Altcoin

Aave Reaches $172: Highest Price and Market Cap Since 2022 – What’s Next?

Credit : ambcrypto.com

- Aave reached its highest worth in over a 12 months at round $172, indicating a powerful bull pattern.

- Complete Worth Locked (TVL) within the community elevated to over $13 billion in 2024 and neared 2021 ranges, pushed by elevated exercise.

Aaf [AAVE] has been on a bullish trajectory in current weeks, reaching its highest worth level in additional than a 12 months over the past buying and selling session. On-chain knowledge evaluation signifies a strong bull pattern, additional supported by elevated Complete Worth Locked (TVL) exercise.

Aave units a brand new annual worth document

Within the day by day timeframe, AAVE closed the final buying and selling session at round $172, marking a rise of just about 6%. This worth degree has not been retested since Might 2022, making it a big milestone for the cryptocurrency.

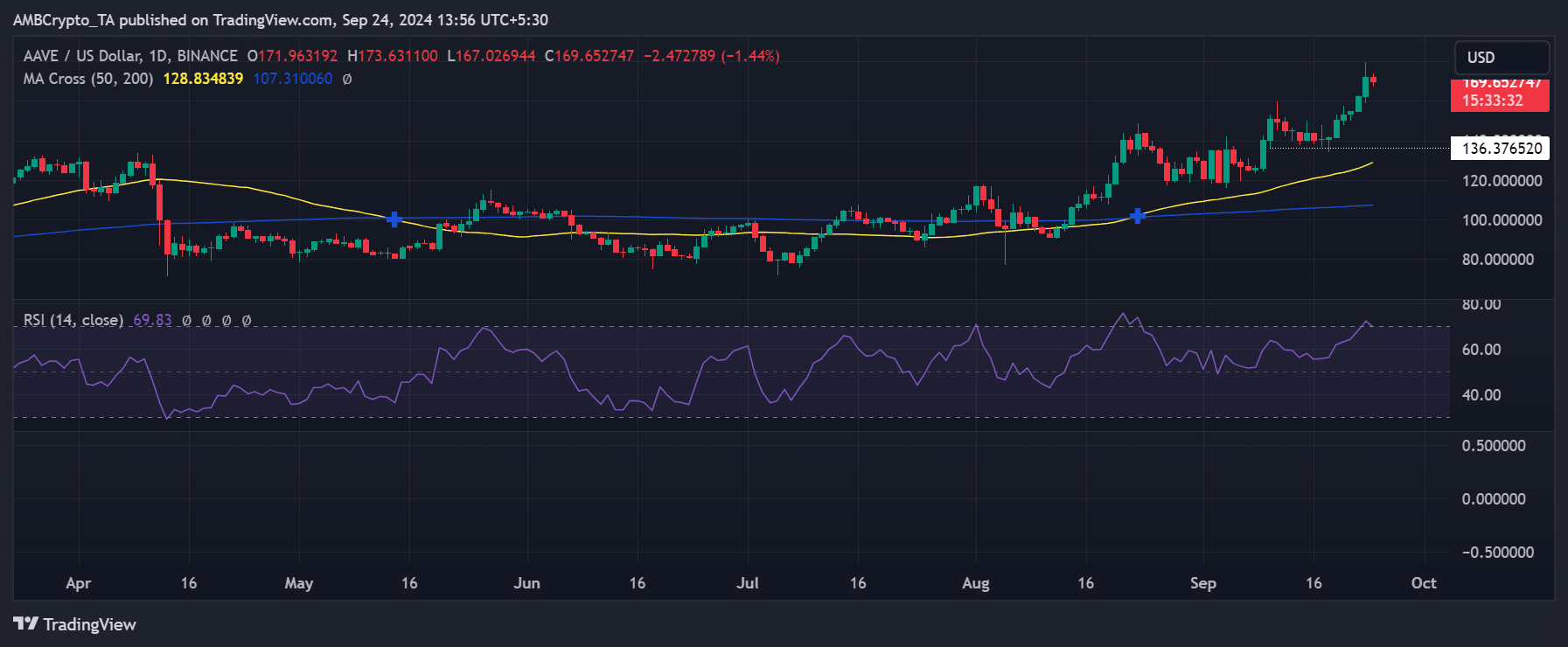

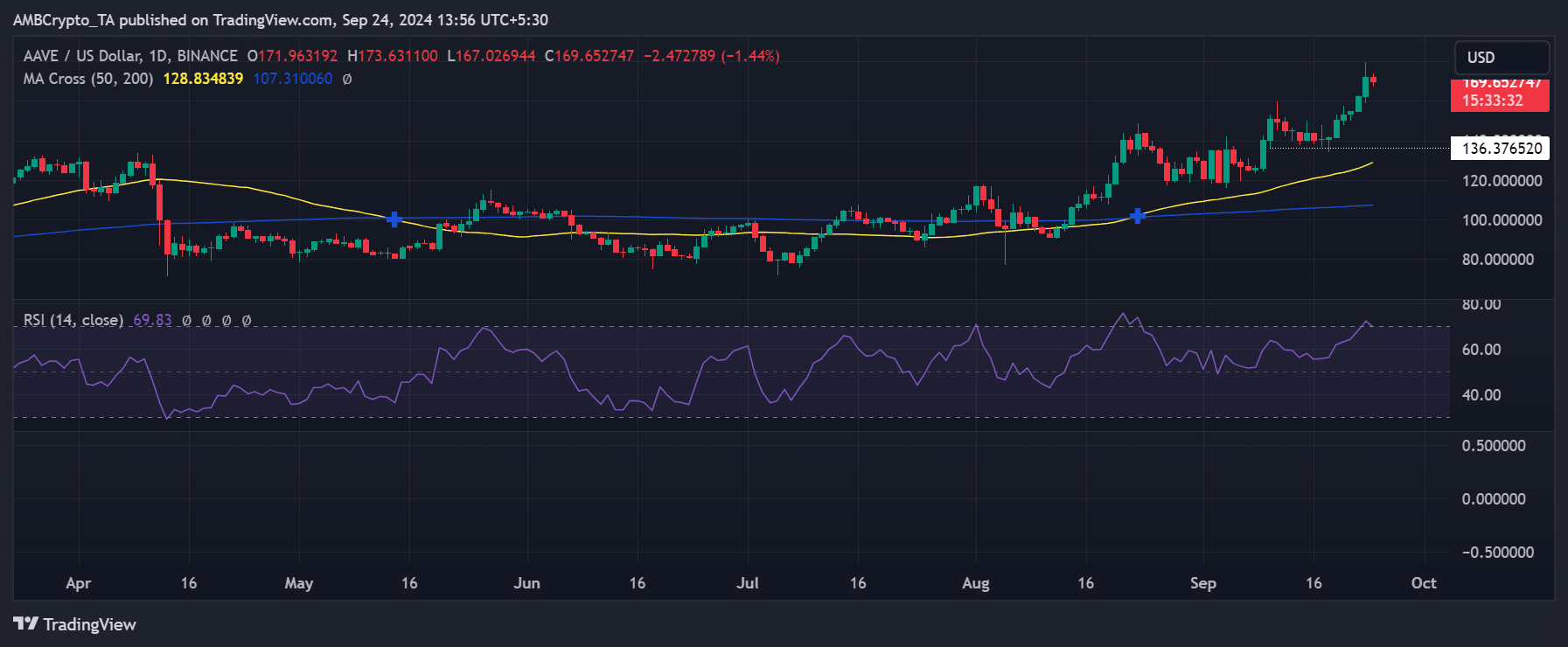

Supply: TradingView

The current rise has set a brand new help degree at $136, with longer-term help round $128, which is indicated by the short-term transferring common (yellow line).

The Relative Power Index (RSI) has remained above the impartial line for greater than a month, indicating a continued bull pattern since August. Presently, the RSI is hovering round 70 and getting into the overbought zone as a result of current worth surge.

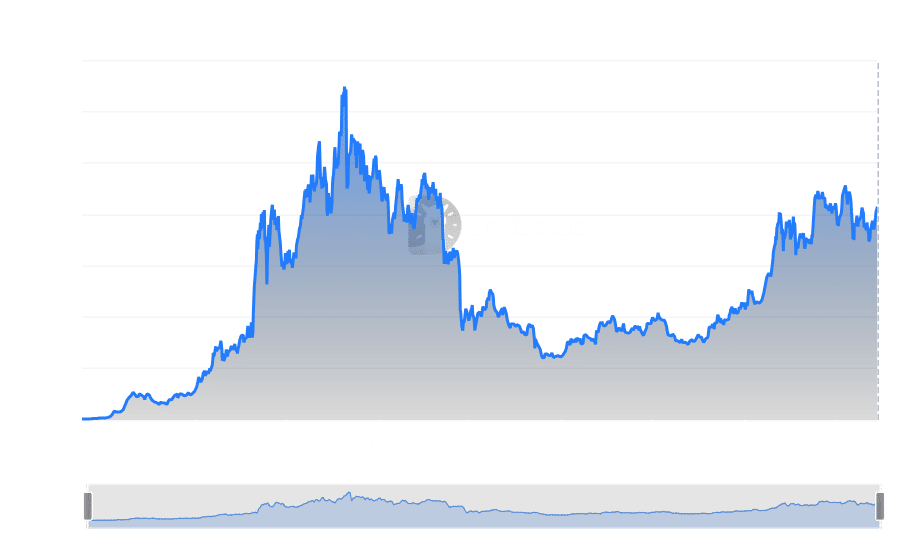

Market capitalization displays worth developments

AAVE’s market cap has risen together with its worth. Based on CoinMarketCapits market capitalization now exceeds $2.5 billion. This can be a substantial enhance from a 12 months in the past, when it was roughly $882 million.

