Analysis

AAVE Price Climbs 118% in 6 Weeks, Can It Break Above $300

Credit : coinpedia.org

Principal highlights:

- Aave rose 118% by $ 121.75 to $ 265 Since April 9.

- The crew was launched Aave V3 on APTOS At the moment (Might 19), develop to a non-EVM layer 1.

- Technical tones present one parabolic rallyHowever momentum indicators are cooling.

- AAVE’s TVL struck $ 40.3bof Kettinglink SVR protection Prolonged from 3% to 27%.

- Unveil chain statistics Greater than 80% of the tokens and lively customers are of revenueSupporting the rally.

A foreign money has risen by greater than 118% within the final 6 weeks – and is now moving into his seventh week of revenue. Will the momentum preserve bullish technicals or is a cooldown ahead?

Current developments: ecosystem progress reinforces the rally

Aave has taken appreciable steps prior to now two weeks to strengthen its ecosystem. On Might 12The Aave Dao accepted the Enlargement of Chainlink’s Safe Worth Restoration (SVR) mechanism. This resulted in stimulating TVL protection from solely 3% to greater than 27%.

This motion improves the danger discount of the protocol and positions Aave as a safer credit score platform.

Consequence Might 19the crew was formally launched Aave V3 on APTOSMarking his first implementation on a non-EVM chain. This cross-chain extension makes use of a brand new person base and improves liquidity flexibility for builders and cash lenders who transcend Ethereum.

Acts on the time of the press of an Aave worth $ 264.71upwards 20.35% in 24 hoursof 24-hour quantity rises to $ 808.39 million (+66.97%) and one Market capitalization of $ 4B. Conitnues Strengthening a powerful query after bulletins.

Aave/USDT Parabolic Rally is approaching the Nice Resistance

The day by day age exhibits that Aave’s worth has risen quickly since 9 April, so {that a} parabolic curve That has topping of $ 121.75 to greater than $ 265 – Marking a rise of 118% in simply six weeks.

This upward development broke above a falling resistance line and now checks one Important resistance zone between $ 285 – $ 300That can be a part of an earlier distribution degree from February.

Aave is presently performing within the higher tire of his Bollinger -channelWhich signifies that the value is prolonged. Though this implies a powerful shopping for momentum, it’s also typically preceded within the brief time period pullbacks or consolidation.

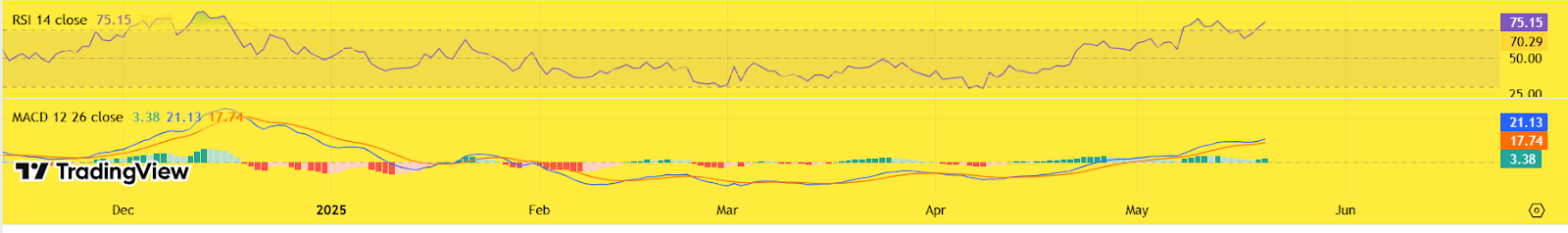

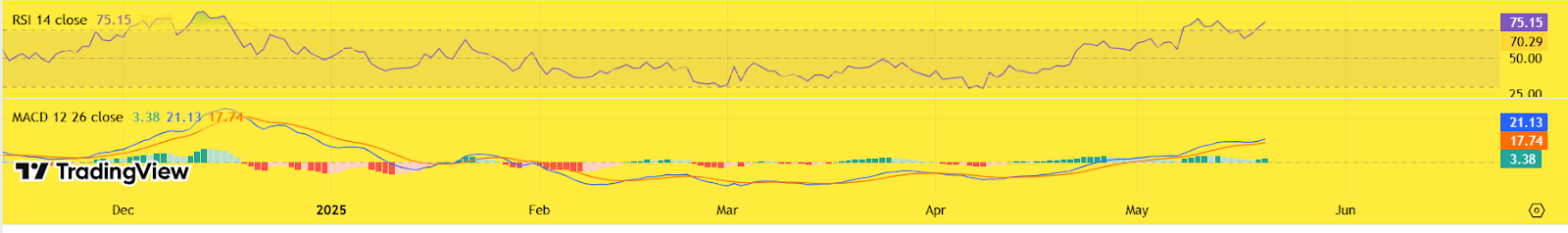

Momentum -indicators present an analogous story.

