Altcoin

AAVE’s Road to $290 – Watch These On-Chain Stats Now!

Credit : ambcrypto.com

- AAVE noticed average AC flows over the previous month

- The weekly bullish market construction break was a robust sign

Aaf [AAVE] Bulls have been stubbornly defending the $140 assist stage for the previous two months. Nonetheless, the altcoin has a goal of $200 and can seemingly go a lot additional based mostly on the upper timeframe worth charts.

Supply: InTheBlok

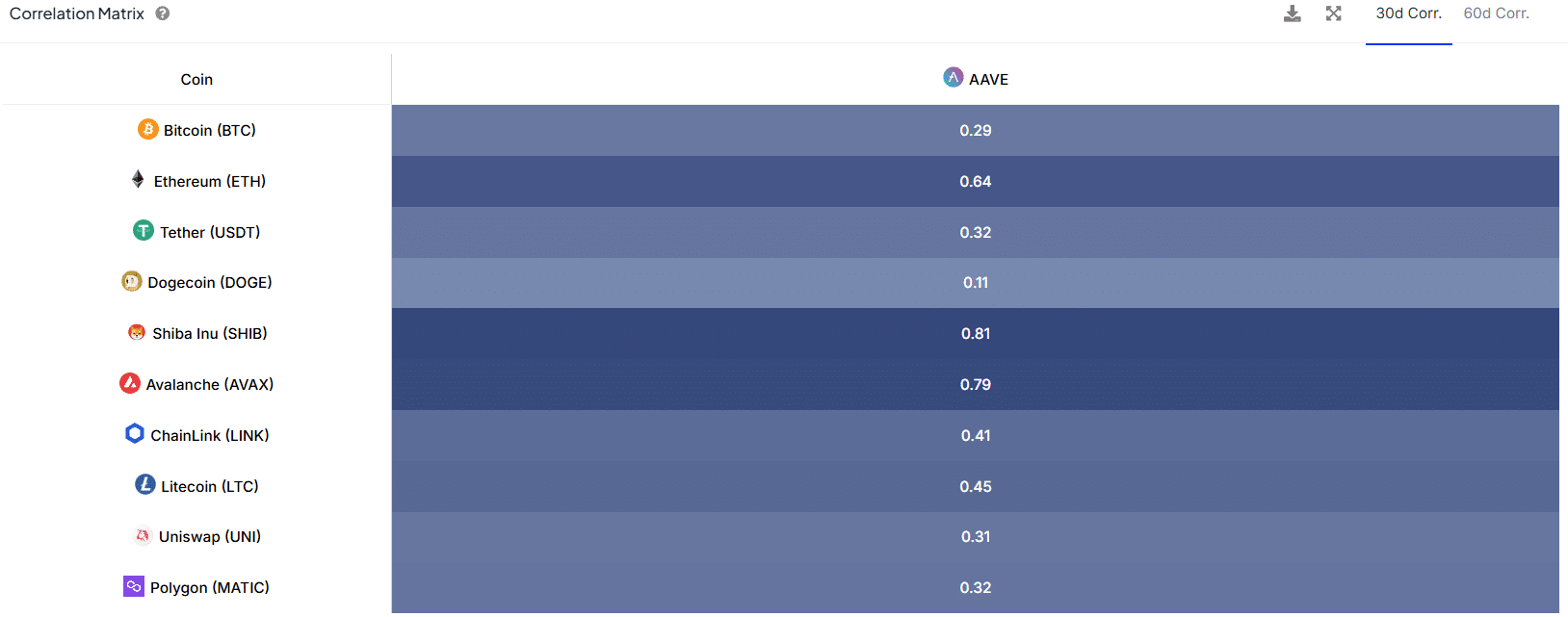

Nonetheless, the low 30-day correlation of +0.29 was not shocking. As AAVE fought to defend $140 and regain $150 as assist, Bitcoin has been steadily shifting increased over the previous six weeks.

Nonetheless, long-term traders have little motive to be gloomy.

