Altcoin

Ethereum: Profit Taking Curbs Potential Rally – Will ETH See $4K?

Credit : ambcrypto.com

- Ethereum Futures rose 40% in quantity as merchants positioned themselves for potential value strikes.

- Revenue-taking by buyers limits a serious ETH rally regardless of elevated outflows from exchanges.

Ethereums [ETH] The value goes via a interval of volatility, with fluctuating highs and lows in latest weeks.

After a short dip beneath $2,600, Ethereum’s value is exhibiting indicators of restoration $2,645.52 at press time.

Over the previous 24 hours, the worth has risen 0.29%, whereas the previous week has seen a small decline of 0.12%. Ethereum’s market capitalization was $318.46 billion, with a 24-hour buying and selling quantity of over $17.88 billion.

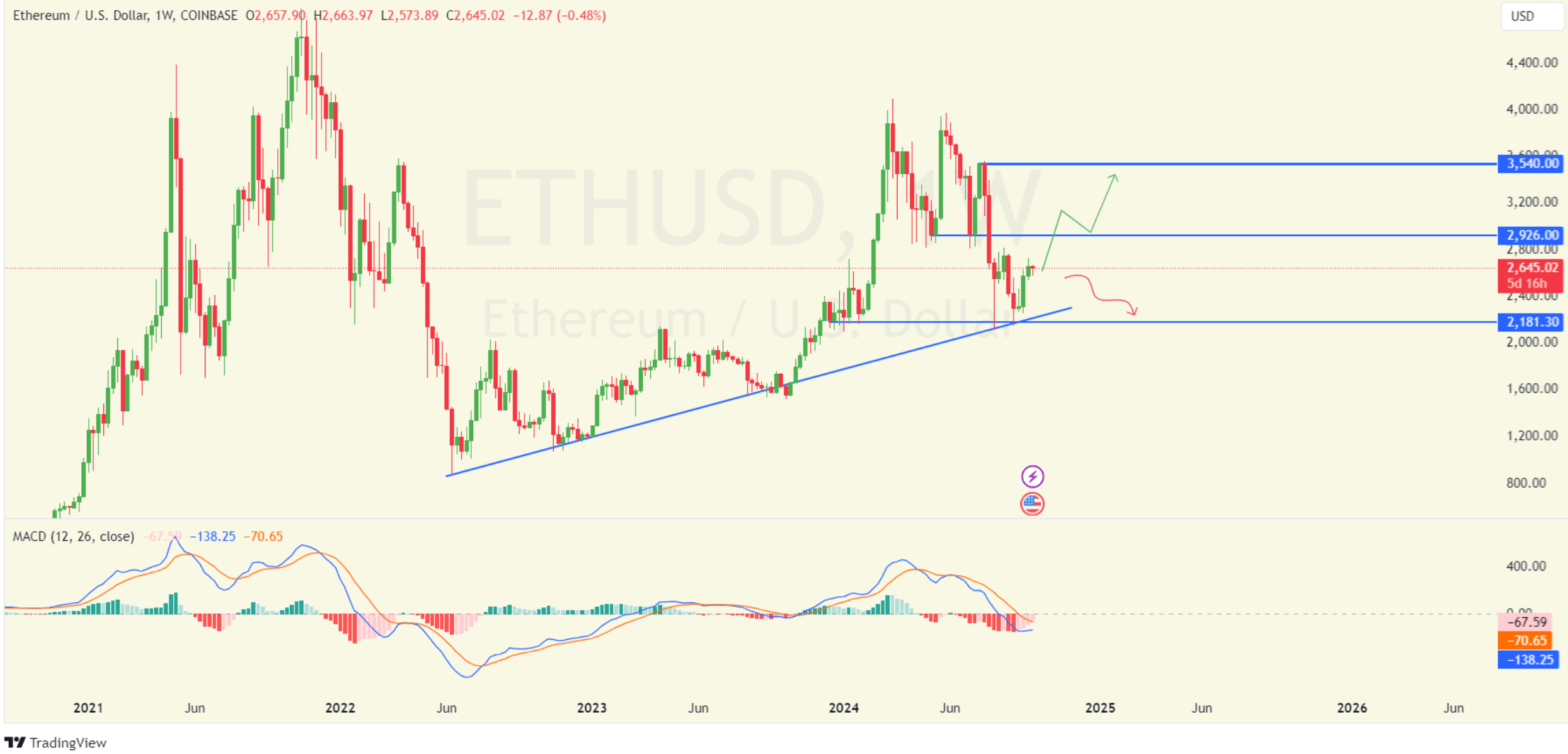

Necessary technical ranges to look at

Ethereum value is close to a crucial assist degree of $2,181.30. This degree is bolstered by a rising trendline that has supported the crypto since mid-2022.

