Ethereum

Ethereum daily active addresses has declined from 382k to 312k

Credit : ambcrypto.com

- ETH is down 6.18% in 24 hours.

- Day by day lively Ethereum addresses have fallen 18.32% from 382,000 to 312,000 YTD.

Ethereum [ETH] has seen a pointy decline prior to now week. Throughout this era, ETH has fallen by 5.46%. In truth, on the time of writing, Ethereum was buying and selling at $2,480. This represented a decline of 6.18% over the previous day.

Beforehand, ETH was on a rising trajectory with a rise of 1.57% on the month-to-month charts. Nonetheless, since reaching a excessive of $2729, the altcoin has failed to keep up any upward momentum. So the current losses virtually outweigh the month-to-month good points.

The current losses on worth charts are usually not remoted because the altcoin has additionally fallen in different points, particularly on lively addresses.

Day by day lively Ethereum addresses are reducing

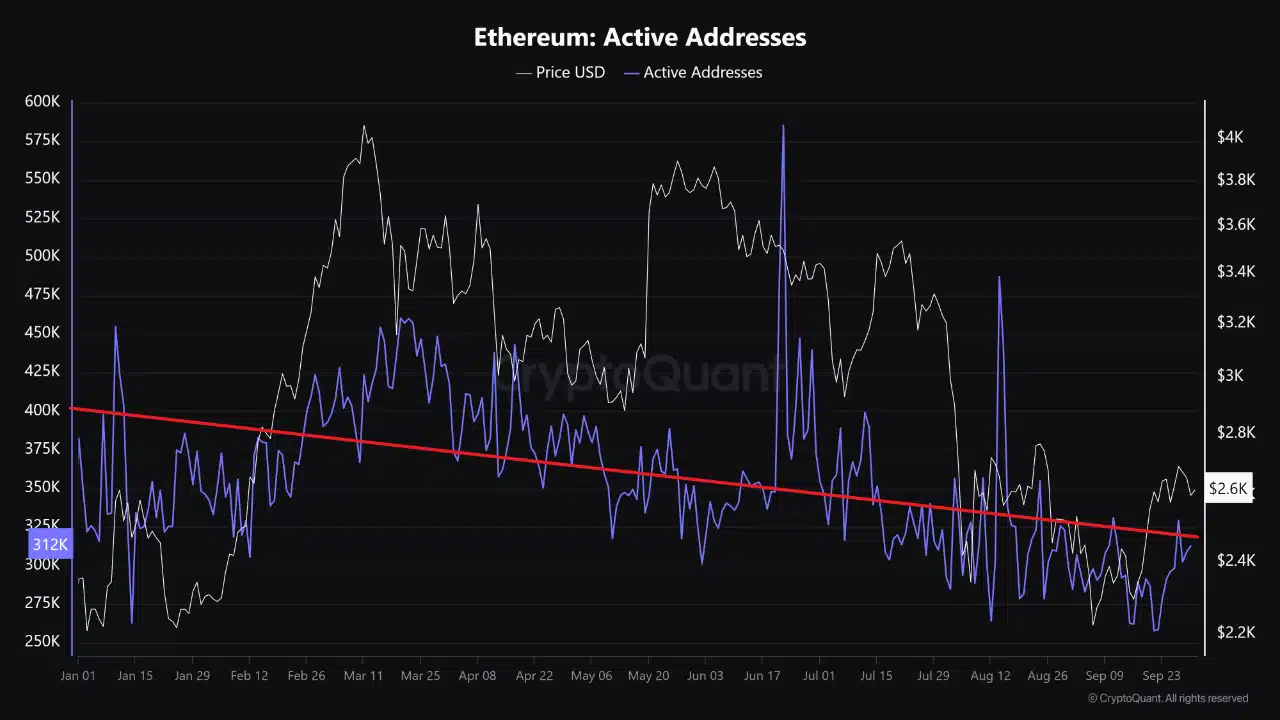

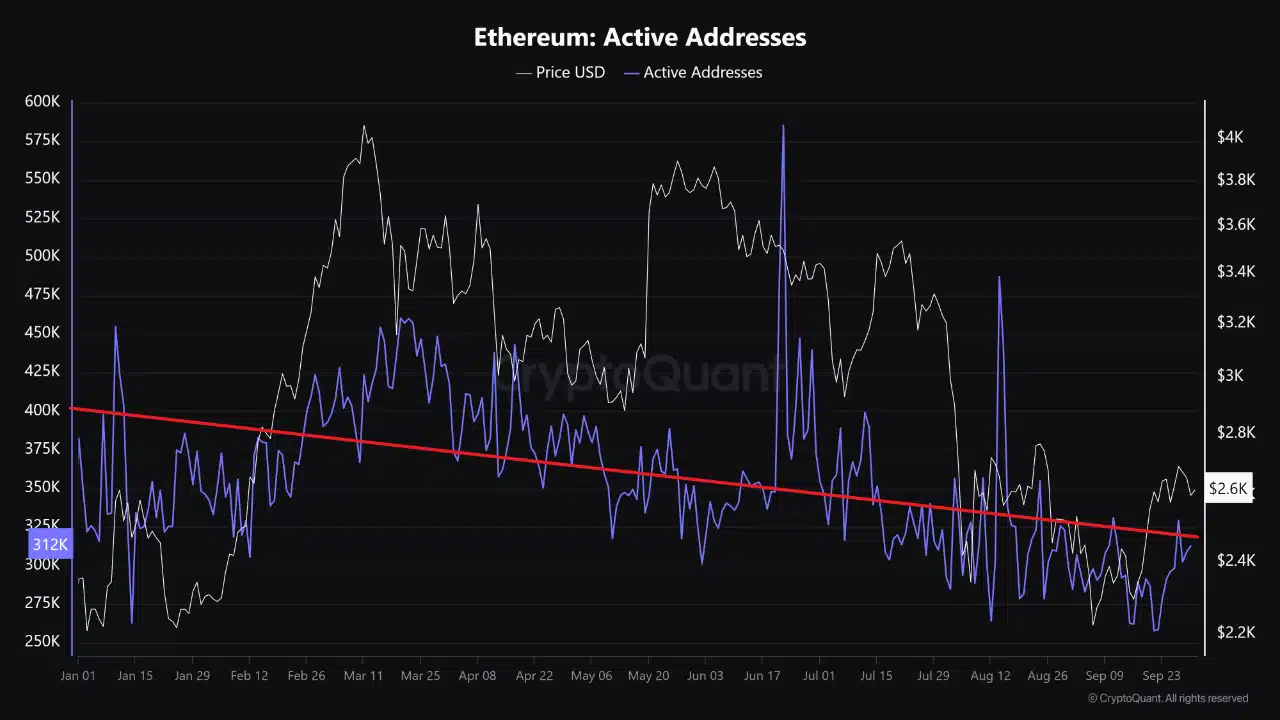

In accordance with Cryptoquantidentical to Bitcoin [BTC]Ethereum has skilled a continued decline within the variety of lively addresses all year long.

Supply: Cryptoquant

Based mostly on this knowledge, Ethereum’s day by day lively addresses have fallen from a excessive of 382k to 312k.

The analysts cited the dearth of recent traders as the principle reason behind the decline. So whereas liquidity has elevated in 2024 following the adoption of Ethereum ETFs, on-chain exercise doesn’t mirror this.

The anticipated rally after the Fed’s rate of interest cuts additionally didn’t materialize. This market failure signifies that no new addresses have come onto the market.

Implications for ETH worth charts

Specifically, a lower within the variety of day by day lively addresses, as indicated above, normally results in worth decreases.

Nonetheless, regardless of the decline within the variety of lively addresses, present market circumstances may spur Ethereum to make a major restoration on the worth charts.

