Ethereum

Ethereum price prediction shows bulls might struggle from THIS point

Credit : ambcrypto.com

- ETH’s efficiency towards Bitcoin was lower than supreme, resulting in a weekly bearish construction.

- Till the $2.8k and $3k ranges are breached, the outlook will stay bearish.

Ethereum [ETH] witnessed a continued enhance in fuel charges as community exercise elevated. That is partly attributed to the rising use of decentralized finance (DeFi) platforms on the community and rising ETH switch volumes.

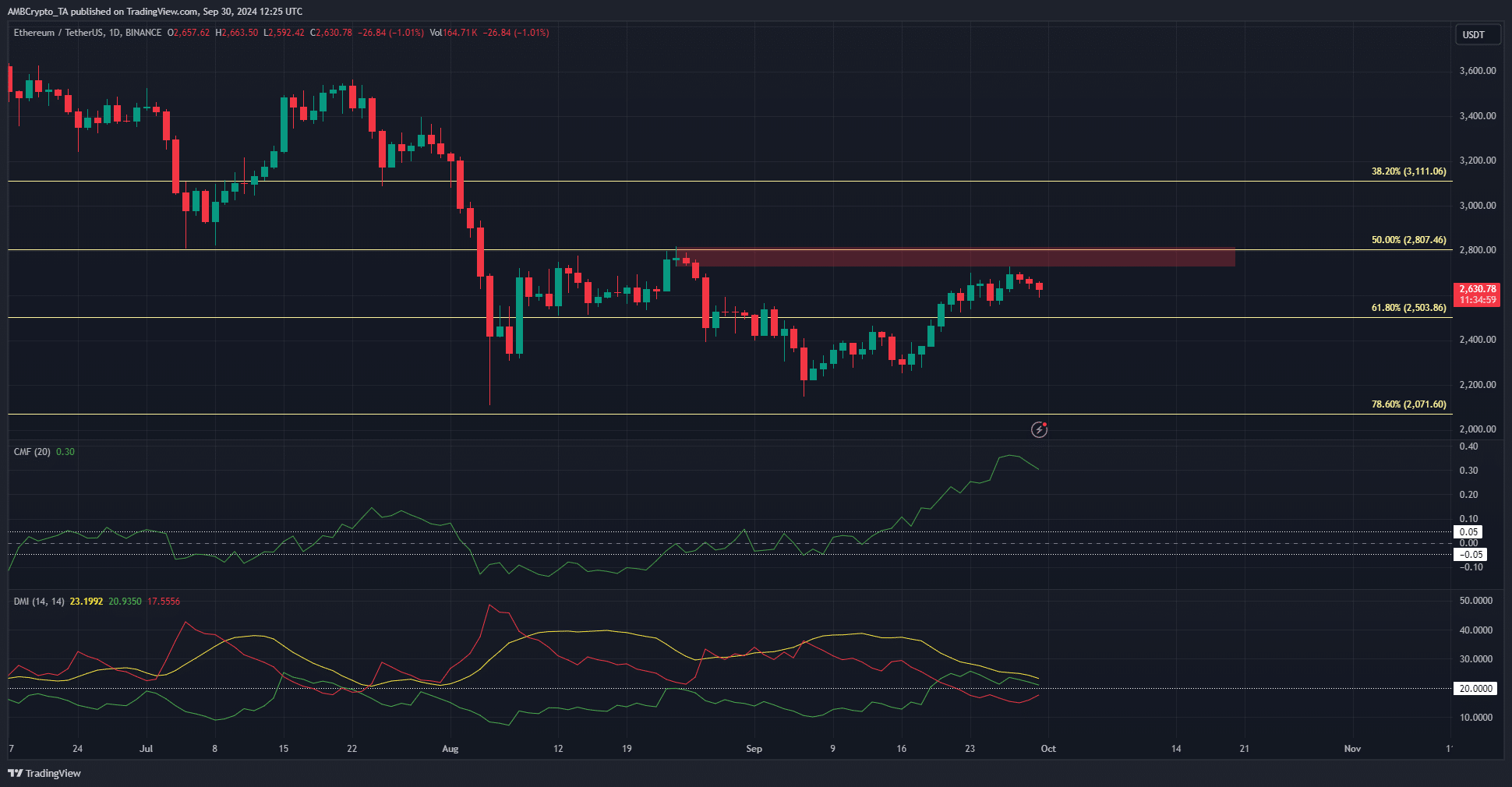

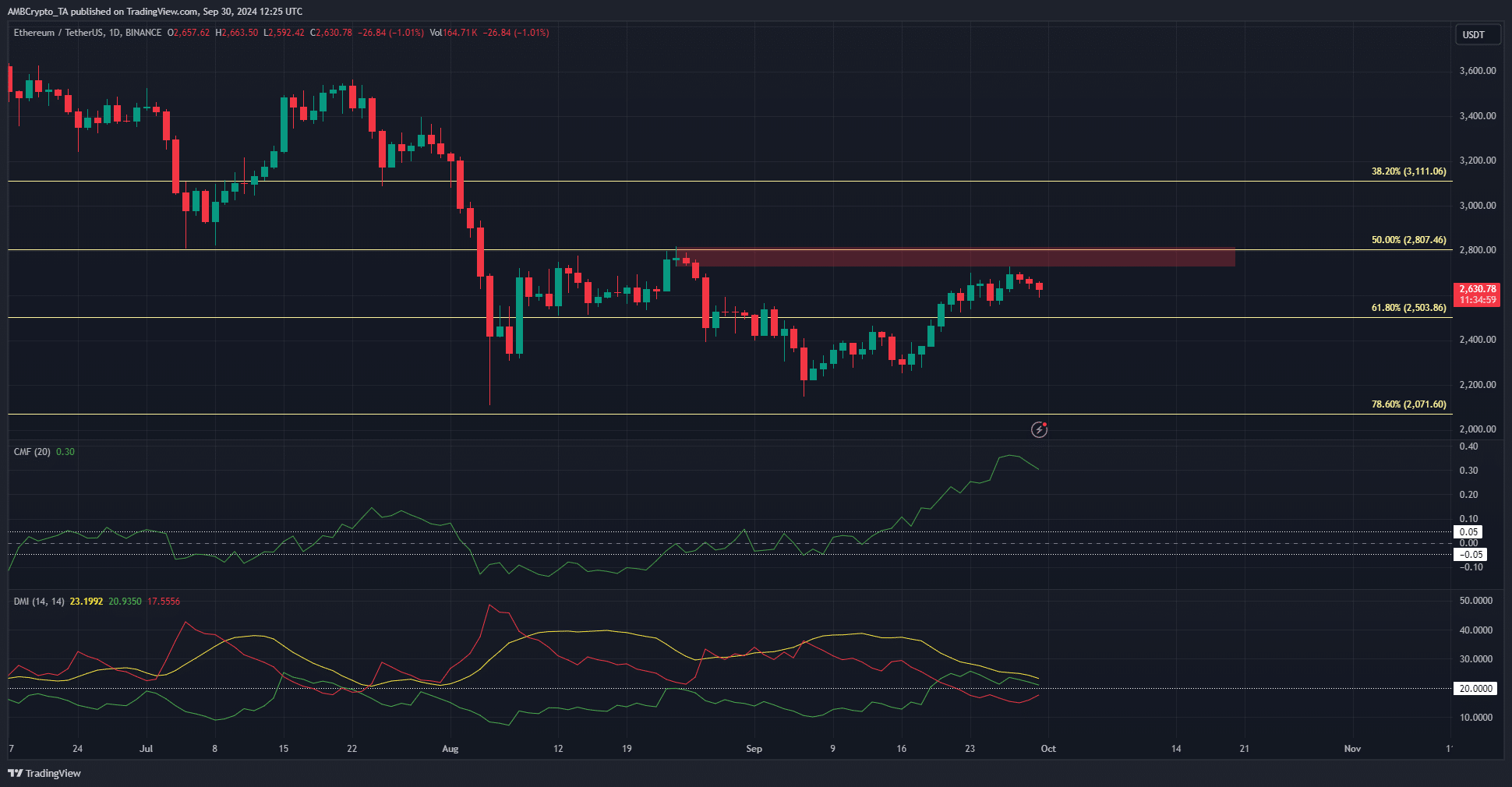

Technical evaluation exhibits that whereas market construction and momentum have been bullish on the day, key resistance ranges stay to be damaged overhead.

Ethereum has misplaced a whole lot of floor through the consolidation

Supply: ETH/USDT on TradingView

Since March highs, Bitcoin [BTC] was solely down 13.4% on the time of writing. Compared, ETH fell 35.8%. This dismal efficiency towards the king of crypto meant that Ethereum’s value forecast favored a bearish outlook till the $3k resistance was damaged.

The weekly chart is in a downtrend and the latest decrease excessive to beat is at $2,820. Moreover these two ranges, the $3.6k space could be the subsequent main problem.

The CMF stood at +0.3, reaching a excessive on the every day chart not seen since March. This comparatively excessive shopping for stress has led to a 16.7% enhance in belongings over the previous two weeks.

The ADX (yellow) and the +DI (inexperienced) on the DMI have been above 20, indicating a powerful development and a bullish development, respectively. Regardless of this, the 50% Fibonacci retracement degree continued to carry again the bulls.

