Altcoin

AAVE Sets a $200 Price Target – Can It Deliver This Time?

Credit : ambcrypto.com

- AAVE rose this week, surpassing the highest altcoins after a dip

- Nevertheless, regardless of sturdy technical indicators, considerations are beginning to come up

With its weekly positive factors surpassing among the main altcoins available in the market, AAVE has gained vital traction on this bullish cycle. Particularly since 24-hour buying and selling quantity elevated by virtually 12% to $180 million.

This restoration adopted a current plunge, as famous by one other AMBCrypto report. Curiously sufficient, with the RSI dipping into oversold territory on the time of writing, the present value of the altcoin gives loads of alternative for merchants to view it as a “dip” earlier than an enormous parabolic wave. Particularly with the bullish MACD crossover.

With a value of $150 on the time of writing, can AAVE proceed its restoration and break the crucial resistance degree at $200? With two current failed makes an attempt, it could be attention-grabbing to see if AAVE can lastly make its transfer.

Technical indicators help this situation

With AAVE valued at round $150, the potential for a rally to $200 is firmly on the desk, particularly if a number of constructive technical indicators are in play.

Nevertheless, this cycle tells a distinct story. In March, when BTC reached its ATH of $73,000, AAVE loved a sustained bull rally that lasted for over a month and ultimately closed near the press time value.

Quite the opposite, with BTC approaching an identical peak this time round, AAVE has skilled some notable pullbacks. Since late September, the worth has been consolidating, with 4 failed makes an attempt to interrupt the $150 resistance degree.

Amid rising volatility as a result of upcoming elections, Bitcoin is more likely to appeal to a lot of the liquidity. This might divert curiosity from lower-capitalization altcoins.

