Bitcoin

Bitcoin: Historical trends indicate bullish outlook for BTC – here’s more!

Credit : ambcrypto.com

- Bitcoin’s reputation continues to be a small fraction of what it was in March 2024.

- The market cap charts gave bullish indicators for the long run.

Bitcoin [BTC] Market sentiment began to show bullish. The Crypto Worry and Greed Index stood at 63, displaying that greed prevailed available in the market after BTC raced previous the $64,000 resistance zone.

In a single message on Xperson Alex Becker famous that regardless of the joy inside the crypto neighborhood, curiosity from the broader market was minimal. It was only a fraction of the frenzy we noticed in the course of the 2020 run.

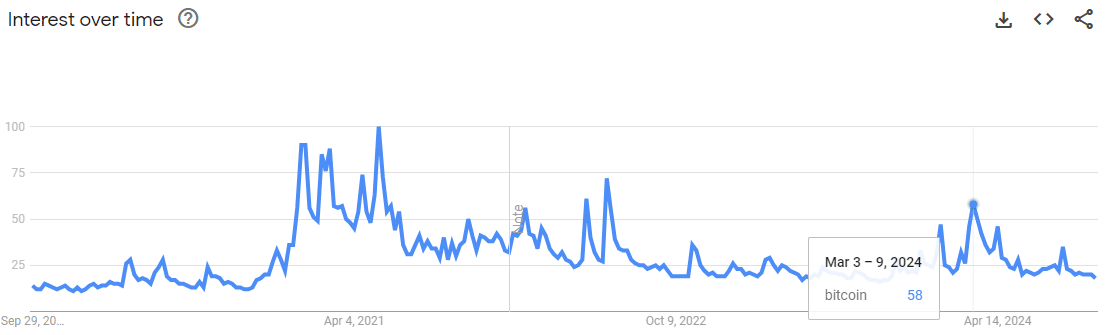

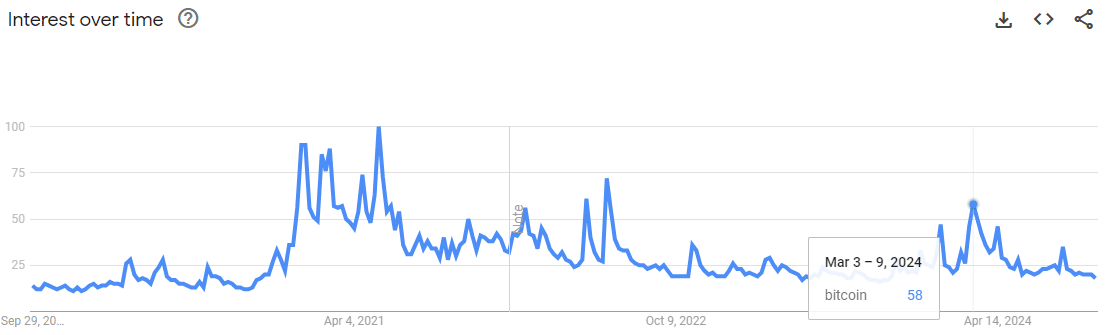

Supply: Google Tendencies

A take a look at the recognition of the time period ‘Bitcoin’ on Google Tendencies underlines this level. It reached the height of its reputation within the first half of 2021. Throughout the rally from October final yr to March 2024, BTC’s reputation reached a rating of 58.

In distinction, the rating it achieved final week was 20. This meant that Bitcoin searches are only a third of what they had been earlier this yr, with the king of crypto buying and selling simply 11% beneath its all-time excessive.

AMBCrypto took a more in-depth take a look at different charts to grasp what this implies for the broader crypto market.

