Layer 2

Ethereum sacrificed $100 million revenue for network growth

Credit : cryptoslate.com

The Ethereum blockchain recorded its strongest working 12 months in historical past in 2025, processing document transaction volumes and securing the overwhelming majority of the DeFi market.

Nonetheless, the crypto property powering the community did not mirror that development, posting double-digit losses this 12 months.

In response to Crypto Slates Information exhibits that ETH is down 10% this 12 months to lower than $3000. Efficiency in opposition to Bitcoin, the main digital asset, has additionally lagged, with the ETH/BTC ratio down 6% because the begin of the 12 months.

This distinction highlights a basic shift within the economics of the world’s most generally used business blockchain.

Whereas community provisioning has skyrocketed, technical upgrades designed to decrease prices for customers have considerably lowered the income flowing into the core community, decoupling Ether’s worth from on-rail exercise.

The lack of $100 million

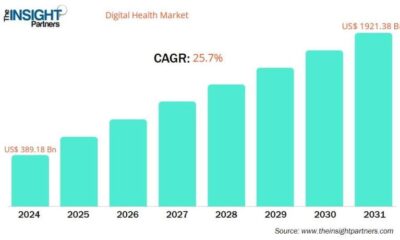

One of many greatest elements in Ethereum’s monetary profile this 12 months was the collapse of the ‘lease’ paid by Layer-2 networks.

These networks, which bundle transactions to avoid wasting charges earlier than deciding on the principle Ethereum blockchain, beforehand served as a significant supply of payment income.

In 2024, Layer-2 networks generated a complete of $277 million in income. Of that quantity, they paid roughly $113 million – or 41% – to the Ethereum mainnet to course of knowledge and safe the community.

In 2025, that income mannequin reversed. In response to Growthepie knowledge, whole income for Layer-2 networks fell 53% to $129.17 million as end-user charges have been lowered.

Nonetheless, charges paid to the Ethereum mainnet fell even additional. Layer-2 networks paid roughly $10 million in Ethereum for safety in 2025, representing lower than 10% of their whole income.

The remaining $119 million was retained as revenue by the Layer-2 operators.

In impact, this meant that Ethereum has sacrificed greater than $100 million in assured payment income this 12 months to make sure its long-term survival.

This lower is because of the “Dencun” improve applied final 12 months. The replace efficiently lowered transaction charges, successfully subsidizing the ecosystem’s development by lowering the income Ethereum collects from the ‘Layer-2’ networks constructed on high of it.

This allowed the community to deal with bigger site visitors volumes with out clogging the principle blockchain or peak fees.

Whereas the technical implementation succeeded in making Ethereum cheaper and sooner, it eliminated a significant driver of demand for the ETH token.

In earlier years, excessive community utilization resulted in excessive prices, a few of which have been “burned”, lowering provide and supporting worth.

With charges reaching document lows in 2025, deflationary pressures on token provide have weakened considerably. Consequently, Ethereum inflation has elevated by 0.204% because the merger in September 2022.

The Coinbase community dominates the revenue share

The realignment of Ethereum’s economics has created a consolidated marketplace for scaling options, with one dominant participant accounting for almost all of the sector’s revenues.

Base, the Layer-2 community developed by the listed US alternate Coinbase, generated greater than $75 million in income by 2025. This determine represents virtually 60% of your complete Layer-2 sector’s revenues for the 12 months.

Base’s monetary efficiency far exceeded its decentralized rivals. Arbitrum, which had a big market management place in earlier years, generated roughly $25 million in income, inserting second.

Different rivals noticed decrease values. The Polygon community generated $5 million in income, whereas Consensys-backed Linea introduced in $3.94 million. Optimism, one other early chief within the scale-up sector, earned about $3.83 million.

This focus of income marks a break from 2024, when the market was extra evenly distributed. Final 12 months, Arbitrum generated $42 million, Linea $36.6 million and Scroll $35 million.

The rise of Base means that distribution channels and consumer expertise have turn out to be the deciding elements within the scale wars.

By integrating the community straight into its alternate merchandise, Coinbase has efficiently pushed the retail enterprise onto its personal rails.

Consequently, a good portion of the worth generated by the Ethereum ecosystem now finally ends up on the steadiness sheet of a person enterprise entity moderately than the broader community contributors.

Market share reaches multi-year excessive

Regardless of ETH’s worth efficiency, institutional adoption of the Ethereum community continues to speed up.

Accessible knowledge signifies that buyers aren’t abandoning the ecosystem for sooner or cheaper different blockchains, a pattern that outlined the 2022 bear market.

For context, Ethereum’s dominance within the DeFi sector expanded all through 2024 and 2025. The blockchain community’s mainnet now secures roughly 64% of the entire worth locked (TVL) in DeFi purposes, up from a cycle low of roughly 45% in 2022.

Leon Waidmann, head of analysis at Onchain headquarters, posited that the Ethereum ecosystem’s market share rises above 70% when property held on Layer-2 networks reminiscent of Base, Arbitrum and Optimism are included.

This consolidation alerts a “flight to high quality” amongst main capital allocators.

Because the business matures, establishments are prioritizing the safety and authorized readability of Ethereum over the speculative advantages of newer, extra unstable blockchains.

The community has successfully turn out to be the settlement layer for the sector, at the same time as the precise mechanism for extracting worth from that exercise stays underneath strain.

On the similar time, analysts notice that the soundness of the ecosystem contrasts with earlier market cycles.

Transaction volumes are accelerating in direction of the top of the 12 months with out the blow-off high hypothesis sometimes seen throughout peaks, suggesting development is pushed by basic utilization moderately than short-term buying and selling frenzy.

Buyers weigh utility in opposition to worth

Nonetheless, the widening hole between Ethereum’s operational success and its market worth presents advanced prospects for buyers heading into 2026.

The ten% decline in ETH’s worth because the starting of the 12 months displays uncertainty concerning the token’s function on this new low-cost atmosphere.

With the mainnet successfully subsidizing the Layer-2 networks, the direct correlation between elevated transaction quantity and better token worth has been disrupted.

Trade observers level out that whereas the ecosystem is more healthy than ever, the monetary advantages are presently on the utility and scale layers.

Nonetheless, community supporters argue that it is a obligatory transition part. They declare that Ethereum has secured its place as the worldwide commonplace for blockchain settlement by decreasing prices and growing capability.

In response to them, this moat will finally drive long-term worth to the token, with BitMine chairman Tom Lee believing the asset may rise above $5,000 subsequent 12 months.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now