Ethereum

Ethereum’s breakout odds – Is $3200 a viable price target?

Credit : ambcrypto.com

- Ethereum was buying and selling at a major degree on the day by day time-frame on the time of writing

- Establishments and whales resumed exercise as optimism returned to the market

Ethereum (ETH), the second largest cryptocurrency in the marketplace, is buying and selling at essential ranges once more. These ranges are particularly vital for long-term buyers. On the time of writing, ETH was hovering round $2,700 – a key resistance degree on the day by day time-frame.

The earlier month’s value ranges now act as key help and resistance zones. ETH respects the earlier month’s low as help, whereas the midpoint between the earlier month’s excessive and low acts as resistance.

Market sentiment stays bullish, pointing to a potential break above the USD 2,700 resistance. This might push ETH to focus on the $3,200 degree. Nonetheless, market dynamics stay unpredictable, and any abrupt change might alter this outlook.

Supply: Hyblock Capital, TradingView

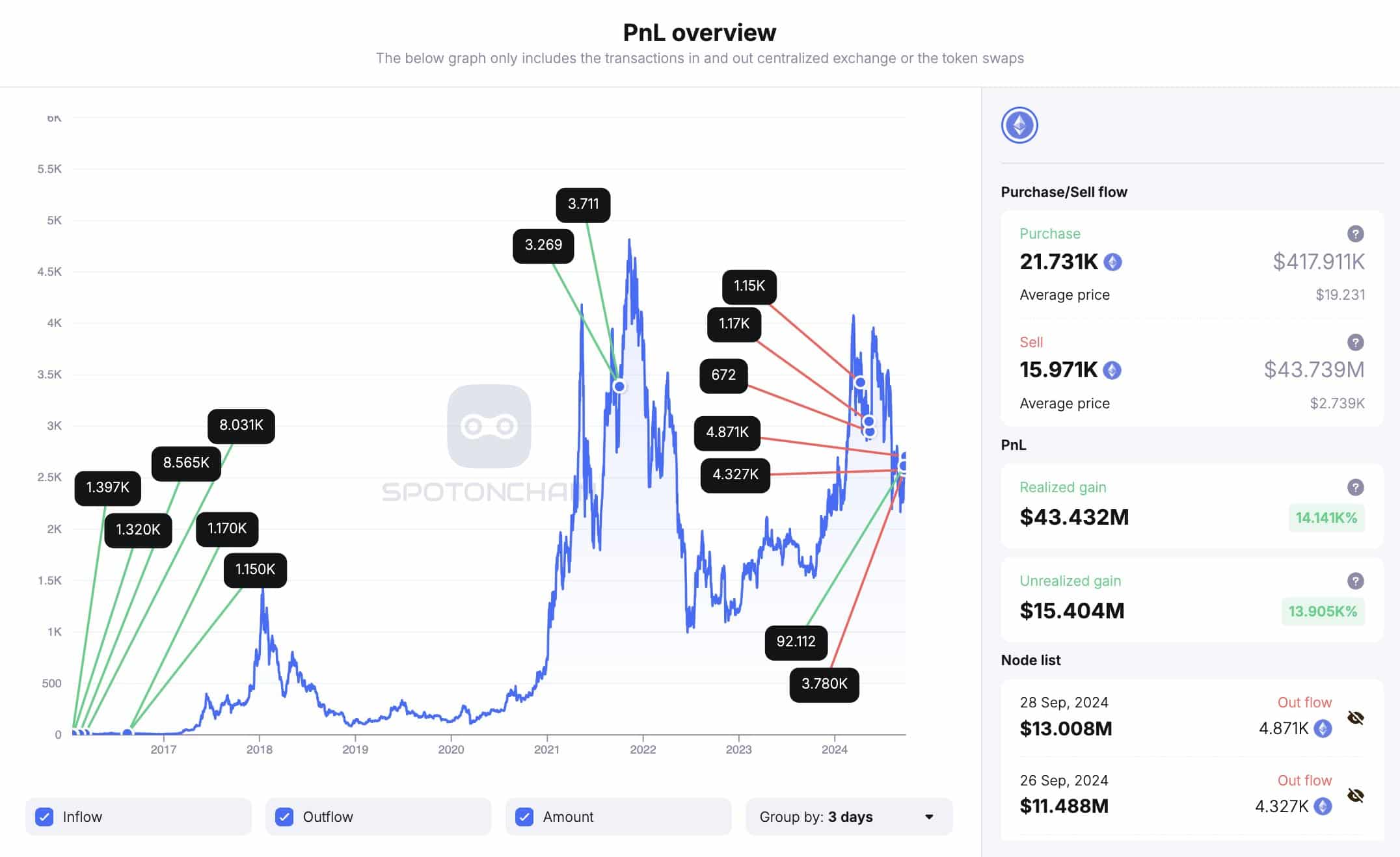

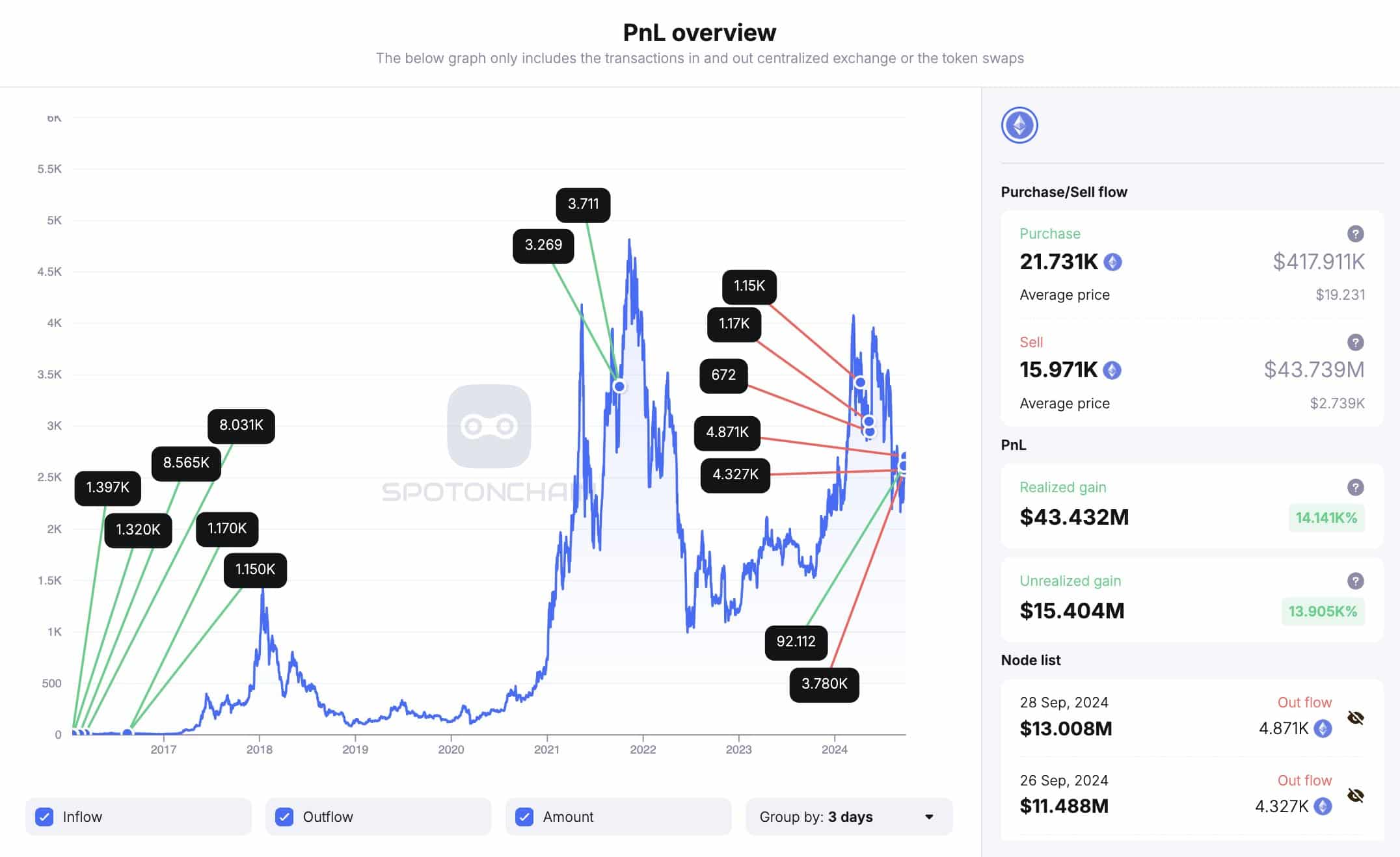

Elevated whale and institutional exercise

Better institutional and whaling exercise additional supported the case for the next ETH value. Just lately, an Ethereum whale that was idle for 4 months cashed in 12,979 ETH, making a revenue of $34.3 million.

This whale initially purchased ETH for simply $7.07 per token. This whale has since offered a complete of 15,879 ETH, making a revenue of $43.5 million.