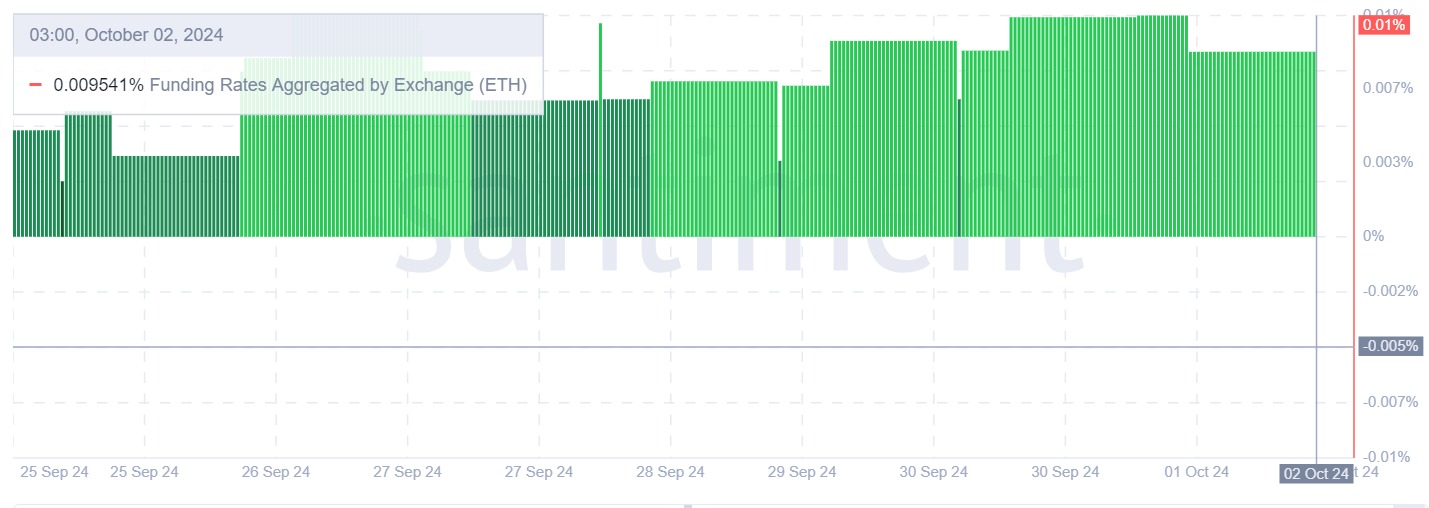

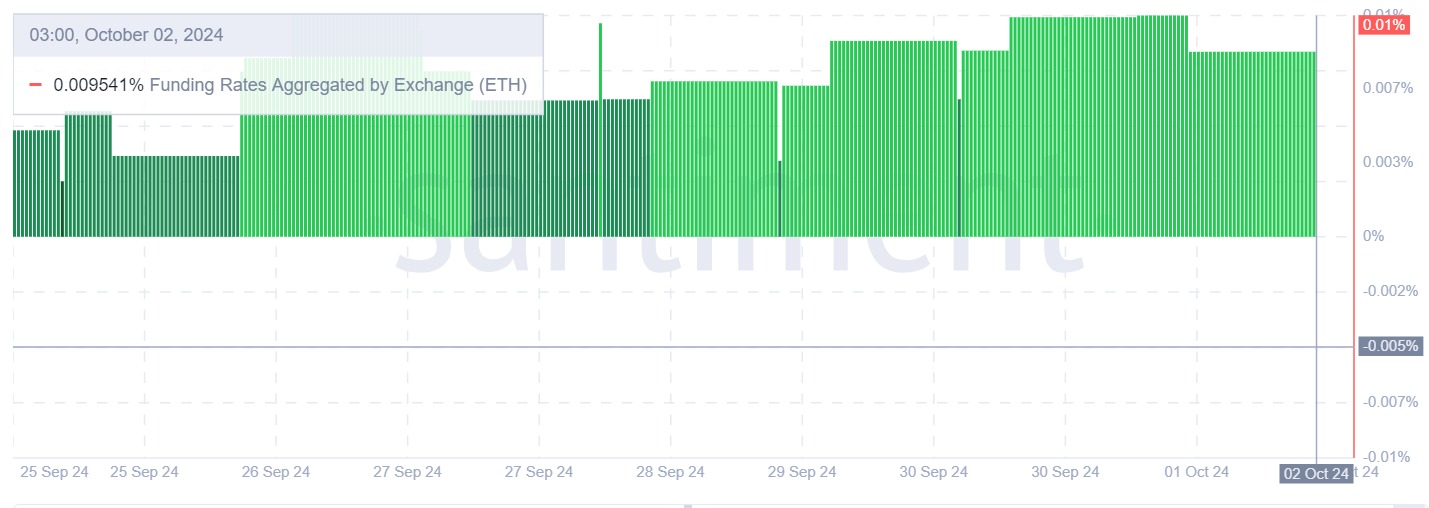

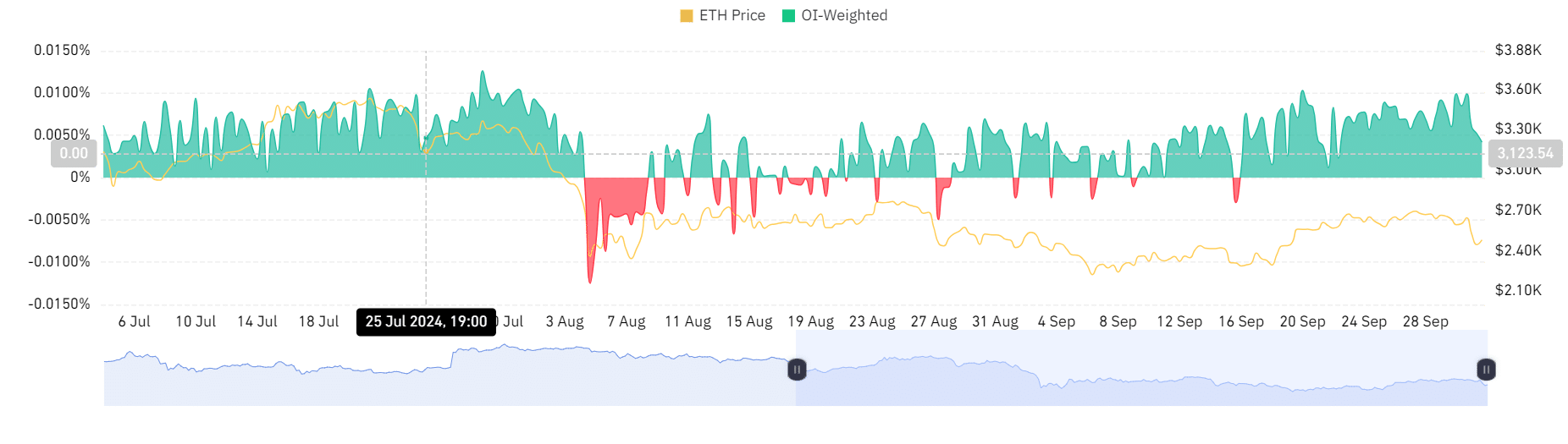

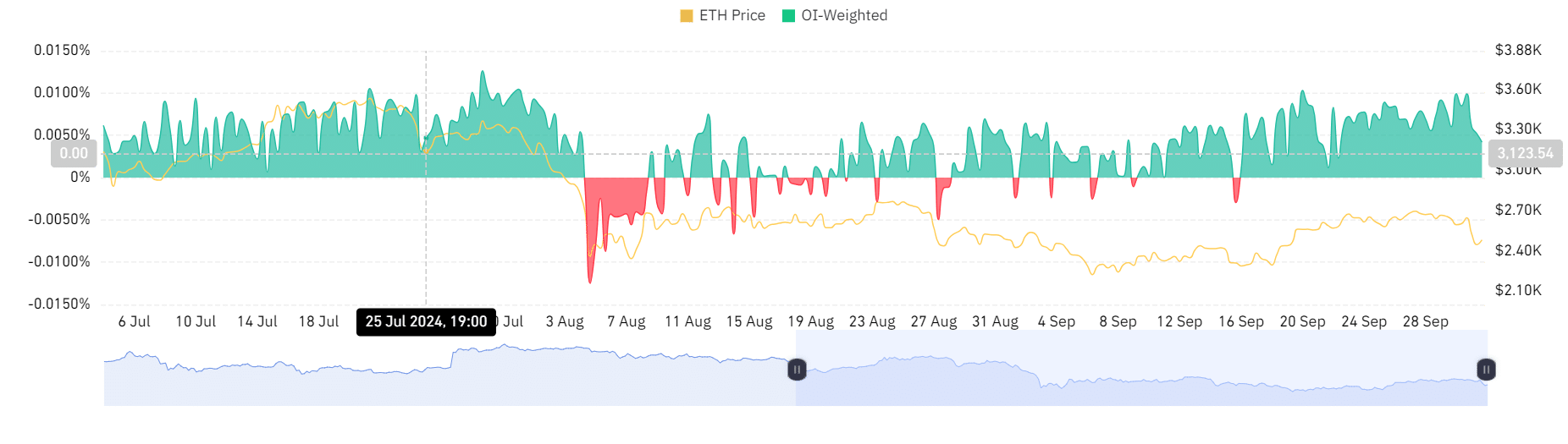

Supply: Santiment

For instance, Ethereum’s funding charge, aggregated by alternate charge, has seen a sustained enhance over the previous week and continues to be optimistic. This means rising demand for lengthy positions as traders anticipate additional good points.

The truth that traders are sustaining lengthy positions regardless of the worth drop signifies confidence out there.

Supply: Coinglass

This demand for lengthy positions is additional supported by a optimistic open interest-weighted financing charge.

