gotten deeply concerned in Bitcoin

Bitcoin (BTC) is as soon as once more on the forefront of the crypto market, driving momentum towards a long-awaited bull market.

On the time of writing, Bitcoin was buying and selling at $66,000, sparking pleasure about potential new all-time highs (ATHs) within the ultimate quarter of the yr. Nonetheless, right here it’s price taking a look at historic knowledge. Notably the 2-week Ichimoku Cloud indicator, because it has precisely predicted Bitcoin’s ATHs in earlier cycles.

With the present cycle progressing forward of schedule, there’s in all probability no want to attend for the shifting averages to cross. The main intervals present us when this may occur, indicating {that a} new excessive could possibly be shaped in November.

Supply: CryptoCon/X

Many at the moment are questioning if November would be the month Bitcoin reaches new heights. Particularly as establishments and merchants are maintaining a detailed eye on this timeline.

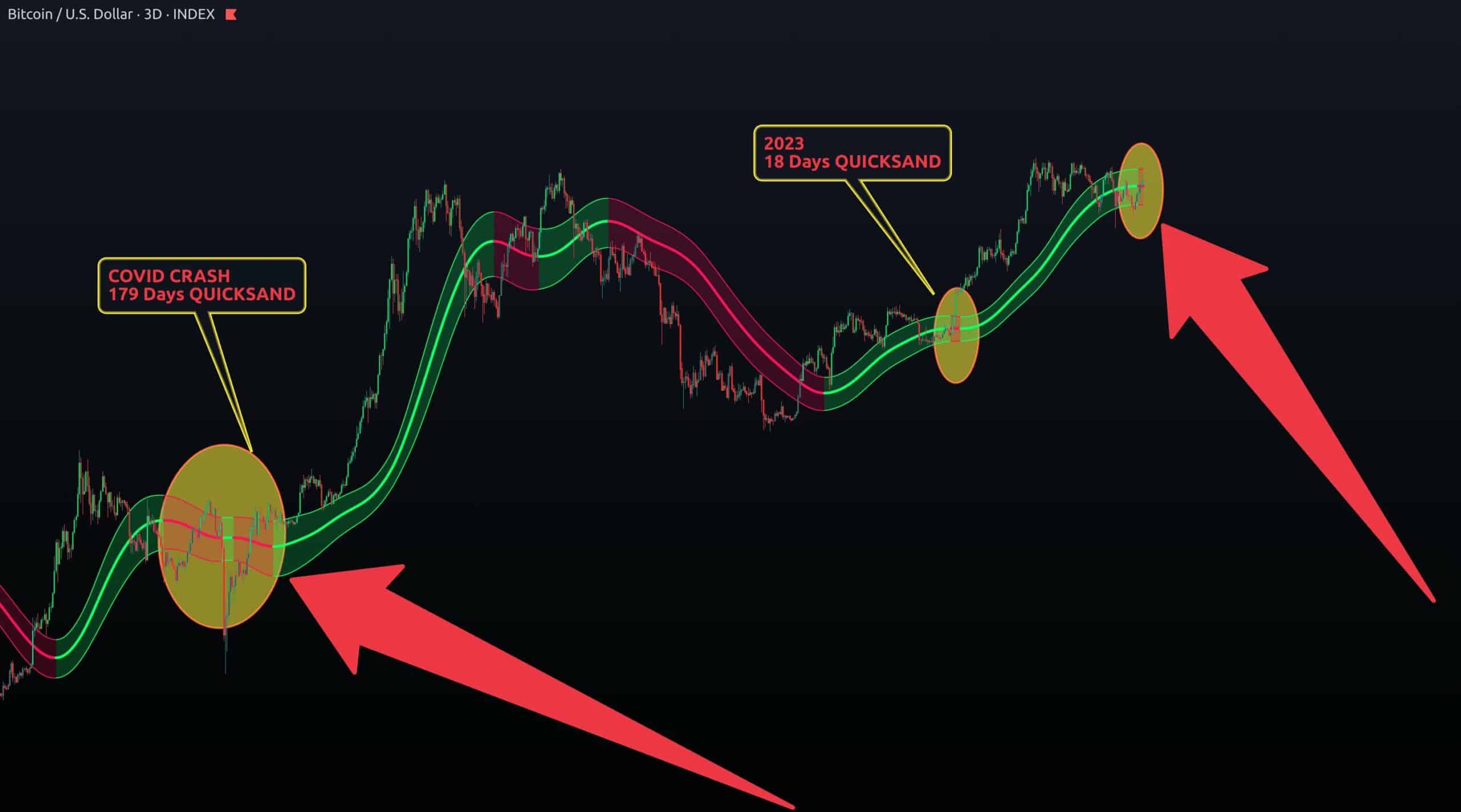

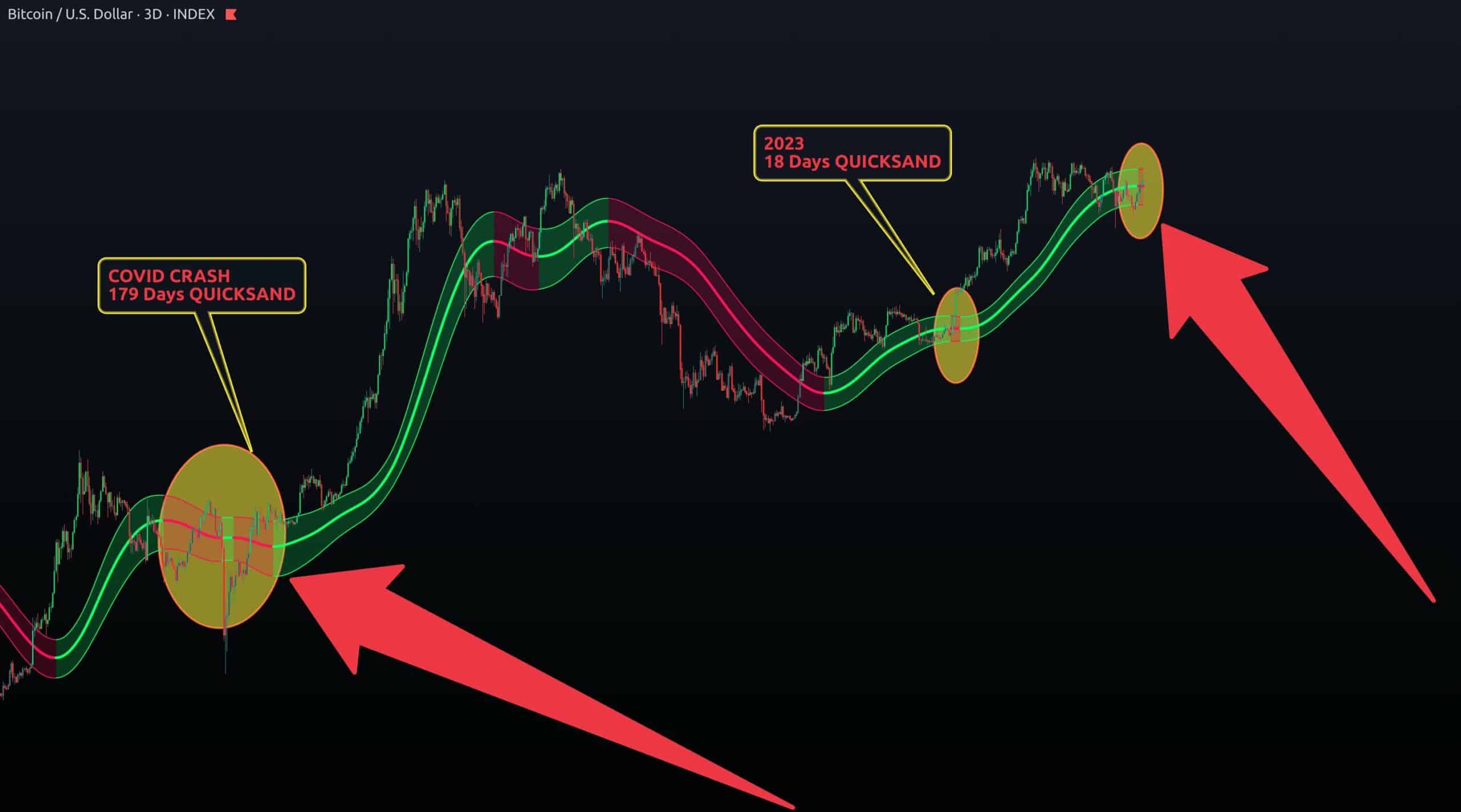

Repeat of the Covid19 crash sample

A key issue supporting this risk is the repeat of the 2019 sample. The Gaussian channel on the three-day BTC chart has turned crimson, which has traditionally solely occurred twice: in the course of the Covid crash and through part 2 of the earlier Bitcoin bull run.