The RSI sits on 74.88Getting into overbough territory for the primary time on this rally. This displays the energy of the customer, but additionally signifies that the highest could be restricted until the quantity is supported.

The MacD Stays in a bullish crossover, however the histogram stations slim – an indication that though the momentum stays constructive, it’s weakened.

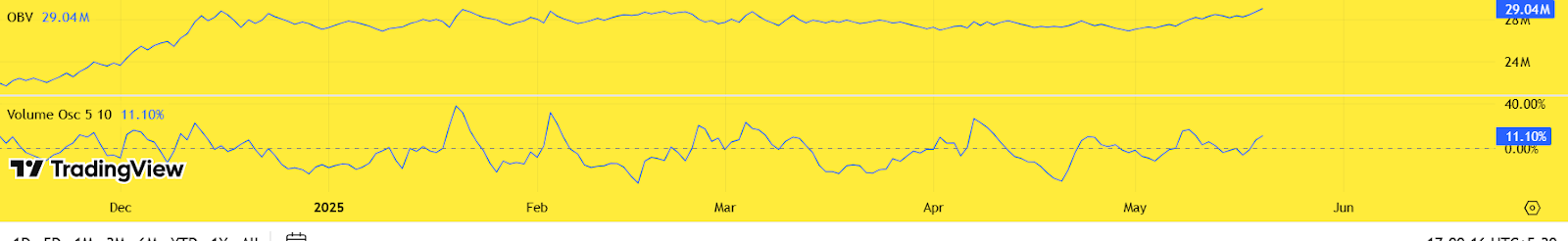

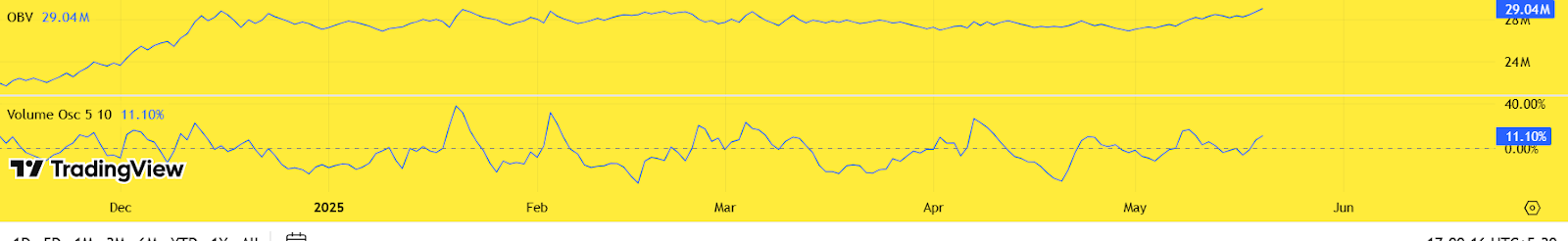

The Based mostly on (quantity on steadiness) – that quantity stream follows in comparison with worth motion – has Painted at 29.04m Other than the graph till April. This visible plateau signifies that Buy stress is caughtThough the value continues to rise.

It typically means that the rally loses depth, as a result of fewer consumers help the present push.

In the meantime the Quantity -Scillatorthat compares the quantity treatment within the brief and long run is seen on +10.74% – nonetheless in a constructive space Clear from his peak earlier in Might.

This deterioration on the graph signifies a reducing tempo of latest consumption, which signifies that the bullish impulse remains to be alive however doesn’t speed up.

Collectively, these indicators replicate a market that may be Strategy after a break or pullbackParticularly if no recent quantity is available in to push Aave neatly above the present resistance zone

If Aave breaks and closes $ 300 with a powerful affirmation, the following goal is on $ 340 – $ 360. Nonetheless, if the rally is, the help is on $ 240adopted by $ 210Close to the 20-day EMA and center line of the Bollinger band.

Any longer the day by day construction Bullish stays, however momentum indicators recommend warning as the value approaches the exhaustive ranges. Merchants should observe $ 285 – $ 300 intently on Breakout for the entrance or reversal alerts.