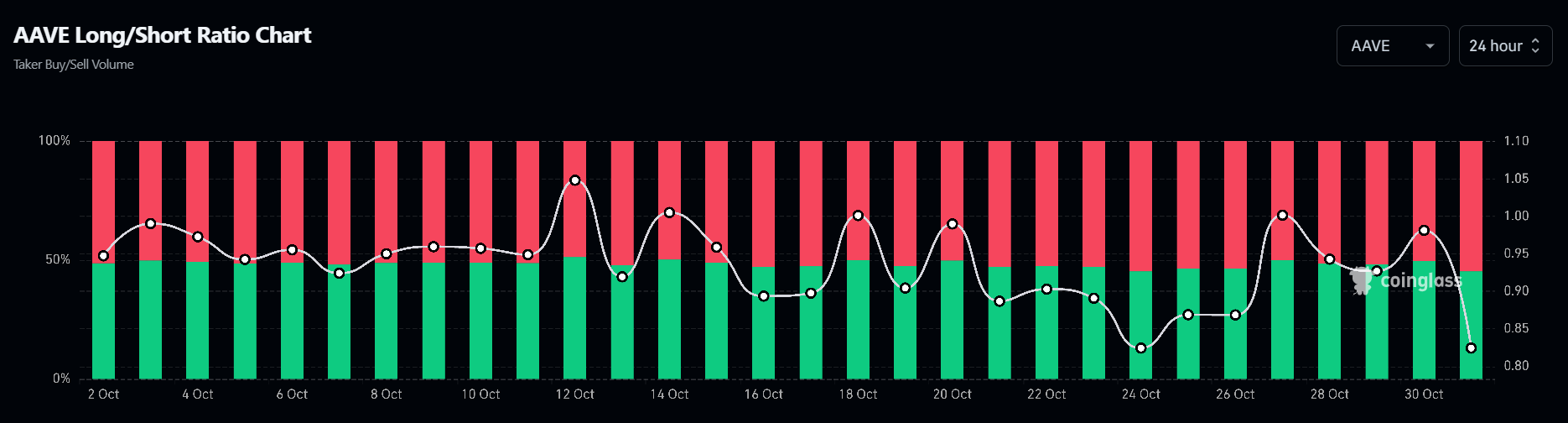

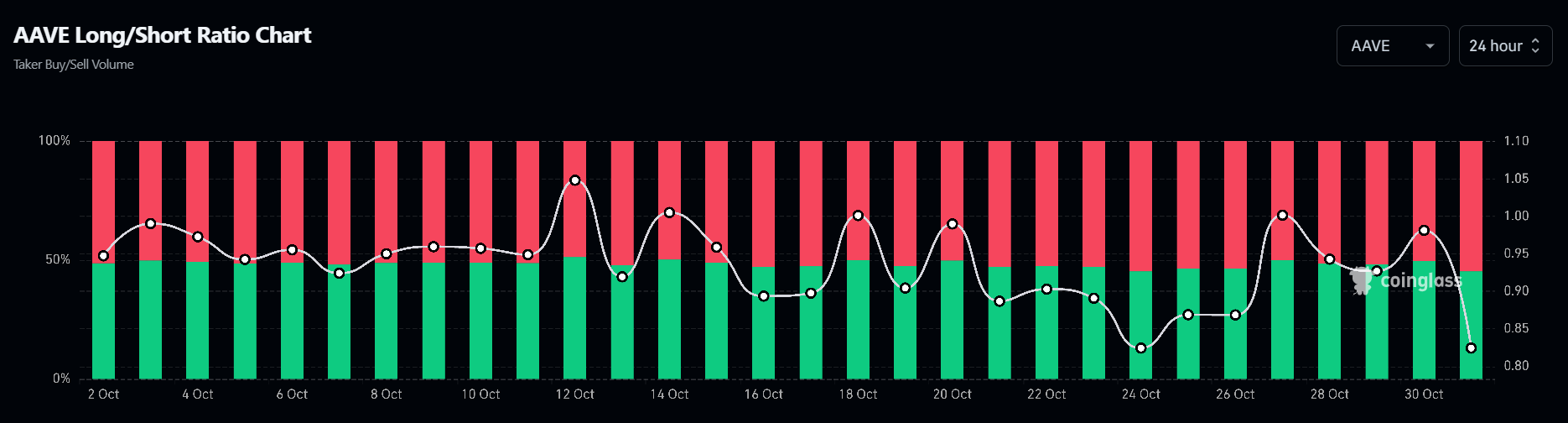

Supply: Coinglass

Moreover, there was a big improve briefly positions within the derivatives market – a pattern that is smart given the present circumstances.

If this story doesn’t reverse itself, AAVE might face a downtrend and will drop to $140. This might be a sexy entry level for brand new traders, whilst technical indicators level to a bullish outlook.