When this sample final emerged throughout Covid 19, it led to a major rally, pushing Bitcoin to new ATHs. If historical past repeats itself, Bitcoin could possibly be poised for one more main upward transfer and probably new highs in November.

Supply:

Finally, nonetheless, market dynamics will decide the result, and it stays to be seen whether or not this sample will certainly result in greater costs.

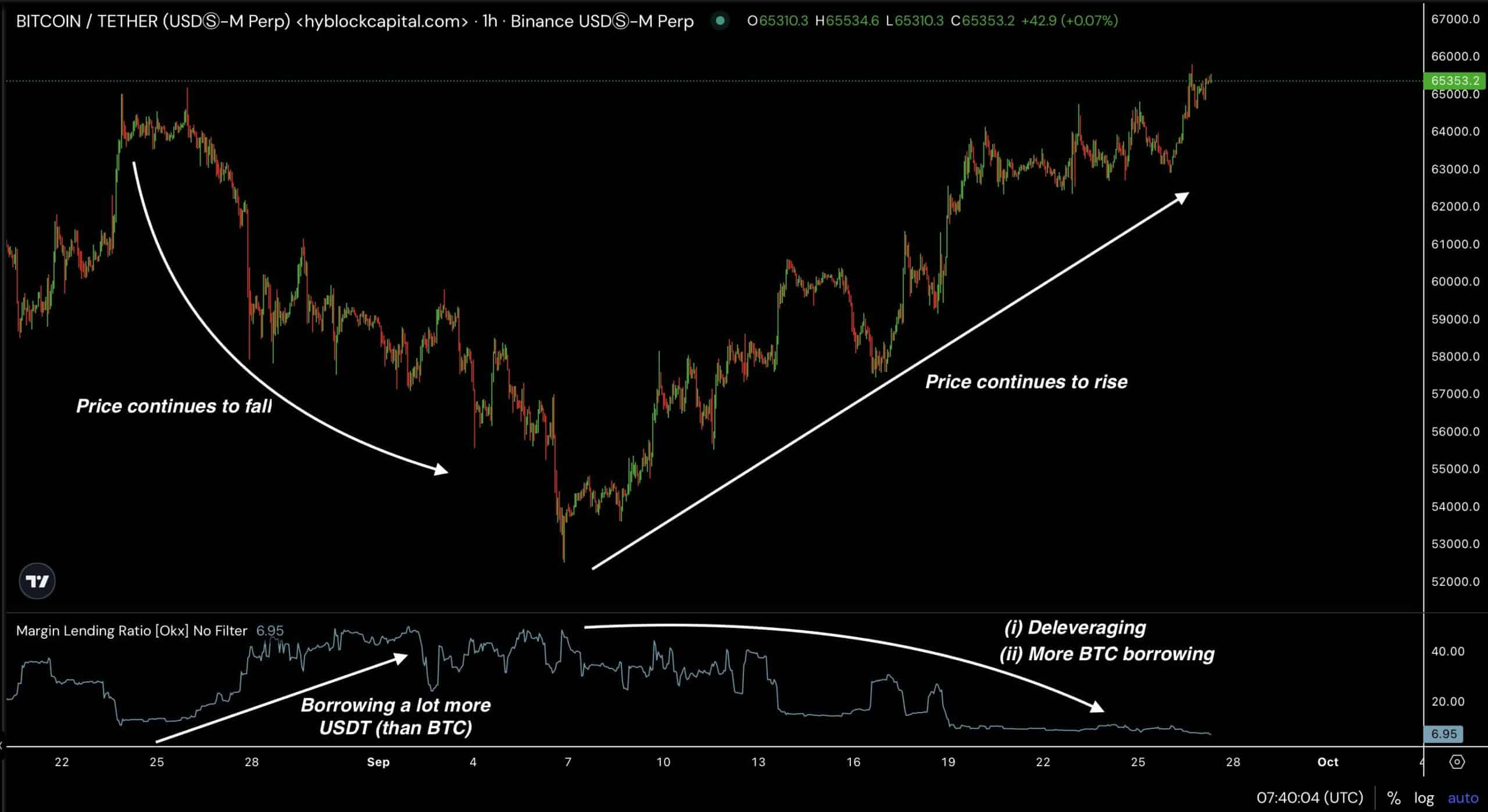

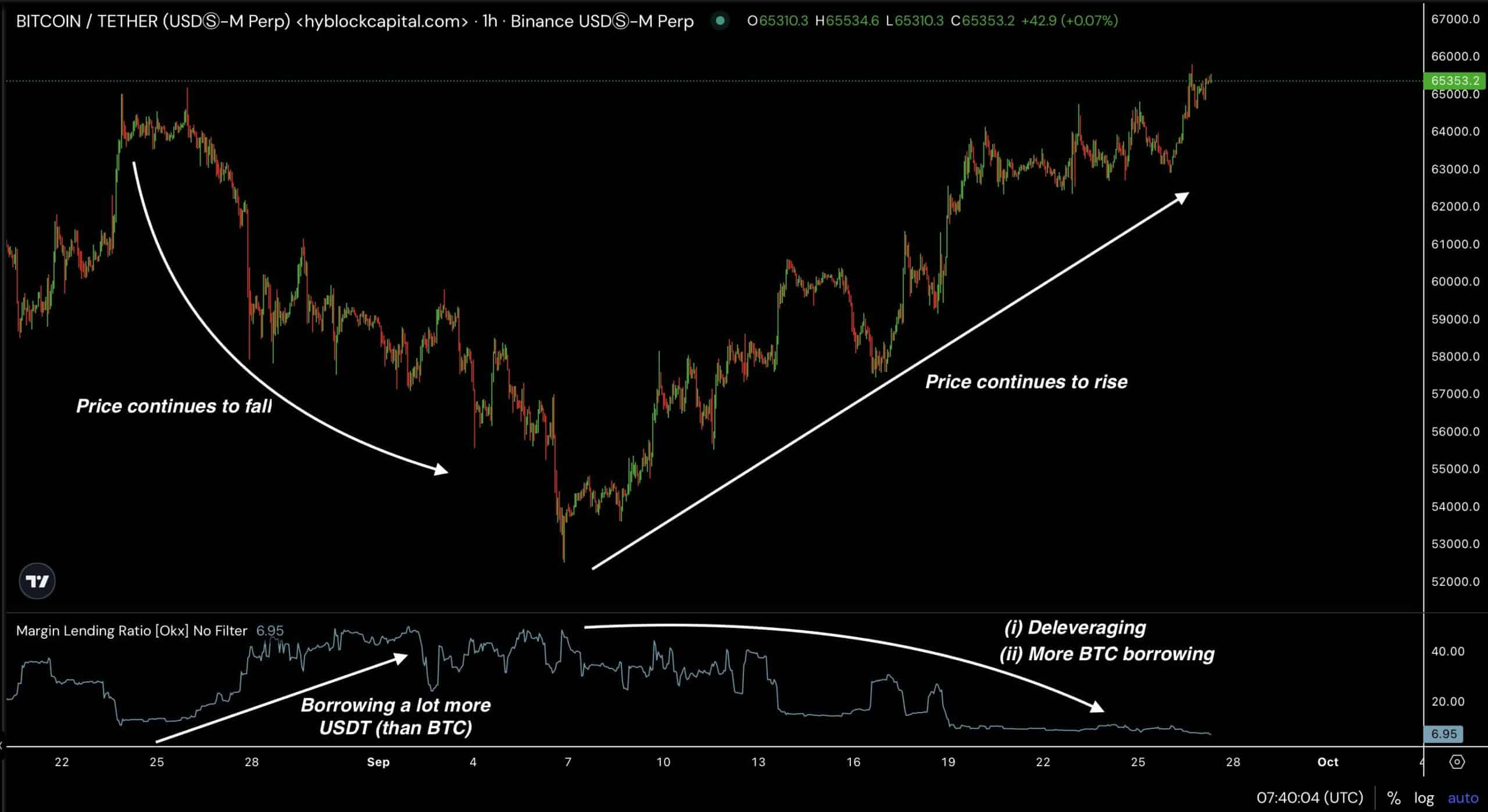

Potential affect of closely borrowed USDT

One other issue that would push Bitcoin greater is the affect of closely borrowed USDT. Merchants have borrowed giant quantities of USDT to purchase Bitcoin. Nonetheless, as a substitute of driving up the value, this initially led to a decline, leaving over-indebted merchants with losses.

Such a market conduct typically precedes a major rally. Particularly now that retailers are being shaken out by liquidations. If the present pattern continues, this may create an ideal preparation for Bitcoin to soar to new highs, probably in November.

