Bitcoin

Abu Dhabi Tripled Down On Bitcoin In Q3 2025 Before Crash

Credit : bitcoinmagazine.com

The Abu Dhabi Funding Council (ADIC) expanded its publicity to Bitcoin forward of the cryptocurrency’s sharp downturn, greater than tripling its stake in BlackRock’s iShares Bitcoin Belief (IBIT) throughout the third quarter, regulatory filings present.

ADIC – an independently managed funding unit inside Mubadala Funding Co. – elevated his holdings to nearly 8 million IBIT shares as of September 30.

In keeping with Bloomberg, the place was valued at about $518 million on the time, up from 2.4 million shares three months earlier. reporting.

The Abu Dhabi Council’s accumulation got here simply weeks earlier than Bitcoin soared to a document excessive in early October after which fell under $92,000 as leveraged bets unwound throughout the market.

Abu Dhabi Council says the move is a part of a broader long-term diversification technique. A spokesperson described Bitcoin as a digital counterpart to gold and mentioned the allocation is meant to take a seat alongside the fund’s conventional shops of worth.

The acquisition was not an remoted incident. Mubadala individually reported proudly owning 8.7 million IBIT shares, price $567 million on the finish of the third quarter, unchanged from the earlier submitting.

Different main establishments, together with Harvard, additionally expanded IBIT positions throughout the identical interval.

Nonetheless, investor urge for food has waned because the October sell-off. US spot Bitcoin ETFs have seen outflows of about $3.1 billion thus far in November, in accordance with knowledge from Bloomberg.

IBIT alone hit a every day document of $523 million in redemptions after Bitcoin broke under a key value degree, leaving many ETF buyers underwater.

Abu Dhabi’s bitcoin is shifting

ADIC’s elevated allocation is notable given Abu Dhabi’s monetary attain and rising ambition to determine itself as a worldwide crypto hub. The emirate’s wealth funds collectively oversee greater than $1.7 trillion, and Mubadala has already been a significant participant within the enlargement of digital property within the area.

Earlier this yr, MGX – a know-how funding agency backed by Mubadala – acquired a $2 billion stake in Binance utilizing a stablecoin linked to US President Donald Trump’s household.

Inside ADIC, the push on Bitcoin is a part of a broader shift towards international enlargement. The council, which was initially established in 2007 and later got here beneath the Mubadala construction, continues to function with its personal mandate and funding technique.

It just lately strengthened its management workforce with executives akin to Alain Provider, former head of worldwide affairs at Canada Pension Plan Funding Board, and Ben Samild, beforehand head of investments at Australia’s sovereign wealth fund. Bloomberg.

Whereas cryptocurrency volatility stays a priority for international buyers, Abu Dhabi’s stance underlines one other perception: main sovereign wealth funds are more and more comfy treating Bitcoin as a long-term strategic asset.

Different governments are shifting in the identical path. El Salvador added greater than $100 million in Bitcoin this week, the Czech central financial institution introduced its first crypto buy, and Kazakhstan is constructing a nationwide cryptocurrency reserve fund that would attain $1 billion.

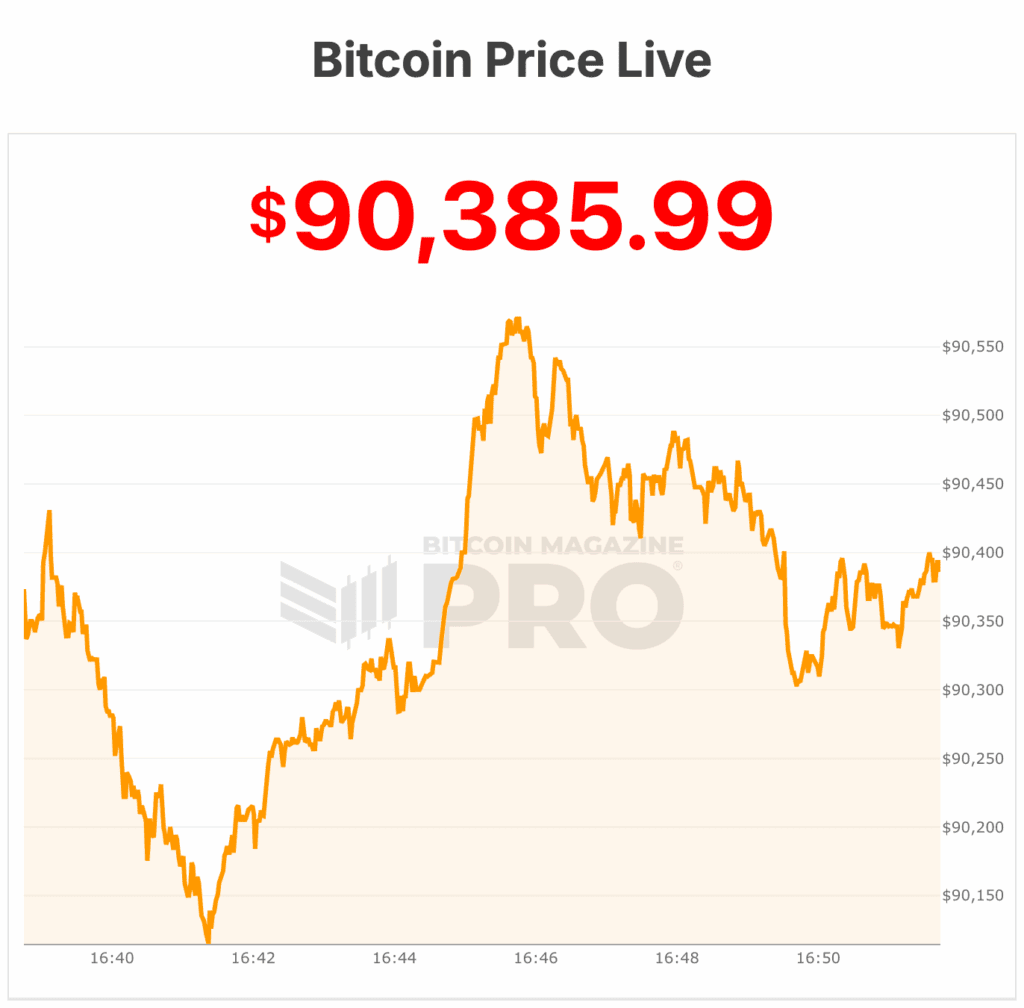

The worth of Bitcoin is presently round $90,300.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now