Bitcoin dominance is the important thing to understanding the movement of capital

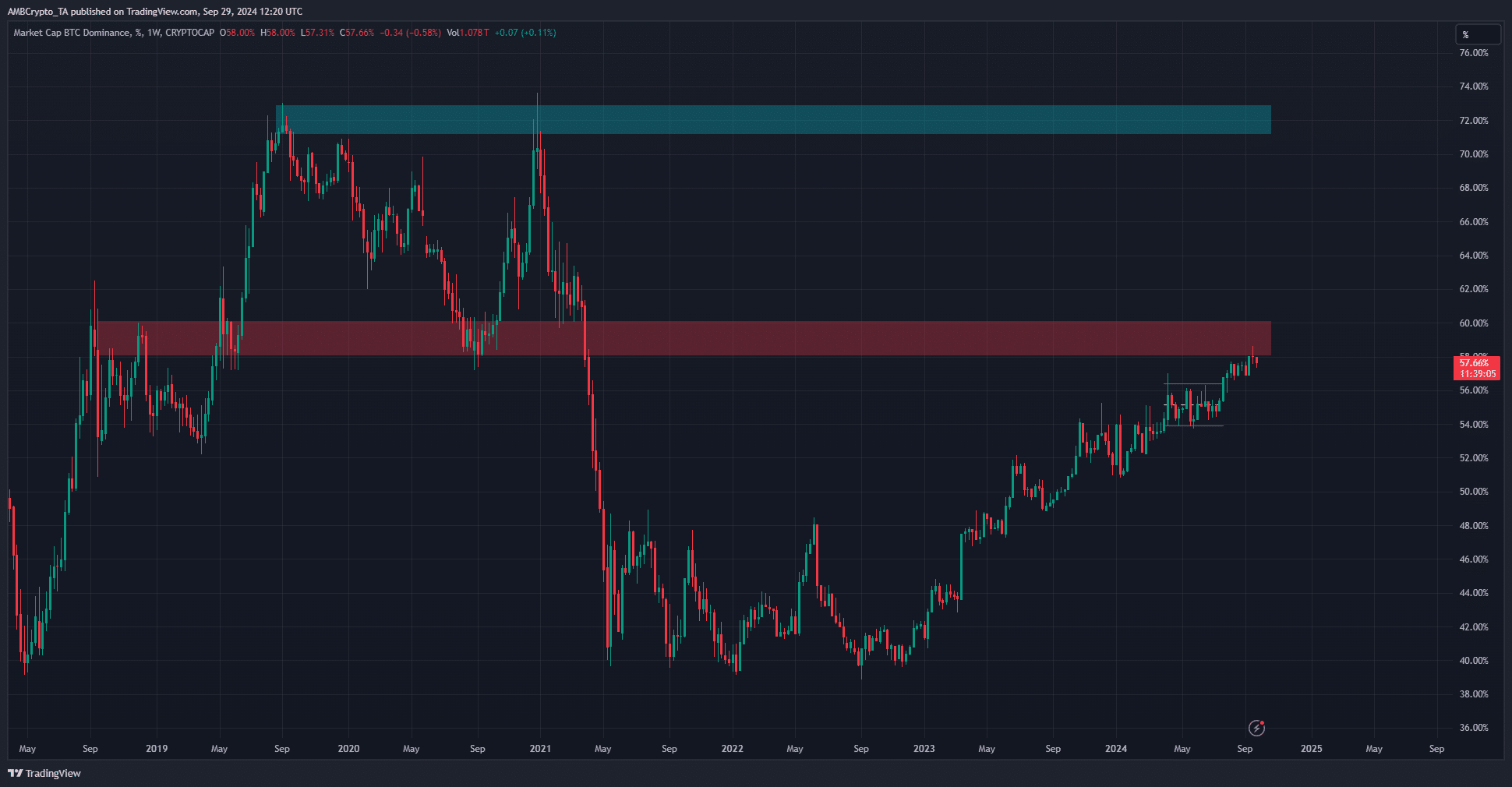

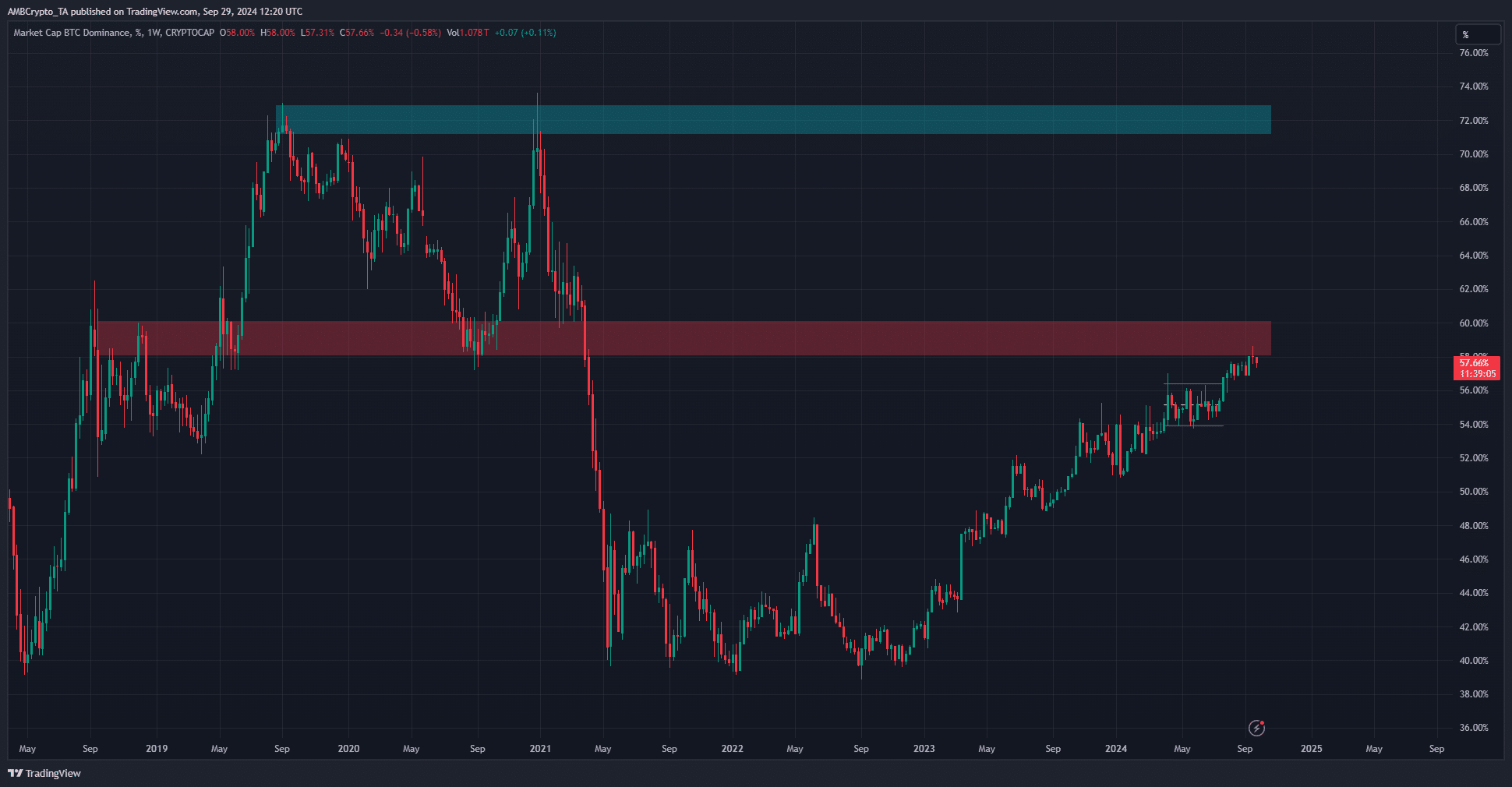

Supply: BTC.D on TradingView

On the time of writing, the whole crypto market capitalization was $2.3 trillion. Bitcoin Dominance, or BTC’s share of the whole market capitalization, stood at 57.66%. The weekly chart depicted the 60% space as a resistance zone.

The BTC.D chart usually has an inverse correlation with how properly alts carry out. A decline in BTC.D implies that the market capitalization of altcoins will rise quicker than that of BTC, which might be a optimistic improvement for the alt market.

Nevertheless, in comparison with the 2020 cycle, we see that it could be excellent if Bitcoin can begin a long-term upward development to draw capital to the crypto market. As soon as it does, this capital can ‘rotate’ into different altcoin sectors, benefiting merchants and traders.

Lengthy-term traders can use this dominance chart to grasp whether or not Bitcoin or the altcoins are the main target of the market at any given time.