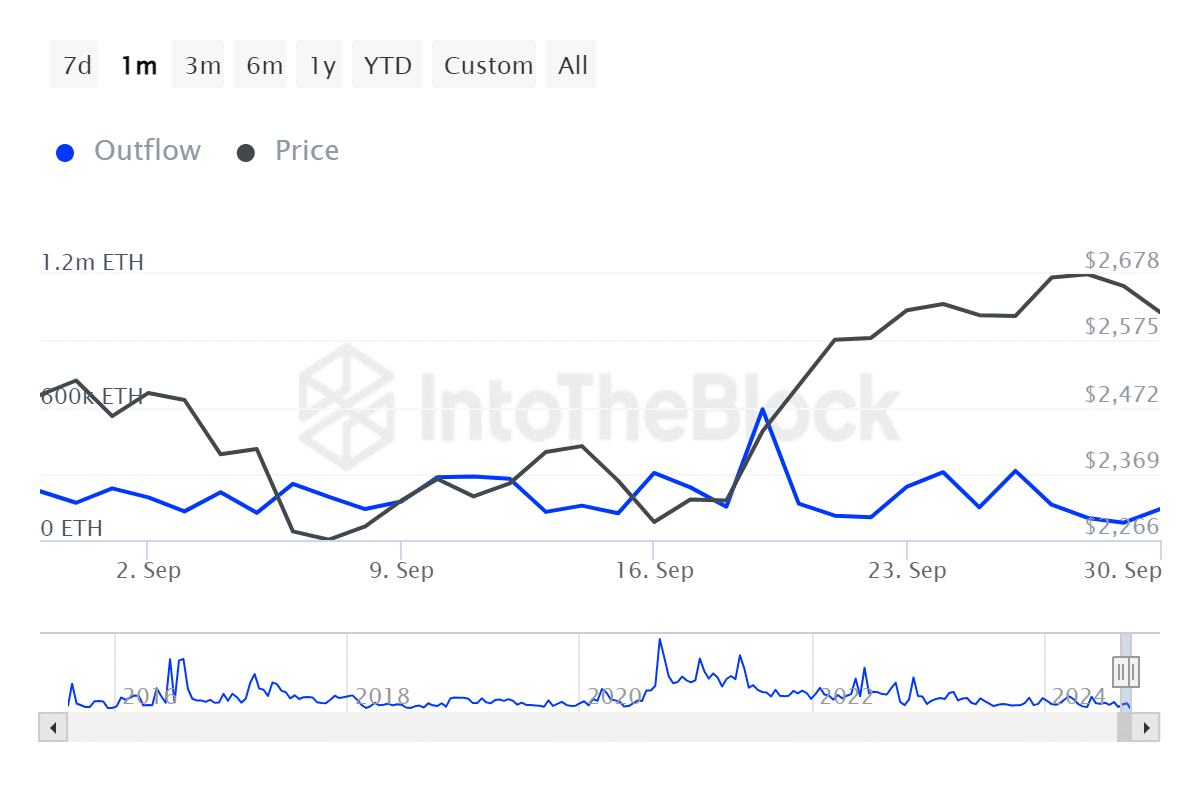

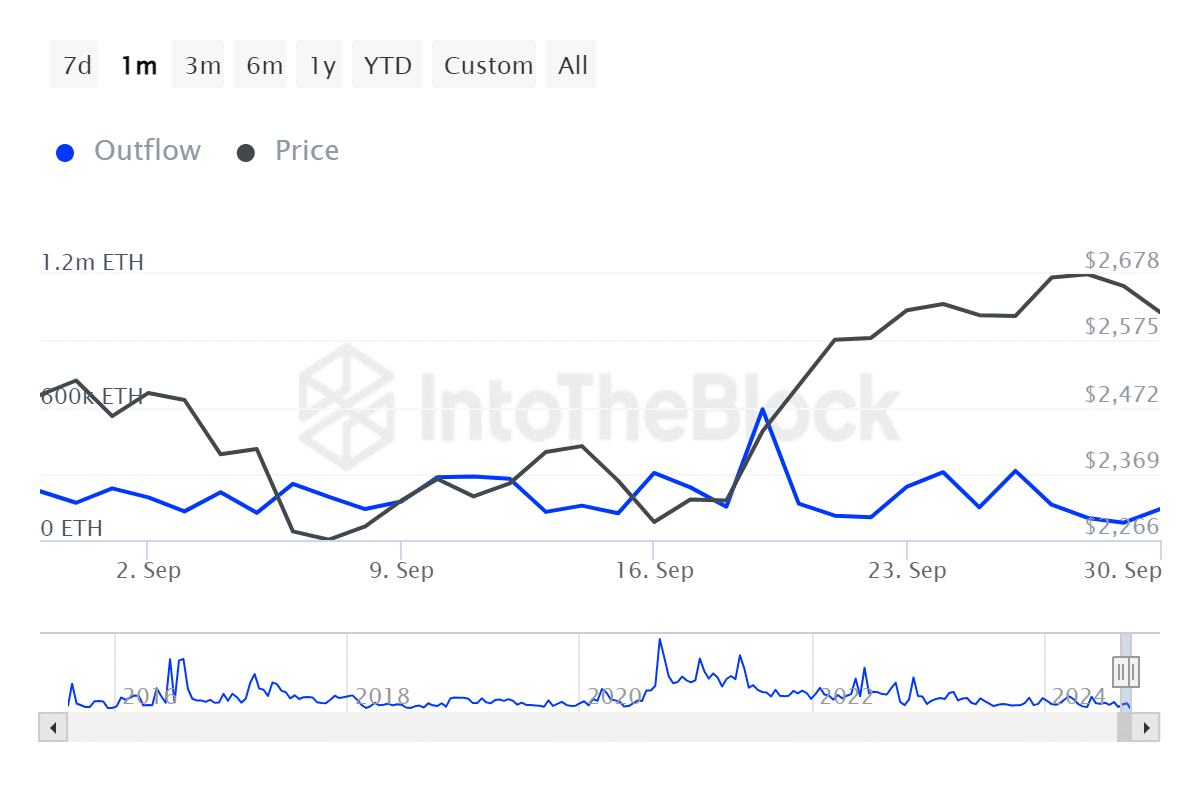

Supply: IntoTheBlock

Moreover, outflows from giant Ethereum holders have fallen from a excessive of 311.95k to a low of 139.39k. This means that enormous traders are nonetheless accumulating their belongings and sustaining their positions regardless of the market downturn.

Such holding habits signifies confidence in the way forward for the altcoin.

Learn Ethereum’s [ETH] Worth forecast 2024–2025

Due to this fact, regardless of the decline within the variety of lively addresses, ETH has proven power on the worth charts. This means that the market usually has a optimistic sentiment.

As such, ETH may rally and regain the following important resistance degree at $2668. Nonetheless, if the present decline continues, ETH will discover help at $2728.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024