Bitcoin

Aave outpaces BTC but hits resistance: Is a reversal on the horizon?

Credit : ambcrypto.com

- Aave is outperforming Bitcoin however is dealing with important resistance.

- The basics of the protocol look good.

Aaf [AAVE] stays a frontrunner within the crypto area regardless of doubts surrounding the income fashions of Decentralized Finance (DeFi) blue chips.

Some trade voices are suggesting a reevaluation of what qualifies as income and expenditure in decentralized programs, as these protocols will not be conventional companies.

However, the AAVE/USDT pair broke a big 800-day vary, inflicting the pair to development greater and outperform Bitcoin over the previous two months [BTC] throughout this era.

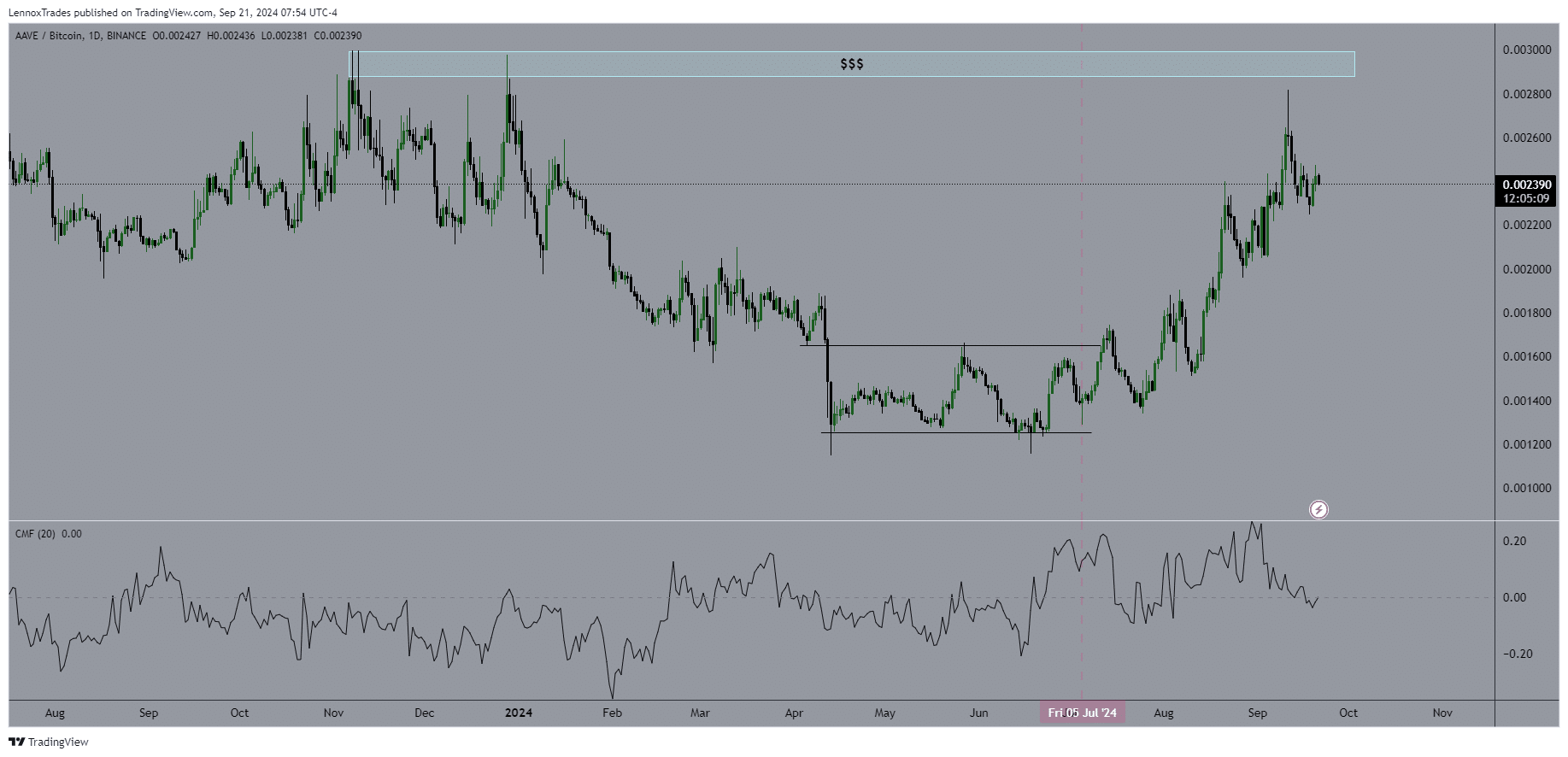

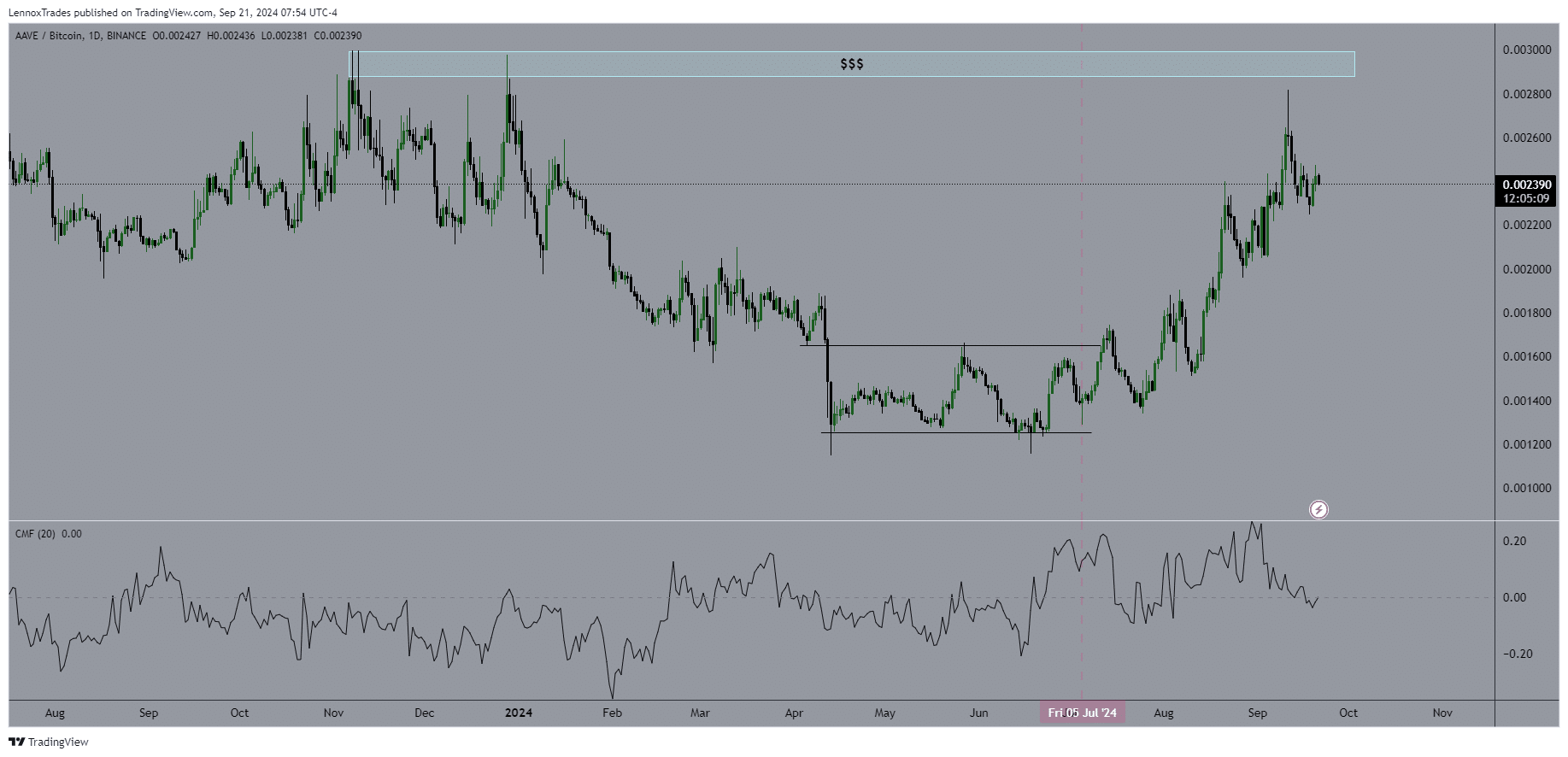

As of June 18, AAVE/BTC has proven greater highs and better lows, however not too long ago confronted robust resistance close to the 0.003 BTC zone. This rejection, mixed with Bitcoin’s latest efficiency, has slowed the pair’s rise.

Whereas Aave is anticipated to proceed its uptrend resulting from robust fundamentals, its hyperlink to Bitcoin might pose issues within the quick time period.

Supply: TradingView

Moreover, the Chaikin Cash Circulation (CMF) indicator additionally exhibits merchants taking earnings, with cash flowing out of the AAVE/BTC pair.

Nevertheless, the general trajectory stays constructive, particularly when traded towards stablecoins, that are anticipated to outperform as each AAVE and Bitcoin might rise within the fourth quarter.

This may very well be the beginning of a reversal for Aave’s BTC pair, however has but to be confirmed since…