Brief-term positive factors for AAVE appear extra seemingly

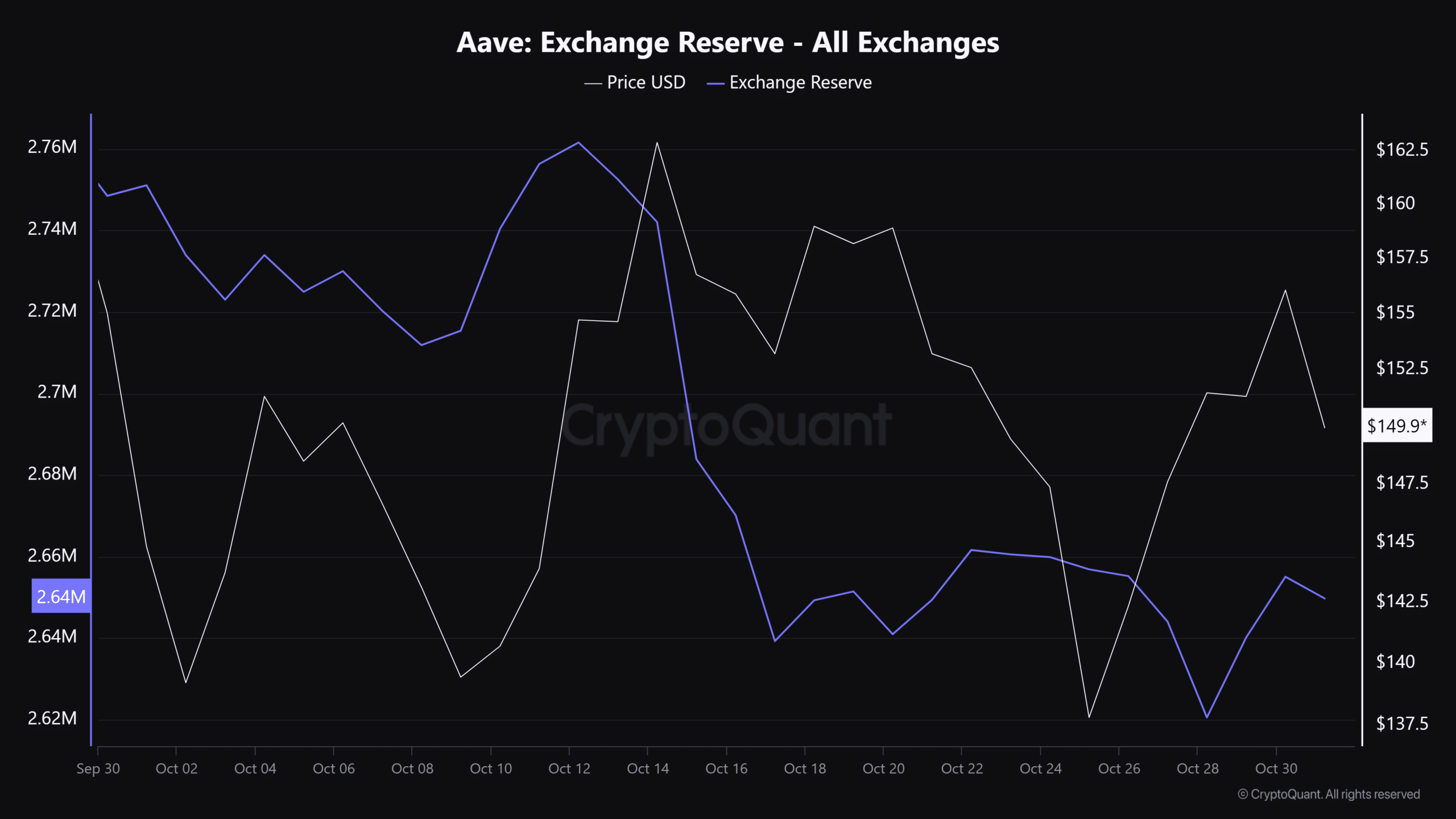

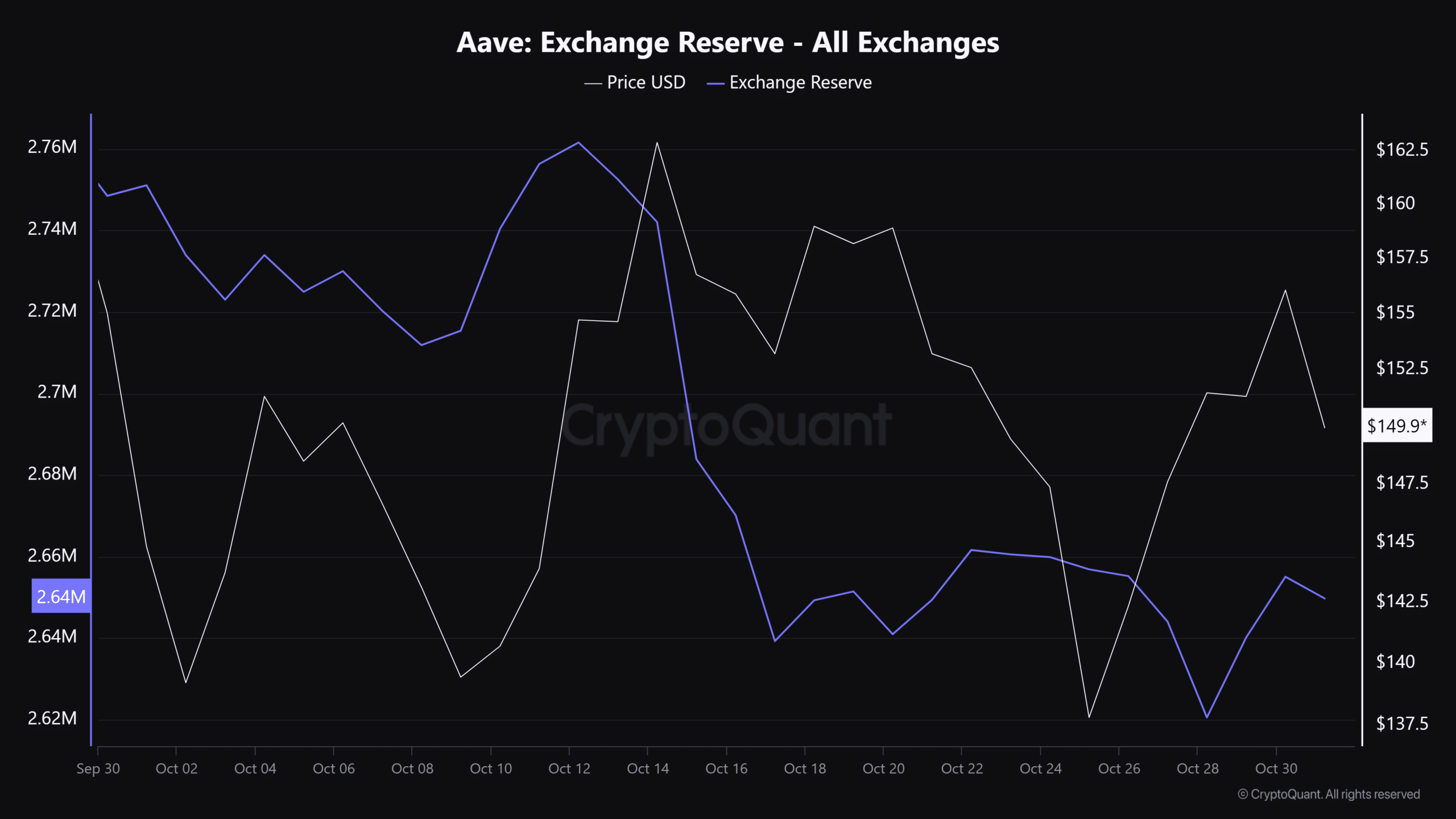

Over the previous two days, traders have withdrawn greater than 20,000 AAVE tokens from the exchanges, indicating that the altcoin’s value represented a pointy dip. Nevertheless, this second of optimism rapidly pale as traders started divesting their holdings.

Supply: CryptoQuant

The reasoning is easy: The market is unstable proper now. Till stability returns, traders will seemingly view Bitcoin as a secure haven, alongside property like gold, silver and bonds.

Learn Aave’s [AAVE] Worth forecast 2024–2025

Whereas the present value of AAVE appears enticing accumulation it’s troublesome to verify whether or not a bull rally is within the offing. Brief-term positive factors are more likely to preserve AAVE round $150 for now, particularly if BTC continues its bullish trajectory.

Nevertheless, a retracement to $140 appears extra seemingly. Till pre-election uncertainty subsides, it might be troublesome for whales to deconsolidate AAVE, even when they goal the dip.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September