Altcoin

A 20%-30% correction is ‘the most bullish thing that can happen to Bitcoin’

Credit : www.newsbtc.com

This text is obtainable in Spanish.

Bitcoin is navigating turbulent waters as its worth continues to fall, trying to find a secure assist stage amid rising uncertainty. The present downward momentum has raised issues amongst buyers and analysts, with many questioning if Bitcoin has reached its cycle high. Market sentiment has modified dramatically, with worry changing the as soon as euphoric optimism that drove the cryptocurrency to latest highs.

Associated studying

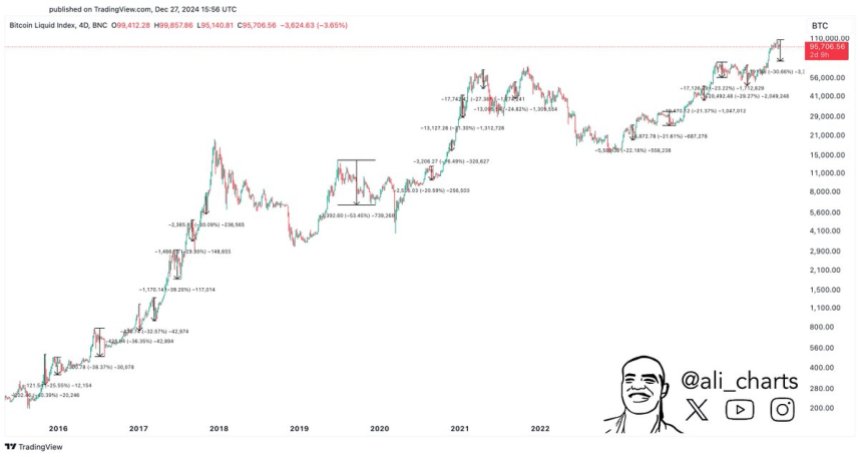

Regardless of the inconvenience, crypto analyst Ali Martinez provides a extra optimistic perspective on the state of affairs. In a latest evaluation shared on X, Martinez prompt {that a} 20% to 30% correction at this stage might truly be probably the most bullish consequence for Bitcoin. He highlights how such pullbacks have traditionally paved the way in which for stronger rallies by shaking out weaker fingers and giving the market an opportunity to reset earlier than resuming its upward trajectory.

As Bitcoin’s worth motion teeters on the sting of a doable collapse, all eyes are on the important thing assist ranges that would decide the following transfer. Will Bitcoin verify fears of a cycle high, or will a wholesome correction lay the muse for the following leg of its rally? The approaching weeks might be essential in shaping the narrative for the world’s main cryptocurrency.

Bitcoin correction looms

Bitcoin appears to be on the verge of coming into a important correction section, with the $92K stage rising as a line within the sand. Analysts and buyers are more and more involved {that a} drop under this threshold – and probably the $90,000 mark – might set off a wave of promoting strain, pushing the value under $80,000. The rising worry has solid a shadow on Bitcoin’s bullish narrative as many brace for potential draw back dangers.

Associated studying

Nevertheless, not everybody sees this potential correction as bearish. Martinez offers a contrarian viewThis implies {that a} 20% to 30% correction may very well be probably the most bullish consequence for Bitcoin inside the context of a bull pattern.

Martinez introduced a compelling chart displaying each Bitcoin correction above 20% throughout earlier bull markets. His findings present that every of those corrections acted as a reset for the market, shaking out weaker fingers and paving the way in which for stronger rallies.

Martinez emphasizes that corrections are a pure and wholesome a part of Bitcoin worth cycles, particularly throughout bull runs. By giving the market an opportunity to recalibrate, they set the stage for continued upward momentum. If Bitcoin experiences a major pullback, it may very well be the harbinger of a extra sturdy and extended rally within the coming months.

BTC assessments ‘the final line of protection’

Bitcoin is presently buying and selling at $94,500 and going through continued promoting strain and bearish worth motion. Market sentiment has modified considerably in latest days, with fears of a deeper retracement gaining floor amongst analysts and buyers. Many imagine that if Bitcoin loses the $92,000 mark, it might open the door for an accelerated decline.

The $90,000 stage is rising because the important assist zone that Bitcoin should maintain to take care of its bullish outlook. This stage represents a psychological and technical barrier that would decide the cryptocurrency’s trajectory within the coming weeks. If BTC manages to carry above $90,000, analysts count on a robust restoration that would reignite bullish momentum and result in a push in the direction of earlier highs.

Associated studying

Nevertheless, the stakes are excessive. A decisive break under the $90,000 stage would seemingly exacerbate promoting strain, pushing Bitcoin into deeper correction territory. In such a situation, costs might fall to $75,000, which represents a major decline from latest highs.

Featured picture of Dall-E, chart from TradingView

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Solana6 months ago

Solana6 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?