With this whale nonetheless holding 5,760 ETH, value about $15.5 million, it means larger buyers are betting on ETH hitting the $3,200 goal. This renewed whale exercise is a powerful indicator of ETH’s bullish potential and additional helps the $3200 goal.

Supply: SpotOnChain

In the meantime, institutional actions additionally affect the market.

Two main establishments not too long ago offered off ETH. Cumberland, a buying and selling agency, deposited 11,800 ETH, value $31.88 million, into Coinbase. Fairly, ParaFi Capital withdrew 5,134 ETH from Lido and transferred it to Coinbase Prime.

Regardless of this promoting exercise, the rise in whale participation is an indication that many are nonetheless optimistic about Ethereum’s future value motion.

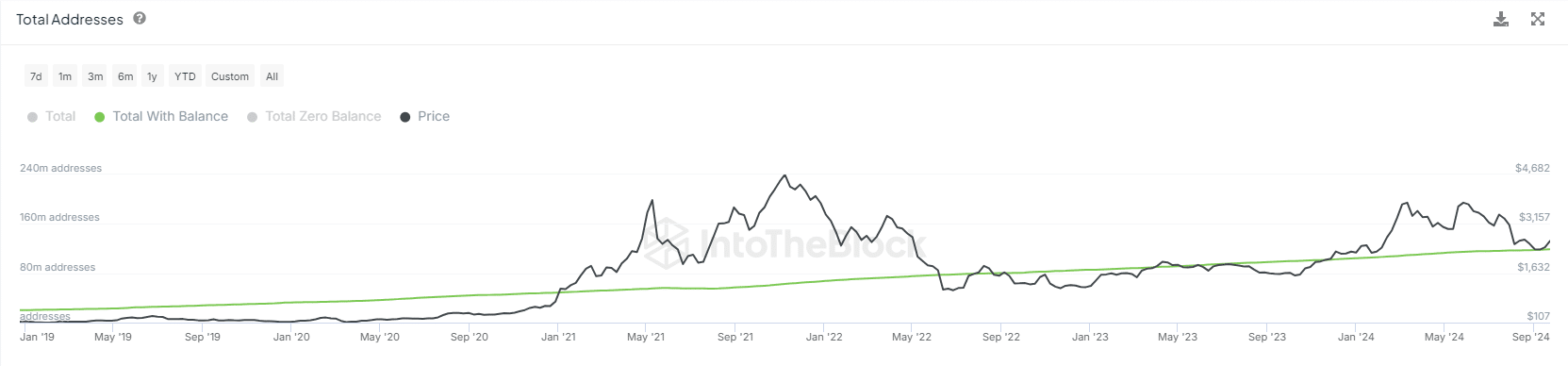

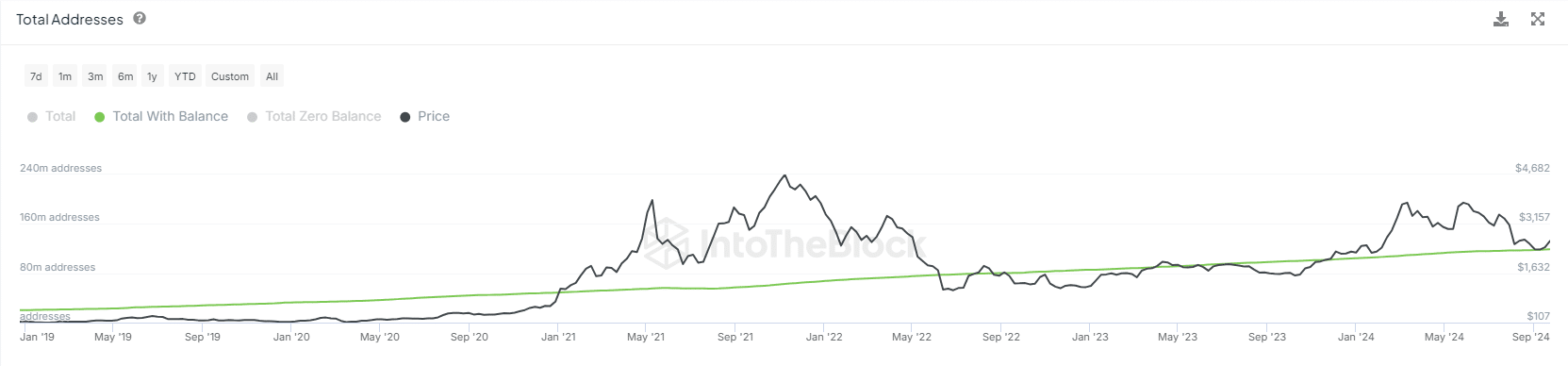

Stroll in ETH whole addresses with stability

One other optimistic sign for ETH is the rise within the whole variety of addresses with a stability. The rising variety of pockets addresses is a powerful indicator that extra buyers are getting into the Ethereum ecosystem.

