Altcoin

AAVE: Where will the altcoin go now that bullish signals appear?

Credit : ambcrypto.com

- AAVE has emerged from consolidation and the ascending channel, indicating sturdy bullish momentum.

- On-chain and inventory market knowledge confirmed rising curiosity from traders, indicating a possible upside.

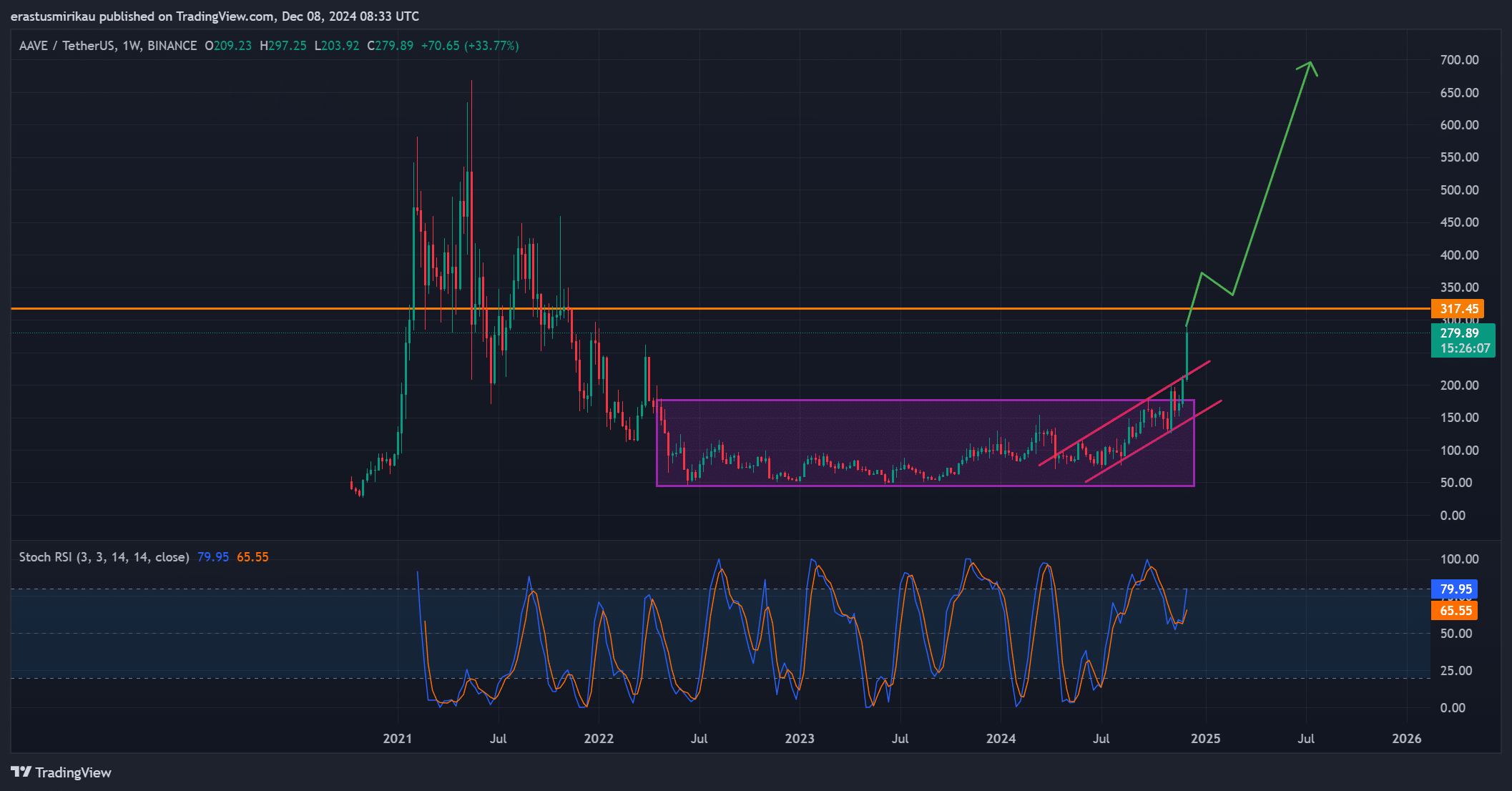

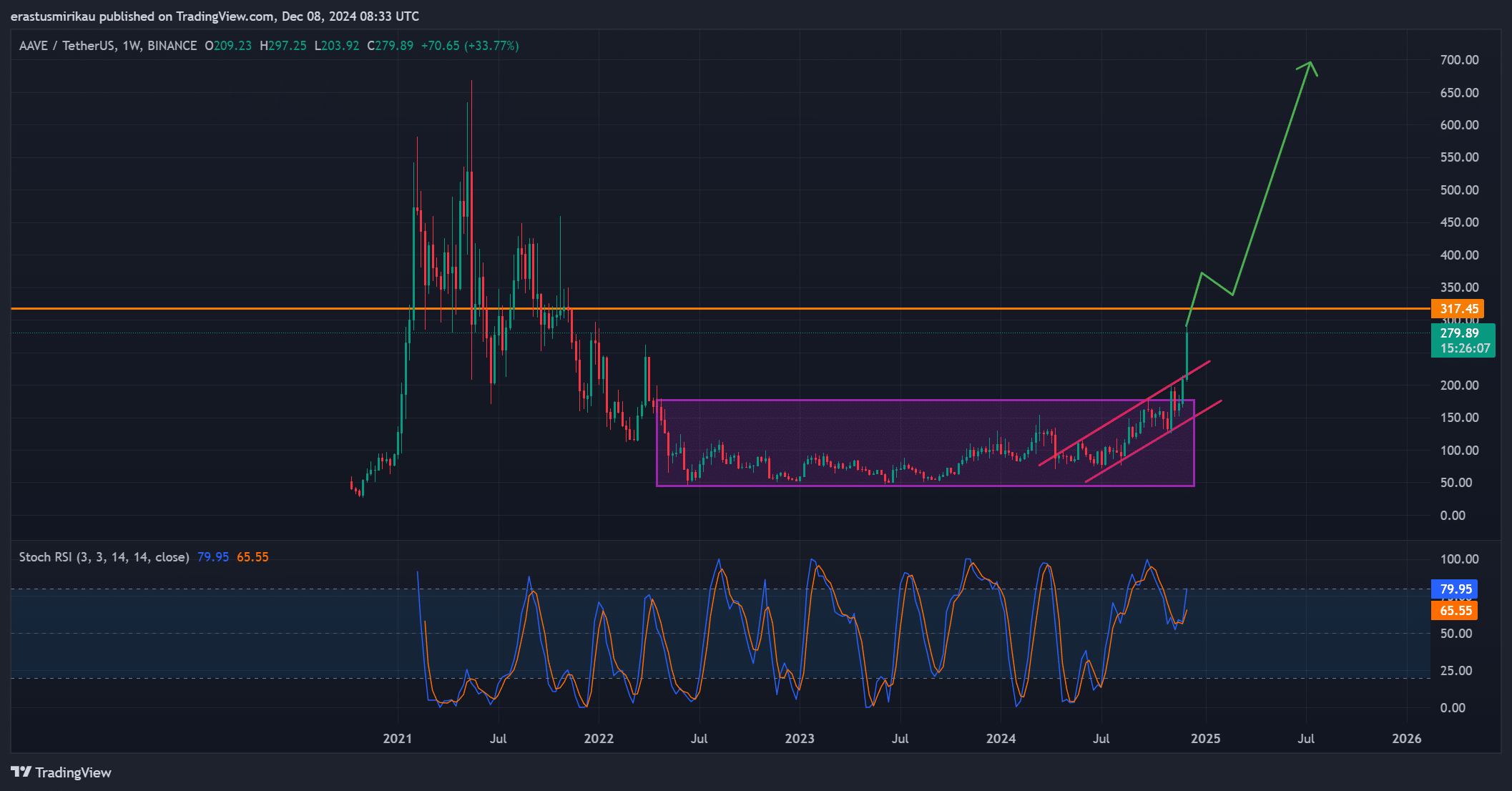

Aaf [AAVE] has damaged the long-standing consolidation section and exited the ascending channel, displaying sturdy bullish momentum.

On the time of writing, AAVE was buying and selling at $279.53, down 1.68% up to now 24 hours.