One other optimistic signal for the alt season

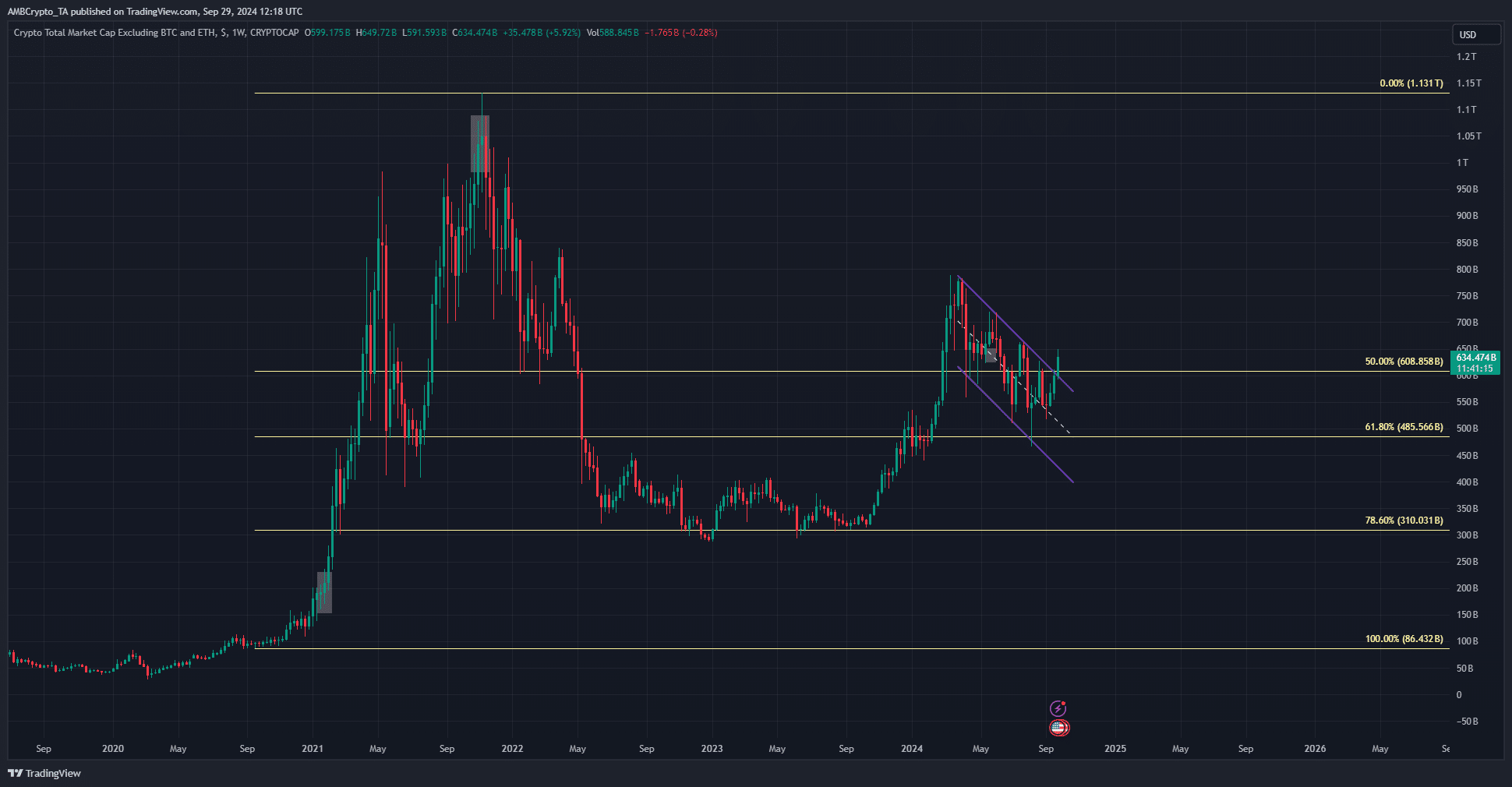

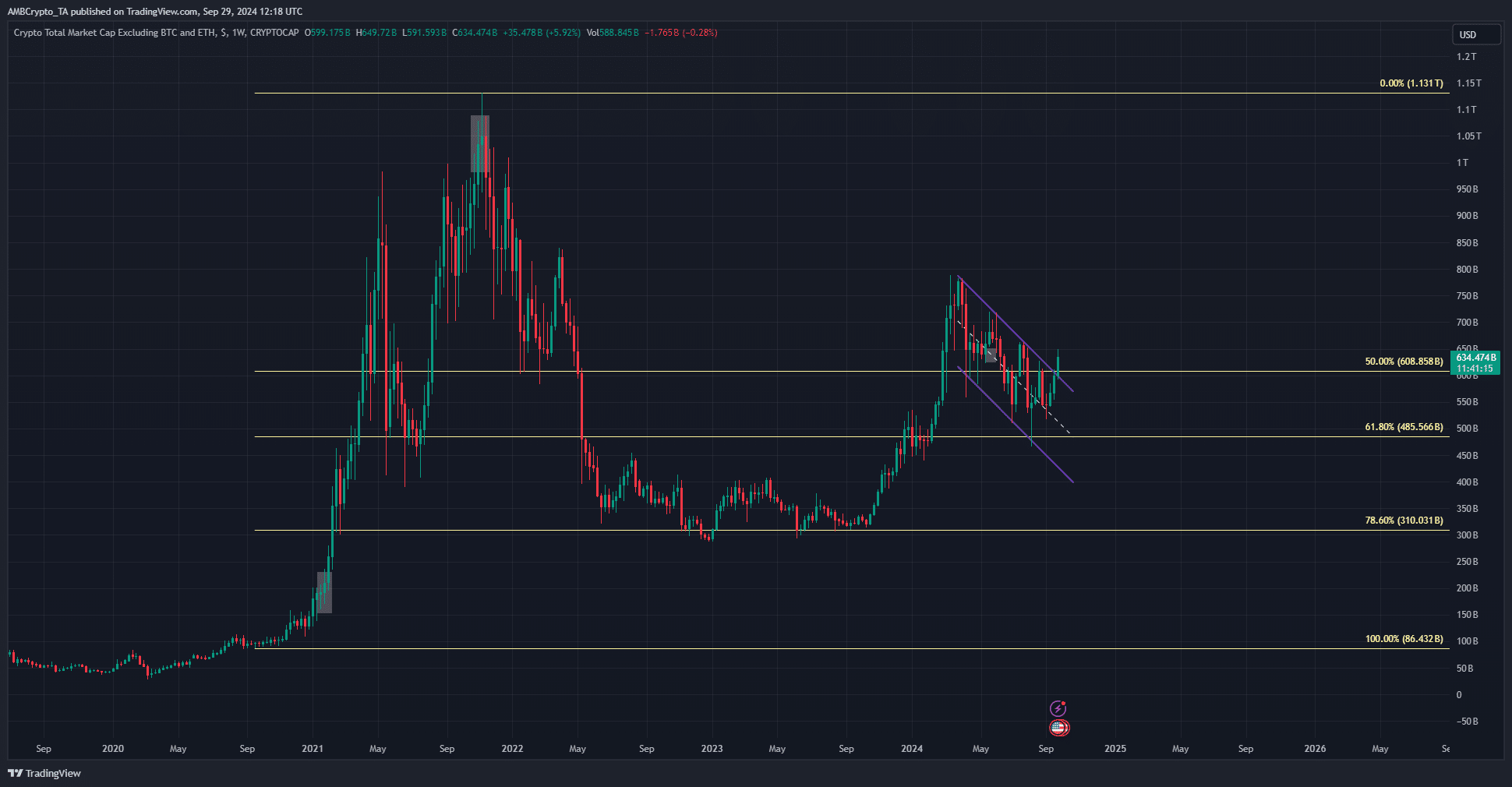

Supply: TOTAL3 on TradingView

The market capitalization of the main crypto property, excluding Bitcoin and Ethereum [ETH] are proven within the graph above. It broke out alongside a descending channel formation.

Learn Bitcoin’s [BTC] Value forecast 2024-25

In doing so, it additionally breached the 50% Fibonacci retracement degree of the 2020 bull run.

This set the stage for robust altcoin efficiency within the coming months. From a technical perspective and historic tendencies, the one manner the crypto market can develop is with a rise over the subsequent three to 6 months.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024