Gaming

The rise and fall of “to-earn” projects

Credit : cryptonews.net

Folks have all the time been keen for straightforward cash by means of video games, strikes or faucets, however typically it ends sadly. Is there a future for incomes cash for on a regular basis actions?

The Hamster Kombat airdrop has saddened 1000’s, if not thousands and thousands, of customers. Nevertheless, this state of affairs just isn’t new: the crypto neighborhood has already seen the speedy rise and fall of assorted mechanisms that supposedly make it potential to become profitable from easy actions. What have we discovered from that?

Desk of contents

Early look: hope for steady revenue

The rise of web3 video games has created an enormous curiosity in incomes cryptocurrency by means of fairly easy actions. Play-to-earn (P2E) video games have turn out to be a brand new sort through which customers can earn cryptocurrency and NFTs by means of actions.

Axie Infinity was a pioneer on this discipline. To begin the sport, customers wanted beginning capital to buy Axie, a digital NFT pet. Customers might earn tokens by finishing duties, taking part in battles with different gamers, and reaching ranges within the recreation. Tokens had been exchanged for different digital or fiat currencies, and gadgets may very well be bought on crypto exchanges and NFT marketplaces.

And, no joke, as a pioneer, the sport was thought-about an actual revenue choice for a very long time. It grew to become particularly standard within the Philippines. In 2020, when the entire world was hit by a pandemic, borders had been closed and folks began dropping their jobs, enterprising Filipino crypto fanatics began creating guilds, providing extraordinary customers the chance to become profitable from P2E video games .

Nevertheless, Axie Infinity was ruined by in-game inflation. Because of its fixed development, the value of its utility token, Easy Love Potion (SLP), started to say no. Sustaining the excessive demand for SLP and AXS (the governance token) would require an infinite variety of new registrations, together with gamers who’ve neither one nor the opposite..