Aave’s stablecoin surpassed $150 million

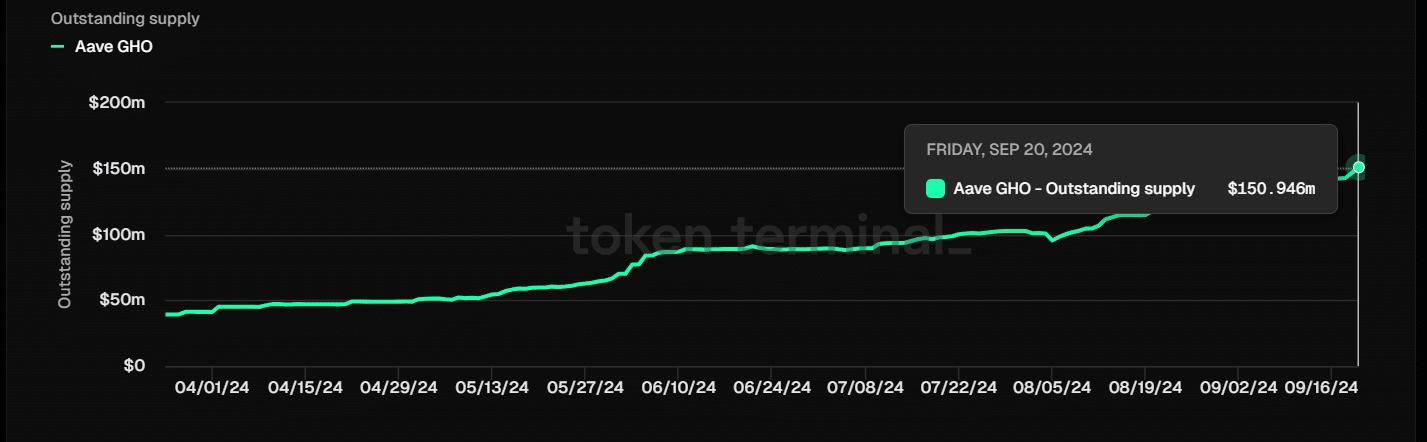

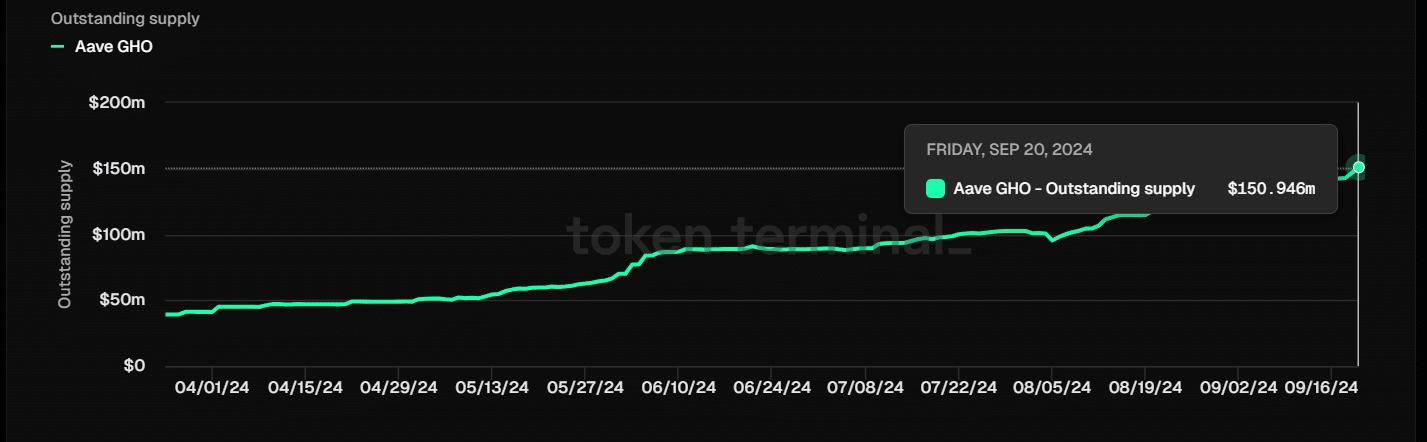

A significant factor driving Aave’s bullish momentum is its stablecoin, GHO. GHO has seen regular development since launching throughout a bear market, alongside Curve’s stablecoin (CRV).

In early September 2024, GHO’s provide elevated by over 6.7% and has now reached a milestone of over $150 million in excellent provide.

Supply: Token terminal

Regardless of CRV having a bigger provide than GHO, each stablecoins have the potential for important development.