This development is usually seen as a bullish sign, indicating that Ethereum adoption is rising as a result of its usefulness in decentralized finance (DeFi) and scalability options.

Supply: IntoTheBlock

The rise within the variety of pockets addresses may be interpreted as a brand new bullish sign pointing to ETH’s value goal of $3,200 within the final quarter of the 12 months. This era is traditionally identified for bullish crypto market exercise.

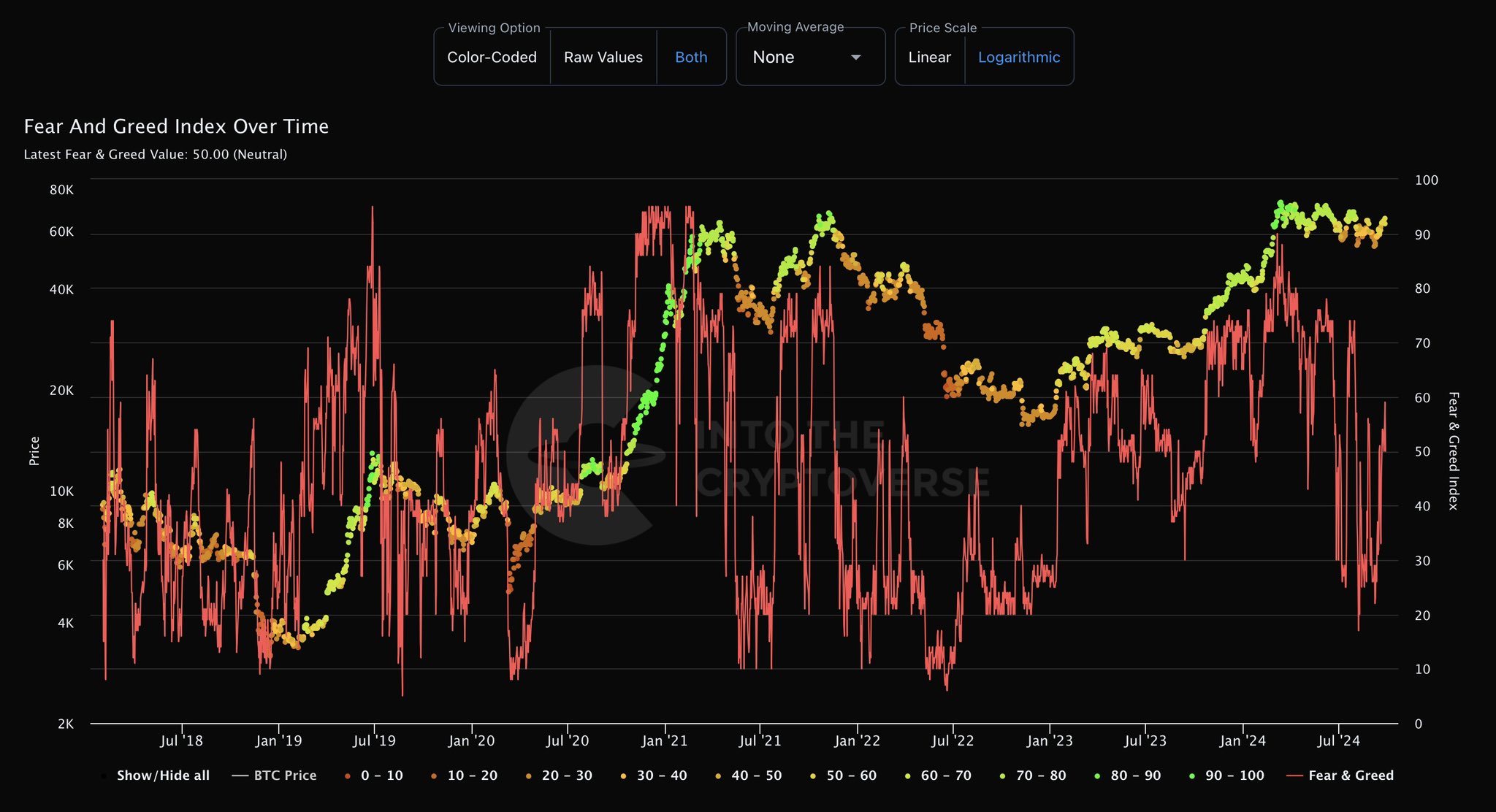

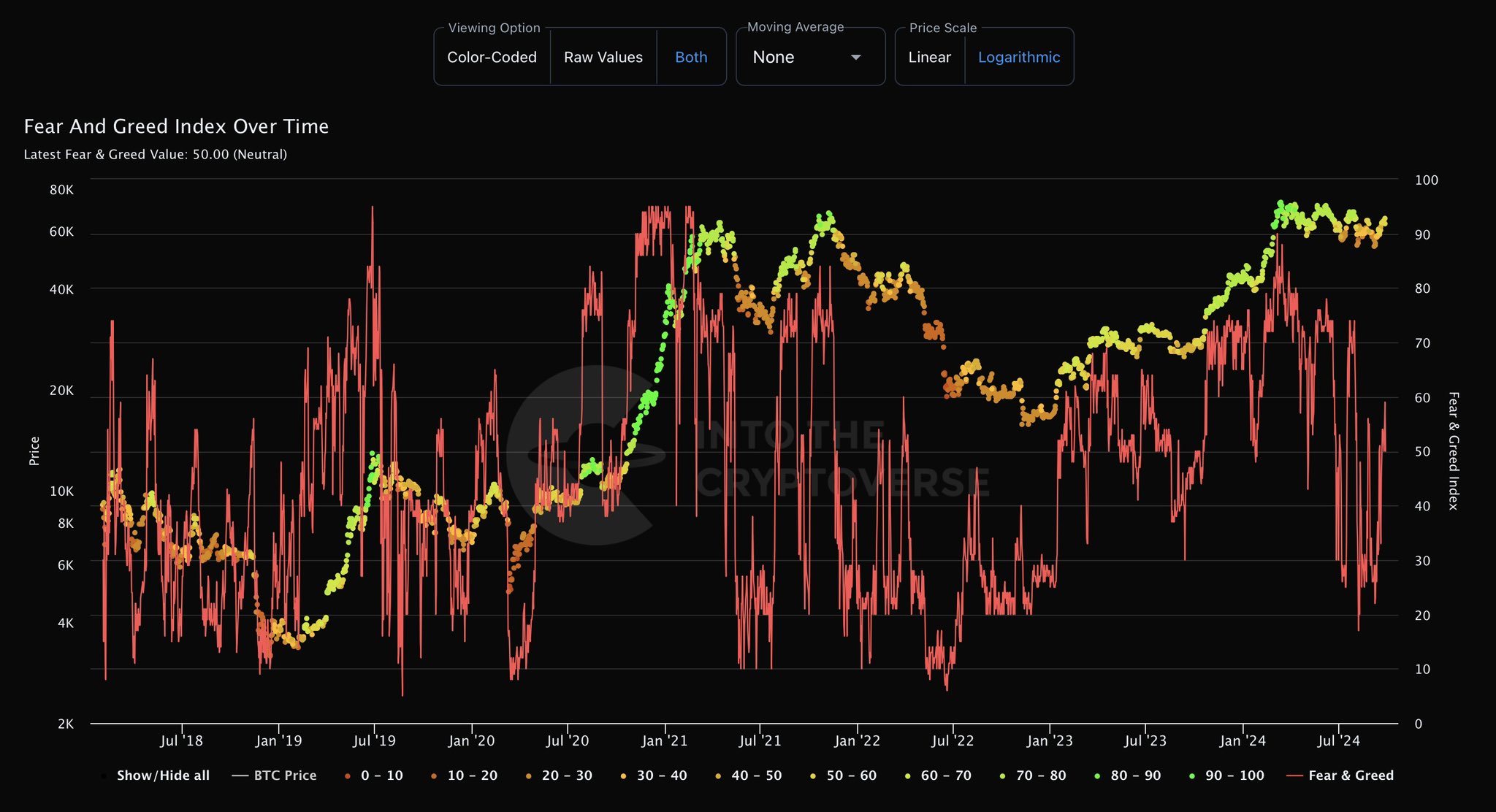

Worry and Greed Index is now impartial

The market’s optimism can be mirrored within the Worry and Greed Index, which moved to a impartial studying of fifty on the time of writing. This can be a optimistic shift after a protracted interval of utmost concern, particularly after the August 5 market crash.

Because the market begins to get better, extra merchants will seemingly be interested in ETH, making this a great time to build up extra ETH forward of the anticipated bullish transfer.

Traditionally, getting into the market when there may be impartial sentiment provides higher alternatives than ready for excessive greed. This typically signifies market tops.

Supply: IntoTheCryptoverse

Proper now, Ethereum is positioned to maneuver increased, pushed by whale exercise, elevated adoption and bettering market sentiment.

If ETH can break the USD 2,700 resistance, the following goal of USD 3,200 could possibly be inside attain.

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International