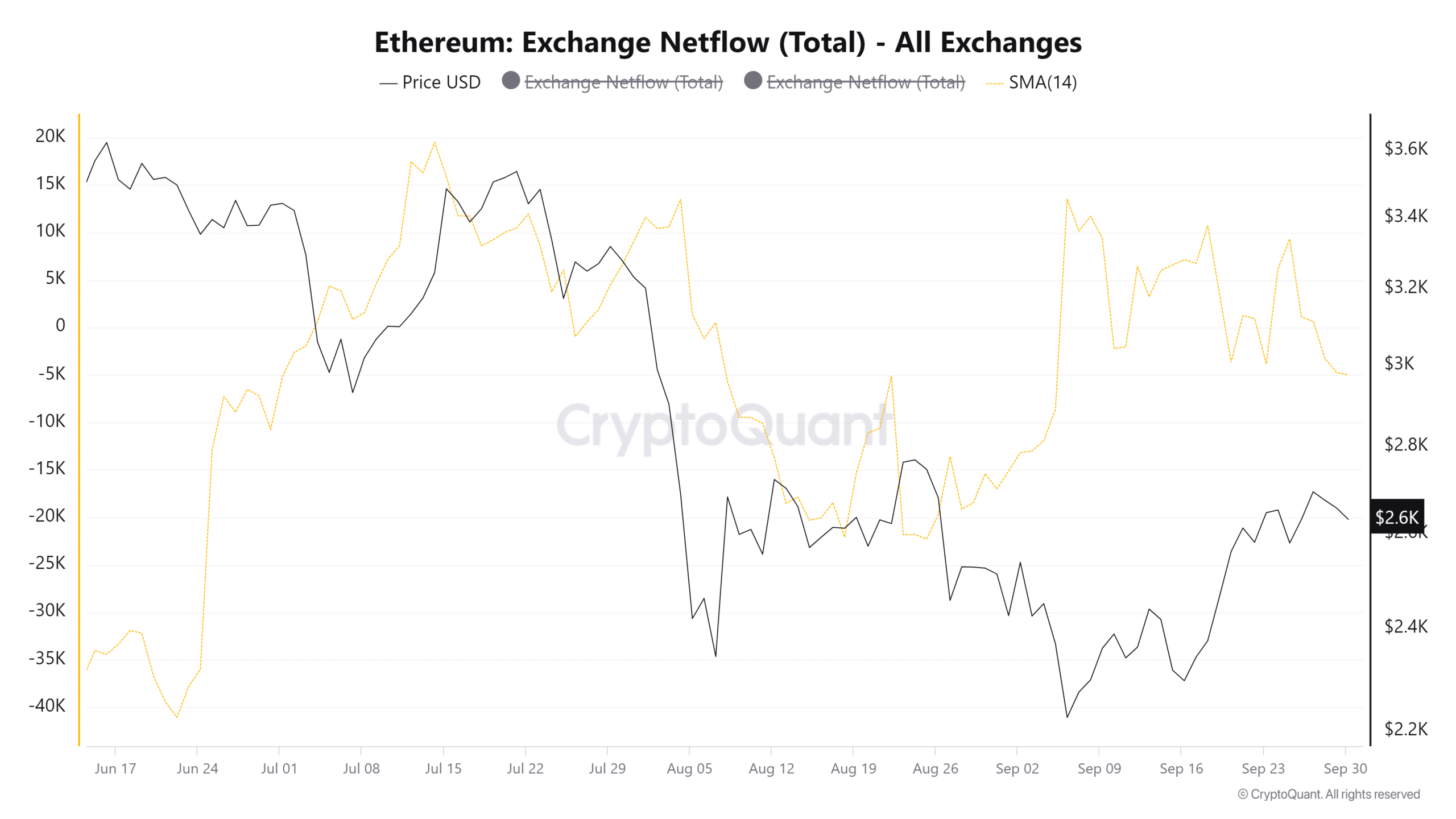

Netflows present indications of development power

Since late July, the move of Ethereum from centralized exchanges has been primarily outward. This supported the thought of accumulation. Nevertheless, it wasn’t as robust because it was in February or November 2023.

Is your portfolio inexperienced? Test the Ethereum revenue calculator

Furthermore, web flows had many constructive days over the previous two weeks. The quantity wasn’t excessive sufficient to name it an exodus, but it surely additionally confirmed that some holders have been desperate to take income. This might have one thing to do with ETH’s efficiency since March.

As issues stand, the netflows chart didn’t assist a strongly bullish Ethereum value forecast for the subsequent 4 to eight weeks.

Disclaimer: The knowledge offered doesn’t represent monetary recommendation, funding recommendation, buying and selling recommendation or another type of recommendation and is solely the opinion of the author

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024