As GHO continues to develop, it strengthens the broader Aave protocol and its potential for long-term development.

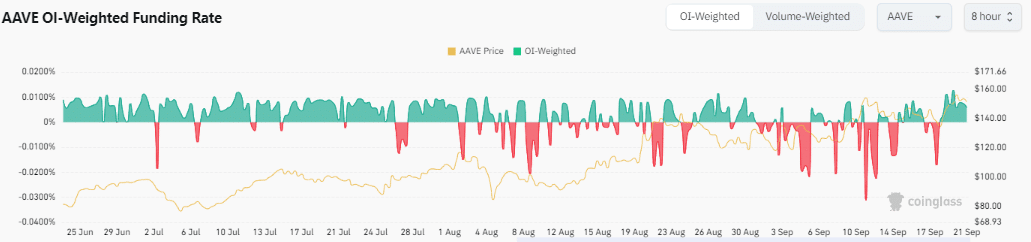

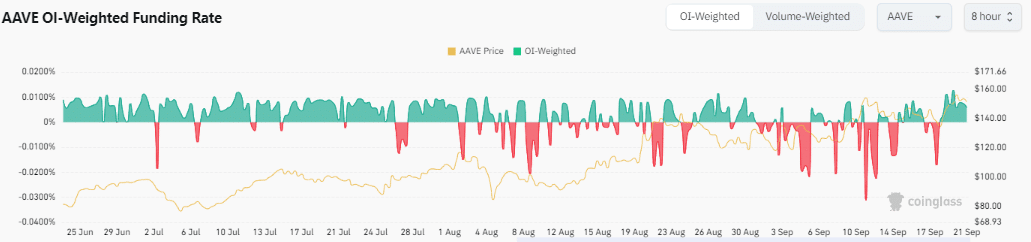

Constructive OI-weighted financing charges

Moreover, OI-weighted financing charges mirror bullish sentiment. In accordance with the newest information, the rate of interest was 0.0058%, which signifies that lengthy positions repay quick positions.

Supply: Coinglass

This means robust shopping for demand for Aave and is in keeping with the constructive value outlook. The rising demand underlines that merchants stay optimistic a couple of rise in Aave’s value within the close to future.