Essentially the most notable progress occurred round August, from about $1.3 billion to $2 billion.

Bullish indicators from Aave’s on-chain knowledge

On-chain indicators present elevated accumulation of AAVE in current months. The whole variety of holders with a non-zero steadiness elevated from roughly 168,000 to roughly 170,000, after which there was a slight lower to 169,000.

This enhance signifies that extra wallets have lately bought the asset.

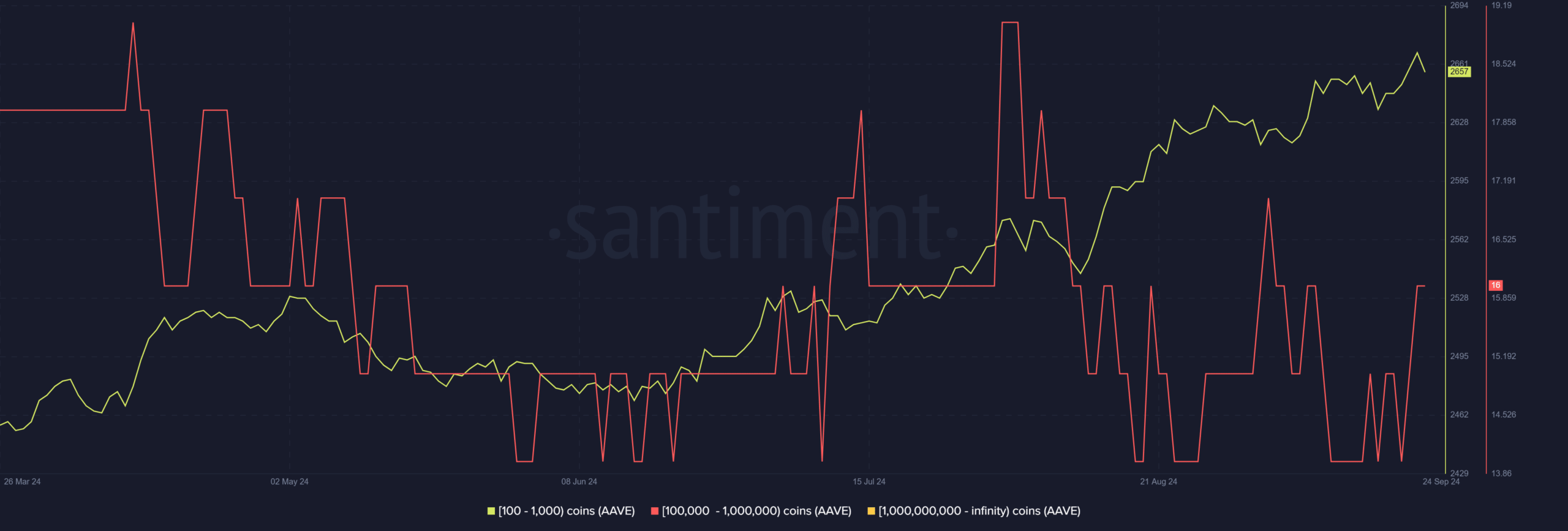

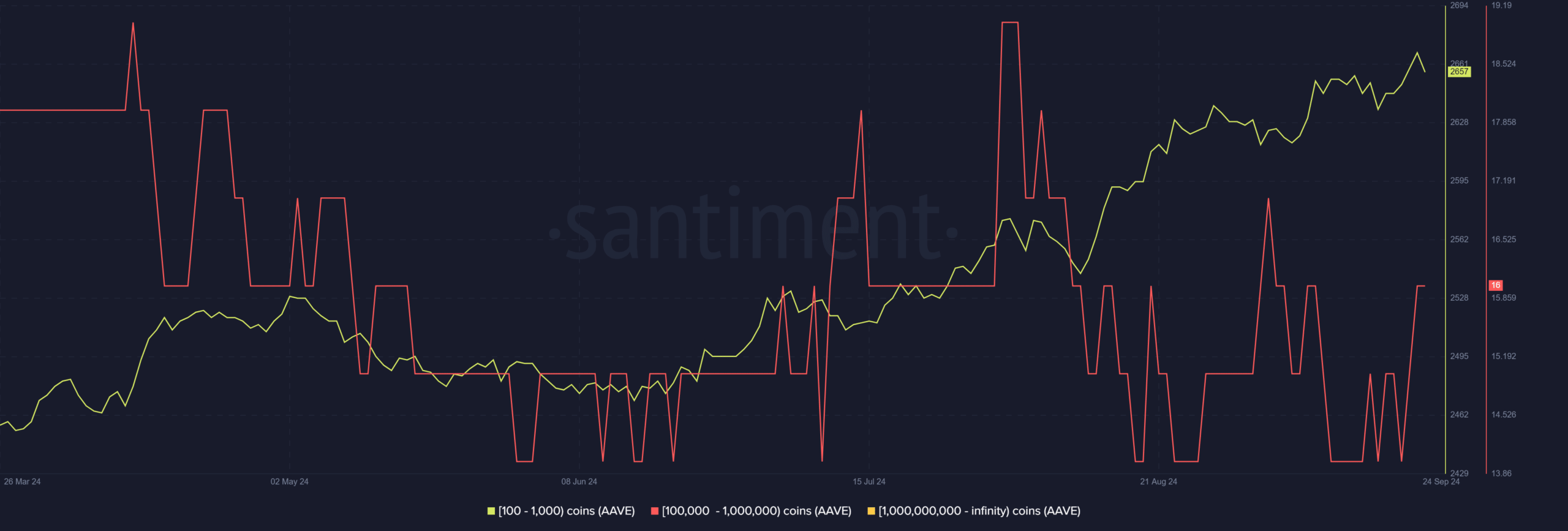

Supply: Santiment

Additional evaluation exhibits elevated exercise amongst AAVE sharks and whales. The variety of wallets holding between 100 and 1,000 AAVE tokens has elevated by greater than 1,000.

Moreover, wallets holding between 100,000 and 1 million tokens have grown by two over the previous three days, indicating important accumulation by massive holders.

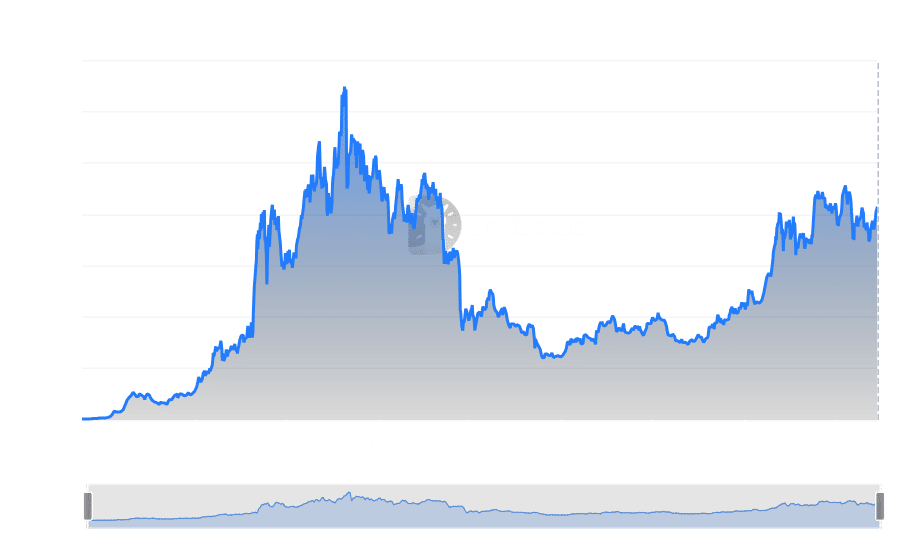

TVL is experiencing important progress

Based on one Santiment Based on the report, Aave’s elevated exercise is partly on account of a lack of confidence in Curve Finance, which suffered a significant safety breach in the summertime of 2024.

Aave’s enlargement into Layer 2 (L2) platforms has additionally contributed to the rise in exercise.

Supply: DefiLlama

An evaluation of Aave’s TVL op DefiLlama confirms this progress and brings it nearer to 2021 ranges. The TVL fell to round $7 billion in Might 2022, however recovered at its peak in 2023 to round $6.38 billion.

In 2024, TVL rose to over $13 billion within the present quarter. On the time of writing, the TVL is roughly $12.4 billion.

Is your portfolio inexperienced? View the Aave Revenue Calculator

Conclusion

Aave’s spectacular worth efficiency and bullish indicators from on-chain knowledge point out robust upside momentum.

The elevated market capitalization, rising variety of holders, and important rise in TVL all level to Aave’s strengthening place that might proceed for some time.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now