Ought to Ethereum break beneath this assist, the market may see a downtrend, probably resulting in additional value declines.

Then again, Ethereum is going through resistance round $2,926. A break above this resistance may ship the worth larger, with a possible goal of $3,540.

If shopping for momentum strengthens, the worth may even check earlier highs round $4,000.

For bullish buyers, the upward pattern line will play an important function in sustaining market confidence.

Supply: TradingView

Ethereum Futures Rise Throughout Occasions of Volatility

The MACD indicator for Ethereum confirmed bearish sentiment, with each the MACD line and sign line beneath zero.

Nevertheless, if the MACD histogram had been to begin exhibiting constructive motion, it may sign a reversal, which might assist a extra bullish situation for Ethereum within the coming weeks.

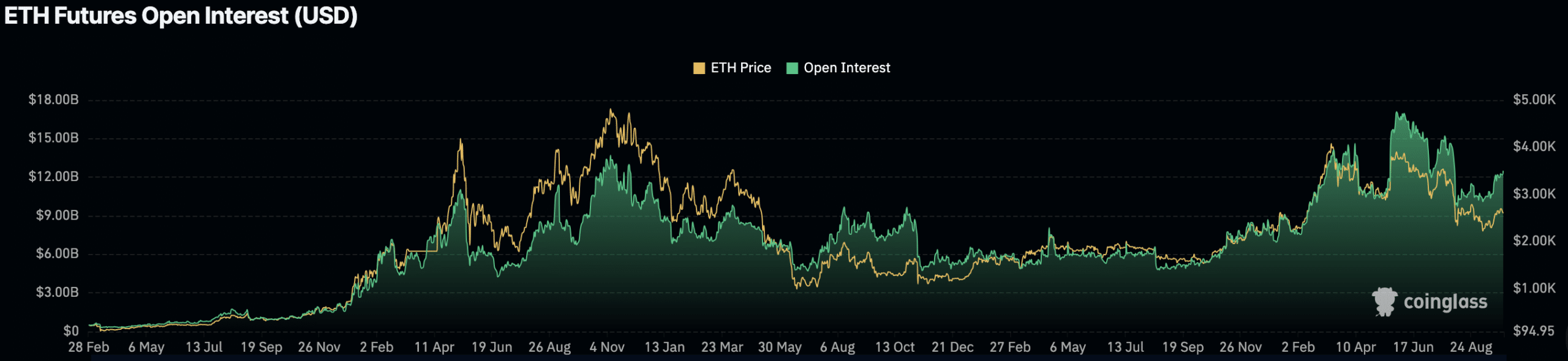

Latest futures information from Coinglass revealed elevated exercise within the Ethereum market. Open curiosity in ETH futures has risen 2.94% and now stands at $12.66 billion, indicating rising curiosity from merchants.

Supply: Coinglass

Moreover, ETH Futures quantity elevated 40.39% to $25.63 billion, whereas Choices quantity elevated 258.39% to $564.17 million.

These will increase mirrored rising participation in Ethereum Futures buying and selling, indicating market members are positioning themselves for potential value actions.

Revenue taking, not accumulation

A overview by AMBCrypto famous that since late July, Ethereum outflows from centralized exchanges have elevated, indicating accumulation by some buyers.

Nevertheless, this accumulation was not as intense as in February or November 2023. Over the previous two weeks, internet flows have seen numerous constructive days, indicating that some holders have been taking income.

Whereas the amount of those outflows just isn’t massive sufficient to point an exodus, it does point out that a part of the market is selecting to reap the benefits of the latest value beneficial properties.

Learn Ethereum’s [ETH] Value forecast 2024–2025

The netflows information means that whereas there may be some accumulation, it might not be sufficient to spark a serious bullish rally for Ethereum within the close to time period.

As an alternative, profit-taking seems to be the dominant habits as some holders profit from Ethereum’s efficiency since March 2024.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024