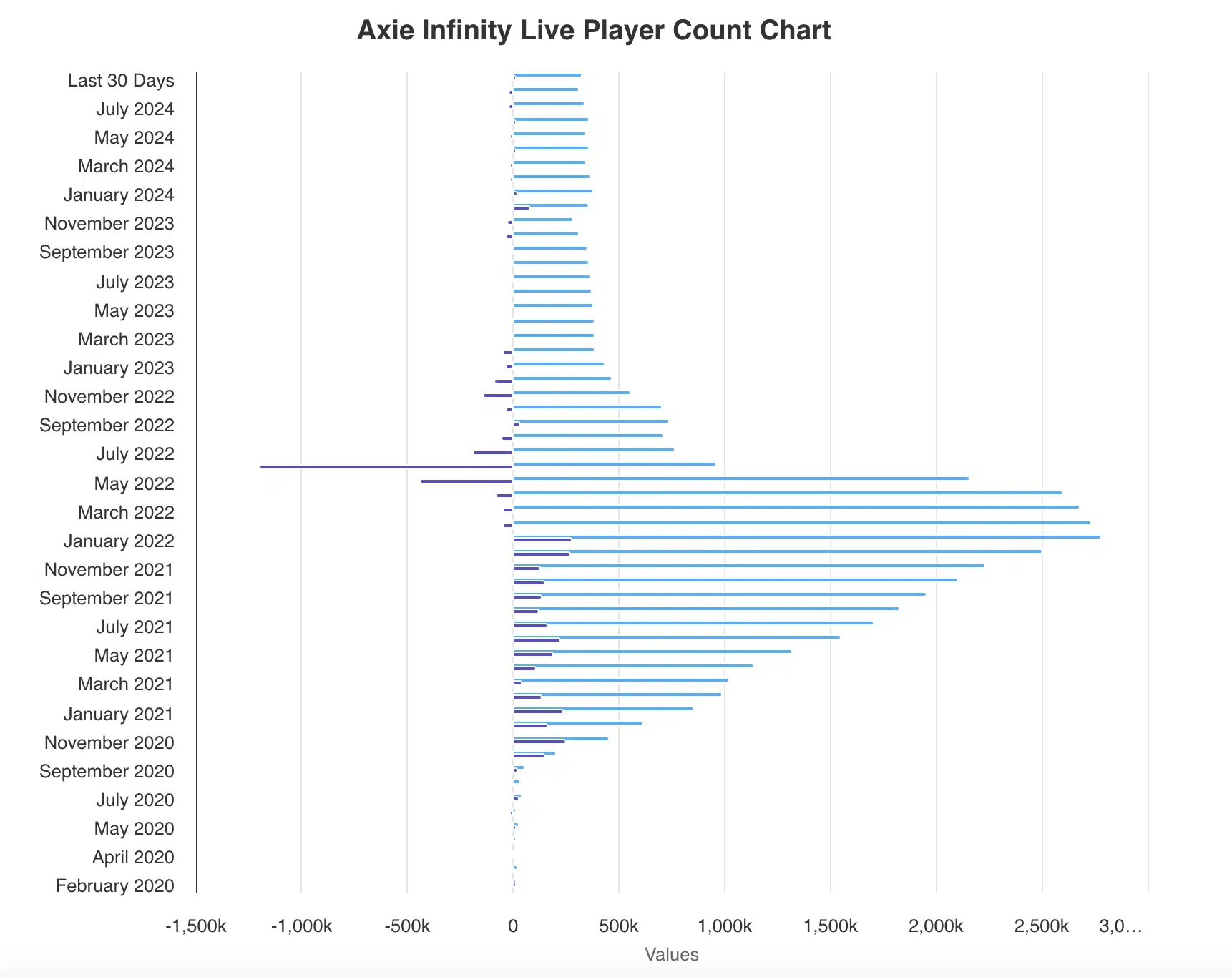

If the variety of month-to-month lively customers (MAU) was over 2.7 million at its peak, then in July 2024 this quantity was simply over 310,000. The decline within the Axie Infinity indicators occurred through the correction interval of the whole digital asset market, after Bitcoin (BTC) reached its earlier all-time excessive (ATH) on November 10, 2021.

Axie Infinity month-to-month lively customers. Supply: Lively participant

The huge hacking of the sport in March 2022 performed an important position within the decline in reputation. The outflow and lack of latest customers meant that current customers might not become profitable. The tales of some platform customers turned out to be even sadder. In an try to become profitable from investing within the recreation, some gamers fell into debt. They didn’t become profitable on the challenge.

Wholesome habits are changing gaming, however not for lengthy

In opposition to the backdrop of the decline of the P2E gaming period, a brand new breed of monetization with the move-to-earn mechanism entered the Web3 enviornment. The very best-known instance of such a recreation is STEPN.

Nevertheless, profitability fell considerably resulting from an inflow of customers, and a few consultants themselves found indicators of a monetary pyramid within the STEPN mechanics.

On the identical time, the suspicions concerning the challenge don’t change the truth that the early gamers of the platform really managed to make good cash. Customers had been capable of recoup their investments, whereas losses considerably exceeded the earnings of those that participated within the hype section.

Why did a recreation geared toward educating wholesome habits fail? The associated fee retention mechanisms established by the challenge crew didn’t justify themselves. STEPN was ruined by its reputation: as a substitute of utilizing in-game tokens, Inexperienced Satoshi Token (GST), customers actively transformed them into tradable tokens, Inexperienced Metaverse Token (GMT), hoping for additional development, particularly after the spring 2022 rally, when the token reached an ATH of $4.11.

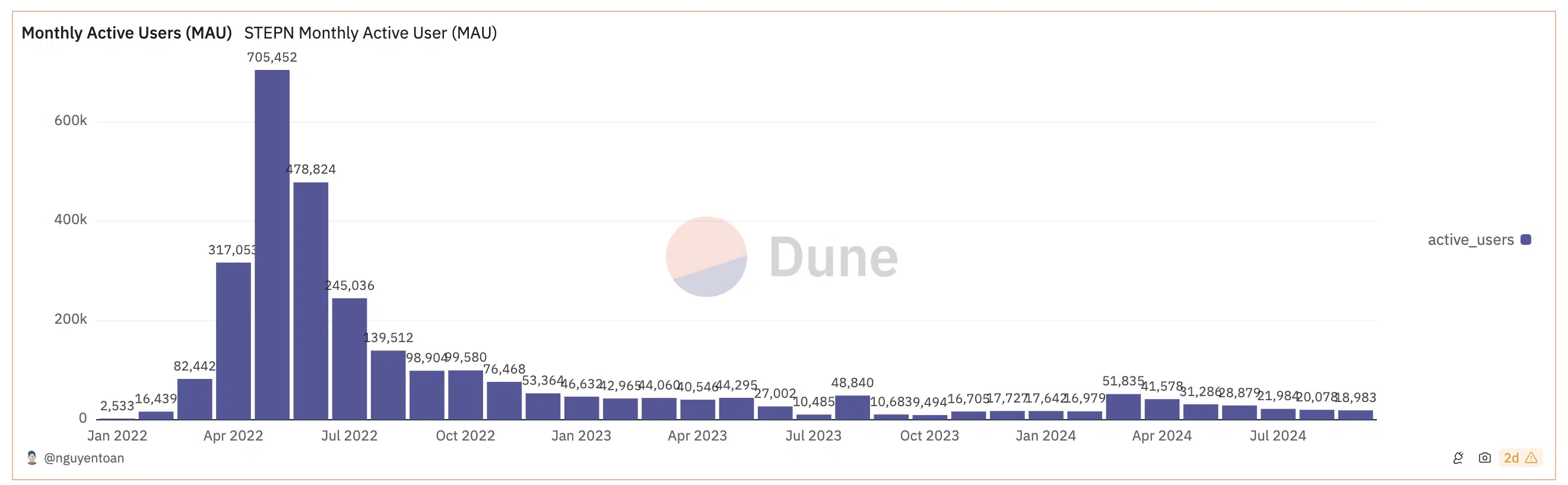

In keeping with Dune, the challenge additionally noticed a major drop in MAU: in Could 2022 this quantity was greater than 705,000, and by September 2024 it was already lower than 19,000.