Supply: Hyblock Capital

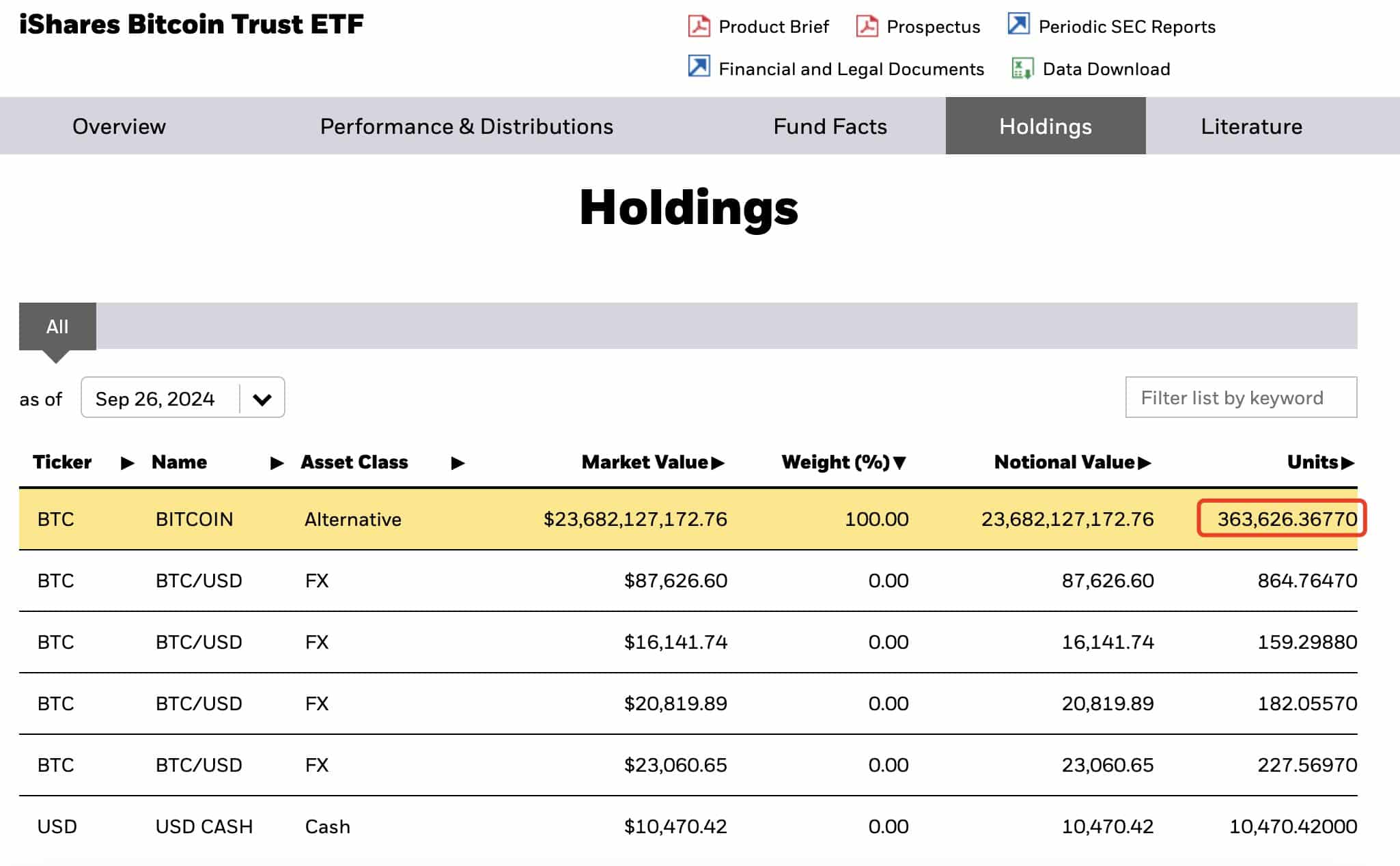

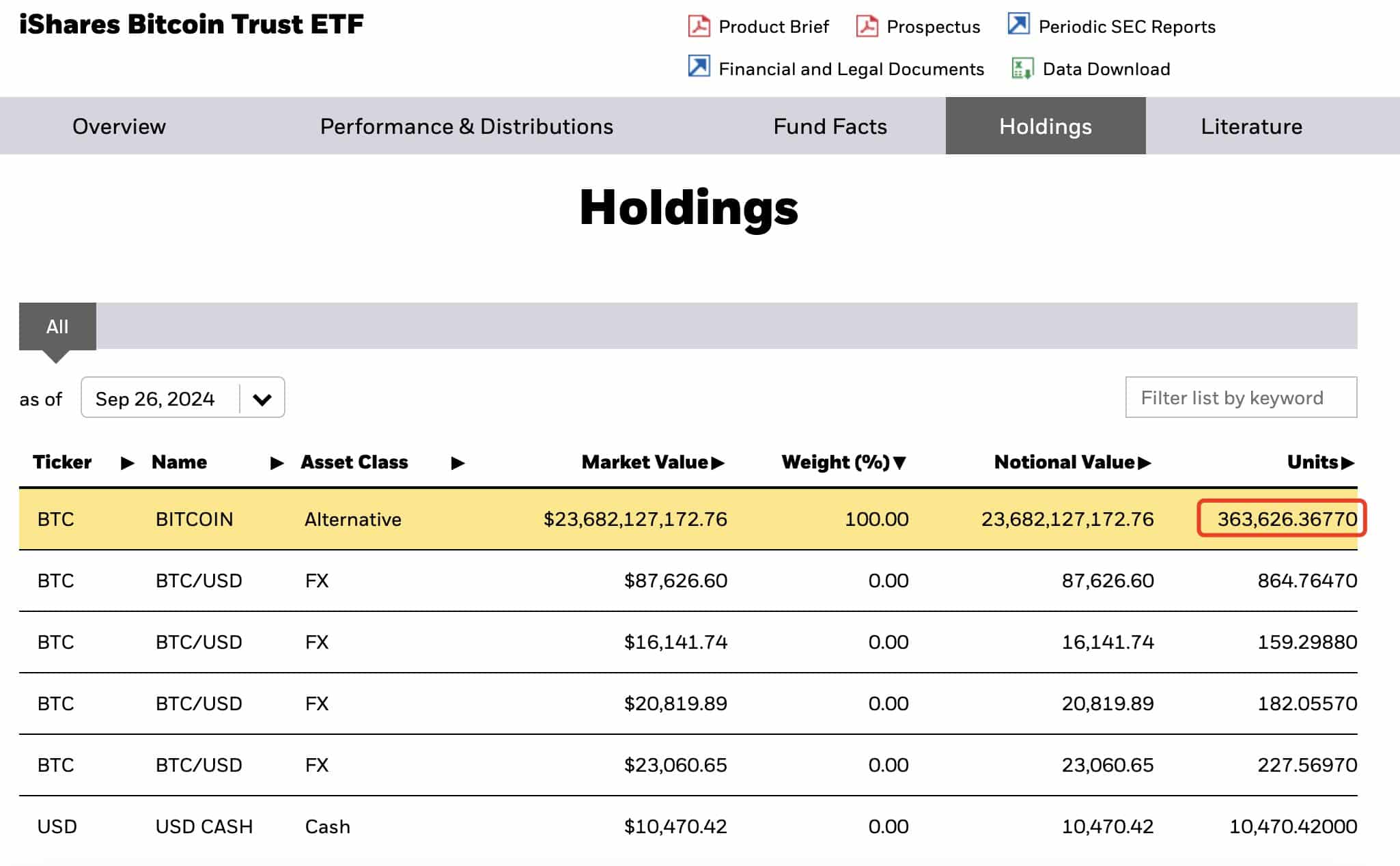

Blackrock continues to purchase BTC

Moreover, BlackRock’s continued accumulation of Bitcoin lends additional confidence within the bullish outlook. Earlier this week, BlackRock (IBIT) bought 4,460 BTC, price $289 million, growing its complete holdings to over 362,000 BTC.

This was adopted by one other buy of 1,434 BTC price $94.3 million. They not too long ago added one other 5,894 BTC, bringing their complete holdings to 363,626 BTC, price $23.68 billion.

BlackRock’s important and ongoing investments in Bitcoin imply they count on a major value improve, probably as early as November.

Supply: Lookonchain/X

With historic patterns, market dynamics, and institutional help all aligning, Bitcoin’s value may attain new highs within the close to future. The potential for a bullish run stays excessive, and merchants and traders will likely be maintaining a detailed eye on developments as November approaches.

If these elements come collectively, Bitcoin couldn’t solely attain new ATHs but additionally set up itself firmly in greater value ranges for the remainder of the yr.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024