Nonetheless, regardless of this short-term setback, technical and inside chain indicators pointed to a possible upward pattern. Might AAVE be on the verge of a big bullish breakout within the crypto market?

What do the charts say about AAVE’s technical motion?

AAVE was at a vital resistance stage at $317 on the time of writing, a degree that might affirm the bullish pattern. The outbreak of the consolidation section and the ascending channel point out strong upward motion.

The stochastic RSI was 79.95, indicating sturdy bullish sentiment.

Nonetheless, such a excessive RSI additionally signifies overbought circumstances, which may trigger a short lived pullback. However, AAVE’s constant upside and breakouts confirmed stable help.

Subsequently, a decisive break above $317 would probably present additional bullish momentum and appeal to extra investor consideration.

Supply: TradingView

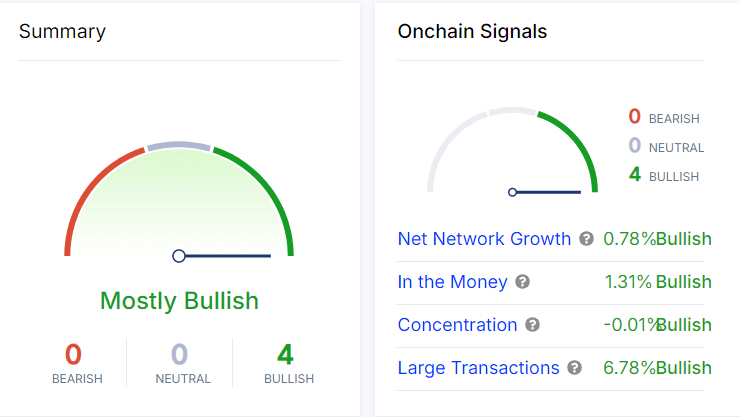

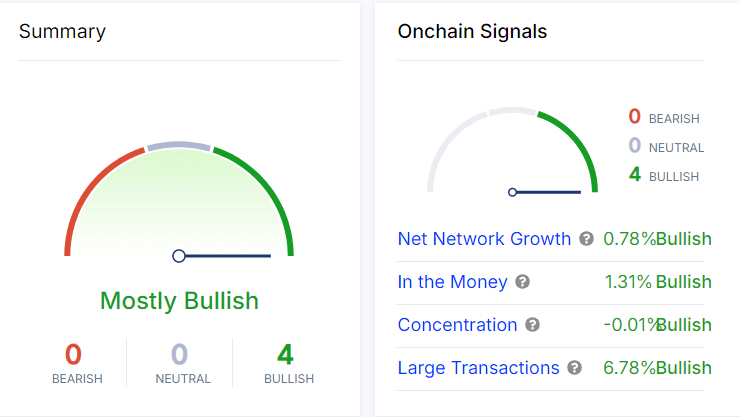

What do the alerts within the chain inform us?

On-chain knowledge provides to the bullish outlook for AAVE. Web community progress was 0.78%, indicating a rise within the variety of energetic customers. Furthermore, 1.31% of traders had been within the cash, reinforcing the bullish sentiment.

Focus knowledge additionally reveals a barely bullish pattern of -0.01%, whereas massive trades are up 6.78%.

These indicated important investor curiosity and exercise, highlighting a rising bullish pattern inside the altcoin ecosystem.