Indicators of a sustained upward development have but to emerge

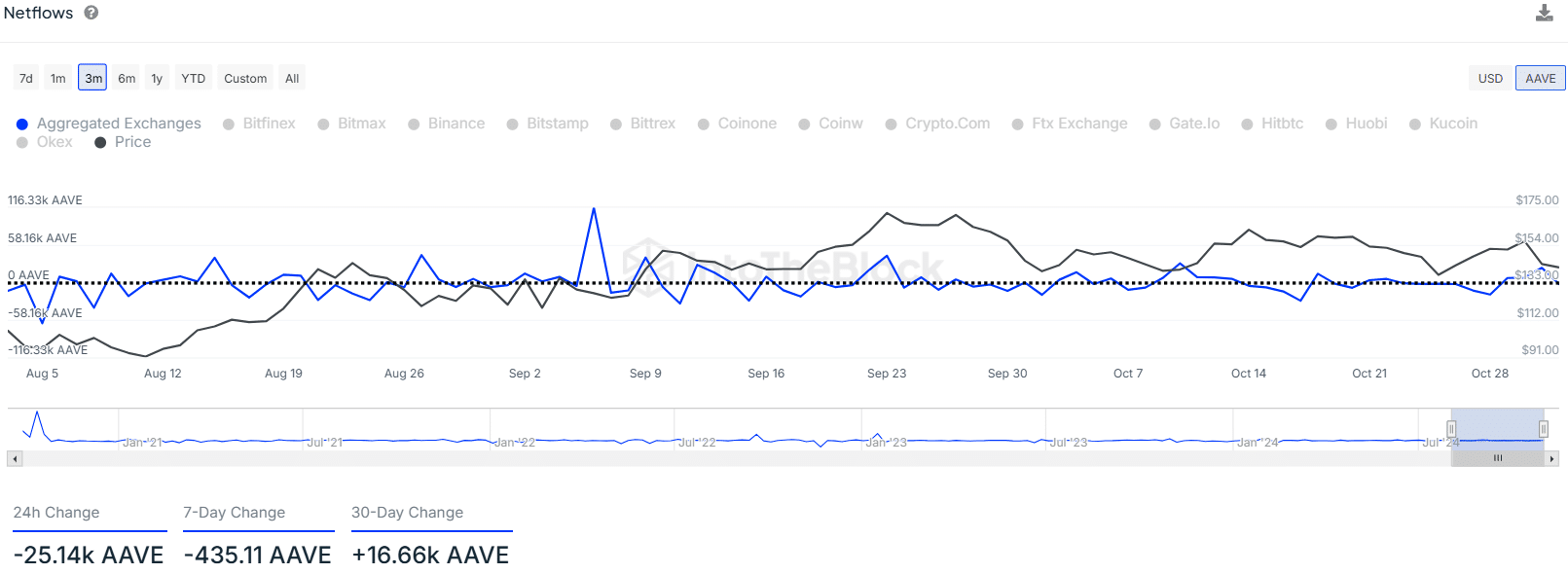

AMBCrypto discovered that netflow knowledge over the previous week and month was hardly encouraging. Outflows from -435 AAVE totaled simply $61,000. The +16.66k AAVE change in 30 days represented a $2.3 million influx into the exchanges.

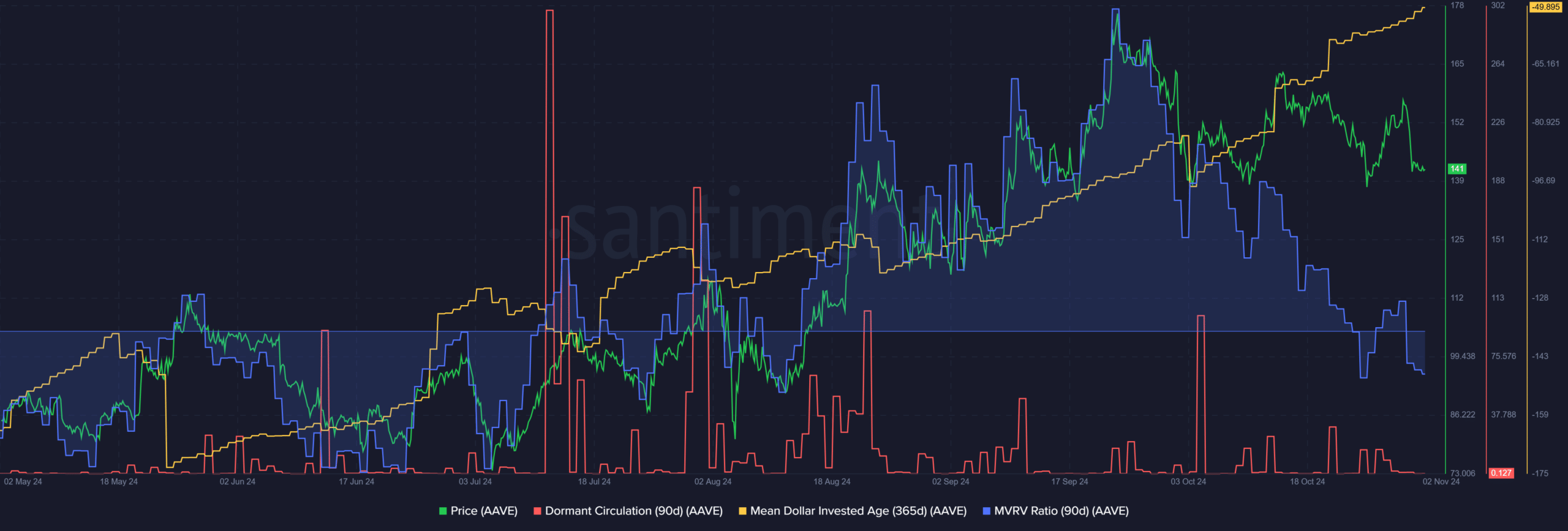

Santiment knowledge additionally confirmed that dormant circulation was calm over the previous month. This highlighted the average token motion between addresses, in comparison with the sell-off in mid-July.

So there’s in all probability no excessive promoting stress within the coming days.

The declining MVRV ratio confirmed that 3-month holders suffered common losses. This might encourage delicate promoting stress on an upswing in direction of $160. It additionally appeared a sign that profit-taking will not cease bullish efforts.

These bullish efforts have already begun, however could also be extra seen on the weekly timeframe. For instance, the continual upward development within the common age invested in {dollars} (MDIA) meant stagnation. The drop can be an indication of extra motion and new patrons, and this in flip might herald a sustainable uptrend.

AAVE gives robust proof on the upper time frames

Supply: AAVE/USDT on TradingView

The weekly chart underlined a downward development within the second half of 2021, a development that continued all through 2022. The $100-$120 space shaped a resistance zone that was not convincingly damaged for 805 days.

Learn Aave’s [AAVE] Value forecast 2024-25

This long-term consolidation was damaged in mid-September when the earlier excessive at $153 was damaged with a weekly session simply above it. Since then, AAVE was rejected at $180 and performed protection on the $140 space.

The weekly break out there construction six weeks in the past was an indication of bullish intent. Within the coming months, $290, $400 and even the all-time excessive of $661 can be achievable bullish targets. A hunch within the MDIA would seemingly be an early signal that the altcoin is poised for a surge.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024