STEPN month-to-month lively customers. Supply: Dune

The creators of the challenge state on the official web site that the play-to-earn format could be seen as a part of a Ponzi scheme, however STEPN has nothing in widespread with that. In keeping with them, the builders have constructed sturdy tokenomics into the platform, guaranteeing the coin worth stability of the challenge.

Primarily, nonetheless, STEPN had no actual financial system and lived off the cash of latest customers who purchased 1000’s of {dollars} value of digital objects hoping to get their funding again in just a few months whereas doing imaginary, ineffective work.

Sustaining the required viewers exercise requires a gradual inflow of latest gamers buying recreation foreign money and NFT artifacts from previous gamers. With an enormous inflow of latest individuals, such initiatives are potential. Nevertheless, the precept of revenue sharing in do-to-earn differs from the traditional Ponzi scheme and is extra just like retail buying and selling.

STEPN has been round for a yr and the provide of doing one thing easy and getting paid for it attracts individuals who like straightforward cash. On the time of writing, the value of the unique GMT token is $0.1464, which is 96% lower than ATH.

You may also like: Fundamentals of Enjoying to Earn: Learn how to Get Began and What You Can Earn

Mechanics turn out to be easier

One other department of evolution within the “incomes” phase was the tap-to-earn mechanism. These video games made incomes even simpler for customers than their predecessors. If earlier gamers had been supplied a minimum of some gameplay, tap-to-earn permits customers to earn cash by merely tapping the display screen.

One of the crucial standard initiatives on this phase was Hamster Kombat: with the assist of thousands and thousands of customers, the challenge acquired a serious wave of discontent as a result of measurement of the airdrop.

Had been there any indicators that would level to Hamster Kombat’s demise? In fact, it’s sufficient to have a look at the challenge’s tokenomics and viewers.

So 75% of the token provide is meant for the neighborhood. On the identical time, a major a part of the viewers consists of newcomers or freebie lovers. Such an viewers could also be inclined to promote tokens rapidly, placing quite a lot of stress on the coin value after the itemizing. Moreover, the challenge crew has just about not revealed the long-term worth of the coin.

Due to its referral mechanisms, Hamster Kombat has constructed a powerful base of thousands and thousands of customers. Nevertheless, this additionally created an extra danger of the challenge’s collapse as customers rushed to do away with the tokens after the itemizing.

Will the neighborhood be taught from previous failures?

Commenting on crypto.information, Yat Siu, co-founder and govt chairman of Animoca Manufacturers, defined {that a} vital downside for blockchain video games is the shortage of established mass distribution channels. Main platforms such because the Apple App Retailer and Steam typically prohibit video games containing NFTs and restrict their mass attain.

“Nevertheless, as extra avid gamers work together with the blockchain by means of simply accessible Telegram Mini Apps, we will anticipate that the rising reputation of those merchandise will encourage mainstream recreation builders to speculate extra boldly within the web3 gaming business. This path is just like how early cell video games advanced from a distinct segment despised by a lot of the standard gaming business to a dominant gaming enterprise mannequin.”

Bozena Rezab, co-founder and chairman of GAMEE, then again, is bound that the phenomenon of such video games is principally that they stimulate the mass adoption of cryptocurrencies, which is nice for the business. For instance, she recalled that 131 million customers acquired Hamster Kombat tokens – this determine is far greater than earlier Web3 engagement charges, which usually exceeded 1000’s or maybe tens of 1000’s of individuals.

“This can be a clear indication of the potential of informal gaming and Telegram to drive cryptocurrency adoption.”

Is there any hope of creating wealth?

Who makes cash from monetizable initiatives? Often solely the challenge creators and early individuals. The profit to the consumer of web3 video games concerning receiving actual cash is kind of debatable. On the one hand, there have been profitable instances of withdrawing in-game foreign money; then again, there are such a lot of lively customers that the developer firm can’t cowl all the cash gamers make.

Play-to-earn, move-to-earn or tap-to-earn initiatives are in the end destroyed by their speedy reputation. Most of those standard video games are dominated by a pyramid scheme: new gamers fund previous gamers till curiosity dries up. At this level the challenge is doomed to failure.

Are all ‘straightforward cash’ initiatives doomed to failure? In fact not. The primary disadvantages of such video games are poorly thought out tokenomics and the dependence on a continuing inflow of latest customers. The way forward for initiatives with income mechanisms will subsequently depend upon the flexibility to implement sustainable enterprise fashions. Nevertheless, though the mechanics are primarily pyramid-based, the world of web3 video games has seen many high-profile ups and downs.

You may also like: Greatest crypto to spend money on fall 2024

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024