Supply: IntoTheBlock

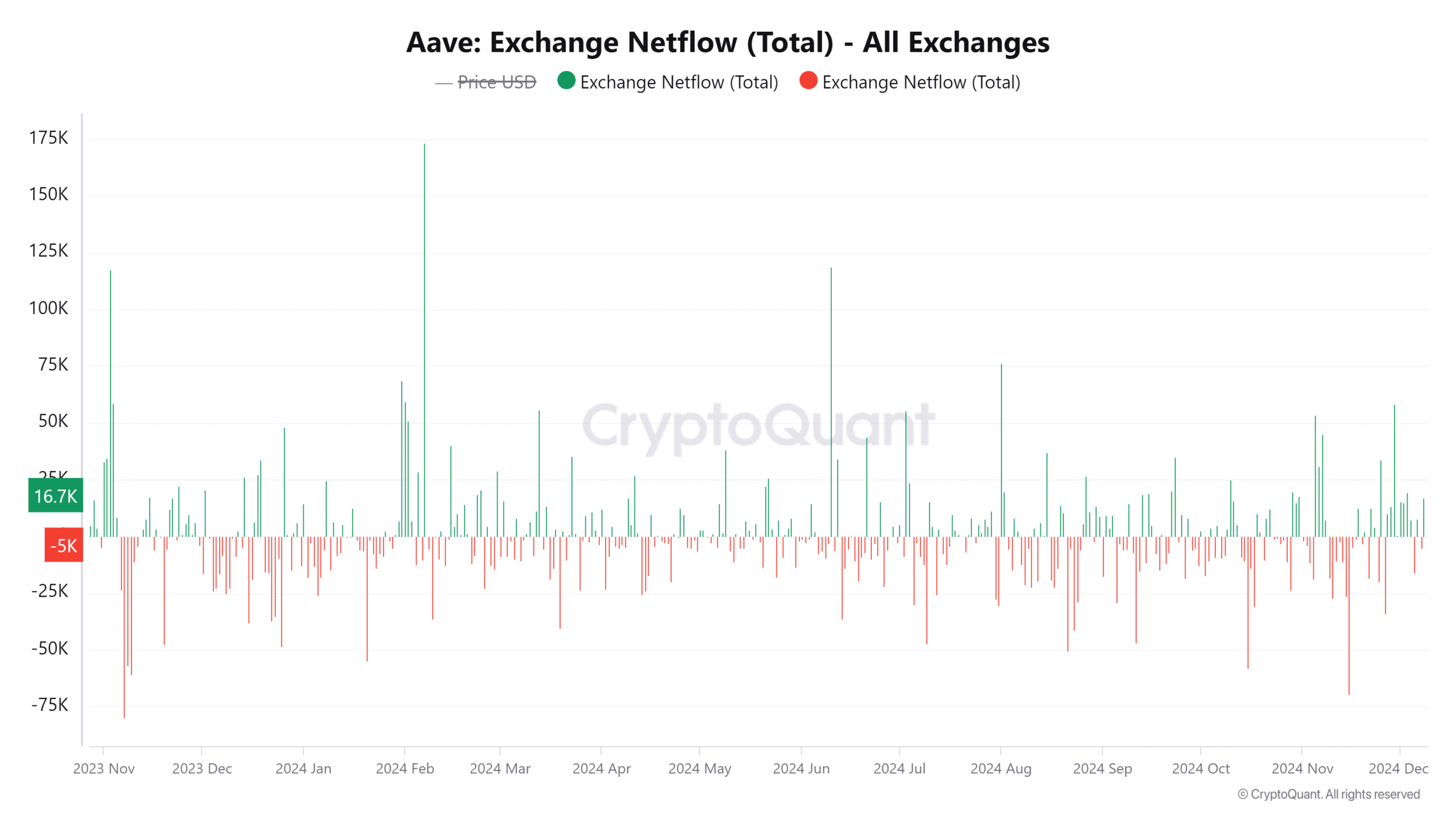

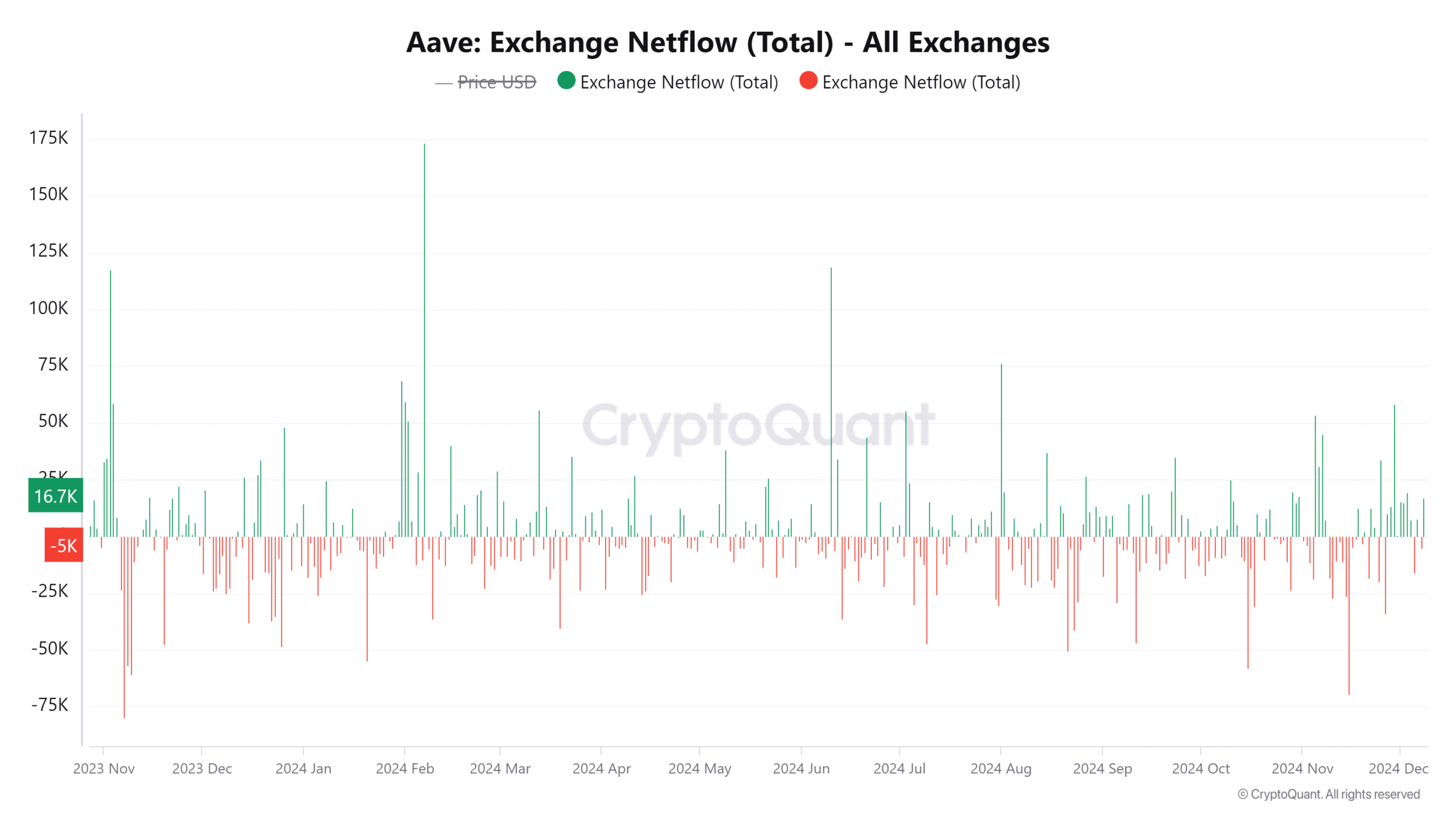

What does the change internet circulate reveal in regards to the energy of AAVE?

The change’s grid energy fell 3.35% over 24 hours, reaching 22.5459k. This urged that increasingly more traders had been withdrawing their holdings from the inventory markets, an indication of long-term bullish sentiment.

Traders favor to retailer property in non-public portfolios quite than on inventory exchanges as they count on increased returns within the close to future.