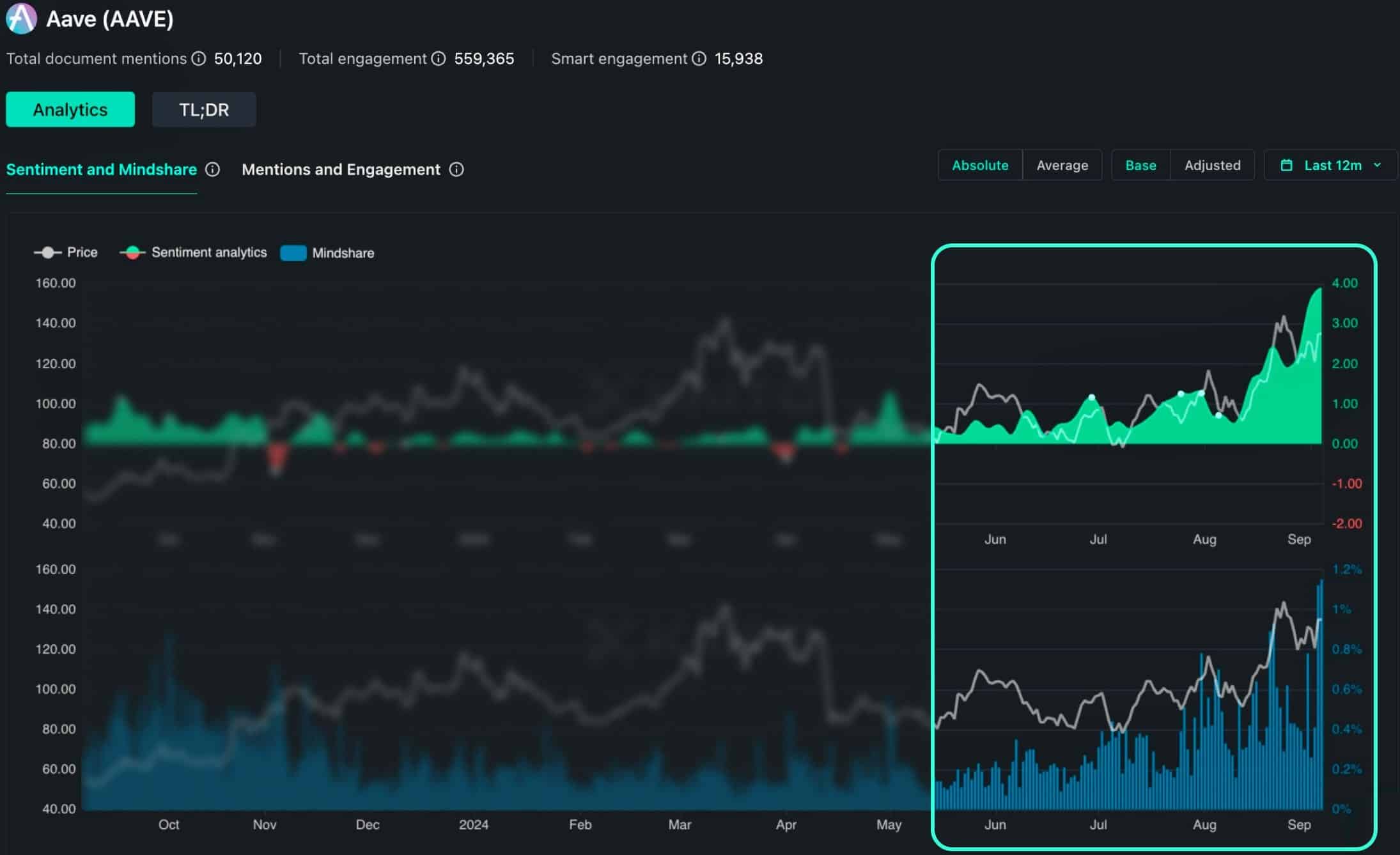

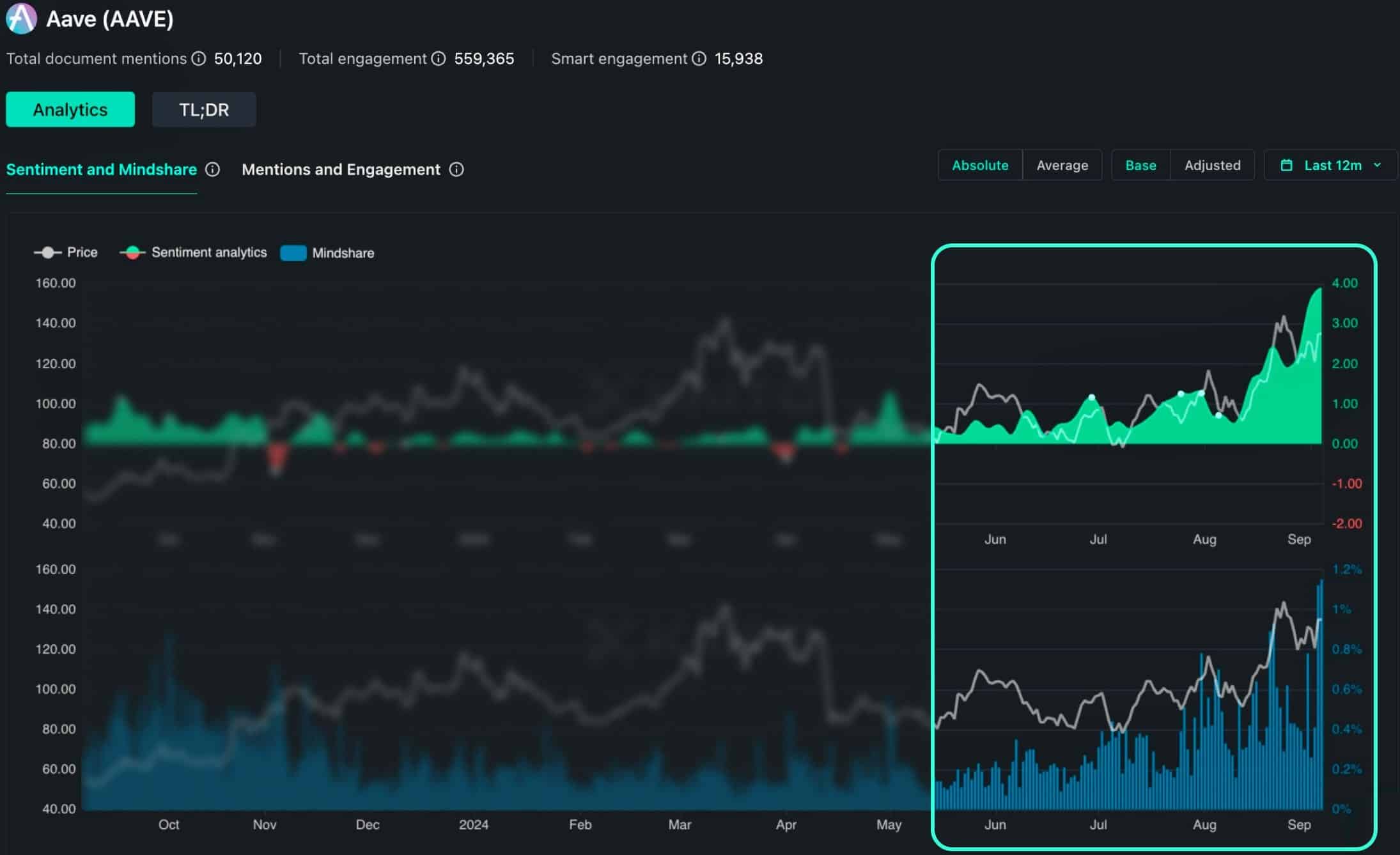

Sentiment and mindshare rise

Lastly, Aave’s social sentiment and mentality are additionally bullish. Knowledge from the Kaito AI platform reveals record-high ranges of positivity round Aave.

Learn Aave’s [AAVE] Worth forecast 2024–2025

With potential elements equivalent to Trump integration, buybacks and the Sky partnership, Aave is poised for additional development.

Supply: Kaito AI

Aave’s total outlook is powerful, particularly towards stablecoins, indicating a possible value appreciation. It’s going to proceed to carry out properly within the DeFi area, with greater costs on the horizon.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now