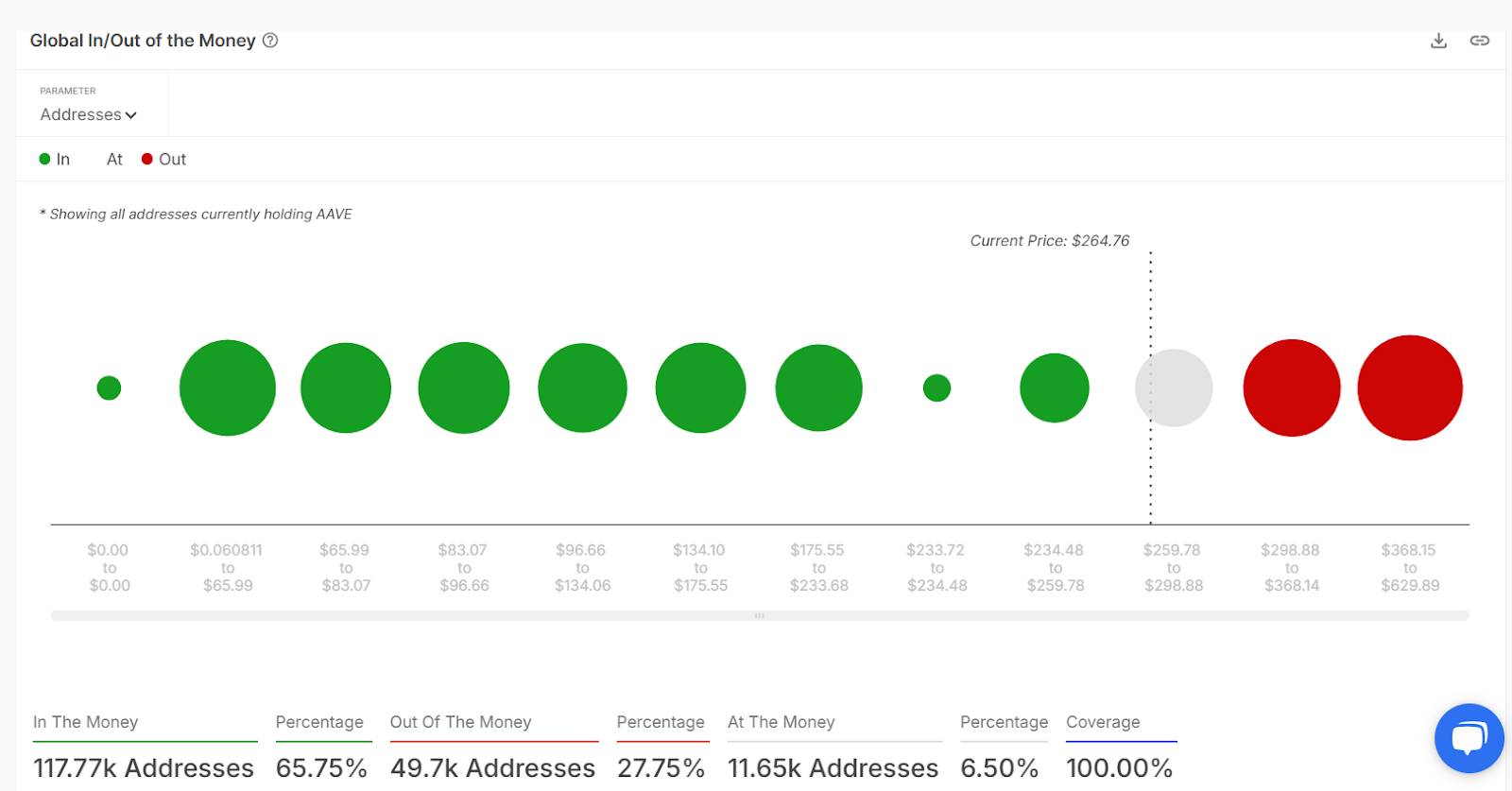

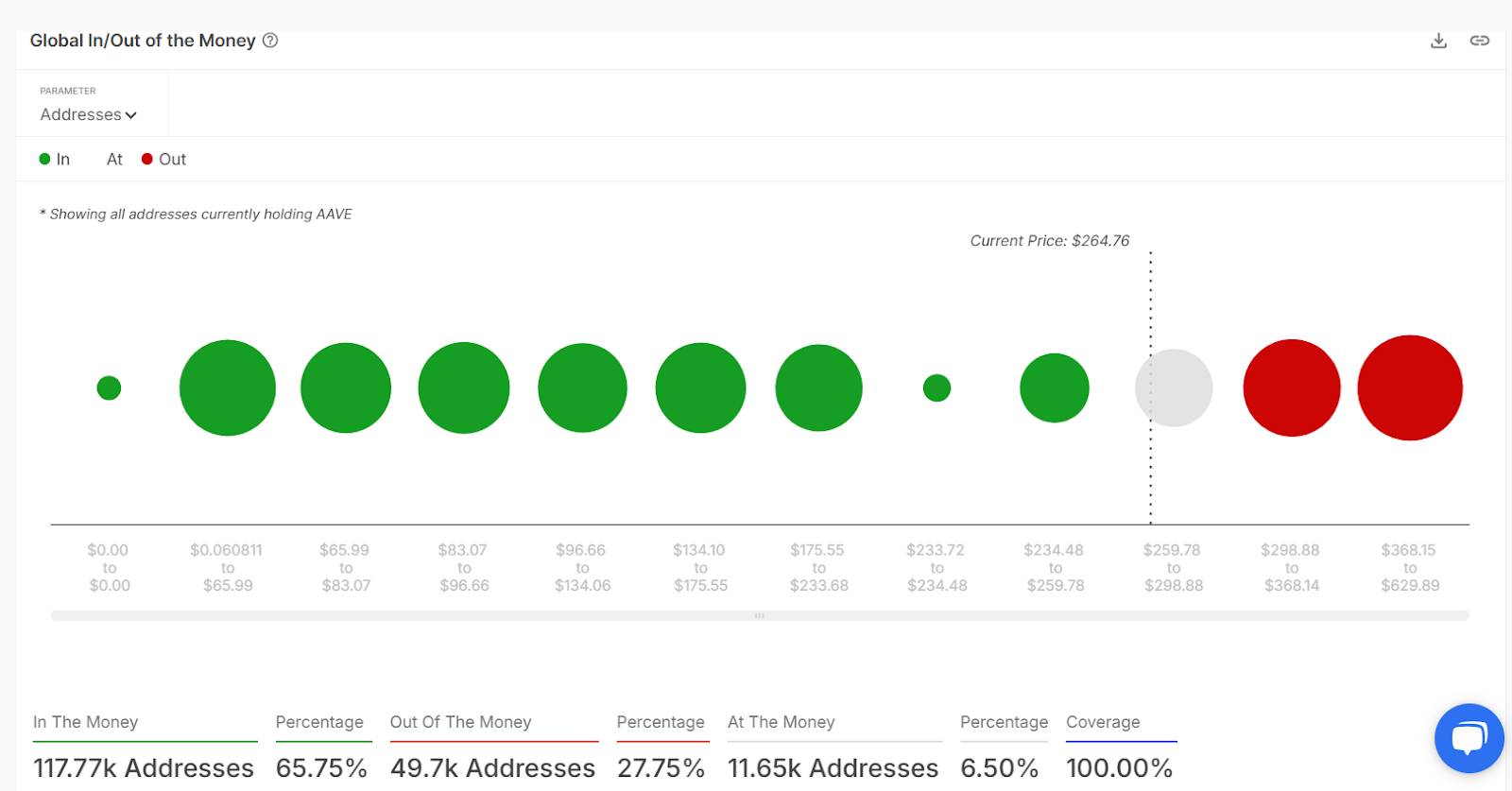

Aave on-chain statistics: Holder confidence nonetheless robust

- 81.92% of an Aave -Tokens are presently “within the cash” primarily based on volume-weighted break-even knowledge.

- Solely 11.95% of the tokens His loss, which reduces the potential for aggressive sale.

- The “Energetic addresses as a consequence of profitability” Graph exhibits that 13.41m Aave price $ 3.55 billion is held by worthwhile portfolios.

- 83.44% of lively customers Have a revenue, which exhibits that merchants who use the protocol or actively act aren’t underneath stress to depart.

These figures point out that the majority holders are income and don’t rush to depart – help the concept Pullbacks could be shallow Except market sentiment adjustments dramatically.

A powerful momentum robust, however all eyes at $ 300 resistance

The six -week rally from Aave stays intact, supported by a powerful technical heading and wholesome help on the chain. That stated, the present rally loses some quantity momentum, and the $ 285– $ 300 zone Stays the road within the sand for bulls.

If this degree has been damaged with robust affirmation, the trail is to $ 340 – $ 360 opens. In any other case a brief -term storage to $ 240 Assist might be earlier than any continuation.Bias stays BullishHowever quantity and copper energy above $ 300 will determine the following part.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024