Supply: CryptoQuant

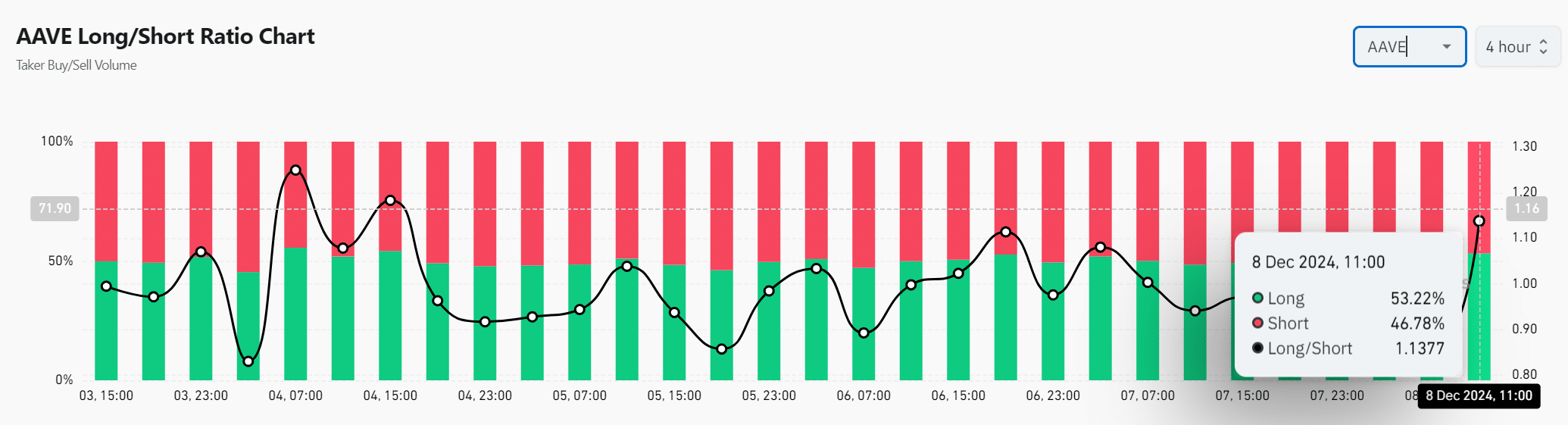

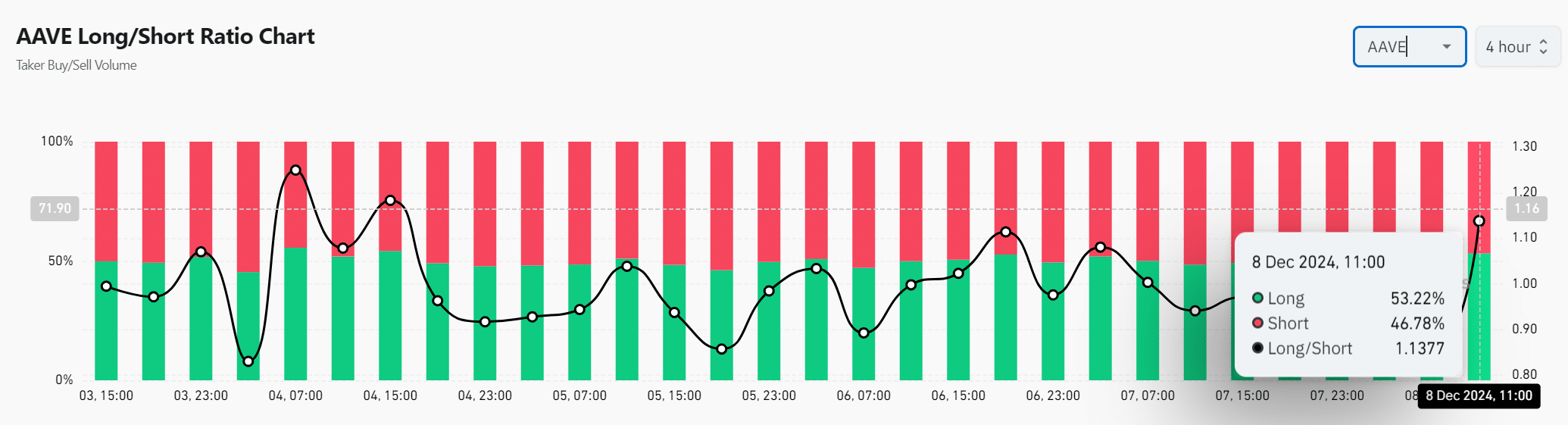

What do lengthy and quick positions say about market sentiment?

The lengthy/quick ratio on the time of writing was 1.1377, with lengthy positions at 53.22% and quick positions at 46.78%. The upper proportion of lengthy positions indicated sturdy bullish sentiment amongst merchants.

Subsequently, traders remained assured in AAVE’s continued upward motion and anticipated important positive factors.

Supply: Coinglass

Learn Aave’s [AAVE] Value forecast 2024-25

AAVE is displaying bullish momentum on the technical, on-chain and inventory market indicators. The $279.53 value stage, mixed with the breakout from the lengthy consolidation section and the ascending channel, signifies sturdy bullish curiosity.

Subsequently, AAVE is probably going on the verge of a breakout, with a big upward pattern anticipated within the close to future.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024